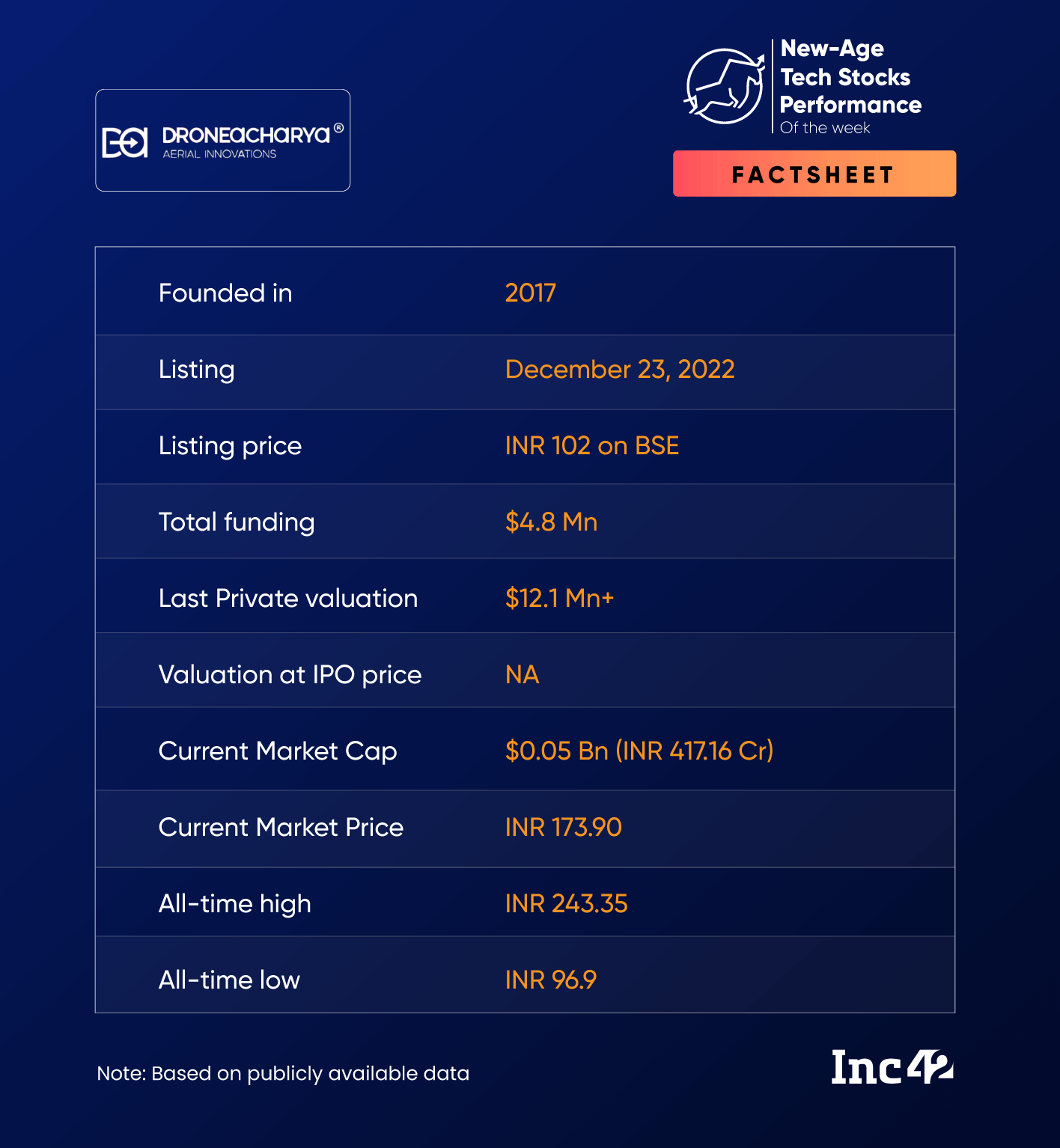

Topping the charts this week was deeptech startup DroneAcharya, which made hefty gains of over 15%

CarTrade Tech was the biggest loser, crashing 7.18%, followed closely by Paytm which lost 6.8%

