At the centre of India Stack developments is the Indian Software Products Industry Round Table (iSPIRT), the software products think tank led by tech advocates and volunteers

Unlike many other industry associations where the engagement with industry leaders have been merely transactional/informational iSPIRT has been successful in engaging with the leading tech experts in building products from scratch

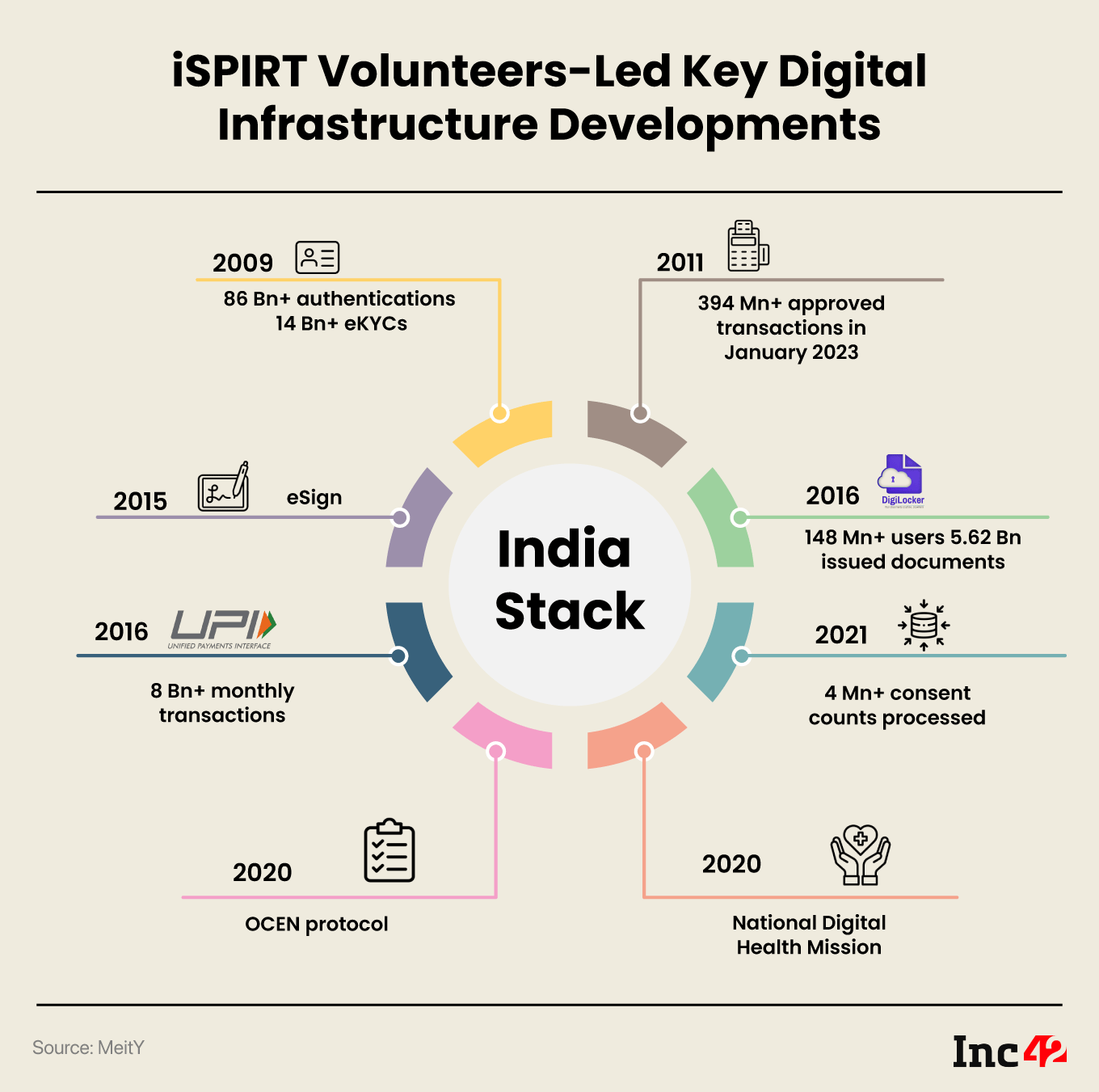

iSPIRT has been behind some of the most critical projects sharing India's digital future include — India Stack APIs like UPI and Aadhaar auth and eKYC, and products such as OCEN, Account Aggregator and health stack

“India has a unique opportunity to create a new and alternative credit infrastructure that can provide easy access to credit for millions of businesses and individuals,” – Nandan Nilekani, cofounder of Infosys and former chairman of UIDAI.

