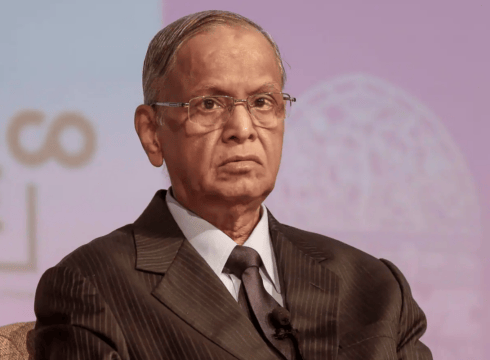

I would hold venture capitalists responsible who propounded the theory that only the topline is important and not the bottom line: NR Narayana Murthy

The tech veteran said that seniors should help entrepreneurs realise that sacrifice in the short and medium terms would give them a much greater return over time

Murthy’s comments have come at a time when the startup funding plummeted to a 41-month low at $693 Mn in February

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

Linking the VC investment model to a Ponzi scheme, Infosys cofounder N R Narayana Murthy has blamed venture capitalists for encouraging the culture to chase growth at all costs among Indian startups.

The tech veteran made his claims during a fireside chat at the Nasscom Technology and Leadership Forum 2023.

“I would hold venture capitalists responsible who propounded the theory that only the topline is important and not the bottom line. I think that is completely wrong. In many ways, it looks like a Ponzi scheme,” said Murthy.

Criticising the VC community further, the Infosys cofounder said, “Investors say they are in Series B, then go to Series C, and sell shares to others at a profit, but it is the series Z fellow who is left with a tin box. Hence, I am not a critique of the younger people but of older people, who have to be open and honest in saying things as it is.”

Murthy added that it was the VCs’ responsibility to provide funding to startups, the advisors and the board of directors to tell the youngsters to accept ‘deferred gratification’.

The Infosys cofounder said that the seniors should help entrepreneurs realise that sacrifice in the short and medium terms would give them a much greater return over time. “This has been the story of Infosys. We travelled the economy even internationally till we were a $1 Bn company,” he added.

At the sidelines of the event, when asked about the global correction that has hit startups, Murthy replied, “There is a belief in the investment industry that PEG should be equal to one. That is, the price-to-earning ratio and growth rate should be equal. If you’re growing at 20% per year, your PE would be 20.”

“I belong to the old school of thought. Therefore, I’d say that the savants and the wise men and women of the venture capital industry should think about the issues and they should do what is necessary because once you keep PEG equal to one, then everything should be alright,” the Infosys cofounder said.

Last month, Narayana Murthy shared his thoughts on the ongoing funding winter that has hit Indian startups.

He said, “Today, the funding has dried up, therefore our entrepreneurs need to realise that the threshold for obtaining funding has been raised and now entrepreneurs need to establish unique solutions in the marketplace.”

The latest comments have come at a time when the startup funding plummeted to a 41-month low at $693 Mn in February.

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.