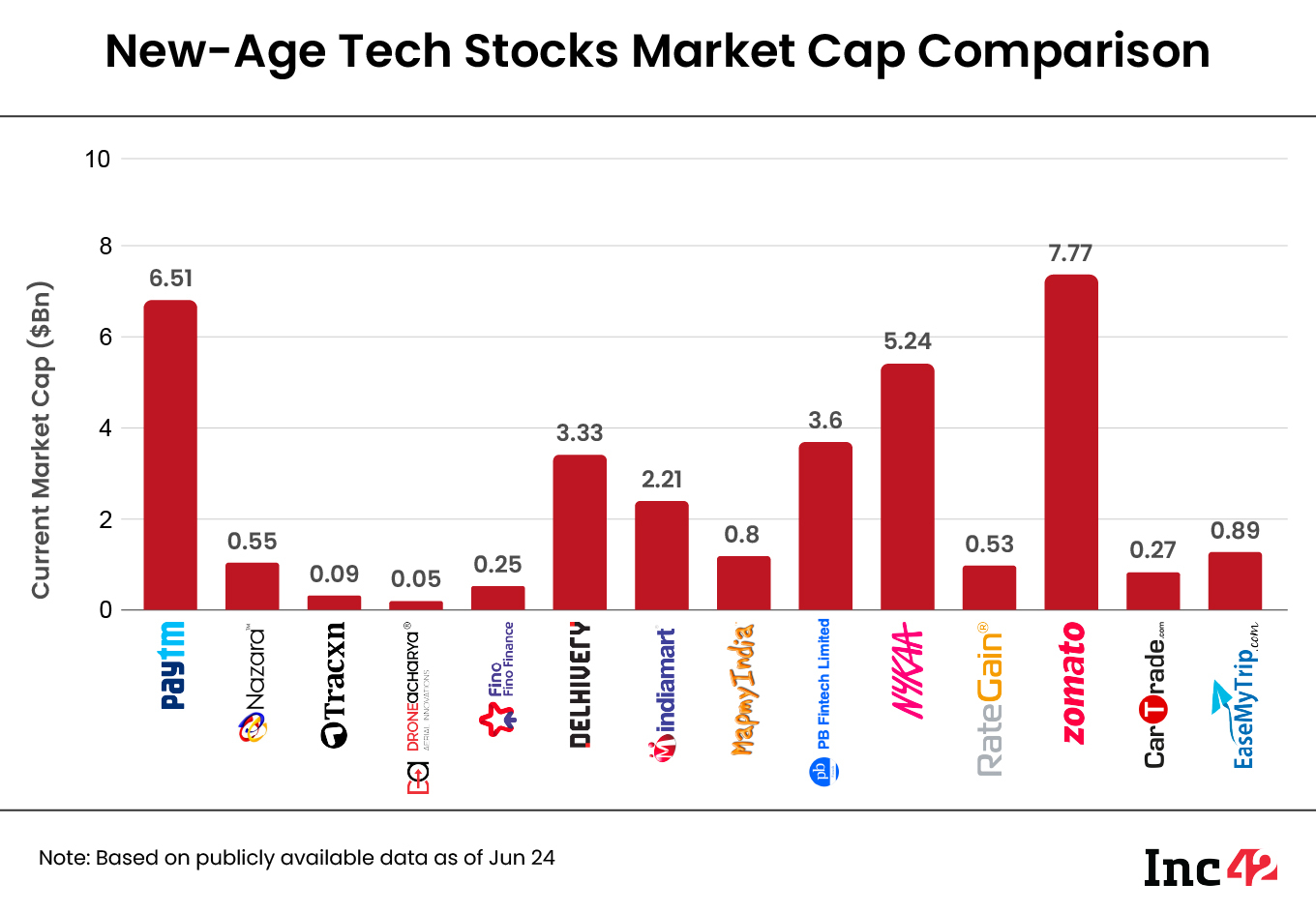

The total market capitalisation of 14 new-age tech stocks stood at $32.1 Bn during Friday’s close against $32.44 Bn last week

After a three-week winning streak, new-age tech stocks hit a slight bump this week as market volatility weighed heavily on the bourses. This mirrored the larger negative sentiment that gripped the overall Indian markets after all sectors emerged in the red.

