Stride Ventures aims to close the third venture debt fund at over $200 Mn

The venture debt firm said the fund will make prudent investments in fast-growing startups that exhibit robust business models, strong unit economics, and skilled management teams

Stride Ventures has invested in over 100 startups so far, including SUGAR Cosmetics, Mensa Brands, Exotel, and The Good Glamm Group

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

Venture debt firm Stride Ventures on Tuesday (May 9) announced the first close of its third venture debt fund at $100 Mn. It is aiming for a final closure of the fund at over $200 Mn.

Stride Ventures said the fund will make prudent investments in fast-growing startups that exhibit robust business models, strong unit economics, and skilled management teams.

The third fund has received backing from several groups of institutional investors, including banks, insurance companies, and family offices.

“We see a growing demand for venture debt as startups look to optimise their capital structure and preserve equity for future rounds. With the launch of our third fund, we’re well-positioned to meet the unique debt requirements and global ambitions of Indian startups,” said Apoorva Sharma, managing partner at Stride Ventures.

The close of the fund comes within a year of Stride Ventures closing its $200 Mn second fund in August last year. The venture debt firm then said it would invest $4 Mn-$5 Mn in 60-70 startups from the second fund, over a period of four years.

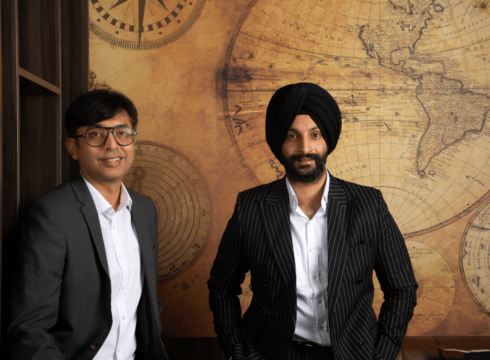

Set up in 2019, Delhi-based Stride Ventures is led by Ishpreet Gandhi and Abhinav Suri. So far, the fund has invested in over 100 startups across sectors such as consumer internet, SaaS, fintech, and B2B platforms. Some of its portfolio companies include SUGAR Cosmetics, Mensa Brands, Exotel, The Good Glamm Group, Yubi, HealthifyMe, Ace Turtle, Rebel Foods, and Waycool.

In a statement, Gandhi, founder and managing partner of Stride Ventures, said that the firm is the largest contributor of credit to new-age businesses in the country and has sanctioned over INR 5,000 Cr in the Indian startup ecosystem.

Stride Ventures said it has also successfully distributed over 100% of its commitments, including coupon payouts and principal redemptions, to the early investors of its Fund 1.

The venture debt fund’s two most recent investments include an INR 50 Cr fund infusion in cloud kitchen unicorn Rebel Foods and INR 75 Cr debt funding of Battery Smart, a battery swapping company for EVs.

Stride Ventures’s announcement today follows venture capital (VC) 3one4 Capital closing its fourth early-stage investment fund at $200 Mn and VC fund AdvantEdge unveiling its third fund. Overall, since the beginning of 2023, funds worth $3 Bn have been raised for Indian startups.

Amid a funding winter, when the overall funding has declined in the startup ecosystem, debt funding has gained eminence. As per an Inc42 report, Indian startups raised a total of $3 Bn in Q1 2023, down 75% from $12 Bn raised in Q1 2022. However, debt funding rose 40% to seven compared to last year’s quarter.

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.