The bank has assured many of its corporate card users to resume the service by July 31, 2023

Even though SBM Bank has finally broken its silence, a larger resolution to give respite to its customers seems hanging fire in the absence of any clarity from them

Inc42’s extensive piece on the issue gave a voice to the many entrepreneurs and entities impacted by the mismanagement of SBM Bank India, we were told

Three months after SBM Bank India suspended all its cobranded corporate and prepaid cards, the bank has finally started to respond to its corporate card users, assuring them that the cards will be operational by July 31, 2023.

While the bank refrained from responding to its customers’ queries for months after the suspension of their corporate cards, its decision to finally break its vow of silence and respond to its jittery corporate card customers has come following Inc42’s report on How SBM India’s Baffling Silence On Re-KYC Has Put Fintech Lenders, Users In A Tizzy. This has also provided some relief to its impacted customers and fintech card providers.

While a few users have reported receiving meaningful responses from the bank or their fintech partners, a larger resolution to their ongoing problem is still a work in progress.

Sharing his recent experience, serial entrepreneur and cofounder of KloudMate Pranab Buragohain said, “I just received a response from Kodo, mentioning that our prepaid balance amount had been credited back to us, but my account details on Kodo’s dashboard show otherwise.”

Buragohain is a Kodo prepaid card user. The card, which was issued to him by SBM Bank India, got defunct on March 31, 2023.

“There has been no update from the bank (or from Kodo, whose prepaid cards we use). The Re-KYC links shared by SBM Bank didn’t work either. We escalated it to Kodo, who termed it as a technical glitch. Kodo team has been trying to help us withdraw the funds, but to no avail. Surprisingly, we found no feature within their console to make the withdrawals directly on our own,” Buragohain had previously told Inc42.

What’s The Issue?

The issue stems from SBM Bank India’s failure to enforce the RBI’s re-KYC guidelines. The central bank issued these guidelines in 2021 to ensure the periodic updation of KYC data by regulated entities.

However, conducting the re-KYC process was the responsibility of issuing banks and not the fintech partners.

As a result, over eight Lakh corporate cardholders, registered with companies such as Enkash, Razorpay, Happay, Kodo, Karbon, Open, Velocity, and Volopay, among others, faced card suspension, thereby negatively impacting their businesses.

Notably, many startup founders use these corporate cards to pay for subscription services critical for their businesses, such as web services, cloud and other SaaS products. However, three months ago, all of them were left stranded with little information and no recourse to unblock their defunct cards. To avert the immediate crisis, many startup founders started using their personal credit cards to avoid the loss of subscriptions imperative for the sustenance of the operations of their ventures.

“This can’t be the solution as personal credit cards are not supposed to be used for the company’s expenses,” the founders told us.

Interestingly, most startups and SMEs are also finding it difficult to get a new corporate card. “This is because, unlike SBM Bank, they are asking us to open an FD first, which many may not be willing to do,” a startup founder said.

