Ebix has already announced 11 acquisitions in 14 months with an investment of nearly $500 Mn

The company planning an IPO, sometime in 2019, and after the general election

In 2018, Ebix has acquired Transcorp International, Smartclass, Centrum Direct, Indus Software, Mercury Travels and Leisure Corp

With plans to make EbixCash, the Indian subsidiary of Ebix Inc, public next year, the parent company has continued to double down on its aggressive acquisition strategy in India. Ebix Inc is a global supplier of on-demand software and ecommerce services.

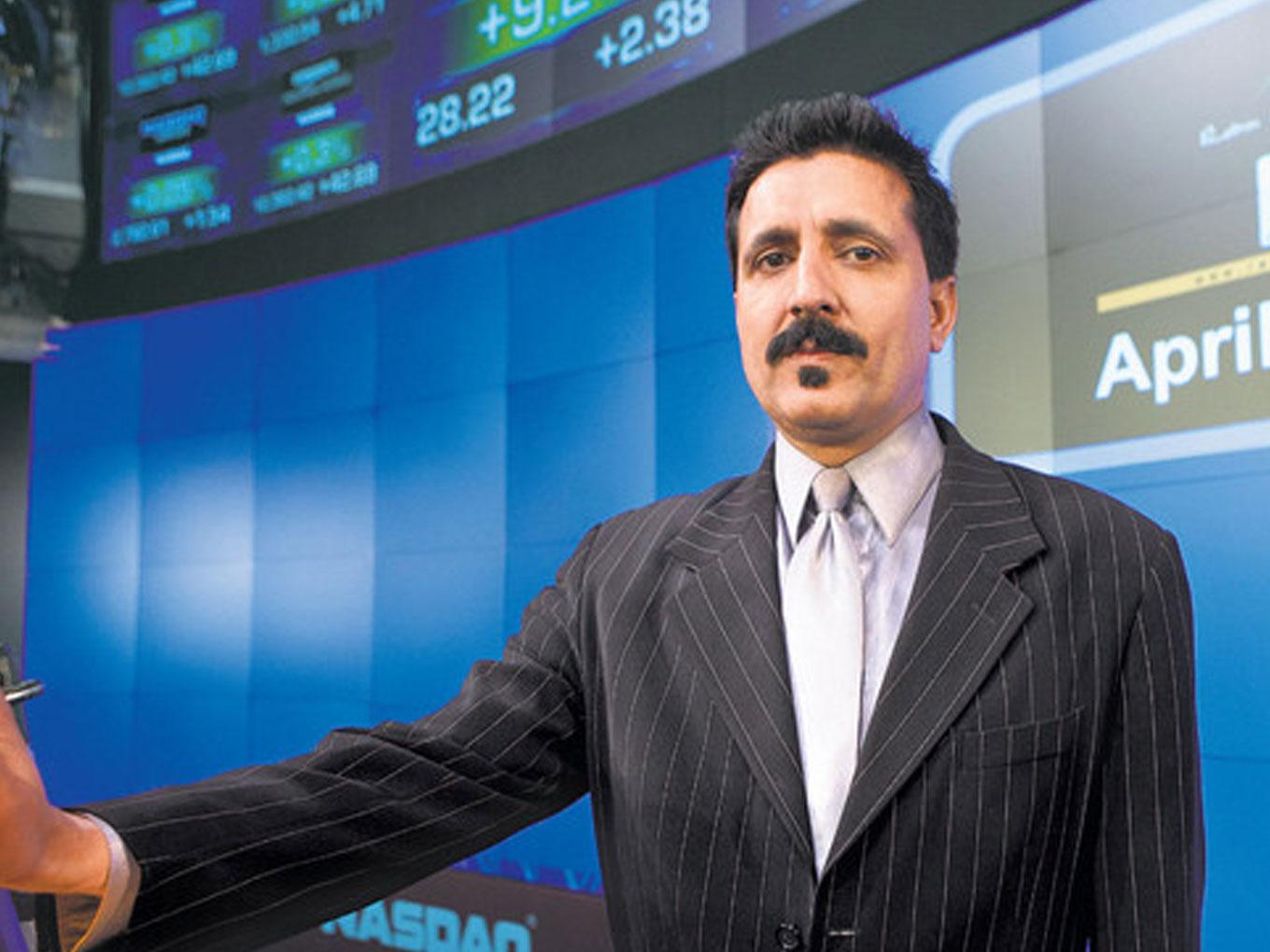

With 11 acquisitions in 14 months thereby investing nearly $500 Mn, Ebix chief executive Robin Raina is ready to shell out another $500 Mn depending on the opportunities.

Raina told ET, “It’s about how much money Ebix is creating. We are not into borrowing money and buying companies. Our leverage ratio is very low… I am willing to leverage up to three times. That’s how much I want to go. Can we bring another half a billion dollars to the market? Absolutely. If we keep making acquisitions with sanity, and include in a disciplined manner into the Ebix story with 30% margins, then we will have enough cash being created.”

With a market capitalisation of $2.41 Bn, Ebix has been one of the most active buyout specialists in the Indian startup ecosystem, after snapping up ventures across sectors like travel, remittances, payment solutions and elearning among others.

“We believe we can create the largest financial exchange the world has seen. We can create this out of India,” he said.

Increasing Portfolio Of Ebix

With 40 offices spread across the globe, Ebix provides end-to-end software and ecommerce solutions to clients in different verticals, including insurance, finance, healthcare and e-governance.

It assists companies in building infrastructure exchanges, front- and back-end enterprise frameworks and risk compliance systems.

Ebix also offers SaaS-based software development solutions, support and consultancy to clients on six continents. The company claims to have conducted in excess of $100 Bn in insurance premiums annually on its platforms.

