Ministry of External Affairs, Govt of India

The NPCI and the Central Bank of Oman (CBO) have signed an agreement for cooperation in fintech and payments

Oman has become the fourth country in the Middle East to start using UPI, following Bahrain, Saudi Arabia and the UAE

In all, NPCI International is in talks with nearly 30 countries for UPI integration around the world

Oman will start using India’s United Payment Interface (UPI) and RuPay credit and debit cards, joining a growing list of countries now using and accepting ‘Made-in-India’ payment solutions.

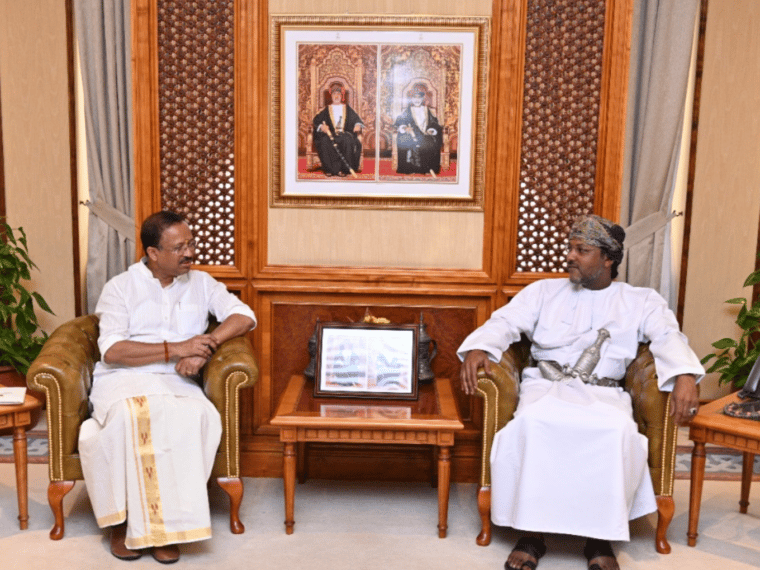

The development came during Minister of State of External Affairs V. Muraleedharan’s two-day visit to the country. The National Payments Corporation of India (NPCI) and the Central Bank of Oman (CBO) signed an agreement for cooperation in fintech and payments during the minister’s visit.

With this, Oman has become the fourth country in the Middle East to start using India’s homegrown payments system, following in the footsteps of neighbours Bahrain, Saudi Arabia and UAE.

The Middle Eastern nation has joined the likes of Singapore, Malaysia, Thailand, Philippines, Vietnam, Cambodia, Hong Kong, Taiwan, South Korea and Japan (in partnership with Liquid Group), along with Nepal, Bhutan, France, the UK and Russia, who have either deployed UPI or are in the process of doing so.

The NPCI has been pushing for internationalising the use of UPI, forming a separate entity – NPCI International – for the same. In August, the payments corporation signed an agreement with UK-based PayXpert to deploy UPI and RuPay cards system in the UK.

In all, NPCI International is in talks with nearly 30 countries for UPI integration around the world. Nepal was the first country to deploy India’s UPI in February 2022.

According to the latest data, 678 Cr UPI transactions were recorded in September 2022, worth INR 11.16 Lakh Cr. Both the figures registered an increase of 3.2% and 4% month-on-month, respectively.

The total UPI transaction volume stands at INR 89.10 Lakh Cr ($1.09 Tn) in 2022 so far, 22% higher than 2021’s INR 73 Lakh Cr (around $970 Bn). At the current pace, UPI transactions are set to reach INR 118.8 Lakh Cr by the end of 2022, which would nearly be a 62% increase year-on-year.

UPI integration in Oman would prove vital for around 6.50 Lakh Indians in the country, who would benefit from the payments system they are familiar with. India is also one of the largest investors in the Middle Eastern country, having invested more than $7.5 Bn.

In FY22, the bilateral trade between India and Oman almost doubled to $10 Bn from $5.4 Bn in FY21.

Ad-lite browsing experience

Ad-lite browsing experience