While India has seen emergence of hundreds of D2C brands, they continue to face challenges—from funding winter to managing inventory

At an Inc42 event, investors spoke about the factors they look for while planning to invest in a D2C brand

Most of the investors believe that D2C brands need a strong reason to win, while the views seemed to be slightly divided on offline expansion

The direct-to-consumer (D2C) market is one of the booming ecommerce subsectors in India as more and more brands continue to emerge, catering to consumers’ needs across segments largely through online mediums and, in some instances, through omnichannel presence.

Some of the D2C brands like Mamaearth, SUGAR, boAt, Bombay Shaving Company, Kapiva and Vahdam have become household names now.

The D2C brands are riding the wave of increasing internet penetration in the country and the pandemic-led change in shopping behaviour, with many consumers now preferring digital channels.

Home to over 50,000 digital-first brands, the Indian D2C market is estimated to grow at a CAGR of 24% between 2021 and 2030 and have a total addressable market opportunity of $300 Bn by that year, according to an Inc42 report.

While there are many success stories and the future looks bright for D2C brands, there are challenges for the brands selling through the D2C channel due to both macroeconomic and sector-oriented factors.

The new-age D2C brands, particularly the emerging ones, continue to face high competition from legacy players and marketplaces. For instance, the FMCG space, which has the largest number of prominent D2C brands in the country, has the presence of giant companies like Unilever, Nestle, ITC, Parle Agro, Colgate Palmolive, Procter & Gamble, among others. The list gets even bigger when it comes to global competition.

Besides, it often becomes difficult for the new-age D2C startups to keep up with the pricing and discounts offered by large marketplaces like Amazon and Flipkart. On the other hand, they also have to bear high customer acquisition costs (CAC) as they need to spend significantly on marketing, face challenges on managing logistics, and low customer retention and loyalty.

