One97 Communications is currently valued at $16 Bn

Damodaran was of the view that it is not a stock that should constitute a smaller portion of one’s portfolio and not a significant portion

The digital payment company is making an offer to issue fresh shares worth INR 8,300 Cr and an offloading of shares by existing investors to the tune of INR 8,300 Cr

As Paytm

The valuation estimate by Damodaran, who is a Professor of Finance at the Stern School of Business, New York comes as a downgrade for One97 Communications, the parent company of Paytm as it is looking at a valuation of $25 Bn – $30 Bn with its proposed initial public offering (IPO).

One97 Communications is currently valued at $16 Bn.

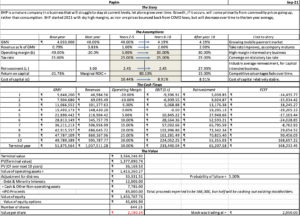

“Assuming that the mobile market continues growing, Paytm retains dominant market share, and the management starts working on improving take rates and profitability, I map out a pathway to a valuation of close to $20 billion (1,500 billion rupees),” he tweeted.

In a series of tweets based on his blog, he put down his analysis and valuation of the Delhi-NCR based fintech startup.

Damodaran is of the view that it is not a stock that should constitute a smaller portion of one’s portfolio and not a significant portion. “This is the type of stock that you would put 5% or perhaps 10% of your portfolio in, not 25% or 40%,” he said in his blog.

Image Credits: Musings on Markets

He also noted that Paytm cannot be a ‘buy and hold’ sort of investment and would require active engagement and monitoring of the company’s actions and performance.

He, however, added that the investment would come with “significant operating and execution risks, and there can be many a slip between the cup and the lip”.

In an interview in September 2021, the Professor at Stern has said that he would like to place his bet on the Vijay Shekhar Sharma-led fintech unicorn.

Damodaran, who teaches equity valuations at Stern and is also referred to as the “dean of valuation”, had then said that Paytm has the real potential because of the scope of the sector it plays in.

In July, Paytm filed its DRHP for raising INR 16,600 Cr through IPO. The digital payment company is making an offer to issue fresh shares worth INR 8,300 Cr and an offloading of shares by existing investors to the tune of INR 8,300 Cr.

Paytm enjoys support from Ant Financials, SoftBank, Elevation Capital, Discovery Capital, and others. One97 Communications operates Paytm Payments Bank Limited, Paytm General Insurance Limited, Paytm Life Insurance Limited, Paytm Money Limited, Paytm E-Commerce Private Limited, Paytm Entertainment Limited among other smaller entities.

.svg)

Fintech

Fintech Travel Tech

Travel Tech Electric Vehicle

Electric Vehicle Health Tech

Health Tech Edtech

Edtech IT

IT Logistics

Logistics Retail

Retail Ecommerce

Ecommerce Startup Ecosystem

Startup Ecosystem Enterprise Tech

Enterprise Tech Clean Tech

Clean Tech Consumer Internet

Consumer Internet Agritech

Agritech