SUMMARY

Nine out of the 14 new-age tech stocks under Inc42’s coverage gained this week, rising in the range of 1% to over 4%

RateGain was the biggest loser this week, plunging 7.4% on the BSE. IndiaMart InterMESH, Paytm, Nykaa, PB Fintech were the others which ended in the red

Reversing last week’s decline, benchmark indices Sensex and Nifty50 gained 1.2% and 1.6%, respectively, this week

New-age tech stocks witnessed some recovery this week as the broader Indian equity market remained upbeat due to a decent March quarter earnings season.

Nine out of the 14 new-age tech stocks under Inc42’s coverage gained this week, rising in the range of 1% to over 4%. Nazara Technologies emerged as the biggest winner, surging 4.4%, followed by Zomato, which rose 4.3% on the BSE.

Tracxn Technologies, Delhivery, and EaseMyTrip were also among the gainers this week.

Post the market close on Friday, EaseMyTrip reported a 33.1% year-on-year (YoY) rise in net profit to INR 31.1 Cr in Q4 FY23, while operating revenue jumped 91.5% to INR 116.6 Cr.

Despite the bullish trend, some of the new-age tech stocks ended the week in the red. RateGain was the biggest loser this week, plunging 7.4% on the BSE. IndiaMart InterMESH (down 0.5%), Paytm (down 0.6%), Nykaa (down 1.6%), PB Fintech (down 4%) were the other losers.

Among these, Nykaa and PB Fintech reported their Q4 FY23 results in the week.

Meanwhile, benchmark indices Sensex and Nifty50 reversed last week’s decline to end this week 1.2% and 1.6% higher, respectively. The indices surged on Friday, with Sensex closing at 62,501.69 and Nifty50 at 18,499.35.

Commenting on the weekly performance, Vinod Nair, head of research at Geojit Financial Services, said that the domestic market was influenced by global cues, including concerns surrounding the ongoing US debt ceiling negotiations, the German recession, and hawkish comments from US Fed officials.

While domestic investors traded cautiously during the week due to these factors, the market witnessed a smart recovery towards the end driven by the strong growth forecast for the Indian economy, he added.

It must be noted that Reserve Bank of India (RBI) Governor Shaktikanta Das hinted this week at the possibility of India’s Gross Domestic Product (GDP) growth exceeding the 7% mark in FY23. Meanwhile, on Friday, Goldman Sachs raised India’s GDP growth forecast for 2023 by 30 basis points (bps) to 6.3%.

With the earnings season nearing its end, the focus of the domestic equity market will now shift to macro data, US debt negotiations, and upcoming central bank policy meetings, said Siddhartha Khemka, head of retail research at Motilal Oswal.

Now, let’s dig deeper into understanding this week’s performance of some of the new-age tech stocks.