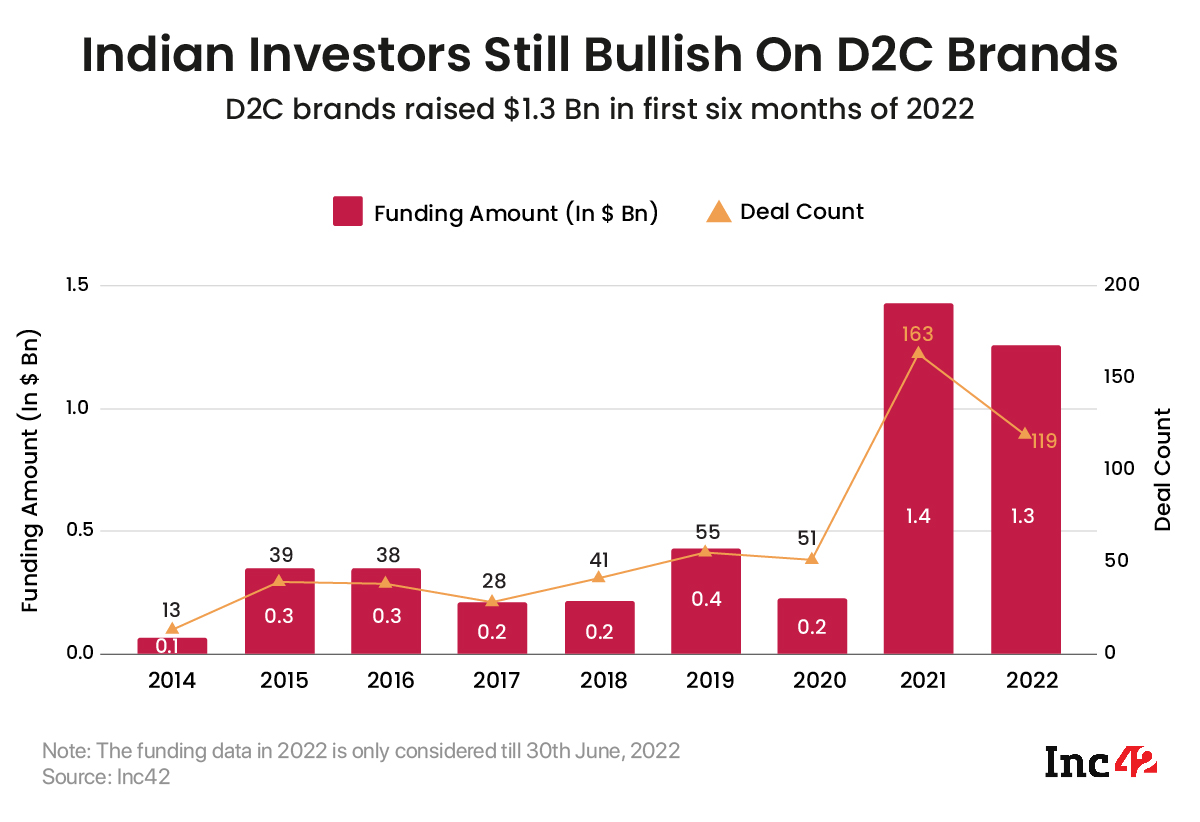

The ongoing funding winter has further added to the woes of D2C brands as funding for the segment declined 10% quarter-on-quarter (Q2Q) to $0.6 Bn in Q2 2022.

However, investors claim that the brands that focus on unit economics, profitability, and other fundamentals, will continue to get funding.

So, what exactly are the investors looking at while funding D2C brands amid the funding winter in the overall startup ecosystem? What are the value propositions that are attracting investors? How do investors perceive the changing landscape of the D2C segment? Inc42 tried to get answers to these questions at the recently held ‘The D2C Summit 3.0’.

Are D2C Brands Also Victim Of Funding Winter?

While it is true that global macroeconomic uncertainties and fears of an impending recession have hit the startup ecosystem funding in 2022, bridge-stage funding for D2C brands has actually seen positive growth. In Q2 2022, funding raised by bridge-stage D2C brands grew 101% QoQ to $26.4 Mn, as per Inc42 data.

However, seed-stage funding was the worst hit during this period, with the total funding amount declining to $452.7 Mn in Q2 from $502.1 Mn in Q1.

SUGAR Cosmetics, Melorra, Farmley, Mamaearth, Plum, and Wow Skin Science are among the startups that raised funding in the last few months amidst the current slowdown. Hence, it seems as if the investors are focusing on the fundamentals and the unit economics of the brands.

In fact, speaking at Inc42’s event, Prasun Agarwal, partner at A91 Partners, opined that D2C brands are becoming the hottest sector with funding winter setting in.

“I genuinely feel like the sector had never become so crazy (in) the last couple of years… All of us have been investing in consumer brands before, irrespective of cycles, but it’s definitely coming more in favour now because of many more consumer companies looking at unit economics, more fundamentals,” said Agarwal.

Some investors are also of the opinion that the funding slowdown will help founders of consumer brands focus on unit economics and understand what they should do and not do.

What Is The Role Of Enablers?

The D2C brands have several enablers that can help them overcome the funding winter, according to investors. These enablers include logistics players, payment service providers, marketplaces, and customer experience platforms.

