The funding will primarily be used for expanding 10club’s portfolio of brands, investing in building its technology stack, and for working capital purposes

10club partners with ecommerce product sellers in India by acquiring their businesses and working with their teams to help them grow 10x in size.

The company has signed LOIs worth $15 Mn, and will push to operate these businesses in the coming weeks.

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

Thrasio-style ecommerce player 10club has raised $40 Mn in seed funding. The funding round was co-led by Fireside Ventures and an international investor active in the space.

The round also saw participation from HeyDay, a player in the roll up space, PDS international, Class 5 Global, Secocha Ventures led by Sanket Parekh, boAt founders Aman Gupta and Sameer Mehta (in their individual capacity) along with other global strategic investors.

The funding will primarily be used for expanding 10club’s portfolio of brands, investing in building its technology stack, and for working capital purposes. Vinay Singh, partner- Fireside Ventures will join the company’s board.

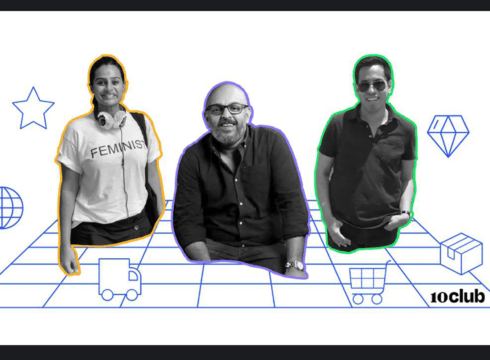

Founded in 2020, 10club partners with ecommerce product sellers in India by acquiring their businesses and working with their teams to help them grow 10x in size. Co-founded by Bhavna Suresh (former CEO, Lamudi); Joel Ayala (cofounder, Class 5 Global), and Deepak Nair (former cofounder, 22feet), the company also claims that they have signed LOIs (letter of intent) worth $15 Mn, and will push to operate these businesses in the coming weeks.

Currently, the 20-people team of 10club includes people from companies such as Amazon, Flipkart, Udaan, Reliance, Coca Cola among others.

“Consumer spending continues to accelerate globally and third-party sellers across marketplaces like Amazon and Flipkart are the driving force behind this trend that is here to stay,” said Joel Ayala, partner at Class 5 Global who is also a cofounder of 10club as well as chairman of the board. “I am determined to work with the team to make 10Club the go-to destination for the most talented sellers and entrepreneurs who want to take their brands to the next level. Moreover, I am excited to work with Bhavna, Deepak, and the entire 10Club team to build the next-generation multi-brand platform in the market.”

The 10club model is similar to that of Thrasio, the Massachusetts headquartered ecommerce company, which is valued in the range of $3 Bn-$4 Bn. Thrasio came to prominence in 2020 as it consolidated third-party sellers on Amazon in the US. Launched in 2018, it has acquired nearly 100 third party sellers or fulfilled by Amazon (FBA) businesses and claims to provide better economies of scale to manage and grow those acquired businesses. It reviews the “top-reviewed, bestselling, essential” product charts on Amazon, and looks to acquire the brands from small business owners.

India is currently seeing an uptick of smaller brands, with around 850K vendors selling on Amazon India. Of these, around 4,152 crossed INR 1 Cr in sales in 2020, according to Amazon. There are around 350K, such sellers, on Flipkart, of which 70 crossed INR 1 Cr in sales.

This makes the segment of D2C brands highly popular and lucrative for investors. Earlier, a similar D2C startup Mensa Brands founded by ex-Myntra and Medlife co-founder Ananth Narayanan, raised $50 Mn in a mix of equity and debt in its Series A funding round from Accel Partners, Falcon Edge Capital, Norwest Venture Partners among others.

New York-based investment firm Tiger Global has also reportedly backed a similar venture headed by Flipkart veteran Rishi Vasudev. Vasudev’s latest fashion and retail venture named GOAT Brands Labs, will acquire lifestyle brands and help them build as well as grow online.

In April it was reported that Pune-based kidswear ecommerce unicorn FirstCry is set to launch a Thrasio-style investment venture for D2C brands and online sellers, with $75 Mn earmarked for capital commitments. The company is raising capital from investors such as Japan’s SoftBank, TPG, ChrysCapital and Premji Invest.

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.