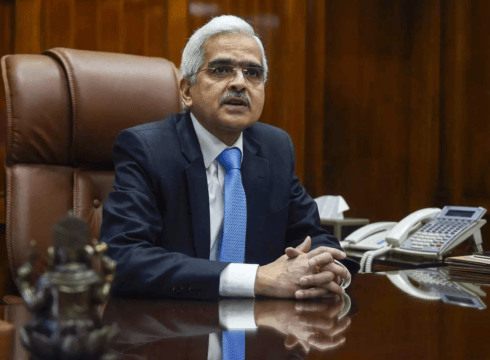

For a better understanding of developments in the fintech ecosystem and to support this sector, it is proposed to set up a fintech repository, said RBI Governor Shaktikanta Das

The development comes at a time when the RBI continues to tighten the regulatory framework for the fintech platforms in the country

Last year, the RBI formed a separate fintech department to foster innovation in the country’s burgeoning fintech sector

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

The Reserve Bank of India (RBI) Governor Shaktikanta Das on Friday (December 8) announced setting up of a fintech repository by April 2024.

Das was speaking after the meeting of its monetary policy committee, during which the central bank also decided to keep the repo rate unchanged at 6.5%.

“Financial entities like banks and NBFCs (non-banking financial companies) in India are increasingly partnering with fintechs. For a better understanding of developments in the fintech ecosystem and to support this sector, it is proposed to set up a fintech repository,” Das said.

“This will be operationalised by the Reserve Bank Innovation Hub in April 2024 or earlier. Fintech would be encouraged to provide relevant information voluntarily to this repository,” he added.

The development comes at a time when the RBI continues to tighten the regulatory framework for the fintech platforms in the country. Recently, the central bank’s decision to increase the risk weight for unsecured consumer credit exposure of banks and NBFCs has already started impacting many BNPL businesses, including Paytm’s loan disbursement business.

Last month, RBI Deputy Governor M Rajeshwar Rao had also called for continuous work to redefine regulations and regulatory frameworks to support innovation in the fintech sector.

Prior to that, the other RBI Deputy Governor T. Rabi Sankar called for the creation of self-regulatory organisations (SROs) in the fintech sector. He had said that such SROs could become instrumental in maintaining ethical practices and promoting responsible growth in fintech.

Last year, the RBI formed a separate fintech department to foster innovation in the country’s burgeoning fintech sector. As per a report last month, the RBI has appointed executive director P Vasudevan as the new head of the fintech department.

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.