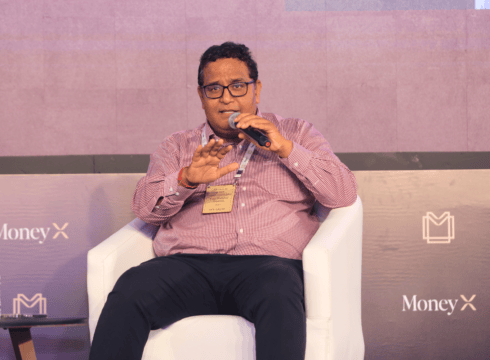

There is never a day that I would not buy more equity in Paytm: Paytm founder and CEO Vijay Shekhar Sharma

The statement from Sharma comes days after he became Paytm’s Significant Beneficial Owner (SBO) and largest shareholder

Antfin had reduced its ownership in Paytm from 23.79% to 9.90%, shifting stake in two transactions over the past few weeks

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

Vijay Shekhar Sharma, the founder and CEO of Paytm, said he’ll look to raise his stake as Paytm edges closer to profitability.

“There is never a day that I would not buy more equity in Paytm,” Sharma told Bloomberg News in an interview on Monday. “The single largest shareholder of Paytm is now an Indian, that is myself, and I believe this is definitely a key milestone.”

Paytm reduced its losses by 44.5% year-on-year (YoY) to INR 358.4 Cr in Q1 FY24. The fintech giant reported a third consecutive EBITDA positive quarter but before the employee stock option (ESOP) cost. EBITDA, sans ESOP costs, stood at INR 84 Cr during the quarter under review versus an EBITDA loss of INR 275 Cr in Q1 FY23.

Sharma’s comments come on the heels of his becoming Paytm’s Significant Beneficial Owner (SBO) and its largest shareholder after Anfin reduced its stake in the company. In a regulatory filing on Monday (September 4), the listed fintech giant disclosed that Antfin had reduced its ownership from 23.79% to 9.90%.

Antfin, a Netherlands-based affiliate of China’s Ant Group, trimmed its stake over two separate transactions.

Firstly, it transferred a 10.3% stake, along with voting rights (excluding economic rights) to Resilient Asset Management, a Sharma-owned company. Valued at approximately $628 Mn (around INR 5,200 Cr), this move elevated Sharma’s cumulative shareholding in Paytm to 19.42% o 19.42%.

It also sold a 3.6% stake through open market transactions last week for INR 2,037 Cr.

This ownership reshuffle also comes months after Alibaba, another subsidiary of Ant Group, offloaded a 3.31% stake in Paytm this February.

Vijay Shekhar Sharma also said that while Antfin has not indicated that they want to sell a further stake at the moment, he remains ready to ‘jump at any opportunity’ to buy more equity in the fintech giant.

The company’s shares, which have made a sharp recovery over the past eight months or so, opened at INR 863.05 apiece on Tuesday (September 5), less than 1% higher than Monday’s close of INR 856.80. While the share price has improved by nearly 60% since the start of the year, it remains some ways off from its listing price of INR 2,150.

On Monday, the fintech giant launched another soundbox, which also features contactless payments via credit or debit cards. Paytm also approved the allotment of 48,495 equity shares on Tuesday as part of its ESOP plans from 2008 and 2019, exchange filings showed.

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.