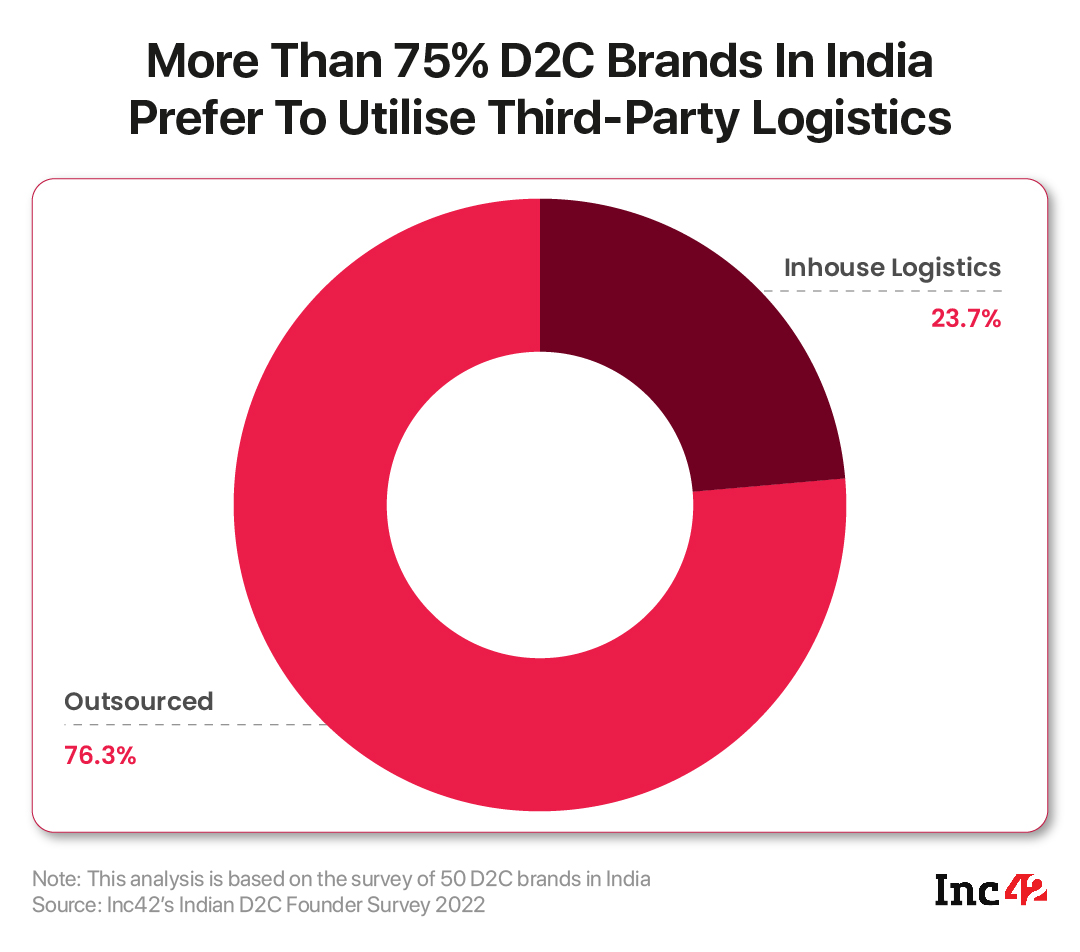

The logistics players play a very important role in enabling D2C shipments in domestic as well as international markets. From ensuring timely last-mile delivery to providing the brands with access to cost-effective warehousing and inventory management, D2C brands have to rely heavily on them.

As per a report, the Indian D2C logistics market is estimated to register a CAGR of over 8% during the 2018-2027 period, in line with the increase in the D2C players. Delhivery, DHL, Pickrr, Unicommerce, and Shiprocket are some of India’s top logistics providers for D2C brands.

Recently, Instamojo, a Bengaluru-based leading ecommerce platform for D2C brands, recorded over 8,000 D2C businesses integrating their logistics applications over the previous six months.

“We feel the days of enablers are really rising right now,” Sanil Sachar, founding partner at accelerator Huddle, said.

“Whenever there is a slowdown, the enablers have a key role in reviving and creating that whole thriving motion with a balance,” Sachar added.

From cold chain to smart warehousing, a strong distribution system requires efficiencies in the back-end and front-end, and the enablers have a very important role to play here, Sachar said.

Need A Strong Reason To Win

Speaking at one of the sessions at ‘The D2C Summit 3.0’, Vahdam founder Bala Sarda stressed the need for ‘a strong ticket to win’ in the global markets.

Reiterating the point, investors said that brands need a strong reason to win, be it in local or global markets.

Kannan Sitaram, partner at Fireside Ventures said, “If your reason to win in the market at a very fundamental level is not strong, no amount of focus on efficiency is going to get you anywhere.”