If Aadhaar, India’s unique identity project for all citizens, was the cornerstone of the country’s digital ecosystem, a non-profit software product think tank led the quantum leap and helped fructify the Digital India vision. It was February 4, 2013, when as many as 25 (then) NASSCOM members met for the first time in Bengaluru to focus on a completely different narrative. Moving away from mainstream IT services which were bringing in sackfuls of dollars, they wanted to build India as a ‘product nation’ because “that’s where the value is created and captured”.

All leading product startup founders were part of the meeting. Among them were BrandSigma CEO Sharad Sharma; InMobi cofounder Naveen Tiwari; Nucleus Software cofounder and MD Vishnu Dusad; FusionCharts’ founder Pallav Nadhani, and cofounder and MD of Tally Solutions, Bharat Goenka.

At the time, the industry lobby NASSCOM represented all related verticals, including IT services, business process management (BPM), IoT and more. But software products were left to languish, both by policymakers and industry bodies, although Aadhaar was a solid example of what all could be achieved and aspired for through such products.

“We felt the need for a different DNA, and that was how the idea of iSPIRT came forth,” recalled Avinash Raghava, a founding member of the organisation, passionately driven by a group of volunteers.

Within a decade, its bunch of APIs or application programming interfaces, popularly known as the India Stack (more on that later), spearheaded digital inclusivity, fast adoption and operational efficiency across critical sectors such as banking and finance (especially payments and lending sub-sectors), data management, healthcare, education, logistics, digital commerce network and more.

The outcome: India continues to build the most extensive digital public infrastructure (DPI) faster than the rest of the world. The focus on the four pillars – cashless, paperless, presence-less and consent layers – is democratising traditional Indian markets.

The impact has been mind-boggling in terms of bandwidth and scale. Home to 80 Cr broadband and 120 Cr mobile phone users, India has issued 135+ Cr Aadhaar Cards and newly opened 48 Cr bank accounts under Jhan Dhan Yojna has leveraged this power of JAM, the trinity of Jan Dhan Yojana, Aadhaar and mobile phone while building a host of solutions for the masses.

