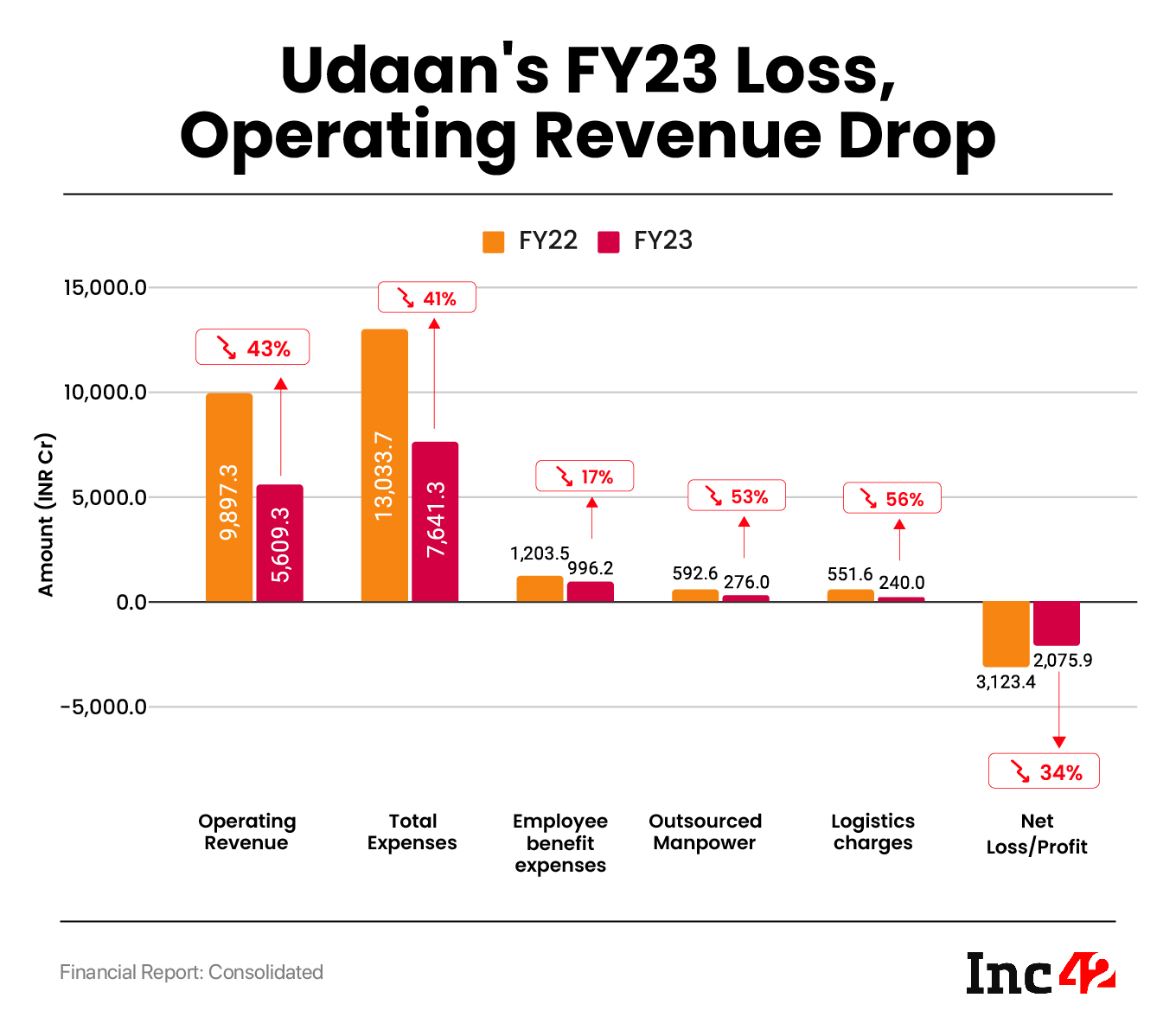

Total expenses dropped 41% to INR 7,641.3 Cr in FY23 from INR 13,033.7 Cr the previous fiscal year

In line with the drop in expenses, Udaan’s net loss fell 33.5% to INR 2,076 Cr in FY23 from INR 3,123.4 Cr

The B2B ecommerce startup has raised over $1.8 Bn in funding to date and was last valued at $3.1 Bn

Bengaluru-based B2B ecommerce startup udaan

Udaan generates revenue by selling products ranging from groceries to electronics appliances to retailers. The drop in revenue can be attributed to the startup’s focus on reducing its loss.

It must be noted that amid the ongoing funding winter, most startups have turned their focus from growth at all costs to profitability.

Including other income, Udaan’s total revenue fell 43% to INR 5,675.9 Cr during the year under review from INR 9,943.8 Cr in FY22.

Meanwhile, total expenses dropped 41% to INR 7,641.3 Cr in FY23 from INR 13,033.7 Cr the previous fiscal year.

Procurement of goods continued to be the biggest contributor to the expenses. During the year under review, the startup spent INR 5,242 Cr on procurement of traded goods, around 69% of its total expenditure. Udaan spent INR 9,415.6 Cr on procurement of goods in FY22.

Employee benefit expenses declined 17% to INR 996.2 in FY23 from INR 1,203.5 Cr in the previous year. Employee benefit expenses comprise employee salaries, PF contributions, gratuity, among others.

A drop in employee costs indicates a reduction in the employee count. It must be noted that Udaan laid off around 500 employees in November 2022. As per reports, the startup fired over 1,000 employees in November 2022. According to LinkedIn, the startup currently has around 11,500 employees.

In FY23, Udaan spent INR 276 Cr for outsourcing manpower, a 53% drop from INR 592.6 Cr in the previous fiscal year. Logistics and packaging costs also plunged 57% to INR 240 Cr from INR 551.6 Cr in FY22.

As the expenses dropped, so did the startup’s overall loss. Udaan’s net loss fell 33.5% to INR 2,076 Cr in FY23 from INR 3,123.4 Cr in the previous fiscal year.

Founded in 2016 by former Flipkart employees Sujeet Kumar, Vaibhav Gupta and Amod Malviya, Udaan claims to have a network of 3 Mn retailers and 30K+ sellers across India. It sells products across over 5 Lakh categories in 1,000+ Indian cities.

The startup has raised over $1.8 Bn in funding to date and was last valued at $3.1 Bn. Earlier this year, it carried out a massive restructuring exercise. As part of this exercise, it merged the Essentials business, comprising FMCG, staples, and pharma categories, with the Discretionary business, including general merchandise, lifestyle, and electronics categories. The rejig also resulted in the exit of the startup’s CTO – Gaurav Bhalotia.

Udaan directly competes against Tiger Global-backed DealShare, which has been in the news lately for the wrong reasons. DealShare, which shut its B2B business recently and witnessed the exit of one of its cofounders Vineet Jain, also fired over 100 employees in September.

Ad-lite browsing experience

Ad-lite browsing experience