With an expansive presence that combines 231.5K physical distribution outlets and an omnichannel online digital platform, EbixCash has established an enterprise financial exchange portfolio spread across money remittance (domestic and international), travel, prepaid and gift cards, utility payments, etc.

In last seven months of 2018, Ebix has acquired Money Transfer Service Scheme (MTSS) business of Transcorp International, elearning company Smartclass, money exchange platform Centrum Direct, financial software provider Indus Software and travel services ventures Mercury Travels and Leisure Corp.

Earlier, Ebix acquired an 80% stake in ItzCash in May 2017. The funding, which was done at a valuation of $150 Mn, allowed Ebix to assume majority shareholder status in ItzCash. As part of the deal, existing investors Matrix Partners, Lightspeed Venture Partners and Intel Capital exited for returns between 3X-5X.

At the time, it was reported that Ebix was looking to foray into areas such as credit, insurance, healthcare and investments to accelerate growth momentum. Having reportedly deployed 25,000 point-of-sale machines in the last few months, the company now intends to deploy 100K POS machines by the end of 2017.

IPO Plans Picking Up Pace In India

Raina said that the company had begun discussions with several merchant banks for the initial public offering (IPO) of EbixCash that it was planning for the second half of 2019.

“We are planning an IPO, sometime in 2019, and after the general election,” Raina said. “When we go for an IPO, we would like to have a minimum of $400 Mn in net revenue, and I would like to go there with a minimum of 30% operating income.”

While 2017 proved to be a blockbuster year with a record 122 companies raising a staggering $10.85 Bn through IPOs, 2018 is witnessing even greater highs.

According to EY India’s IPO Readiness Survey Report, in H1 18, India recorded the highest IPO activity in terms of the number of deals across the globe, accounting for 16% of the total issues.

Overall, India IPO activity was at a comparably higher level and saw 90 IPOs raise $3.9 Bn, driven by solid activity in Q1 18, according to the EY India report.

Raina said, “If the fundamentals are good, you can convert a bad market into a good event… We just have to do what we have to do. Every bank has been pitching to us.”

[The development was reported by ET.]

Ad-lite browsing experience

Ad-lite browsing experience