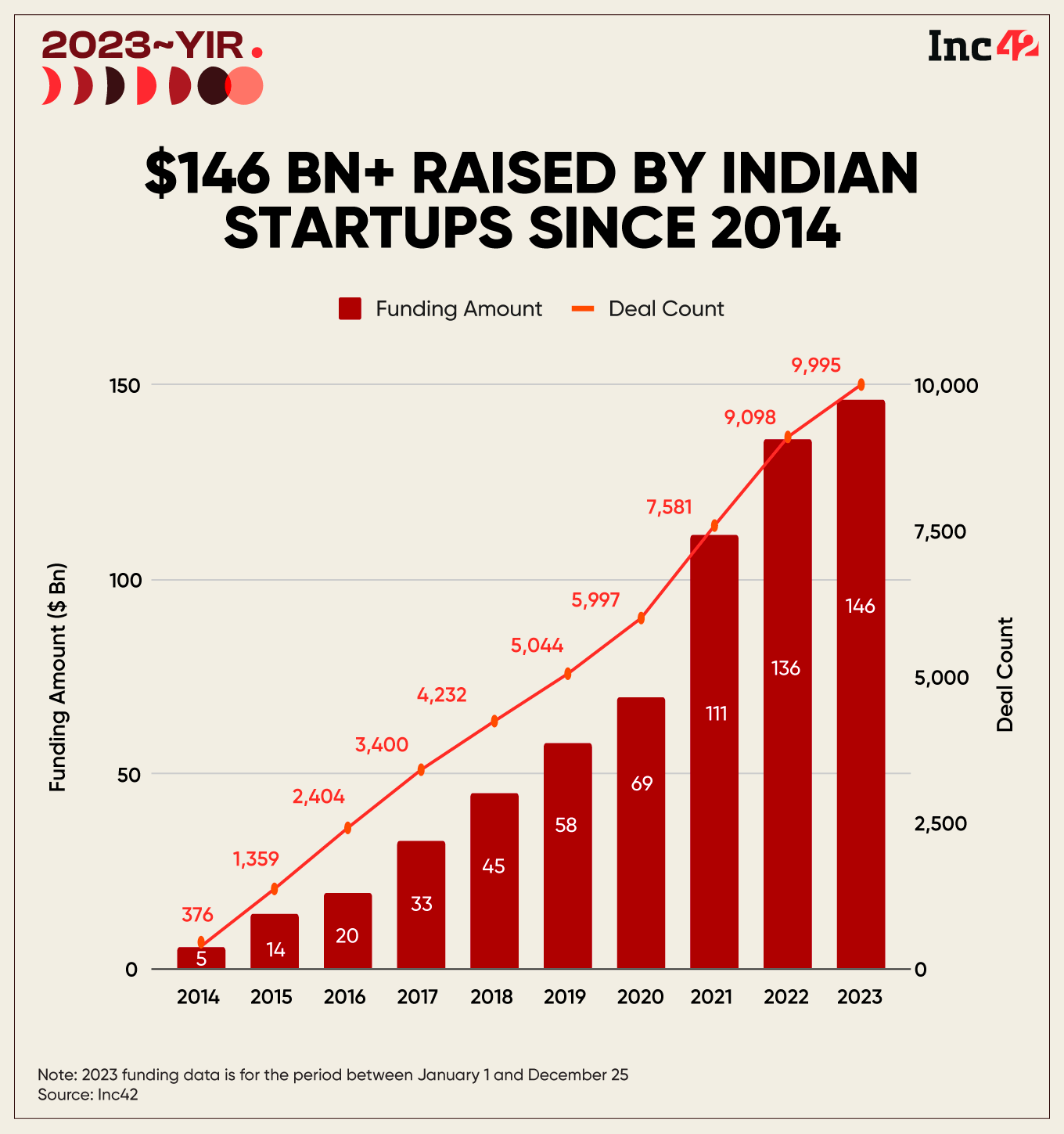

As many as 9,995 Indian startups have raised more than $146 Bn in funding since 2014, having raised around $10 Bn in 2023

The year 2021 bore witness to the most intense period of startup funding in the history of India’s fledgling startup ecosystem

Industry experts believe that the Indian startup ecosystem will continue to witness maturity, which will lead to stronger fundamentals and high-quality startups

There is a reason why India is called the world’s third-largest startup ecosystem. Well, for starters, in terms of unicorns and the number of startups, we are just behind the US and China.

