To begin with, this facility will be extended to travellers from G20 countries arriving at select international airports: RBI

The development comes as part of a string of moves to export UPI, with as many as 30 countries interested

UPI’s international journey started when Nepal became the first country outside of India to adopt it in February 2022

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

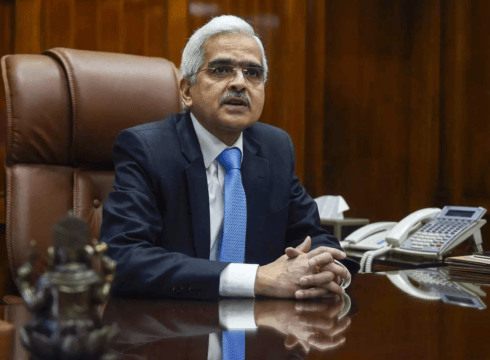

As another feat to the growing popularity of UPI, the payment system may soon be available for people from G20 countries travelling to India. Reserve Bank of India (RBI) governor Shaktikanta Das proposed the move in the last monetary policy statement of FY23.

“UPI has become hugely popular for retail digital payments in India. It is now proposed to permit all inbound travellers to India to use UPI for their merchant payments (P2M) while they are in the country,” said Das in the monetary policy statement on Wednesday (February 8).

However, the RBI governor said that UPI would only be available to G20 residents across select airports in the beginning, with future expansion plans still under wraps. “To begin with, this facility will be extended to travellers from G20 countries arriving at select international airports,” governor Das said.

The development comes as part of a string of decisions and moves to export UPI as the flagship digital payments infrastructure and network. Developed and operated by the National Payments Corporation of India (NPCI), UPI recorded 803 Cr transactions worth INR 12.98 Lakh Cr ($157.85 Bn) in January 2023.

UPI’s international variant, UPI International, has been developed by NPCI International Payments Limited (NIPL). The government has been in talks with as many as 30 countries to export UPI to them as a digital payments network. These countries also happen to have some of the biggest Indian diasporas in the world outside of India.

In January 2023, NPCI instructed UPI members to allow non-resident account types such as non-resident external (NRE) and non-resident ordinary (NRO) accounts with international mobile numbers to use UPI as well, allowing non-resident Indians (NRIs) to access the payments network.

NPCI has enabled UPI transactions for NRE/NRO accounts with mobile numbers from Singapore, Australia, Canada, Hong Kong, Oman, Qatar, the US, Saudi Arabia, the UAE and the UK.

UPI’s international journey started when Nepal became the first country outside of India to deploy the payment system in February 2022.

Since then, UPI has been deployed in several Middle Eastern countries to cater to the massive Indian diaspora there. Meanwhile, UPI’s integration with its Singaporean counterpart PayNow is also set to go live soon.

On Tuesday (February 7), PhonePe became the first Indian digital payments app to enable UPI payments internationally. The decacorn said it has enabled UPI International across the UAE, Singapore, Mauritius, Nepal and Bhutan.

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.