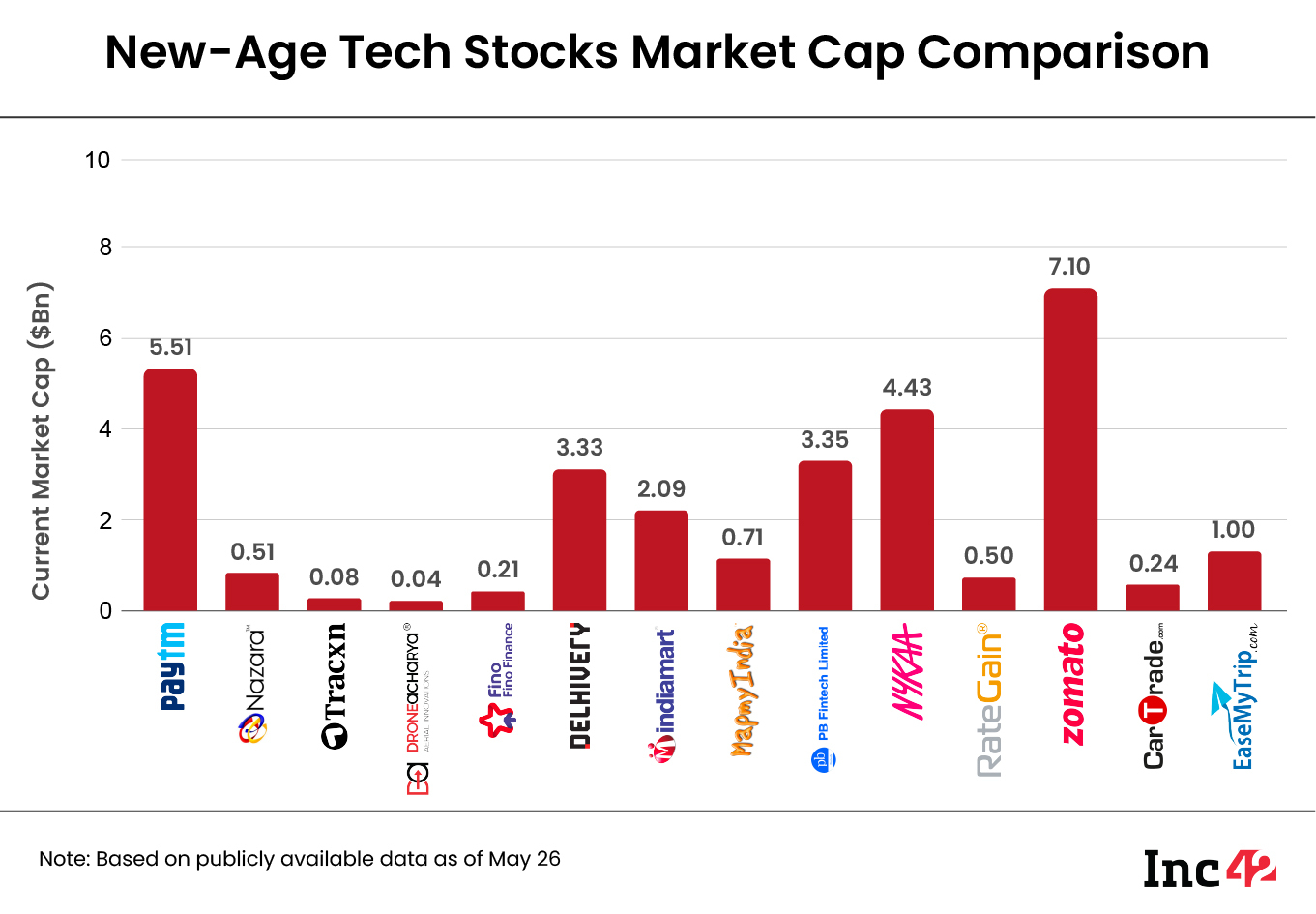

The 14 new-age tech stocks under Inc42’s coverage ended the week with a total market capitalisation of $29.1 Bn versus $28.94 Bn last week.