Nine out of 14 startups under Inc42’s coverage felt the impact while the remaining held their ground. Topping the charts this week was deeptech startup DroneAcharya, which made hefty weekly gains in excess of 15%.

Following its lead were Fino Payments Bank, MapmyIndia and Rategain, which rose 12.1%, 4.61% and 2.9%, respectively, during the week.

Meanwhile, CarTrade Tech was the biggest loser of the week, falling 7.18% week-on-week, followed closely by Paytm, down 6.8%.

Tracxn and EaseMyTrip emerged as the third and fourth biggest losers, respectively. Joining the downward spiral was IndiaMART, which staggered 2.09% on the back of its ex-bonus issue.

Overall, Indian markets sank this week as Federal Reserve chairman Jerome Powell warned of more rate hikes in the future. Delayed monsoons and the Bank of England’s surprise rate hike further aggravated the matter and dampened market sentiments.

Benchmark index Sensex fell 0.73% to end the week at 62,979.37 points while Nifty50 shed 1.01%, concluding the week at 18,665.50 points. All sectoral indices slipped into the red even as markets saw no major activity from foreign institutional investors (FIIs).

“… the broader market saw a sharp correction in the last two sessions after a period of strong outperformance. As we enter a new week, the market is expected to lack clear cues, but the expiration of June’s F&O contracts may introduce some volatility as traders roll over their positions,” said the head of research at Swastika Investmart Santosh Meena.

He added that the movement of monsoons will be ‘crucial’ to the performance of markets and investors will also keep a close eye on crude oil prices, the dollar index, US bond yields as well as any potential stimulus package from China.

Now, let’s delve deeper into the performance of some of the new-age tech stocks that made headlines this week:

Cumulatively, the 14 new-age tech stocks under Inc42’s coverage wrapped up the week with a total market capitalisation of $32.1 Bn against $32.44 Bn last week, and $31 Bn the week before.