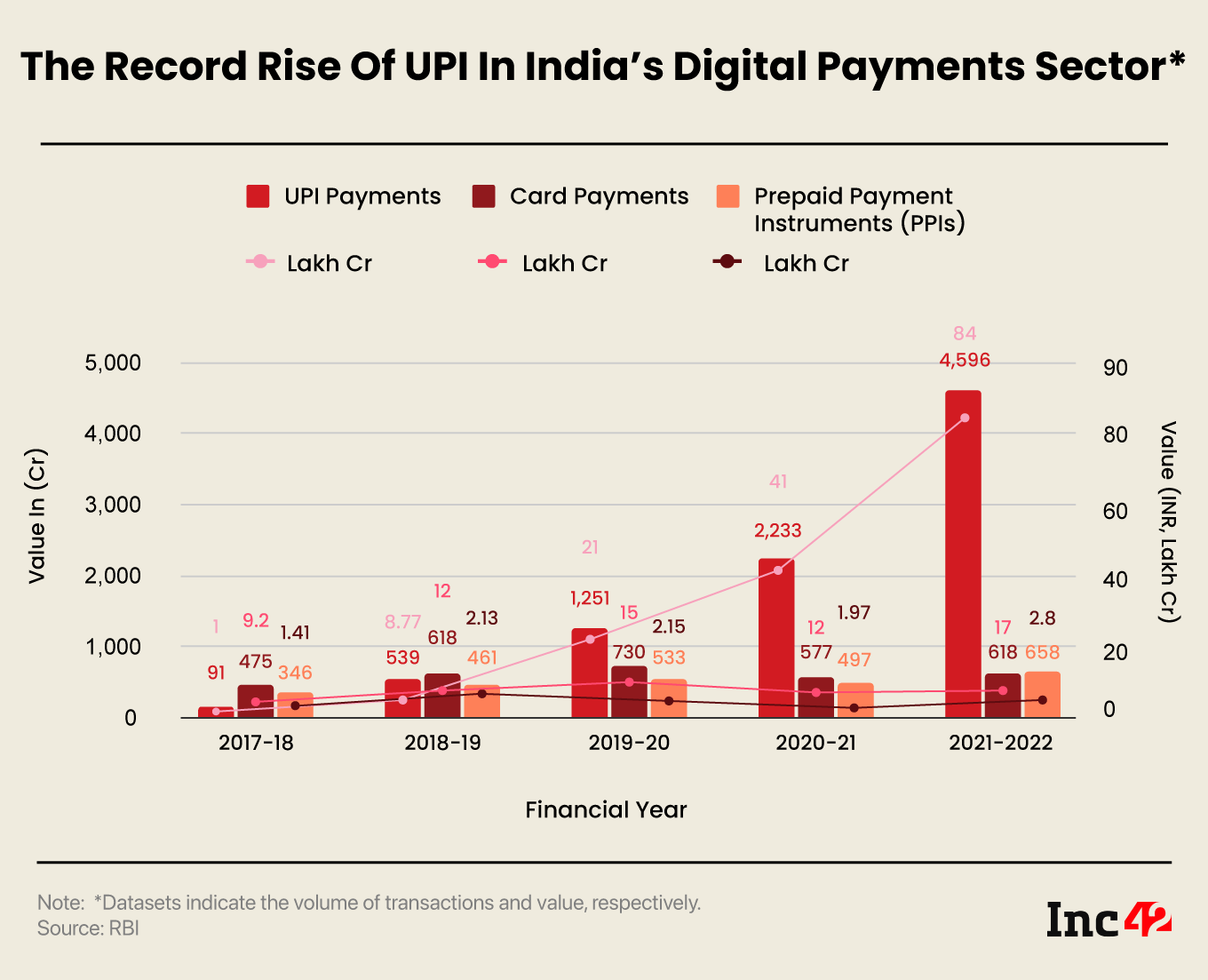

Consider UPI (Unified Payments Interface), India’s flagship digital payments platform with multiple banks and banking features, fund routing and merchant payments under its hood. Union minister Ashwini Vaishnaw, in charge of electronics and IT, communications and railways, said at a Google For India event that the value of UPI transactions equalled 55% of India’s GDP.

Hailing the India Stack story, Google CEO Sundar Pichai said in an interview, “Look at what India has accomplished with the UPI, Aadhaar, and the payments stack, and you will see the value of having an open, connected stack which works. And that is what the internet is. Having responsible regulation which preserves all of this are some of the core elements.”

Before India’s UPI launch under the National Payments Corporation of India (an RBI initiative set up in 2008), a QR code-based payments system was exceedingly popular in countries like China and Kenya. However, clubbed with the other India Stack APIs, UPI is rewriting the scale of success for digital transactions.

Building The Backbone Of India Stack

At the core of India’s newfound digital makeover is the Indian Software Products Industry Round Table (iSPIRT), a think tank building the India Stack since 2013. Set up as a spinoff from the NASSCOM Product Conclave (NPC) by 30 then (NASSCOM) members, iSPIRT recently celebrated its 10th anniversary at a private event in Bengaluru.

Ask them what led to the split, and they would repeat that building software products needed a different approach.

“To build products at scale, we first needed to build an environment like the [Silicon] Valley offers to entrepreneurs. Moreover, India had to build products that could meet its required scale. That was why we set up iSPIRT Foundation, the Spirit of India,” said a founding member who was no longer with iSPIRT and did not wish to be named.

Clearly, there was a need to sensitise the ecosystem. The government needed to step up and allow things to happen. Tech professionals were required to build India-centric solutions which could address Bharat issues. People were also required to adapt to the change. iSPIRT volunteers with ‘no greed and no glory’ also stepped up to fit into these requirements, he added.

