Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

Gurugram-based mobile services marketplace UrbanClap has raised about $3.1 Mn (INR 20 Cr) in venture debt from Trifecta Capital through non-convertible debentures, as per an ET report.

As per company filings with the Registrar of Companies, UrbanClap has also allotted equity through compulsory convertible preference shares to Trifecta for $310K (INR 2 Cr).

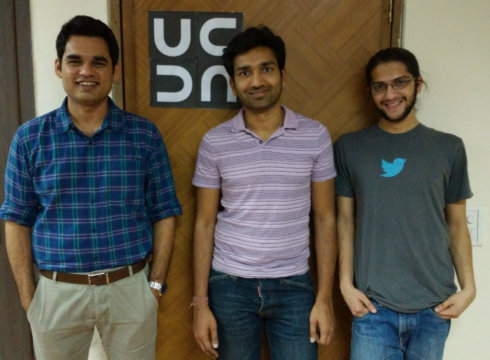

UrbanClap was founded by Varun Khaitan, Raghav Chandra and Abhiraj Bhal in October 2014. It is a mobile marketplace for providing services across 97 categories including photographers, electricians, home cleaning & repairs, yoga & guitar instructors, etc. It is currently operational in eight cities – Ahmedabad, Bengaluru, Chennai, Delhi NCR, Hyderabad, Kolkata, Mumbai, and Pune.

In November 2015, the startup disclosed its $25 Mn (about INR 165 Cr) Series B round led by Bessemer Venture Partners and existing investors Accel and SAIF Partners. SAIF and Accel Partners had invested $12 Mn across two rounds previously. Ratan Tata had also invested in the startup in December 2015.

In January 2016, UrbanClap acquired HandyHome an after sales services platform. Earlier this month, Google launched a new hyper local services app in India – Areo. It tied up with Faasos, FreshMenu, and UrbanClap to provide services via Areo.

As per Inc42 Datalabs, over 400 startups entered the hyperlocal market from 2011 to 2016. Out of these, about 193 were funded and raised more than $1 Bn funding in total and 100+ shut down. Other startups competing with UrbanClap include Housejoy, Zimmber (acquired by Quikr), Qyk, etc.

In March 2017, Bengaluru-based online grocer BigBasket raised about $6.9 Mn (INR 45 Cr) venture debt from Trifecta Capital. Trifecta Capital provides venture debt to new age businesses across different stages of their development. It was founded by Rahul Khanna and Nilesh Kothari.

As per a company statement, in the 18 months since commencement, the fund has supported 18 companies like PaperBoat, Rivigo, Nephroplus, Urban Ladder, Industrybuying, OneAssist, IdeaForge etc.

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.