However, that wasn’t always the case. There was a time when we still had many miles to go in having even a mark on the global startup map. However, since the start of 2014, India’s startup ecosystem has come alive in terms of funding activity, heightened innovation and more stress on building in India for the world.

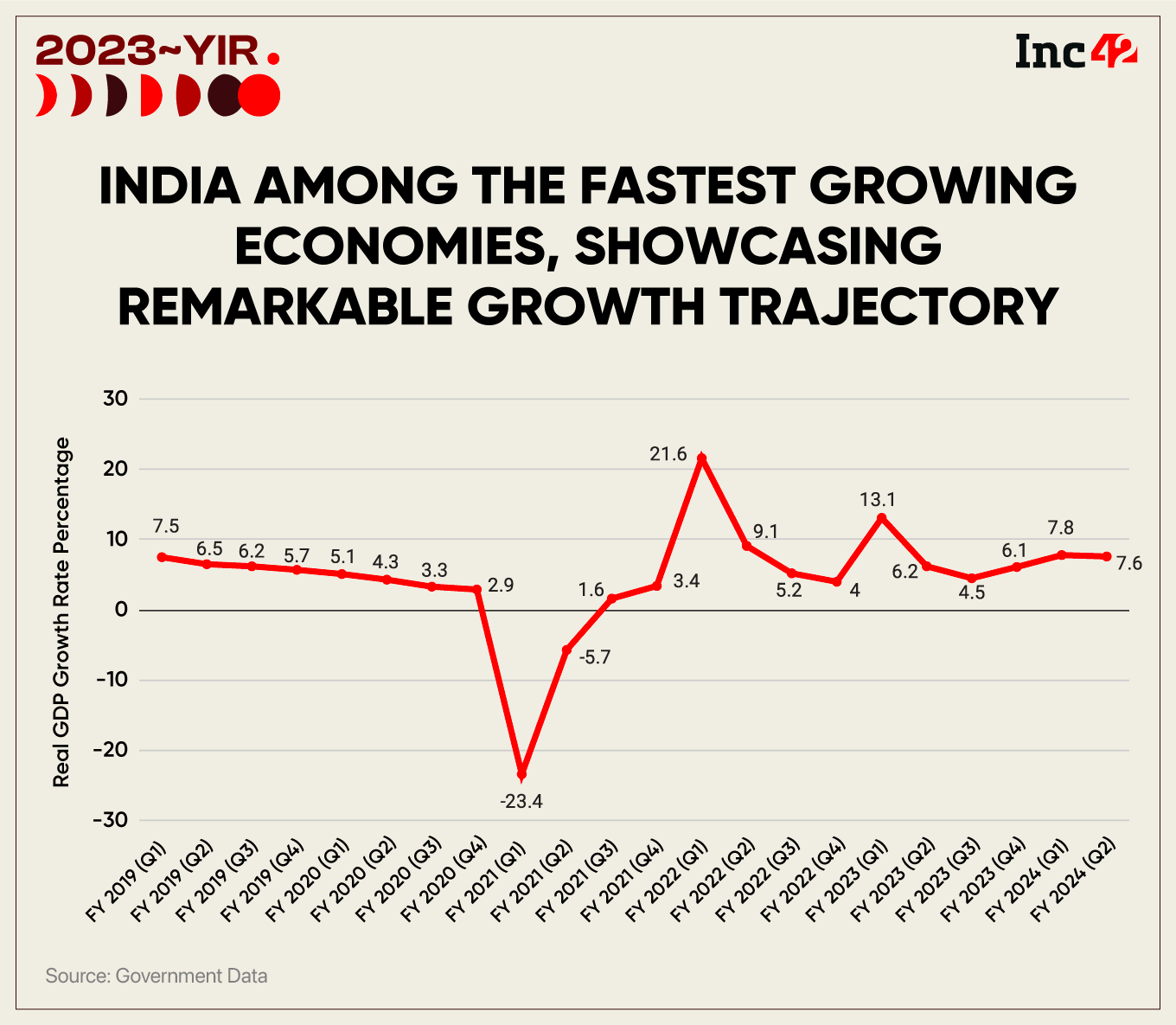

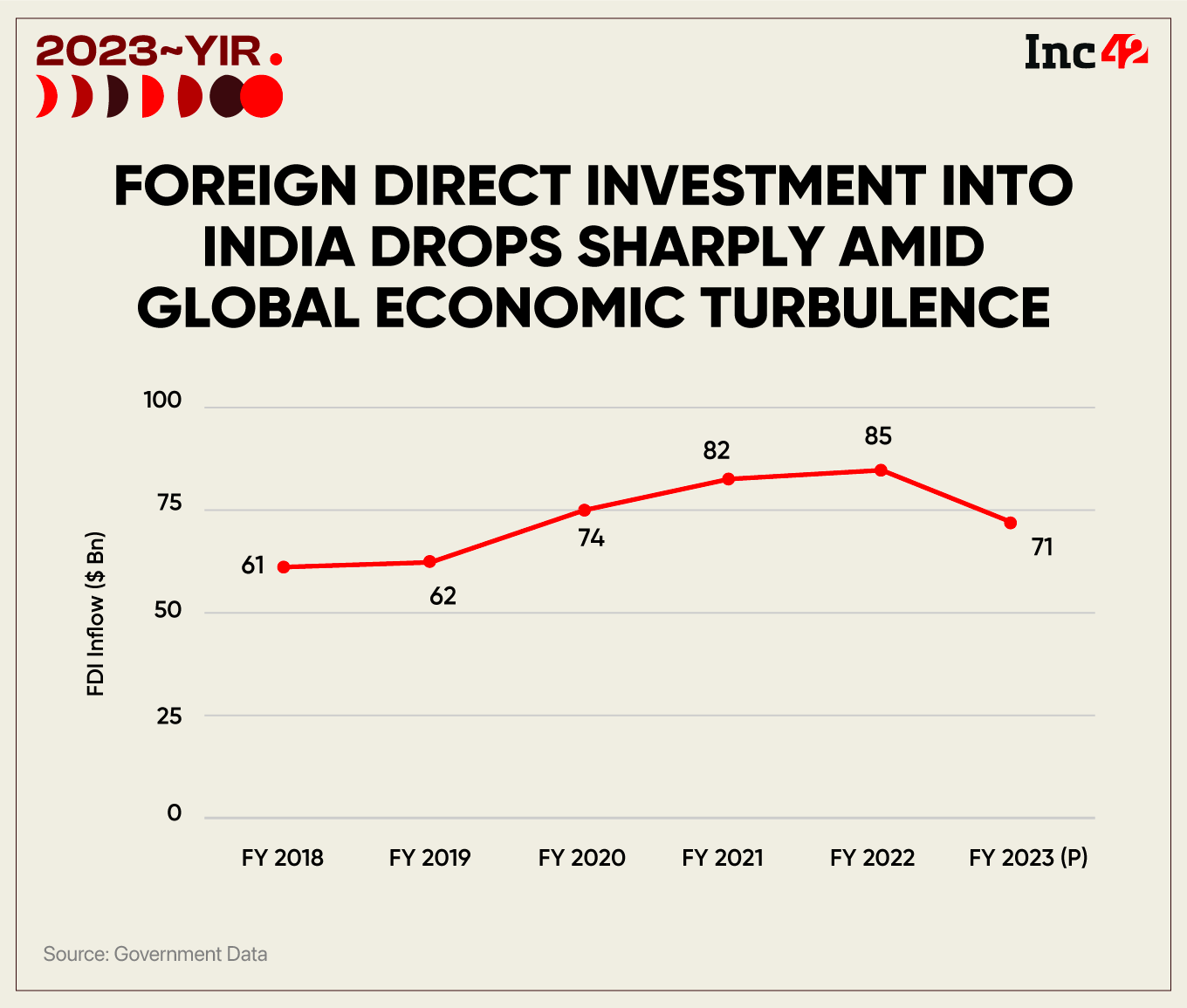

Not to mention, when the rest of the world had to endure several macroeconomic shocks of the last decade, India’s rapid economic growth allowed the country to fuel its entrepreneurial spirit, paving the way for the startup boom. And, it was around this time that the rise in innovation and easing of FDI norms brought major tech investors to Indian shores.

Between 2014 and 2023, India saw more than 3,100 new startup launches each year on average, according to the Department for Promotion of Industry and Internal Trade (DPIIT). Not just this, as many as 9,995 Indian startups have raised more than $146 Bn in funding since 2014.

But, How Has Funding Looked Like Over The Years?

India has seen a near-constant rise in startup funding for the best part of the last decade. In 2014, as many as 376 local startups ended up raising around $5 Bn.

Gauging the success of ventures like Ola, Zoho, and Flipkart, investors started to buy into the Indian startup story, pouring more funds.

Download The ReportIndia’s 4G launch and demonetisation in 2016 significantly drove the fortunes of ecommerce and fintech startups. The advent of UPI at the same time laid the foundation for more startups to emerge. The spread of the Covid-19 pandemic in early 2020 initially dented the Indian economy and the startup ecosystem with it.

