VLCC said that the ‘merger’ will be executed via a combination of secondary buyout and share swap

The deal will enable Ustraa to tap into the huge resource base and experience of VLCC to scale its operations

The acquisition comes eight months after Ustraa raised INR 16 Cr in funding from Info Edge, 360 One (formerly IIFL Ventures) and Wipro Enterprises

Beauty and skincare brand VLCC has announced that it plans to acquire the men’s grooming startup Ustraa for an undisclosed amount.

However, sources told CNBC-TV18 that the deal was pegged at INR 61 Cr in a mix of cash and share swap.

In a statement, VLCC said that the ‘merger’ will be executed via a combination of secondary buyout and share swap. In addition, VLCC said that it will make further investments in the New Delhi-based startup to accelerate its growth.

It was not immediately clear whether the existing team at Ustraa would continue to lead the operations of the company.

The deal will enable Ustraa to tap into the huge resource base and experience of VLCC to scale its operations. Ustraa will also leverage the partnership to significantly expand the reach of the customer base and expand its range of products.

The acquisition is expected to enable VLCC to foray into the men’s grooming space and leverage Ustraa’s tech stack to scale its presence online.

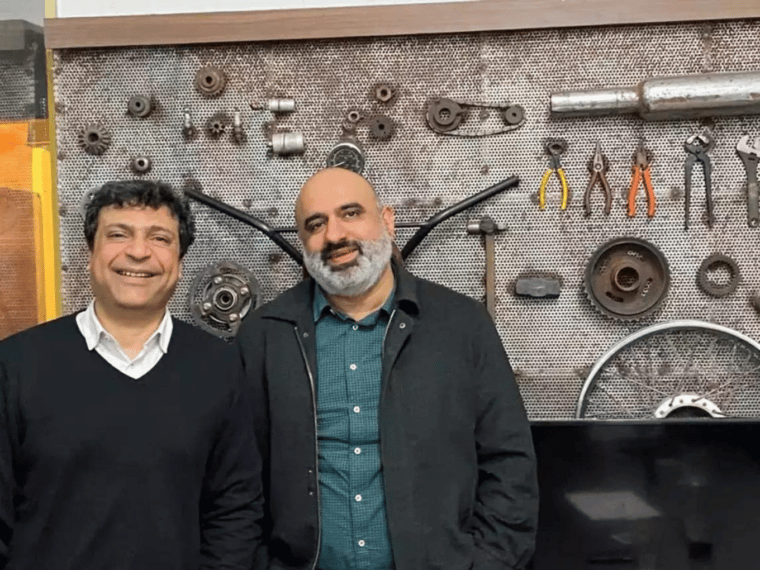

Meanwhile, in a joint statement, Ustraa cofounders Rahul Anand and Rajat Tuli said, “VLCC represents a perfect strategic partner to help us broaden our customer reach, especially in offline retail… We believe our combined expertise in brand building, sales and marketing and distribution will create faster growth for both brands and we are excited to embark on the journey forward as part of the VLCC family.”

Chiming in, VLCC’s chief executive officer (CEO) Vikas Gupta said, “We are impressed with Ustraa’s leading position in (the) fast-growing men’s grooming market, especially the D2C channel. This acquisition marks VLCC’s foray into (the) men’s grooming market and we aim to accelerate Ustraa’s growth journey by leveraging VLCC’s pan-India offline distribution.”

Trilegal and KPMG served as the advisors to VLCC on the acquisition while EY acted as the exclusive financial advisor to Ustraa and its investors.

“… We are bullish about the synergies that can be realized in this VLCC-Ustraa merger for the platform to become a leading consumer business in the beauty and personal care space and look forward to working closely with the management team and Carlyle post-merger,” added ace investor and Info Edge executive vice-chairman Sanjeev Bikhchandani.

Founded in 2003 by Anand and Tuli, Ustraa is a D2C startup, which sells men’s grooming products such as shampoo, face wash, hair oil, beard oil, and other products. The digital-first brand sells its products through its website, ecommerce marketplaces and third-party retail outlets.

The startup last raised INR 16.8 Cr in a strategic funding round led by Info Edge’s subsidiary Startup Investments in September last year. In total, the startup has raised $10 Mn since its inception.

Ustraa is also backed by marquee names such as 360 One (formerly IIFL Ventures) and Wipro Enterprises.

The startup claims to have catered to 22 Lakh customers so far and has more than 85 stock keeping units (SKUs). The platform claims to generate more than 67% of its sales from the online channel.

Ustraa joins the growing list of Indian startups to have opted for mergers and acquisitions (M&As) amid inclement market conditions and a chilling funding winter.

Earlier this week, fintech startup CredFlow announced the acquisition of Y Combinator-backed business management startup TechBiz in an all-cash deal that was pegged at under INR 10 Cr.

Around the same time, Bengaluru-based SaaS platform Capillary Technologies acquired US-based rebranded loyalty and engagement company Tenerity’s product Digital Connect.

Prior to that, ecommerce enabler GoKwik picked up a 100% stake in chat commerce startup Tellephant, while Aurum PropTech’s board approved the acquisition of home rental startup Nestaway, in a fire sale, for a consideration of up to INR 90 Cr.

Ad-lite browsing experience

Ad-lite browsing experience