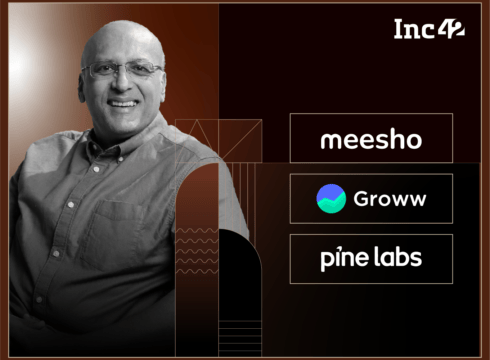

Peak XV’s managing director Mohit Bhatnagar said that shifting domicile back to India is the biggest topic of discussion among the venture capital firm’s portfolio companies at the moment

Speaking at Inc42’s MoneyX 2024 event, Bhatnagar pointed out that startups such as Groww, Meesho and PineLabs are in the process of shifting their base back to India ahead of their imminent IPOs

Founded in 2006, Peak XV is a leading VC firm which invests in India, Southeast Asia and beyond. It counts unicorns like CRED, Meesho, Groww, Mamaearth and Unacademy among its portfolio companies

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

With the reverse flipping parade gaining momentum in the Indian startup landscape, Peak XV’s managing director Mohit Bhatnagar today (September 26) said that shifting domicile back to India is the biggest topic of discussion among the venture capital firm’s portfolio companies at the moment.

Speaking at Inc42’s MoneyX 2024 event, Bhatnagar pointed out that startups such as Groww, Meesho and PineLabs are in the process of shifting their base back to India ahead of their imminent initial public offerings (IPOs).

During a panel discussion with Inc42 cofounder and CEO Vaibhav Vardhan, Bhatnagar also said that he anticipates Peak XV to attract higher interest from anchor investors in the next 10 years or so. As many as 23 of Peak XV’s portfolio companies have launched their IPOS, he added.

Founded in 2006, Peak XV is a leading VC firm which invests in India, Southeast Asia and beyond. It counts unicorns like CRED, Meesho, Groww, Mamaearth and Unacademy among its portfolio companies.

In June last year, Sequoia Capital split itself into three independent partnerships. While its business in India and South Asia was rebranded as Peak XV, its China business adopted the name of HongShan. Meanwhile, its business in the US retained the Sequoia name.

Bhatnagar’s comments come at a time when fintech major PineLabs is reportedly eyeing an over $1 Bn (about INR 8,300 Cr) IPO in India at a valuation of around $6 Bn. In May this year, it secured an approval from a Singapore court to merge its Singapore-based entity Pine Labs Limited (PLS) with the India entity Pine Labs Private Limited (PLI).

Now, it is awaiting approval from the National Company Law Tribunal.

Meanwhile, ecommerce startup Meesho is also said to be in talks to reverse flip its US parent company, a move linked to its plans for an IPO in India. However, the company has not finalised its plans yet.

Fintech firm Groww also completed the process of moving its domicile back to India as of March 2024. With this, it became the second major startup after PhonePe to shift domicile to India.

Several other Indian startups, including Peak XV-backed Freo, Zepto, RazorPay, and Flipkart are also considering a desh wapsi as local markets begin to offer richer valuations for new economy scripts.

In an effort to fast-track the reverse flipping process, the union government has now reportedly exempted overseas incorporated startups looking to merge into their wholly-owned Indian subsidiaries from seeking clearance from the NCLT.

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.