When volunteers from the Indian tech startup ecosystem started iSPIRT, their mission was quite simple. “We wanted India to be known for building software products and not just services. We wanted to focus on building products because that’s where the value is created and captured,” explained Sanjay Jain, former chief product manager of Aadhaar and one of the core volunteers associated with iSPIRT from the beginning.

Currently being run by volunteers like Sharad Sharma; Shoaib Ahmed, founder of Catalystor which helps small businesses identify suitable technologies; Dr Renuka Garg, head of governance at Vityl Medical and Gaurav Aggarwal, ML researcher at Google among others, the think tank has helped build APIs required for disruptive public technology platforms that supplement India’s core digital infrastructure. Interestingly, these solutions are now getting replicated in other countries. It is worth noting that UPI is already in use or on trial in more than 12 countries, while as many as seven countries have expressed interest in India Stack APIs.

Back then, the possibilities were endless, with few products to harness them at scale. Billions of Indians needed access to banking, loans and other financial services besides basic amenities like healthcare and education. Yet, more than 73% of farmer households had no access to formal credit due to the country’s fairly conservative banking system.

Again, due to fraud and fund pilferage, many social welfare schemes run by state and central governments failed to ensure the benefits designed for the economically disadvantaged. In simple terms, India needed new payment standards and lending protocols away from the legacy play. The big question before then Prime Minister Manmohan Singh was thus to bring in effective change for over a billion of Indians!

The problem faced by an average Indian was described by Sharad Sharma, cofounder of iSPIRT Foundation, at the Inc42 Ecosystem Summit in 2019. He cited the example of Rajni, a vegetable vendor operating in rural India, who had to borrow around INR 1K daily from a lender to buy veggies from wholesalers.

As all her transactions were done in cash, Rajni lacked a CIBIL/Experian score and could not access bank loans. Moreover, the branch was a 10 km commute from her home and going there many times a week/month would kill her daily business. So, Rajni and others like her are often ensnared in the debt trap of private lenders and pay exorbitant interest rates.