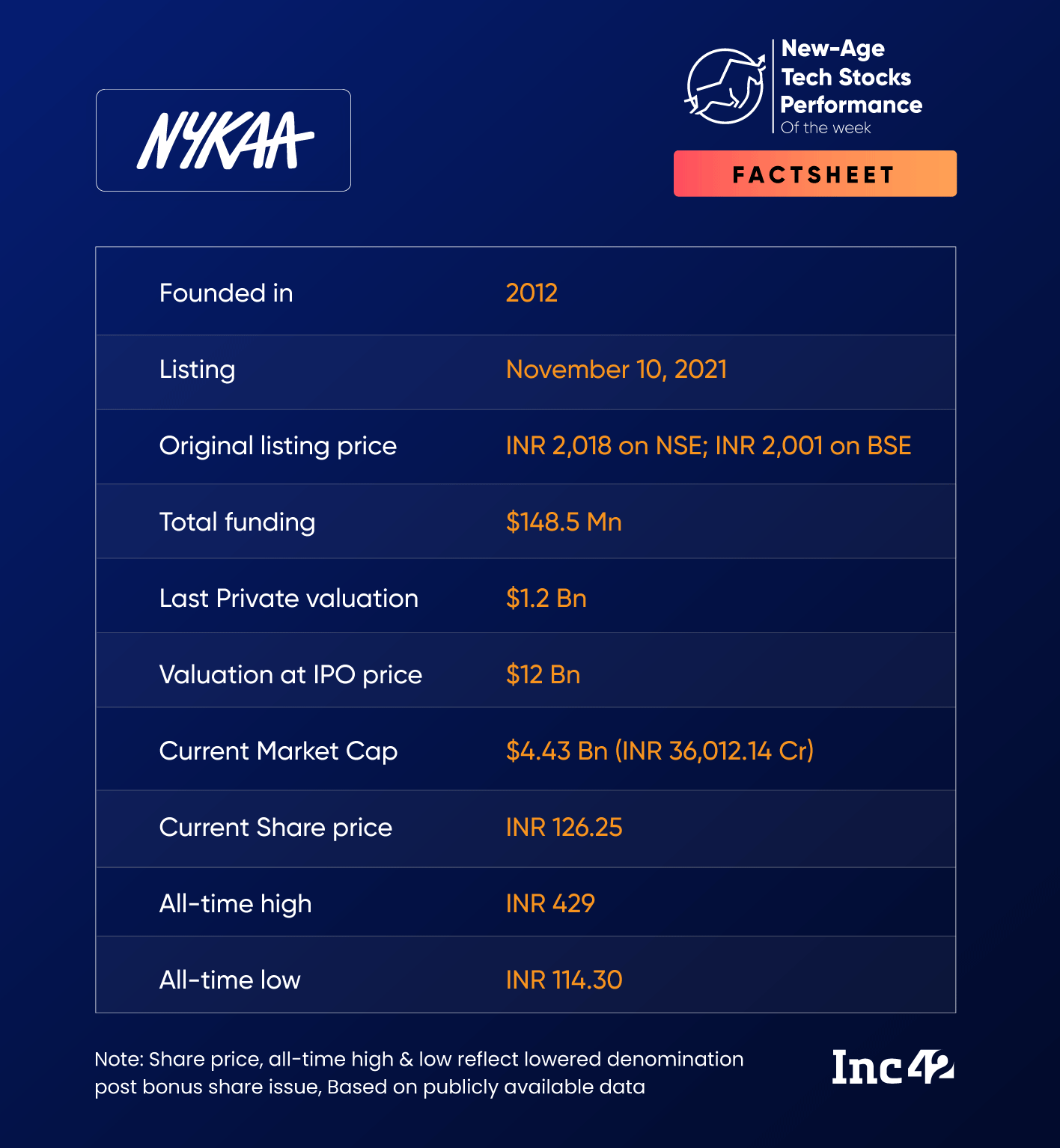

Nykaa’s Q4 Glitters With A Few Major Spots

Beauty ecommerce major Nykaa on Wednesday posted a 70% dip in its net profit to INR 2.3 Cr in the March quarter on FY23, with degrowth seen across its beauty and personal care (BPC) and fashion verticals.

While Nykaa’s operating revenue grew 33.7% YoY to INR 1,301.7 Cr in the quarter, it slightly missed the Street’s consensus estimates and also declined 11% sequentially.

Its shares remained volatile throughout the week and fell 1.6%, ending Friday’s session at INR 126.25 on the BSE.

Nykaa CEO and MD Falguni Nayar said the inflationary pressure is expected to trail off this year. Meanwhile, she also noted that Nykaa fashion would not “dilute” what the platform has to offer in terms of “uniqueness” for instant growth.

While brokerages largely remain positive on the company’s growth trajectory in the medium- to long-term, most of them highlighted a few possible near-term headwinds, particularly for the fashion business vertical.

