SUMMARY

Test preparation and online certification segments together made 88% of the total edtech funding in 2019

Edtech market size is estimated to be $563 Mn, which is about 0.56% of the total education market

There are a total 4,450 edtech startups operating in India currently

The growing internet penetration and smartphone adoption have opened up a huge market opportunity for edtech innovation in India. With over 665 Mn wireless internet subscribers according to a TRAI January 2020 report, India is a huge market for edtech apps, products and services, especially because of the high importance that Indians place on education at every level.

This increase in the addressable market for edtech players has resulted in the rise of personalisation and convenience in the school curriculum and out-of-classroom learning. The overall size of India’s education sector is estimated to be $101 Bn in FY2019. Of these, the online education market stands at $563 Mn, which is about 0.56% of the total education market.

The increasing demand for tech-enabled learning solutions can also be gauged by the fact, that there are a total 4,450 edtech startups operating in India currently. But as is seen in several other sectors, a few sub-sectors are driving the growth of the whole sector. In the context of edtech, these sectors happen to be K-12 and test prep apps, with certification products and services following.

Between 2014 and 2019, a total of $1.802 Bn was raised by edtech startups across 303 deals as per data recorded by DataLabs by Inc42 and presented in its latest report “The Future Of India’s $2 Bn Edtech Opportunity Report 2020”.

ORDER YOUR COPY NOWBYJU’s Earned The Most Funding

In terms of funding size, Byju’s, Unacademy, Vedantu, Toppr, and Eruditus were found to be the most funded startups in the country. Their combined funding contributed almost 80% ($1.38 Bn) to the total funding poured into edtech startups.

In 2019 alone, edtech startups in India raised $433 Mn in total funding which was 36% lower than $681 Mn funding raised in 2018. In addition to this, the number of funding deals and count of unique startups funded in 2019 also dropped by 15% and 4% respectively, as compared to last year.

In 2019, the average ticket size of funding in edtech startups was found to be around $11 Mn as compared to $17 Mn average in 2018. BYJU’s was once again the top-funded edtech startup in India. The Byju Raveendran-led startup has held this spot among Indian startups for the past five years (2015-2019).

Investor Participation Goes Up

In 2019, the top 10 investors in edtech accounted for 22% of the total deal count, however, the fact that the contribution of these investors is slightly less than a quarter of the total deal count indicates that the investment landscape in the edtech sector is not dominated by India’s top tier investors.

In fact, DataLabs recorded a 50% surge in unique investor participation in edtech in 2019, which indicates that the investor confidence towards edtech startups was higher compared to the previous year. With a 9% CAGR in unique investor count between 2015 to 2019, edtech is one of the fastest-growing sectors in this regard.

Taking a stage-wise look at the funding landscape, one can see that late-stage startups recorded a massive 59% growth in capital inflow for 2019. And similarly, seed-stage deals grew by 50%. So the growth in the number of unique investors has had a direct positive impact on the diversity of capital invested in edtech.

ORDER YOUR COPY NOWTest Prep Startups In The Investor Limelight

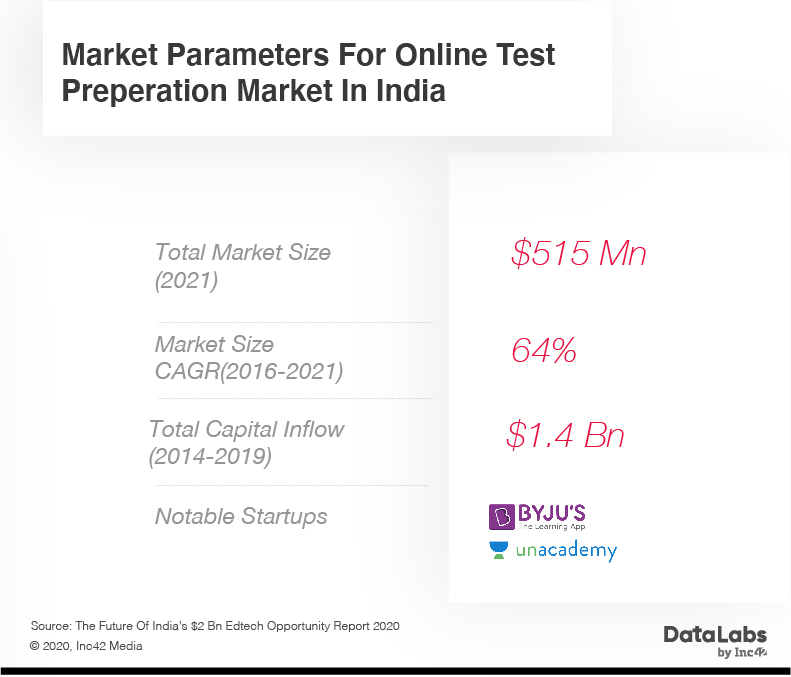

The growing popularity of online education has provided a major push to two subsectors of the edtech market including test preparation (from K-12 to entrance exams) and online certification. Between 2014 to 2019, startups in test prep and online certification startups earned a whopping 88% ($1.6 Bn) of the total capital inflow in edtech.

According to DataLabs, a large portion of the total edtech space will be captured by K-12 startups, which are currently growing at a CAGR of 60%. Further, skill development was found to be the most preferred edtech sub-sector for seed-stage investors. Also in terms of the number of unique edtech businesses funded between January 2014 and September 2019, skill development-focused startups are the most preferred.