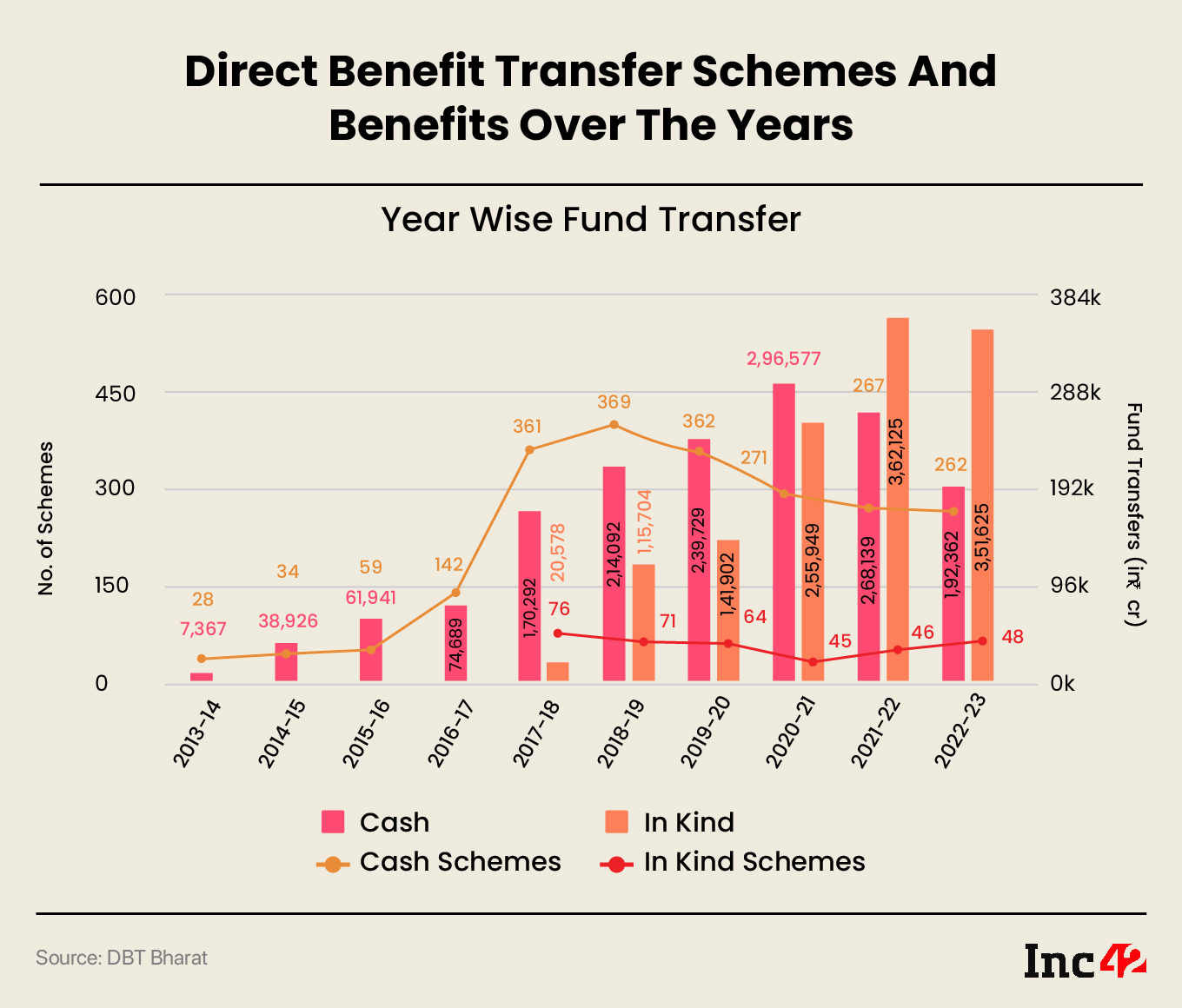

But this is just one side of the coin. Every year, the government used to spend INR 5-6 Lakh Cr on various welfare programmes such as MGNREGA (100-day employment for rural households), PDS (for food security), fertiliser subsidies PMAY-G (initiated to ensure housing for all) and more. However, a significant part of the spending failed to reach the rightful beneficiaries. For instance, before Aadhaar, subsidised food items were being given to nearly 4 Cr duplicate/fake ration cards. Similarly, 1.7 Cr fake LPG connections were obtained to benefit from these welfare schemes.

In addition, document validation required for such benefits remained a costly and cumbersome process. Be it financial assistance, healthcare or education, one had to carry multiple hard copies of original documents for authentication. Payment delay was another bane that used to plague beneficiaries.

When India Stack Brought Benefits To The Doorstep

India Stack, coupled with the JAM trinity, not only addressed these pain points in the simplest possible way but also made the changes at a scale required by the country. As an IMF report said, “No single aspect of the India Stack is entirely unique. However, its comprehensiveness has succeeded in building a more inclusive digital economy from the bottom up.”

For example, fulfilling a simple know-your-customer (KYC) mandate for a loan disbursal could have taken days or even months as a bank executive had to visit the applicant’s physical address. An eKYC has now reduced the process to a few minutes, and the cost has dipped over 100x.

Or take, for instance, how the Pradhan Mantri Jan Dhan Yojana drove financial inclusion by helping the masses open their bank accounts. Aadhaar not only bestowed a digital identity and a presence-less layer (the capability of being authenticated from anywhere) to every Indian but also brought down the KYC cost. Section 5 of the 2016 Aadhaar Act has made special arrangements for the homeless to apply for Aadhaar using the Introducer system.

And eight out of 10 Indians have benefited from this initiative. According to a World Bank’s Global Findex report, Indians accounted for 55% of the bank accounts opened worldwide between 2014 and 2017.

Do these tech-powered inclusion drives make life easier for Rajni?

In the digital ecosystem, Rajni gets an Aadhaar number, a presence-less identity that helps her open a bank account in minutes and access a digitally enabled payment system (read UPI) that creates financial records, a prerequisite for formal loans. Based on the data, many fintech companies will be willing to offer her short-term credits. Besides, as a beneficiary of various government welfare schemes, Rajni can get the money into her Aadhaar-linked bank account under direct benefit transfer schemes. It means people are no longer required to be physically present to receive or make payments.