Customers Are Still In A Tizzy

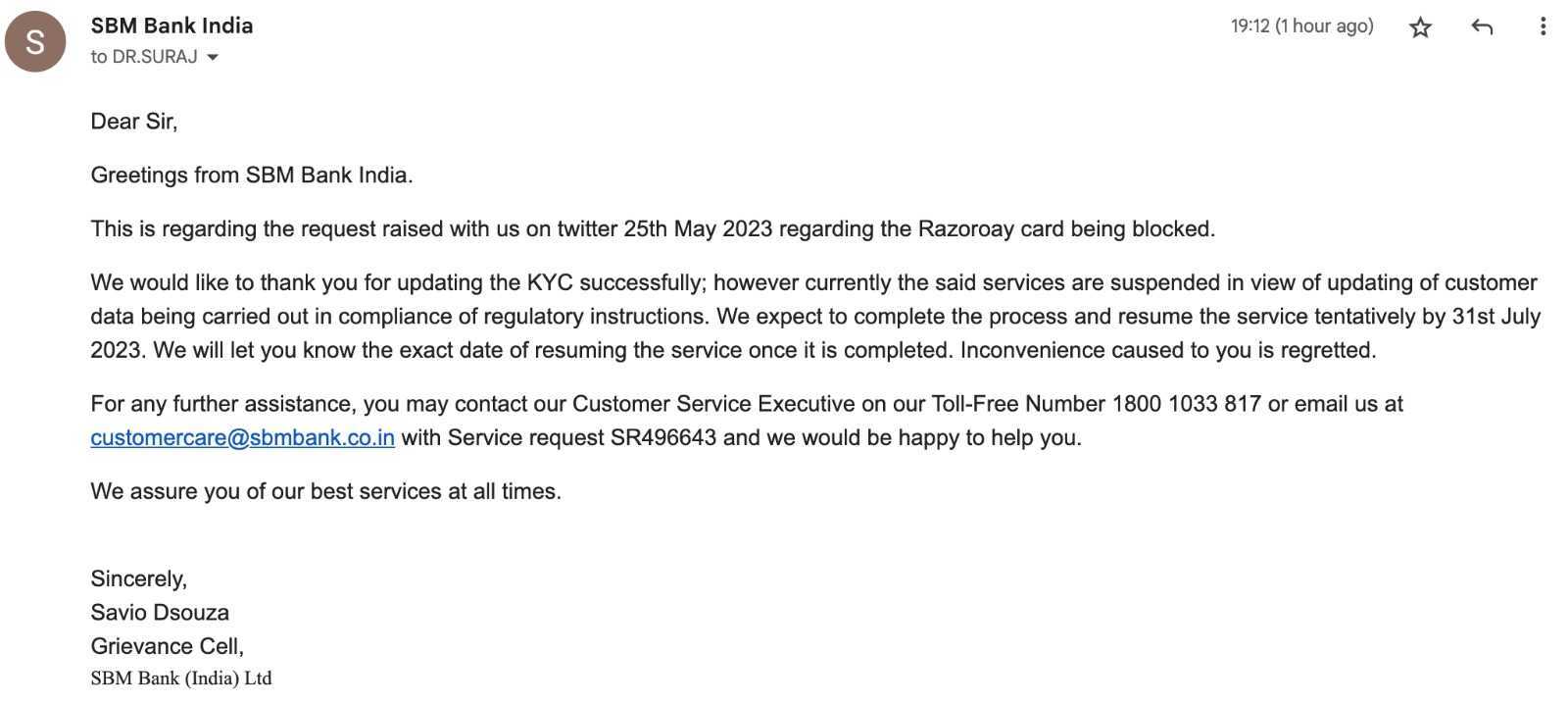

Dr Suraj Dhirwani, the founder and CEO of TechnoMedix, a Mumbai-based healthcare IT and content creation company, has confirmed receiving multiple responses from SBM Bank India.

The bank has assured him that his corporate card services will resume by July 31, 2023.

“While the news was reported in April, it largely went unnoticed. Now that we have been suffering for months, Inc42’s article has managed to stir up awareness about this issue,” Dr Dhirwani said.

He added that many, including regulators, banks and fintech partners, seem to have turned a blind eye towards this issue, but now, it seems, the voice of many entrepreneurs and entities has started reaching their ears.

Moving on, another corporate card user, Deb Sethi, a Bengaluru-based Android developer, said that responding to his query the bank has now informed him that it was updating consumers’ data as per RBI guidelines, with the process expected to be completed by July 31, 2023.

Out of the 15 corporate and prepaid card users interviewed by Inc42, only four confirmed receiving a meaningful response from SBM Bank India or its fintech partners. The remaining 11 users stated that they had not received any response thus far.

Card users like cofounder and CEO of CredoHire Himanshu Kumar, Rohan Chaudhary of Unlearn Product, Ajay Patel of Atyantik Technologies, and Srinivas Gowda, a Prequin engineer, too, expressed their concerns over the lack of communication from the bank or its fintech partners.

Rohan Chaudhary shared that the last message he received regarding the corporate card was on April 28, requesting re-KYC. However, since completing the re-KYC process, he has not received any further communication.

Kalpesh Ahir, who operates the Aprozone iPhone accessories platform, said that despite multiple attempts to contact the bank, he has not received a single response. The sudden blocking of the card has resulted in a significant loss to his business.

“I have contacted them multiple times, but I haven’t received any response yet. Every time, they close the complaint by saying that they are continuously working to resolve the issue. Due to the sudden blocking of the card, my brand has suffered significant losses as the Facebook ads have stopped running. The ads were down for 7 to 8 days and we couldn’t make any sales during this time. It also takes a lot of time to set up everything again,” Ahir said.

Echoing similar sentiment, Kumar of CredoHire said, “We had a Razorpay-SBM India corporate card, which stopped working on April 1, and, despite the re-KYC, there has been no response from the bank. Responding to a query, the Razorpay team said that they have no clue when these cards would be operational again. This made us opt for a new corporate card from another bank.”

SBM Bank India’s Struggles In The Past

The recent suspension of corporate cards is one of the several instances when SBM Bank India has failed to comply with the RBI’s guidelines.

On January 23, 2023, the RBI directed SBM India to halt all LRS transactions due to material supervisory concerns. This decision immediately impacted all cobranded global cards issued by the bank. However, the ban was partially lifted to allow ATM/PoS activities.

In June 2022, although the RBI’s order to cease all credit lines extended over PPI (Prepaid Payment Instruments), SBM Bank India reportedly continued offering prepaid card services via PPI.

On October 15, 2019, the central bank imposed a penalty of INR 3 Cr on SBM Bank (India) for being non-compliant with regulatory norms set by SBM Bank (Mauritius). These norms included provisions issued by the RBI related to the ‘time-bound implementation and strengthening of SWIFT-related operational controls’ and the ‘cybersecurity framework in the banks’.

Such back-to-back instances highlight a pattern of SBM Bank India’s ineptitude in handling both regulatory and operational compliances, resulting in the unfortunate suffering of its customers.

Nevertheless, even though SBM Bank has finally broken its silence, a larger resolution to give respite to its customers seems hanging fire in the absence of any clarity from them.

Ad-lite browsing experience

Ad-lite browsing experience