For instance, ICICI Securities upgraded its rating on Nykaa to ‘buy’ from ‘add’ but noted that the company chasing growth at elevated levels, which could be dilutive of gross margin, and difficulty in fashion business achieving success, given higher competition in the category, remain the key risks to its thesis.

Meanwhile, Kotak Institutional Equities increased the estimated loss from Nykaa’s fashion business over the next year. The fashion business may need more time to achieve EBITDA break-even, the brokerage said. It also reduced price target (PT) for Nykaa to INR 210 from INR 215, which implies an upside of 66% to the stock’s last close.

However, the brokerages are more positive on the growth of Nykaa’s BPC business.

Of the 20 brokerages covering the stocks, 15 have a ‘buy’ or above rating on Nykaa, while two rate it as ‘hold’

Amol Athawale, deputy vice president, technical research at Kotak Securities, said that Nykaa is consolidating on the technical charts but is not showing signs of reversal. It looks to be in the oversold category.

“The immediate hurdle for the stock is its 50-day simple moving average (SMA), which is INR 130 currently. If the stock succeeds to close above this level, then we can expect a sharp pullback rally to INR 135-INR 140,” Athawale said.

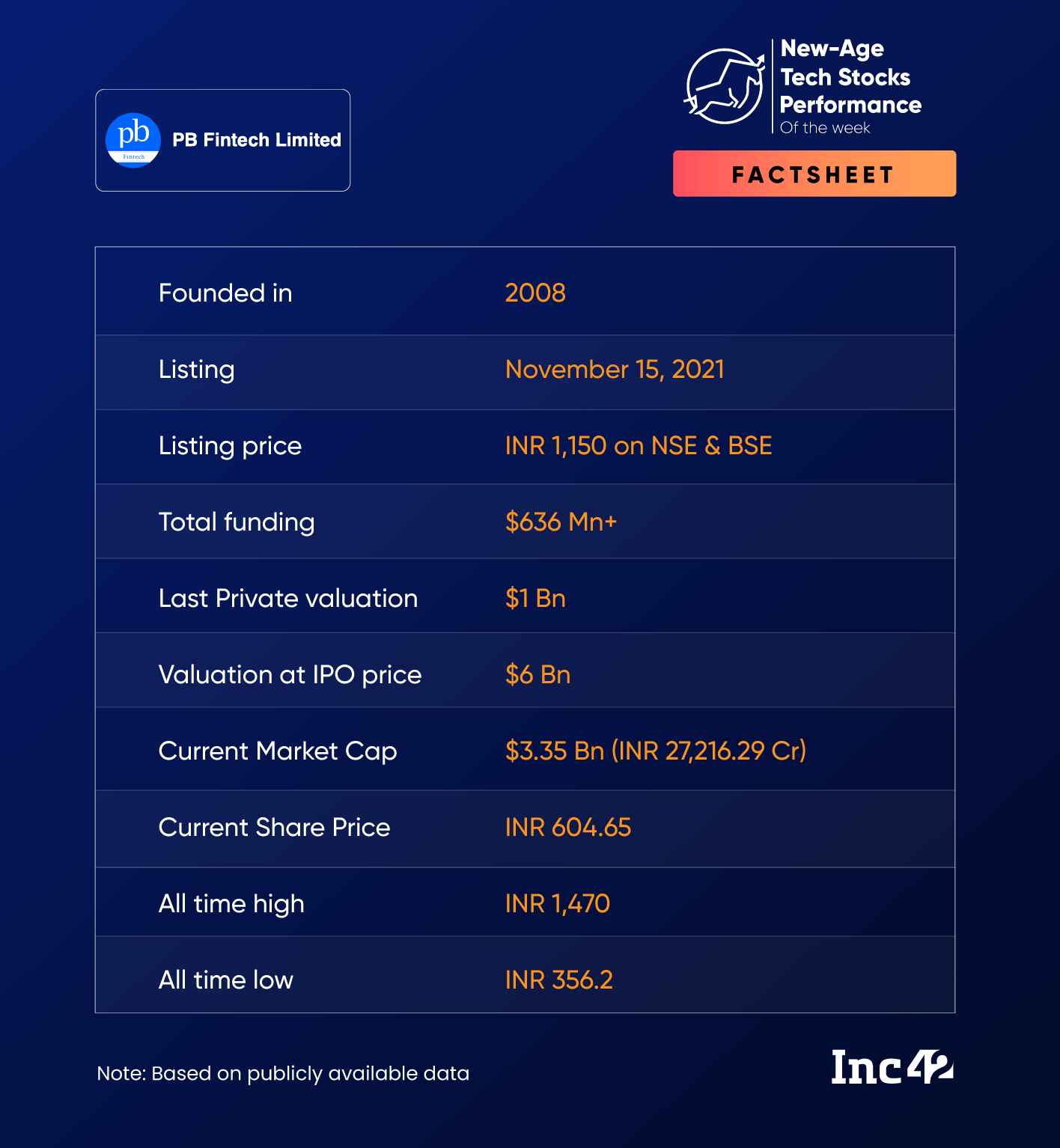

PB Fintech Slips After Tencent Offloads Stake