However, funding picked up, supercharged by the unprecedented demand for digital solutions for everything from grocery shopping to health consultations.

The year 2021, which saw a devastating second wave of the pandemic, also bore witness to the most intense period of startup funding in the history of India’s fledgling startup ecosystem. In a single year, Indian startups raised as much funding as they had lapped up between 2014 and 2018.

Indian startups were innovating and investors were investing. ‘Growth at all costs’ was the new motto amid the new normal, and startups raised whatever deemed them fit, sometimes even without a minimum viable product (MVP).

Soon came February 2022, and as Russian boots fell on Ukrainian soil, the global economy tanked. Russia was heavily sanctioned and taken out of the global financial network, and as a result, the world went through an energy crisis. This spooked investors, and funding in startups started to slow down.

As the slowdown threatened to evolve into a recession, Indian startup funding continued to decline and hit a seven-year low in 2023. Even so, Indian startup funding ticked over $146 Bn, a new milestone for the ecosystem.

Despite the shocks, Indian startups have had a strong 2023 as several big names have turned profitable, signalling that good times might just be close by.

Download The ReportPolicies Supporting India’s Startup Economy

For the most part, India’s startup ecosystem has enjoyed great policy and regulatory support from the government. One of the most important schemes promoting India’s startup ecosystem has been the Startup India programme, managed by DPIIT.

Launched in 2016, Startup India has played a pivotal role in propelling the growth of India’s startup ecosystem. Tax breaks, simplified regulations and incubation support have since fostered a nurturing environment for innovation and risk-taking.

Coupled with the easing of FDI norms, VC funding skyrocketed, attracting investors and empowering startups to scale and compete on the global stage. As a result, India is now the world’s third-largest startup ecosystem and home to 112 unicorns.

To boost local manufacturing, the government also introduced production-linked incentive (PLI) schemes in 2020 across 14 key sectors, including semiconductors, advanced cell chemistry batteries, and drones. This has incentivised both global tech giants like Apple and local startups to make in India for the world.

Speaking about innovations, India Stack is the top talking point. Internationally acclaimed breakthroughs such as the United Payments Interface (UPI), electronic Know-Your-Customer (eKYC), Aadhaar Card, the Account Aggregator network (AA) and the Open Network for Digital Commerce (ONDC) have stepped up the Indian startup game.

UPI, in particular, has proven to be among the most influential government-backed fintech platforms anywhere in the world. The platform is enabling thousands of transactions in India each second, for free, all the while displaying unparalleled resilience and stability. Hundreds of tech startups in India started by enabling UPI payments, including PhonePe, Paytm and BharatPe, among dozens of others.

Lastly, India’s G20 Presidency in 2023 made way for the Startup20 initiative, which brought together startups, investors, policymakers, and innovation hubs from across the G20 member nations, with a focus on investment, inclusivity and collaboration. This resulted in more visibility for the world’s third-largest startup ecosystem, wider discussions around it and a favourable policy push within the country.

How India Stacks Up Against Its Peers On The Podium

While the Indian startup ecosystem has made a significant mark on the global map, it has a long way to go before it can challenge China and the US.

For context, US-based startups raised $2.7 Tn between 2014 and 2023, while Chinese startups raised $793 Bn during this period, and India is not even close to these figures. The key reason behind this stark difference is that the US and China had multiple startup-friendly policies in place, much earlier than India.

For instance, Apple was founded in 1976 and India was a closed-market economy until the early 90s. Being far more mature startup ecosystems, the US and China also are home to a far larger number of startups.

However, as India’s internet penetration rises, and the demand for tech solutions with it, the country could emerge as a threat to China’s position.

Gazing In The Crystal Ball

Industry experts believe that the Indian startup ecosystem will continue to witness maturity, which will lead to stronger fundamentals and high-quality startups.

Speaking of maturity, many companies founded at the peak of India’s startup-minting era of the late 2010s have grown fully and are headed towards possible IPOs now. This trend is expected to continue over the next few years.

Meanwhile, senior executives of many late-stage startups are now launching their ventures to start up again. This trend, too, is expected to grow at an exponential rate, luring in more investments from VCs.

In addition, the Indian government’s support for startups and the belief in their potential to boost the country’s economy is expected to result in the creation of more startups, soonicorns, unicorns and even decacorns. Now, as we approach the beginning of a new year, it is time to reiterate that India continues to be the most exciting place on the global map.

[Edited By Shishir Parasher]

Download The Report

Ad-lite browsing experience

Ad-lite browsing experience