Ola had recently raised Series J Funding of $74 Mn from Steadview Capital

Bansal’s latest investment has valued Ola’s worth between $5.5- $6 Bn

Bansal recently invested $6.39 Mn in two residential properties in Koramangala, Bengaluru

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

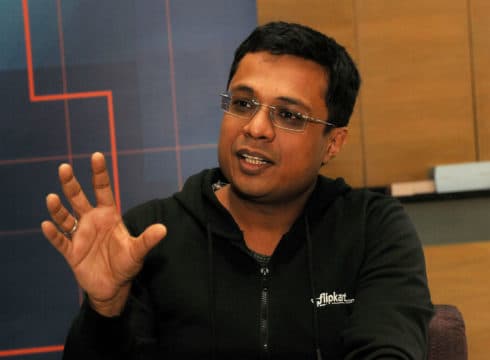

Flipkart cofounder Sachin Bansal has invested $21.2 Mn (INR 149.9 Cr) in a cab-hailing platform Ola as part of the latter’s ongoing Series J round through preference shares, according to the Ministry of Corporate Affairs (M&CA) filings accessed by Inc42.

However, a company source told Inc42 on the condition on anonymity that Bansal’s total investment in Ola is $91.7 Mn (INR 650 Cr).

The development comes a week after Ola raised Series J Funding of $74 Mn (INR 520 Cr) from its existing investor, a Hong Kong-and London-based hedge fund — Steadview Capital — through preference shares.

Inc42 had earlier reported that Bansal is looking to invest about $100 Mn in Ola. This recent investment from Bansal has valued the homegrown cab aggregator Ola between $5.5 Bn – $6 Bn.

In preference shares, an investor owns a stake at the issuing company at a certain price. In this investment, Sachin Bansal has been allotted 70,588 number of shares in Ola, according to the filing.

Ola counts investors such as Softbank, China Eurasian Economic Cooperation Fund, Sailing Capital, Temasek Holdings, Tencent Holdings, and Tekne Capital, among its investors. Reports suggest Ola is trying to curb the Japanese tech conglomerate Softbank’s influence in the company. Softbank currently owns a 26% stake in Ola. Interestingly, Ola’s biggest competitor, Uber, also counts Japan’s SoftBank Group Corp as an investor. In October last year, Ola raised $2 Bn from SoftBank Group Corp and Tencent Holdings. In January this year, SoftBank reportedly invested $1.25 Bn directly into Uber.

Meanwhile, the cab aggregator saw its losses mount to over $695 Mn (INR 4,897.8 Cr), although its total income grew 70% during FY16-17 as compared to the previous fiscal. The company reported a loss of $447 Mn (INR 3,147.9 Cr) in FY15-16. The company is currently present in 110 cities across India, with over 1 Mn driver partners. It has 14 service categories and ferries 2 Mn people every day, as on July 2018.

Bansal left Flipkart with $1 Bn (INR 6,955 Cr) richer. He has recently acquired two residential properties worth $6.39 Mn (INR 45 Cr) in the upmarket locality of Koramangala in Bengaluru.

Bansal is also looking to begin a new entrepreneurial journey with a focus on artificial intelligence (AI). He has recently started a new venture – BAC Acquisitions Pvt Ltd – along with a friend and former investment banker Ankit Agarwal. Further, Bansal may invest $50–100 Mn (INR 347 Cr- 695 Cr) in an electric vehicle startup Ather Energy.

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.