In a rather happening week for Policybazaar parent PB Fintech, its shares nosedived 4% to INR 604.65 despite upbeat Q4 results. PB Fintech shares slumped almost 3% on Friday alone after Tencent dumped 2.1% stake in the company.

In the News For:

- The fintech major announced achieving break even on a consolidated basis in Q4 FY23. It posted a consolidated adjusted EBITDA of INR 28 Cr in Q4. It saw growth across existing and new businesses. PB Fintech’s consolidated net loss also narrowed on a YoY basis as well as sequentially to INR 9 Cr in the quarter.

- Tencent sold 94.16 Lakh PB Fintech shares worth INR 562 Cr on Friday, in a bulk deal. Societe Generale bought 22 Lakh of those shares.

Brokerages gave a thumbs up to the stock after the Q4 results, with many of them also raising their PTs.

Citigroup said that the startup’s end-to-end customer journey model (phy-gital origination, servicing, claims management), market dominance in digital-backed origination, robust tech-backbone, and transitioning monetisation model toward annuity revenues position it in a sweet spot.

Kotak Securities’ Athawale noted that the stock is consolidating between INR 650 and INR 590 after a strong rally. “INR 590 is the strong support zone for the stock. If it sustains above that, then the immediate upside would be INR 650 and INR 670. The texture of the stock is positive but might take some time for the next rally,” he said.