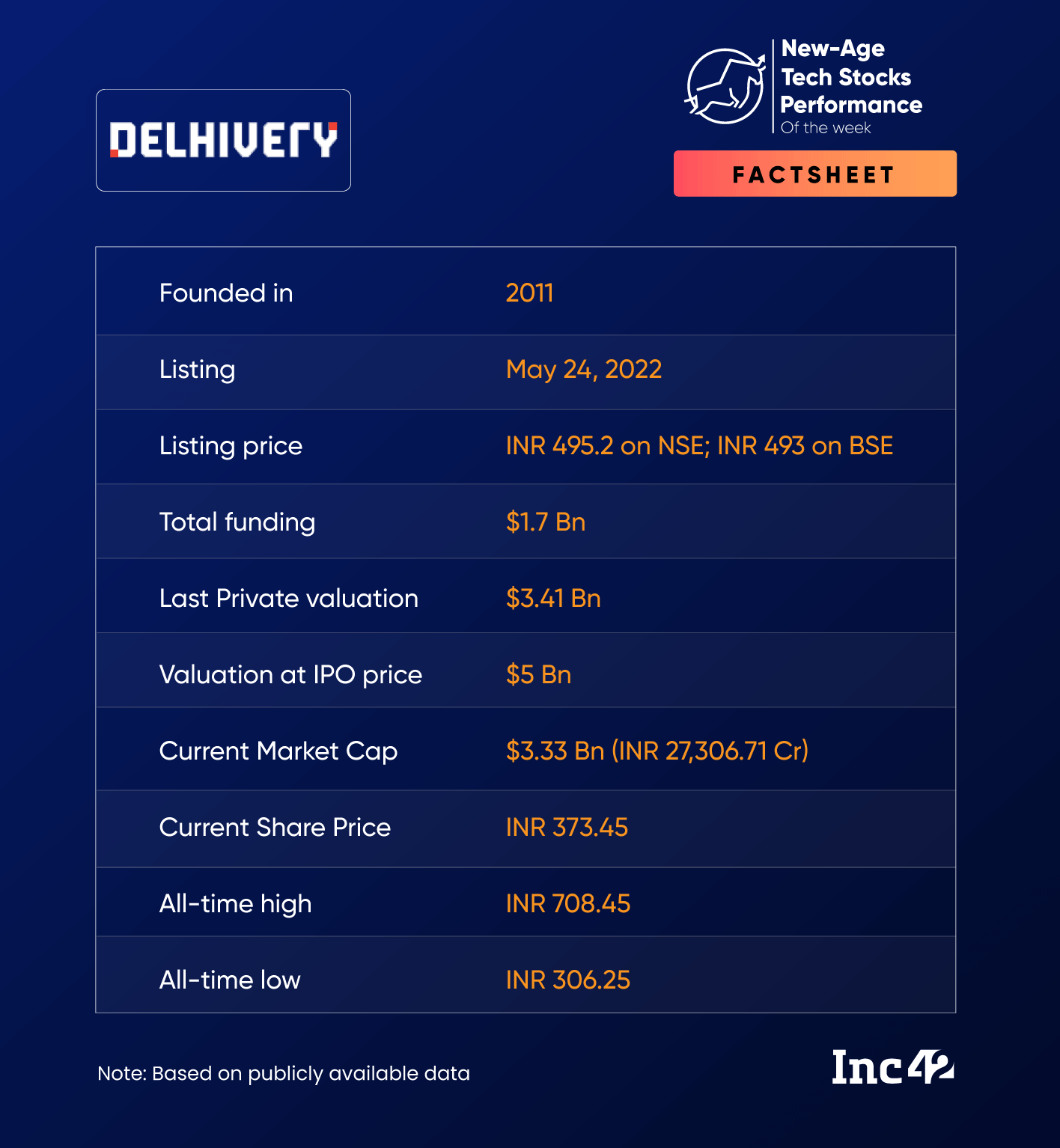

Delhivery Bears The Brunt

After notching up a seven-month high last week, logistics giant Delhivery took a major hit this week as Carlyle Group-owned CA Swift Investments offloaded its entire stake in the startup.

The Group sold 1.84 Cr shares via bulk deals, totalling INR 709.5 Cr, which, as per estimates, helped the investor pick up a handsome 2.7X return. However, this hit the stock, which closed 2.65% lower this week.

However, big names such as Norges Bank, BNP Paribas Arbitrage, Societe Generale, Goldman Sachs, and Saudi Central Bank were among the 34 institutional investors which lapped up the shares sold by Carlyle Group.

Despite the tumble this week, analysts continue to remain bullish on the stock. Speaking with Inc42, senior manager and technical research analyst at Anand Rathi Jigar S Patel said that support for Delhivery could bounce from INR 370 currently to the INR 400-410 level next week.

The stock’s stop loss would be around INR 345, he added.

The stock closed at INR 373.45 on the BSE even as the company’s market capitalisation hovered around the $3.33 Bn mark. Despite gaining some ground in the past few months, Delhivery continues to lag behind its bumper IPO listing last year when it soared to a valuation of $5 Bn.

DroneAcharya Continues The Dream Run

It was another bumper week for drone startup DroneAcharya as the stock continued its upward journey. Despite the ongoing volatility gripping the market, the week saw the scrip gain 15.55% as retail investors bought shares in heavy numbers, emerging as the highest gainer this week.

The week opened to a slow start as the stock stayed steady for the first two sessions, closing at around INR 160 on Tuesday. On Wednesday, the share price took a sudden jump, gaining INR 16 to close at INR 176. Eventually, the stock closed the week at INR 173.90.

The jump came even as its competitor ideaForge prepares for its IPO, which would open on June 26.

DroneAcharya was listed on the BSE SME platform in December 2022 at INR 102, a premium of 90% to its listing price. At its current levels, the drone manufacturer continues to be way ahead of its new-age tech peers, with its share prices trading 70.5% above its listing price.

However, Anand Rathi’s Patel believes that the trend for DroneAcharya is largely positive, adding that the upside for the stock is expected around INR 200 with a stop loss of INR 150.

The company’s market cap currently stands at INR 417.16 Cr ($0.05 Bn).