However, capital inflows into the test preparation and online certification segments are comparatively higher. These two sectors together make up for 88% of the total funding into edtech startups.

“Since, the end goal in test prep is in the short term and there is gratification achieved quickly, the consumer is willing to pay for such solutions. Products linked to either getting a job or cracking high-stakes exam will find it easier to monetise. Hence, there is significant interest from most VCs in this space,” said Sunitha Viswanathan, senior Associate at Unitus Ventures.

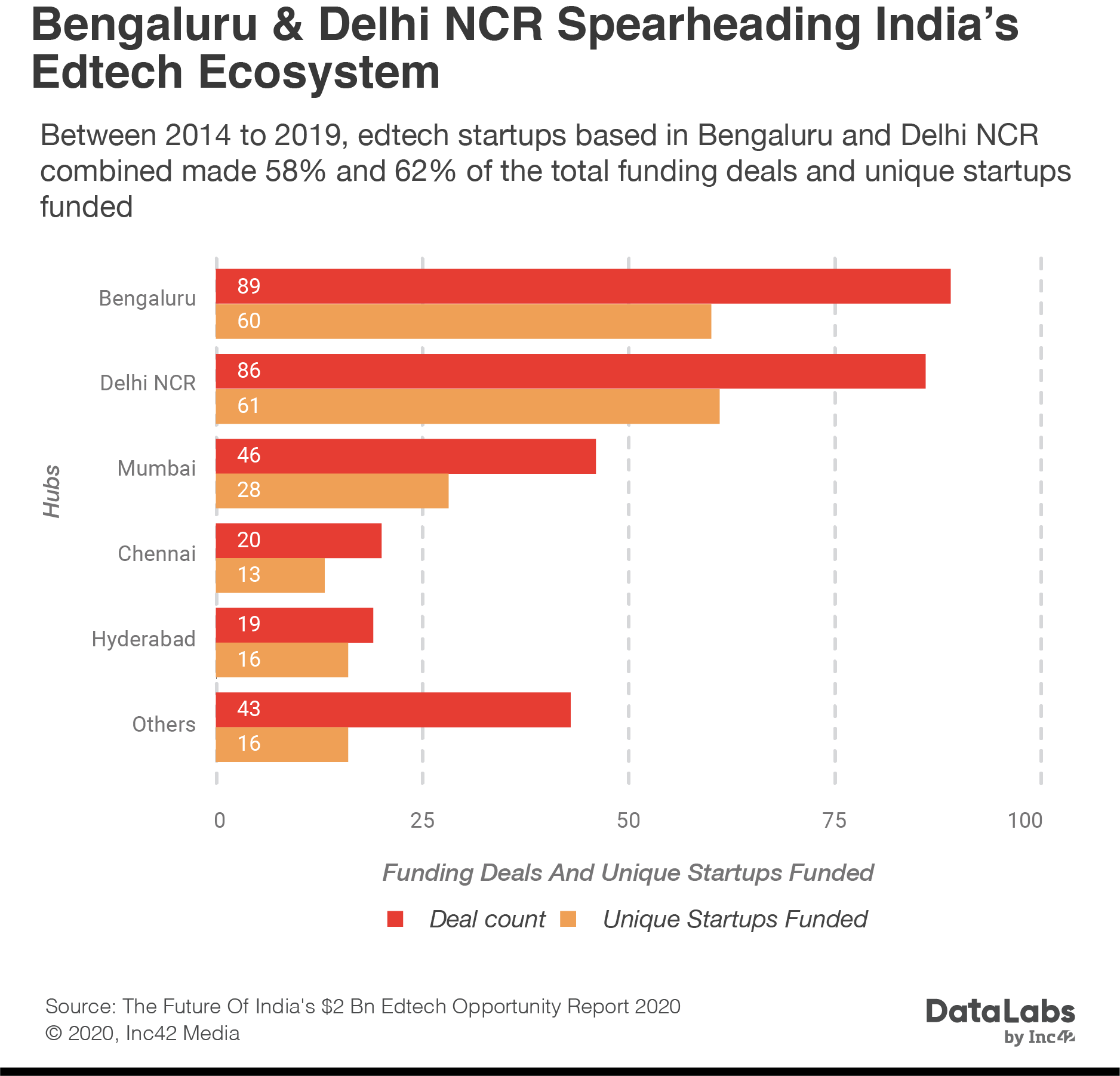

In terms of demographics, the venture capital investment in the edtech startups is highly skewed towards the top three startup hubs of India: Delhi NCR, Bengaluru, and Mumbai. Businesses based in these cities accounted for 92% ($1.6 Bn) of the total $1.73 Bn raised by edtech startups across India between January 2014 and September 2019.

Sajith Pai, director, Blume Ventures earlier told Inc42 that an increased focus on regional language learning and data analytics will play an important role in the success of edtech startups in 2020, just like it did in 2019.

Another reason for this skewed metric could be the relative maturity of startup ecosystems in these cities as compared to other locations. Further, the stronger presence of venture capitalists in Delhi NCR, Bengaluru and Mumbai have also led many entrepreneurs to set up businesses in these metro cities.

DataLabs has analysed the future of edtech and learning in India, and recorded the growth prospects, the market and consumer-related insights from the booming Indian edtech market in its latest report — The Future Of India’s $2 Bn Edtech Opportunity Report 2020.

ORDER YOUR COPY NOW