Commenting on the impact, the Economic Survey (2022-23) observed: Transforming welfare through technology, Aadhaar and JAM trinity have revolutionised the universe of state-citizen interaction, enabling targeted delivery of direct benefit transfers (DBTs) through 318 central schemes and more than 720 state DBT schemes, seamless portability of ration cards across states through ‘one nation one ration card’ and a national database of unorganised workers called the eShram portal. Broad-based improvement in employment indicators is also observed in data covering both the supply and demand sides of the labour market.”

Meanwhile, the government also used the Aadhaar-enabled payment mechanism to cut down on INR 2.22 Lakh Cr fraudulent payments till March 31, 2021.

Building payments around the Aadhaar ecosystem culminated in UPI, and the latter’s popularity went through the roof. The reason is quite clear. As the iSPIRT volunteer quoted earlier pointed out – why should people carry a wad of paper money or even plastic money when they already carry their mobile phones?

How UPI has challenged other cashless payment methods like cards and PPIs is all too apparent from the datasets featured below. Interestingly, the value of card payments during FY20-21 dipped by 20% while UPI payments nearly doubled. UPI transactions have now surpassed all other digital transaction modes used globally.

DigiLocker, another popular product conceptualised under India Stack, aims to ensure that every Indian should go document-free. Users can upload all certified documents such as driving license, educational degrees and certifications, Aadhaar cards and so on and share those as and when they are needed. This digital depository currently boasts more than 145 Mn users and has more than 5.6 Bn documents issued on the platform.

Apart from these flagships, iSPIRT is working on an array of projects. But before treading that path, we need to delve deeper into how the think tank uses its innovation chops and the power of influence at the policy level to get things going.

How iSPIRT Helps Develop The Tech Policy Playbook

In the past, iSPIRT worked with various government ministries and government organisations, including the Reserve Bank of India, MeitY, the health ministry, the civil aviation ministry and more. Post the launch of Aadhaar-enabled solutions, its operations reached a new peak with the introduction of the Open Credit Enablement Network (OCEN), the National Digital Health Mission (for universal health coverage), drone rules and more.

More importantly, the startup ecosystem found it much easier to hold difficult dialogues with government departments and learnt to communicate effectively. Through iSPIRT, startup founders understand how the government works and how they should address the underlying issues. The government, too, has recognised the talented volunteers working on critical projects and delivering results.

Amit Ranjan, who built Slideshare and sold it to Linkedin for $120 Mn before joining iSPIRT as a core volunteer and the architect of DigiLocker, said, “iSPIRT plays multiple roles. The policy part is there, but it does not make those policies. It only advises and helps the government with policymaking.”

The government often remains preoccupied with critical things. So, it can be tough for them to go deep into the latest technology, identify current trends and comprehend the role of various stakeholders in the ecosystem. iSPIRT gathers input from the industry, consolidates it and presents it to officials to help them understand and appreciate different perspectives, he added.

Consider this. Under the central bank, account aggregators (AAs) enable the organised sharing of financial data between providers and users while maintaining a log of the consent granted and providing tools to control and revoke that consent. So, iSPIRT brought the necessary techno-legal clarity for ecosystem stakeholders.

Building The Tech Community

iSPIRT is a think tank supported by esteemed mentors, well-wishers, donors and volunteers like Infosys cofounder and former UIDAI chairman Nandan Nilekani, Kiran Karnik a prominent Indian administrator who is currently a director in the central board of directors of the RBI, Ravi Venkatesan founder of Global Alliance for Mass Entrepreneurship, former CFO of Infosys Mohandas Pai, Paytm founder and CEO Vijay Shekhar Sharma (as donor), InMobi’s Naveen Tiwari and Vishnu Dusad of Nucleus Software. But not all iSPIRT volunteers are tech founders making waves. Most of them are mid-senior professionals, according to Ranjan.

“They are the people who have worked in the industry for a few years; they have been through a career. A lot of times, the most common profiles you will find here are those with 10-20 years of industry experience,” he added.