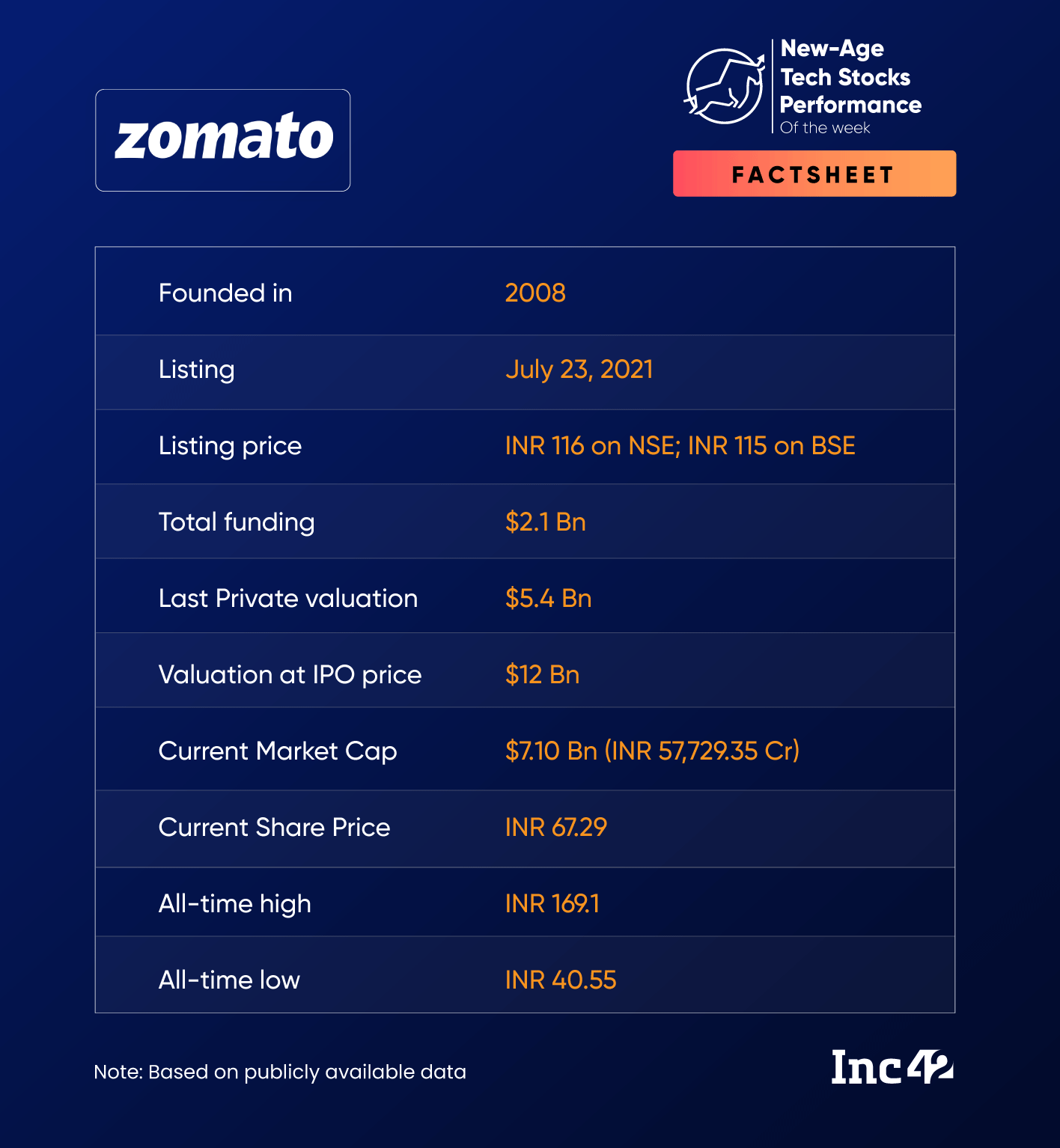

Zomato Closes At A Five-Month High

On the back of improving visibility to profitability and the Q4 beat, Zomato shares continued to rally this week.

After gaining over 3% last week, the foodtech major emerged as the second-biggest winner this week by gaining 4.3% on the BSE. It closed the week at INR 67.29, a level last seen in the beginning of December last year.

While some concerns around Blinkit business still remain and the food delivery vertical awaits recovery, Zomato is taking baby steps to turn overall profitable.

It claimed to have achieved adjusted EBITDA profitability, excluding the quick-commerce vertical, in Q4 FY23. Its net loss declined over 45% YoY and sequentially to INR 187.6 Cr.

While debates on potential competition from the Open Network For Digital Commerce (ONDC) continue, analysts from various brokerages have so far noted that the network is not an immediate threat but would be a key competitor to watch out for.

Kotak Securities’ Athawale said that Zomato is consistently trading above the 200-day SMA, which is a positive sign for the stock. After a strong rally, the stock is forming higher-high and higher-low series, which is also a big advantage for the stock, he believes.

INR 62 is an important support for Zomato and above that, the stock can rally till INR 75 in the near-term, he added.