This gains even more significance considering the growing number of D2C brands in the country with hundreds of value propositions.

Which Segments Are Grabbing Market Share?

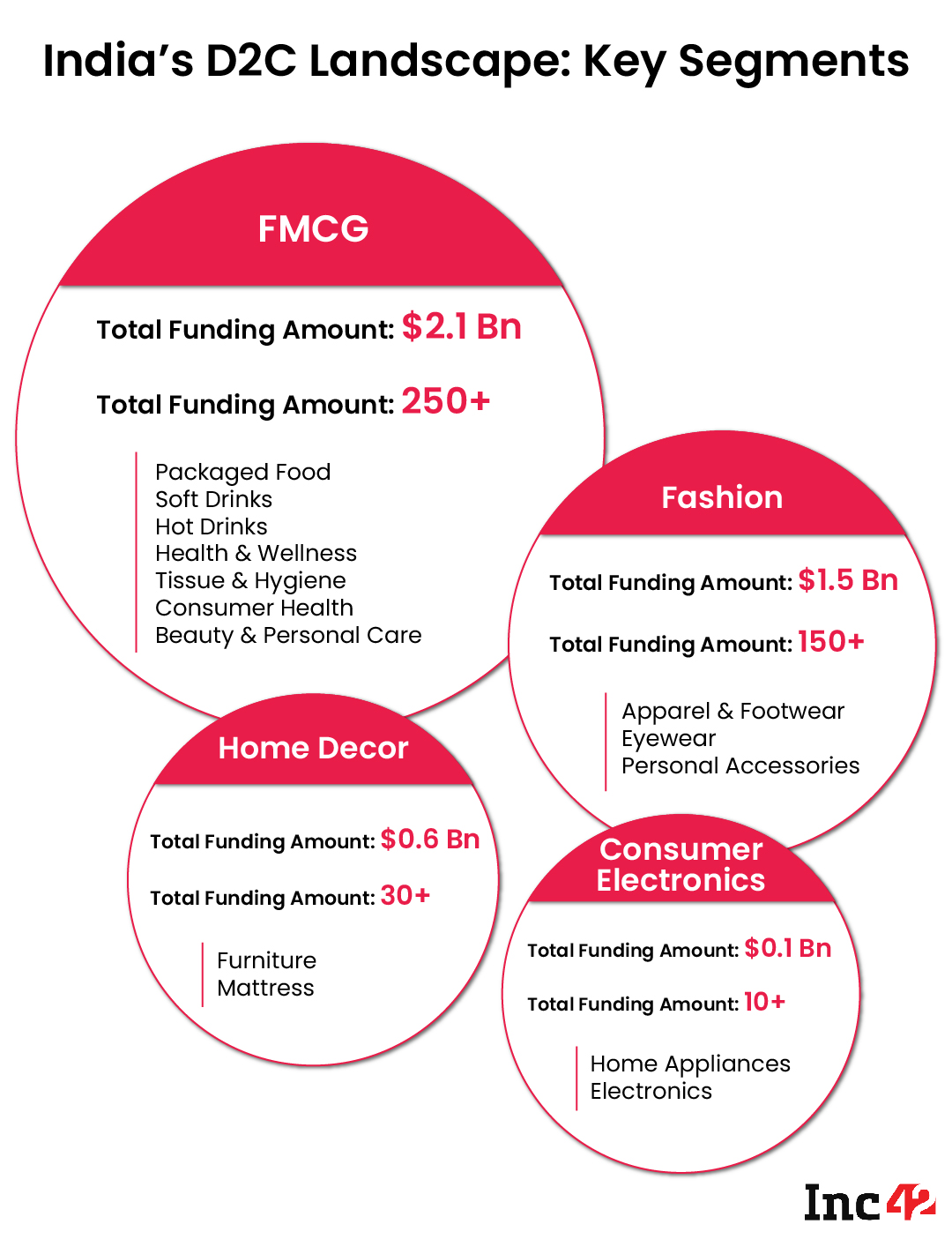

The FMCG segment is the undisputed leader here with the presence of 192 unique funded startups. Besides, investors also believe that D2C brands in beauty and personal care (BPC), and consumer health and wellness segments are also set for growth over the coming years.

