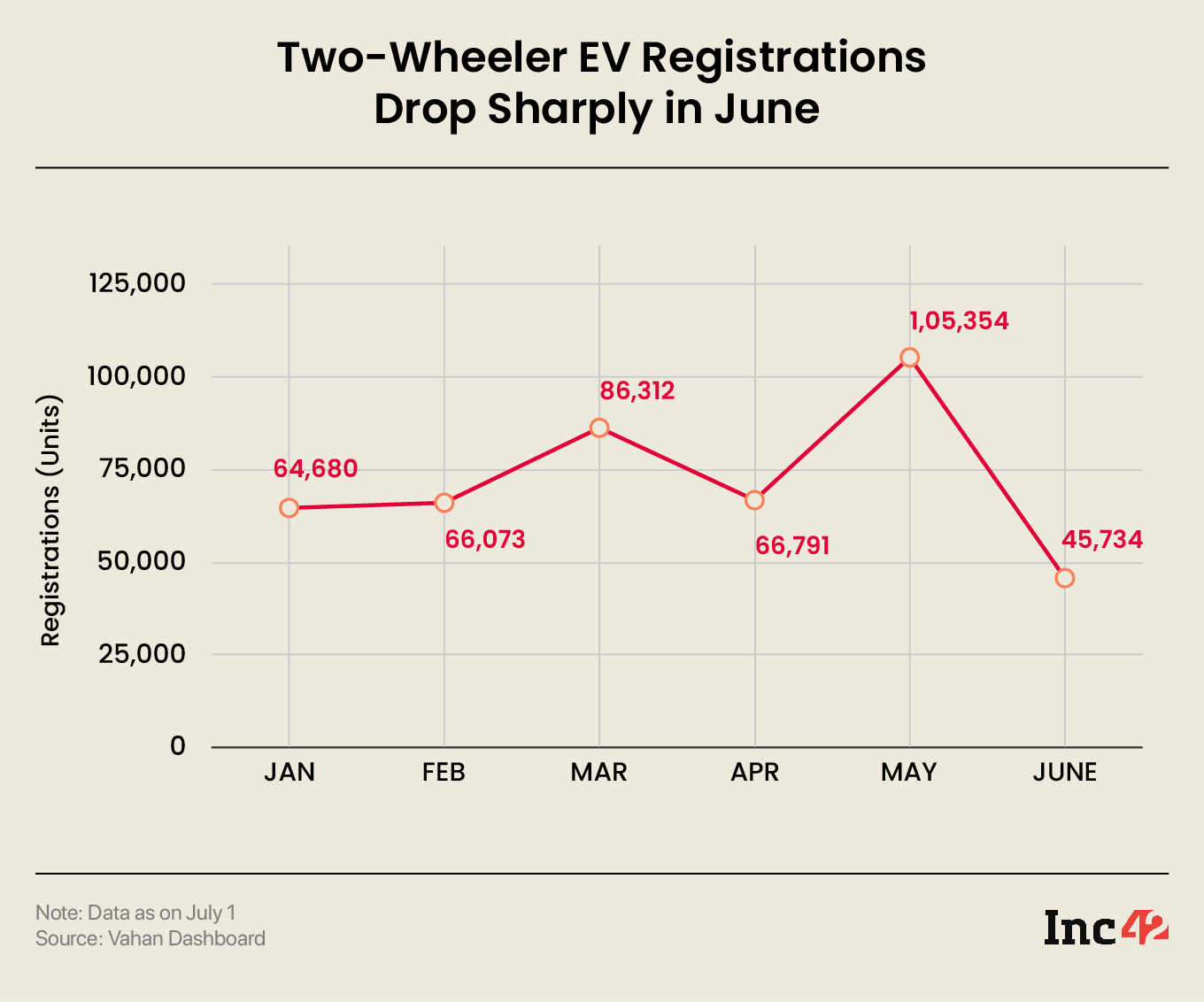

In line with the subsidy cuts for FAME-II scheme and the subsequent hike in prices by EV players, electric two-wheeler registrations fell 56% MoM in June 2023

Ola Electric retained its top spot but saw its EV registrations fall over 38% to 17,552 units from 28,629 units in May

Ather Energy’s escooter registrations plunged 70.5% to 4,540 units in June, while that of TVS Motor slumped to 7,791 units from 20,398 units in May

Following the FAME-II fiasco, electric two-wheeler registrations in the country nosedived to a 12-month low in June by falling 56% month-on-month (MoM) to 45,734 units.

