Setuka Partners LLP were the advisors for this transaction

The company plans to use the funds to make loans to FPOs and SME Agribusinesses that are currently underserved by the formal financial system

Previously, Samunnati has raised equity financing from Elevar, Accel, ResponsAbility, and Nuveen

Chennai-based agriculture finance startup Samunnati has raised $20 Mn debt from the US International Development Finance Corporation (DFC) to expand its lending activities.

In a joint press statement shared with Inc42, Samunnati and DFC said the newly raised capital will help the company to expand its financing and technical assistance to low-income farmers and enterprises throughout the agricultural value chain in India.

Setuka Partners LLP was the exclusive adviser to this transaction.

This loan will help Samunnati to strengthen its financing which enables smallholder collectives to connect to the fast-growing higher value demand for agri-products across India, the press note added.

Anilkumar SG, founder, and CEO, Samunnati said, “Samunnati is working with many FPOs on the supply side and agri enterprises on the demand side across 19 states in India. We are delighted to partner with DFC as this will help us further offer customised financial solutions, using social and trade capital, to FPOs and SMEs, enabling the agri value chain to operate at a higher equilibrium.”

Previously, Samunnati has raised equity financing from Elevar, Accel, ResponsAbility, and Nuveen, and debt financing from a host of local and international financial institutions.

Founded in 2014, Samunnati works in the agriculture sector and has its presence in more than 54 agri value chains spread over 19 states in India.

Ajay Rao, Managing Director – South Asia Region, DFC said, “The DFC is proud to work together with the experienced team at Samunnati and we look forward to collaborate in scaling up the breadth and depth of the company’s operations across India.”

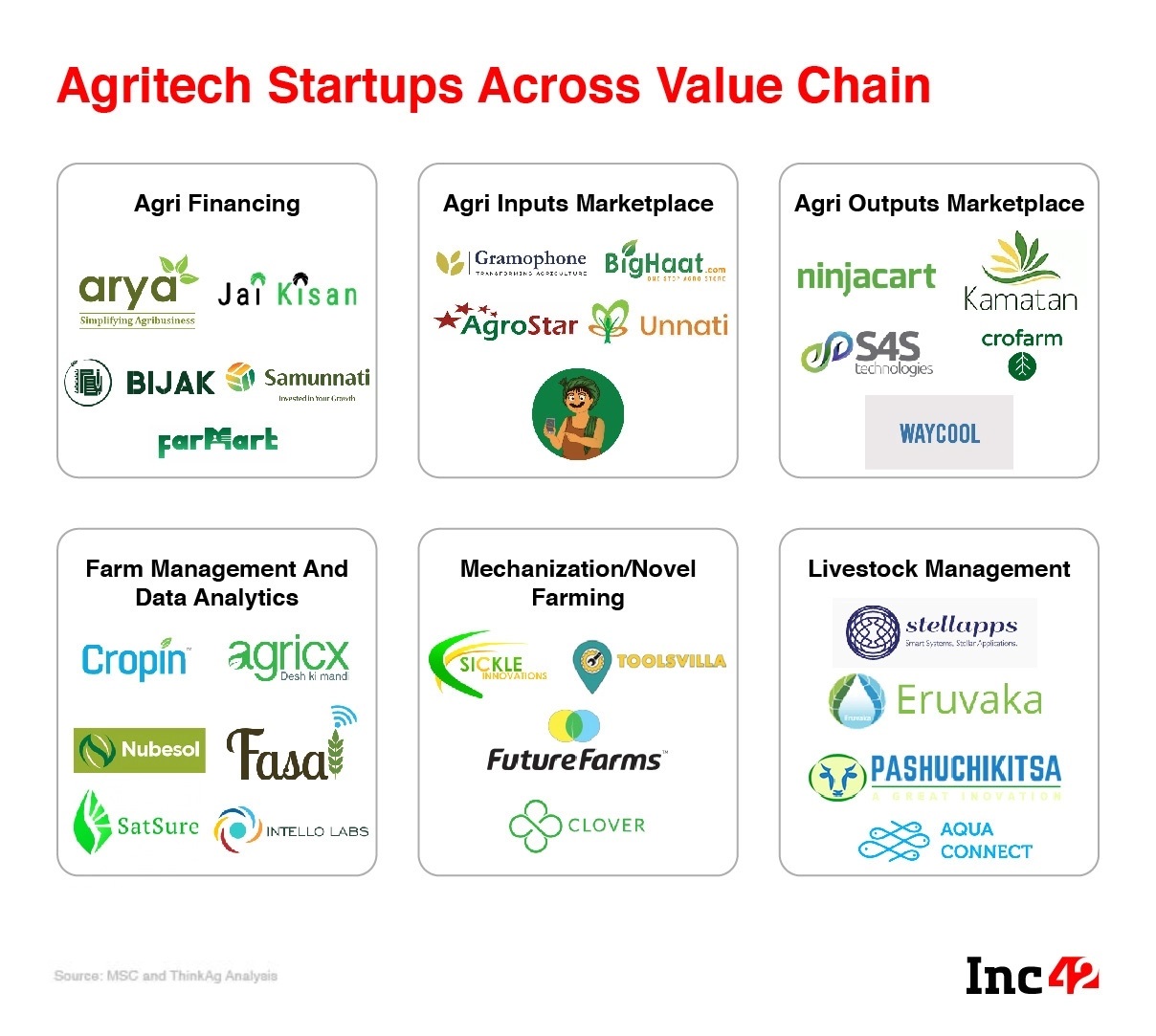

Agritech Boom Does Not Carry Agri Financing

Agriculture and allied sectors contribute $368 Bn to the economy but its 16% share in India’s GDP isn’t an indicator of the financial inclusion of small and marginal farmers. According to ‘The Role of Tech-Enabled Formal Financing in Agriculture in India’ report by Rabo Foundation in partnership with ThinkAg and MicroSave Consulting, over 50% of India’s small and marginal farmers are unable to borrow from any source — tech or traditional — leading to a host of issues in production and income.

However, complex policy patterns and lack of loan access provides an opportunity for ag-fintech startups to provide credit to small and marginal farmers by leveraging technology such as satellite imagery, soil testing, and climate forecasting tools, wearhouse-sourced loans among others.

Some agritech startups that provide financial products and services include Sagri, Samunnati, Arya, Jai Kisan, DeHaat, FarMart, Kissht, and Bijak. The past five years have seen about 3,116 startups registered in the food and agriculture sector in the country, this is a 25-30% growth in the number of startups on a year-on-year basis, with approx $500 Mn investment since 2014, as per Rabo Foundation’s report.

Ad-lite browsing experience

Ad-lite browsing experience