The BPC segment has already seen a few famous success stories like that of Nykaa, which made a stellar debut in the Indian exchanges last year. Besides, Sequoia-backed unicorn Mamaearth has established a strong offline footprint with 40,000 stores in over 100 cities, along with a well-established online presence.

There is also mCaffeine which claims to have gathered more than 2.5 Mn loyal customers with repeat purchases by selling a wide range of caffeinated products.

In the food and beverage subsegment under the FMCG category, brands like Licious, Yoga Bar, Vahdam India, and Rage Coffee have managed to become a part of daily life for many.

The consumer health and wellness space evolved amidst the Covid-19 pandemic and has emerged as a strong category, according to some investors.

“…brands like Kapiva and Wellbeing, with their enormously innovating range of products, tried to really change the way consumers engage with the whole area of supplementation, and it’s doing wonders to how consumers think about supplementation as not being medicine but almost like everyday fun food kind of thing,” said Fireside Ventures’ Sitaram.

In fact, the overall FMCG segment witnessed about a 400% YoY surge in total funding in Q2 2022.

Besides, the fashion segment has also seen the emergence of a large number of D2C brands across jewellery, clothing, and eyewear subsegments. The segment currently has over 105 funded startups, with Lenskart, BlueStone, Zivame, Bewakoof, Giva, and XYXX among the more popular ones.

Online Or Offline Channel?

While consumers shifted to online shopping amidst the Covid-19 pandemic and the subsequent lockdowns, offline shopping has started gaining traction again as the effect of the pandemic wanes. Online-oriented brands aggressively strengthening their offline presence underpins this trend.

In May, SUGAR Cosmetics said it was aiming to expand its offline presence to over 60,000 stores over the next 12-15 months. Meanwhile, Nykaa, after opening several offline stores in the past few months, opened two new Luxe stores in India last week.

In fact, the offline competition has become so intense that Tata Group’s lifestyle ecommerce platform Tata Cliq is also reportedly looking to open physical stores to take on the new-age D2C brands.

However, offline expansion can increase cash burn as rental expenses and employee benefit costs shoot up. Hence founders need to look at these factors while planning offline expansion.

Some investors said that they have witnessed 2X productivity in the brands that first started online and then went offline versus the ones that first went offline. An established product-market fit and data about demand of the product are among the factors that should drive the decision to establish offline presence, they said.

“The offline story seems to complete a beautiful cycle for the brand where you are now available for everybody,” said A91 Partners’ Agarwal, adding that brands can address a much larger set of consumers by going offline.

But some investors are cautious about their portfolio D2C brands taking the offline path, and suggested that brands should not be in a hurry for offline expansion.

“Offline diversification creates a lot of issues for brands with regards to collections as well and I think, that pain point… that’s something we guide our founders to realise that the cash you can recover that’s your real growth at the end of the day,” said Huddle’s Sachar.

Which Financing Works Better — Debt Or Equity?

Debt financing works very well when brands are facing near-term challenges and require working capital, believes some investors.

“Wherever you need to finance that (working capital), you start building relationships with financial institutions fairly early on, and we are seeing very large financial institutions also wanting to partner with younger brands and are willing to work with them because they understand and see that even they find value in building that relationship,” said Agarwal, adding that the brands can also go for debt financing when a little bit of capital expenditure is required.

However, it’s better for consumer brands to go for equity financing if they are looking for experienced partners to work and build relationships with in the long run, he advised.

Agarwal was speaking at Inc42’s 2-day D2C Summit 3.0, which also saw the participation of Sanil Sachar, Kannan Sitaram, head and CIO at RPSG Capital Ventures Abhishek Goenka, with Shiprocket’s Vishesh Khurana moderating the session.

Ad-lite browsing experience

Ad-lite browsing experience