Titan Capital’s new fund will be deployed in existing portfolio companies of the firm in later stages

Titan Capital Winners Fund raised a target corpus of INR 200 Cr to exclusively invest in follow-on rounds of breakout startups from its seed portfolio, in August

Through the fund, around 20 companies will be backed with an average cheque size of INR 15 Cr

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

Seed stage-focused VC firm Titan Capital has reportedly marked the final close of its new opportunities fund known as Titan Capital Winners Fund at INR 333 Cr (about $40 Mn).

This capital will be deployed in existing portfolio companies of the firm in later stages, while the VC firm said it will utilise high-signal data to make informed investment decisions.

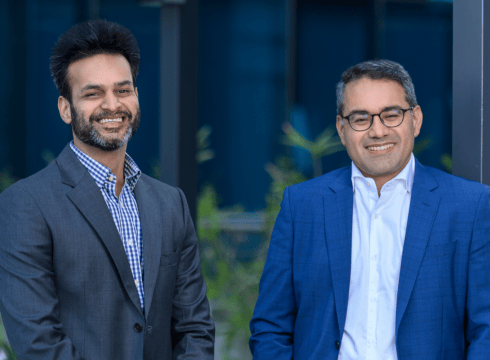

It is to be noted that Titan Capital Winners Fund, backed by Kunal Bahl and Rohit Bansal, raised a target corpus of INR 200 Cr to exclusively invest in follow-on rounds of breakout startups from its seed portfolio, in August.

The Category-II alternative investment fund (AIF) is focussed on backing tech-enabled businesses led by “stellar founders and management teams building category creators”.

The company said in a statement that Bahl and Bansal will anchor this fund as its largest investors and continue supporting founders as they build their ventures.

“Through this fund, we will back about 20 tech-enabled businesses with an average cheque size of INR 15 Cr. This further strengthens our existing partnership with the founders and gives a strong positive signal to new investors in their company,” Bahl said.

The investment firm has already invested in three startups through the fund – including Bengaluru-based Convin, eco-friendly D2C home needs brand Beco, and SaaS startup Simplismart, while it also said that the Fund is also in the process of evaluating multiple other deals at different stages.

Founded in 2015 by Snapdeal cofounders Bahl and Bansal, Titan Capital has backed prominent brands such as Mamaearth, Ola, Razorpay, Urban Company, Shadowfax, OfBusiness, Credgenics, Giva, Invideo.

The investment firm claims to have backed more than 250 startups based in India and the US across sectors including consumer internet, AI, SaaS, fintech and logistics.

This development comes on the heels of its recent launch of Indicorns, a new index to track leading Indian startups which achieved profitability and crossed INR 100 Cr revenue mark within 15 years of its inception.

As of FY23, the VC firm has acknowledged 186 Indian startups, including OfBusiness, Zerodha and Mamaearth among others as Indicorns. These Indicorns have generated a cumulative revenue of INR 1.06 Lakh Cr and a collective profits of INR 8.6K Cr.

Updated at 11:52 AM

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.