Driven by the purpose to build software products for ‘Bharat’, volunteers join iSPIRT and these volunteers then also get benefitted at multiple levels. At best, it provides developers exposure to the industry and an ecosystem with the best talent. This helps volunteers shape their careers.

“I was exiting my startup and trying to figure out what to do next,” said Ranjan. “Then this opportunity came, and I ended up working for the government and iSPIRT. It has been here for a decade now, making a significant impact.”

Unlike many other industry associations where the engagement with industry leaders have been merely transactional/informational iSPIRT has been successful in engaging with the most leading tech experts in building the products from scratch.

“The tech products are not produced in isolation. Since most of these products have created new markets in most cases, there is a need to have techno-legal clarity. Having partnered with the government in such product developments, iSPIRT helped ensure a clear runway for these products too while launching them,” said the volunteer quoted earlier.

However, one of the biggest issues with iSPIRT has been keeping volunteers on board. While new volunteers have joined the think tank, a number of volunteers after building the products, simply leave the organisation.

Is iSPIRT 2.0 Losing Steam?

Despite an iconic status and a massive acceptance of its flagship concepts, iSPIRT cannot shake off controversies and challenges. The think tank members allegedly trolled Aadhaar critics, were accused of conflict of interest and had often been at the receiving end for leveraging power and influence. Most of these accusations seem to be a past now.

But of late, the iSPIRT playbook 2.0 seems to be losing steam even as open networks are being built on India Stack.

The latest series of platforms, for instance, the AAs and OCEN protocols, have struggled to emote the kind of response UPI did. Although implemented in 2021, just six AAs are currently live. Some of the NBFCs with AA licences are yet to begin operations, and the total number of approved counts is as low as 4 Mn. iSPIRT, along with Sahamati (the umbrella organisation for AAs), has been organising various programmes to sensitise users.

It has explored the techno-legal aspect of distributed ledger technology (DLT) and proposed BADAL, or Bharat Distributed Ledger, to drive trusted commerce in two ways. First, it can verify past performances before a party strikes a deal with another. Secondly, it can enforce a contract in most situations as the performance unfolds in future.

The think tank also helped develop the Open Network for Digital Commerce (ONDC) to democratise ecommerce and provide an alternative to the marketplace model to benefit millions of small traders. However, the Parliamentary Standing Committee in its report observed that various issues regarding operational strategy, fair competition, technical capability of MSMEs to leverage the network and clarity in assigning liability is yet to be addressed.

Of course, AAs, ONDC, OCEN and the National Health Stack are critical components of India’s rapidly growing digital infrastructure. But tech adoption in these cases has been slower than expected. Implementational delays are also killing the exuberance in sunrise sectors. For example, commercial drone operations have got the green light, and the techno-legal policy is more transparent now. But the single-window operations under DigitalSky platform have not been fully functional in the past four years.

A similar case of policy paralysis is also causing a great deal of concern.

Based on Balaji Srinivasan’s Crypto India Stack, iSPIRT published a paper in April 2021 on how cryptocurrencies could help mitigate India’s MSME funding crunch. Arguing that there had been a financing/credit gap of $250-500 Bn, it said India could offer a viable path to deploy the new crypto wealth in a controlled manner while solving the financial inclusion issues plaguing the country’s SMEs.

“Inflows of cryptocurrencies from KYC-ed investors through approved Indian and global exchanges can potentially be allowed into India for the purposes of enhancing SME access to low-cost global capital. GST-registered companies could, for instance, receive capital against their issued e-invoices and other information collateral in special accounts opened via a controlled conduit such as GIFT city, which is one of India’s favoured bridges to international markets,” the report stated.

So far, barring the tax imposition, the government has not shown the slightest interest in crypto.

In such a scenario, which iSPIRT product can do a UPI and sweep India off its feet? Or will tech advocacy in India lose its scale and voice, receding into the same obscurity from where it emerged? It is time to wait and watch.

Edited by Sanghamitra Mandal

Update | March 1, 2023: 10.00 PM

More volunteers’ and well-wishers’ names have been added.

Ad-lite browsing experience

Ad-lite browsing experience