After touching a record high of over 1 Lakh registrations in May this year, two-wheeler EV registrations in June 2023 fell to a level last seen in June 2022. The number of two-wheeler EV registrations stood at 44,383 units in the year-ago month.

A majority of escooter OEMs, including Ola Electric, Ather Energy, TVS Motor, Hero Electric, Okinawa Autotech, and Hero MotoCorp, witnessed a significant slump in registrations in June 2023. However, Ola Electric continued to lead the race with total escooter registrations of 17,552 units, as per data available on the Vahan portal on July 1.

Despite the Bhavish Aggarwal-led electric mobility major retaining its top spot, its EV registrations fell over 38% MoM from 28,629 units in May, reversing the sharp upward trend of the past three three months.

On the other hand, Ather Energy’s escooter registrations plunged 70.5% to 4,540 units in June from 15,407 units in May. June 2023 was also the worst month for Ather Energy since June and July last year, when its registration volume stood at 1,289 and 5,377 units, respectively.

As per a statement by Ather Energy, the startup sold 6,479 units in June this year.

TVS Motor’s vehicle registration also slumped to 7,791 units last month from 20,398 units in May. However, it retained its second spot on the list in terms of two-wheeler EV registrations.

It is pertinent to note that Ola Electric, TVS Motor, and Ather Energy have been leading the sales of escooters in India since the beginning of this year. However, these three OEMs also came under the government’s scanner for keeping their vehicle prices artificially low to claim the benefits of FAME-II subsidy.

After an investigation into the matter, these players, along with Hero MotoCorp, were asked to reimburse the excess monies paid by their customers for buying the charges and software separately. Together, the four players agreed to refund about INR 288 Cr to their customers.

Amid this, the government also slashed the incentives for electric two-wheelers under the FAME-II scheme to 15% of ex-factory price from 40% earlier and cut the demand incentive to INR 10,000/kWh from INR 15,000/kWh.

Following this, most of the EV players increased their vehicle prices. Ola Electric increased the prices of its S1 and S1 Pro escooter models by INR 15,000 each from June 1. Ather increased the price of its 450X escooter model by around INR 30,000, while TVS Motor also hiked the price for its iQube and iQube S escooters.

Besides, OEMs including River, Matter, and AMO Mobility also increased their escooter prices.

“The drop in numbers was expected, given the recent price increase on account of the lower FAME subsidy and consumers bringing their purchases forward into May. While the drop was slightly more than we’d anticipated, we remain optimistic about an industry bounce-back over the next 2-3 months,” said Ravneet Singh Phokela, chief business officer at Ather Energy.

“We have always been of the view that the subsidy should be phased off gradually over time so that consumers can adjust to more realistic market prices. While it impacts short-term financials, this is certainly a step in the right direction from a long-term perspective,” Phokela added.

It must also be noted that more than a dozen two-wheeler EV players, including Okinawa Autotech, Hero Electric, Jitendra EV, Greaves Electric Mobility, and Revolt, were also investigated by the government for allegedly violating localisation norms to get the subsidies under FAME-II.

The investigation and the subsequent changes made by the government impacted most of these OEMs.

Okinawa’s EV registrations dropped 10% MoM to 2,615 units in June 2023, while Ampere’s escooter registration volume dropped 84% MoM to 1,601 units. Bajaj Auto also saw a 70% decline in registrations to 2,966 units in June.

EV registrations of Lectix EV, which recently began witnessing some volume growth and saw a record registration of 1,000 vehicles in May, also fell 88% MoM to 115 units in June. However, Revolt and Pure EV were among the two leading names that saw an increase in their vehicle registrations.

Meanwhile, Simple Energy also began delivering its EVs last month and saw registration of 10 units in June.

The decline in two-wheeler EV registrations in June 2023 didn’t come as a shock as the industry was anticipating an adverse impact from the changes in FAME-II norms.

Last month, industry body Society of Manufacturers of Electric Vehicles (SMEV) wrote to Minister of Commerce and Industry Piyush Goyal, seeking ‘contingency support’ for the industry saying that the situation was near ‘breaking point’.

Total EV registration across vehicle categories fell over 35% MoM to 1,01,832 units in June but was up 34.2% YoY.

Ad-lite browsing experience

Ad-lite browsing experience