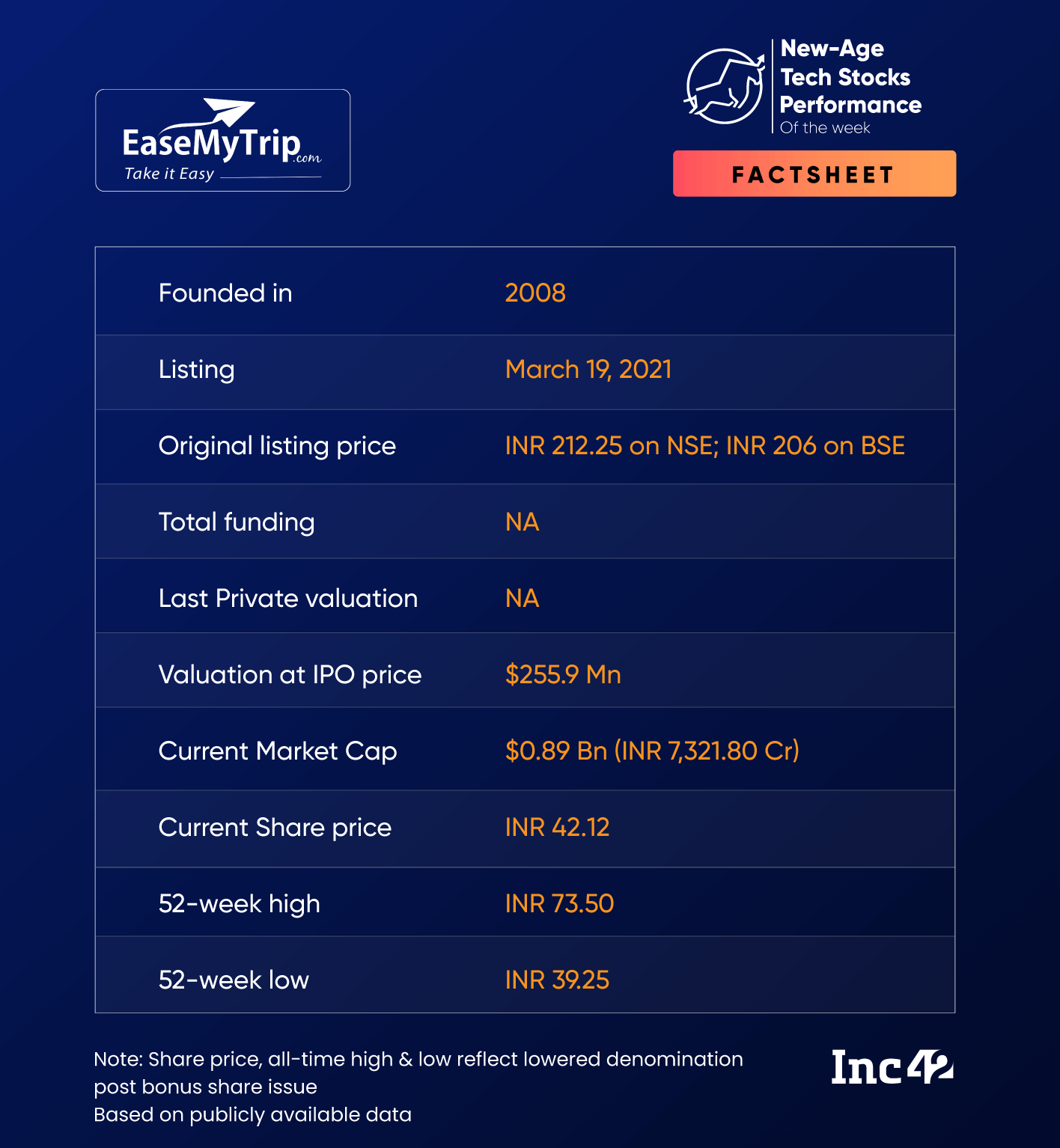

A Gloomy Week For EaseMyTrip

After paring some losses last week, traveltech platform EaseMyTrip again returned to the red this week. The stock opened at INR 43.6 and stayed steady for the next four trading sessions. Subsequently, the share price tanked on the last trading day and closed the week at INR 42.12, down 3.35% from the previous week.

The traveltech platform emerged as the fourth biggest loser of the week.

Anand Rathi’s Patel told Inc42 that the company continues to be on a ‘slightly weak’ footing. He further expects more correction for the startup till INR 39-42 levels.

The target price is slated to be around INR 46-47 levels and stop loss is said to hover around the INR 35 mark.

EaseMyTrip concluded the week with a market cap of $1.01 Bn.

Ad-lite browsing experience

Ad-lite browsing experience