The announcement comes as the online gaming industry is marred by uncertain tax laws

Several online gaming startups also been served notices by the authorities for alleged miscategorisation

An 18% tax is being levied on the commission collected by online gaming platforms for games not involving betting or gambling

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

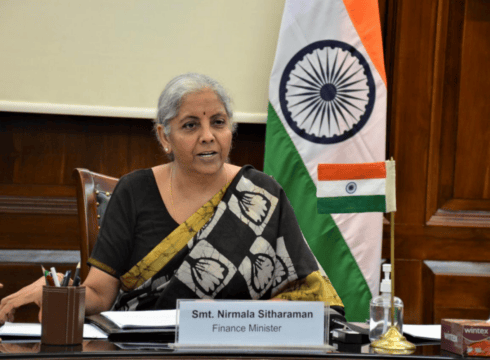

During her speech for the Union Budget 2023-24, Finance Minister Nirmala Sitharaman proposed removing the TDS threshold of INR 10,000 for online gaming startups. She said that online gaming startups should provide for TDS and taxability on net winnings at the time of withdrawal or at the end of the financial year.

Further, the finance minister proposed to keep the same threshold for the lottery, crossword puzzle games and other similar games. However, the TDS would not apply to aggregate winnings during a financial year, Sitharaman added.

“For online games, it is proposed to provide for TDS and taxability on net winnings at the time of withdrawal or at the end of the financial year. Moreover, TDS would be without the threshold of INR 10,000,” said the Finance Minister on Wednesday (February 1).

In her speech, Sitharaman said that the government will issue more clarity on the taxation regime for online gaming.

“Major measures in terms of easing the taxation burden include clarifying taxability related to online gaming; not treating conversion of gold into electronic gold receipts as capital gains, and more,” Sitharaman said.

The announcement comes as the online gaming industry is marred by uncertain tax laws and a lack of clarity on several aspects of taxation, including the amount of tax to be charged and what counts as taxable income. However, the biggest debate of whether these games count as games of skill or chance still remains.

Several online gaming startups have also been served notices by the GST and taxation authorities for alleged miscategorisation. Recently, the Directorate General of GST Intelligence (DGGI) served a notice to online gaming startup MyTeam11, though the Rajasthan High Court stayed the notice.

However, GamesKraft, a similar startup, has not been so lucky. Last September, GamesKraft received a notice from the DGGI of a tax liability worth INR 21,000 Cr. The case is ongoing in the Karnataka HC as the gaming company seeks a stay on the notice.

During the Winter Session in December 2022, the government told the Parliament that the Central Board of Indirect Taxes and Customs (CBIC) is investigating gaming companies for alleged GST evasion of nearly INR 23,000 Cr.

The government is yet to decide on the taxation rate in the sector. For now, an 18% tax is being levied on the commission collected by online gaming platforms for games not involving betting or gambling, whereas it is zero for the contest entry fees. The inter-ministerial panel headed by Meghalaya Chief Minister Conrad Sangma has recommended the GST Council to levy 28% GST.

The government is also tightening the Tax Deduction at Sources (TDS) norms, and winnings from online gaming could come under stringent tax scrutiny.

It is interesting to note that the government has been increasing its focus on the sector for the past couple of years. In her Budget speech last year, Sitharaman announced the formation of an Animation, Visual Effects, Gaming and Comic (AVGC) task force, which was later constituted in April 2022 under the aegis of the Ministry of Information and Broadcasting (MIB).

The task force submitted its report in December 2022, recommending sweeping changes to develop a roadmap for the industry. In a report, the task force proposed the formation of a national AVGC Mission with a dedicated budget outlay to promote the sector.

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.