The sector agnostic fund will have a corpus of INR 20 Cr with a greenshoe option of INR 10 Cr

The SEBI-approved Category-II alternative investment fund (AIF) will target homegrown AI and EV startups that cater to Indian customers and businesses

While Vijay Shekhar Sharma will be the primary contributor of the fund, other external investors will also pump capital in the AIF

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

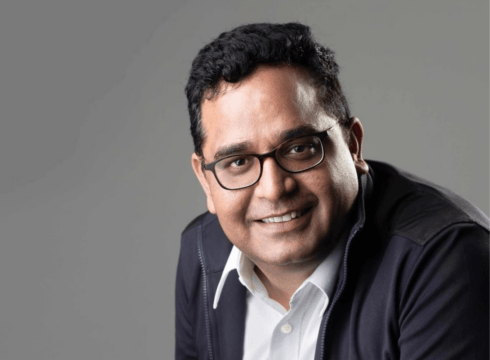

Paytm founder and chief executive officer (CEO) Vijay Shekhar Sharma has launched his maiden fund, VSS Investment Fund, to invest in homegrown startups.

The sector agnostic fund will have a corpus of INR 20 Cr with a greenshoe option of INR 10 Cr. The fund will invest in artificial intelligence (AI) and electric vehicle (EV)-related startups based out of India.

The SEBI-approved Category-II alternative investment fund (AIF) will target homegrown startups that cater to Indian customers and businesses. The fund is sponsored by Sharma-controlled VSS Investco and will be managed by a professional investment manager.

While Sharma will be the primary contributor to the fund, other external investors will also pump capital in the AIF.

A portion of the total corpus will also be utilised to fund various follow-on investments in Sharma’s current portfolio. His current portfolio includes consumer-focused as well as B2B tech startups working in environment and sustainability domains.

Sharma is an active angel investor in the Indian startup ecosystem and has invested in more than 50 startups, including Ola Electric, Mesa School, UNNATI, KAWA Space, Praan, and GOQii.

“The Indian startup ecosystem has some of the brightest entrepreneurs in the world, and we have the potential to become a powerhouse of advanced technology and AI-driven innovations. India’s aspiration to be a $10 Tn Atmanirbhar economy will be defined by the spirit of innovation and entrepreneurship. The launch of this fund is a continuation of my belief in supporting young and promising Indian founders, aligned with the fact that technology has a huge role to play in the development of the country,” said Sharma.

The average ticket size and the stage at which the fund would invest in startups was not immediately clear.

The announcement comes a couple of months after Sharma pitched for more domestic capital in the Indian startup ecosystem at the Inc42’s MoneyX conclave.

With this, the Paytm CEO has joined a growing list of Indian new-age tech entrepreneurs launching their own funds to invest in startups. Earlier this month, Zerodha cofounder Nikhil Kamath unveiled WTF Fund to back and mentor entrepreneurs under the age of 22 and building products in different categories.

The launch of Sharma’s fund comes at an opportune time. The Indian startup ecosystem has been witnessing a biting funding winter which has dried up capital across the board. The new fund is expected to offer a lifeboat to emerging players at a time when institutional investors are adopting a cautious approach.

However, investors continue to accumulate dry powder as they look for ongoing adverse market conditions to abate. Investors have announced 63 funds worth more than $5 Bn, focussed solely on Indian startups, so far this year.

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.