Razorpay’s revenue from operations surged 76% to INR 1,481 Cr in FY22

The fintech unicorn’s total expenses also rose 76% to INR 1,476.5 Cr

For every INR 1 spent by Razorpay on advertising and marketing, it earned INR 17.3 in operating revenue

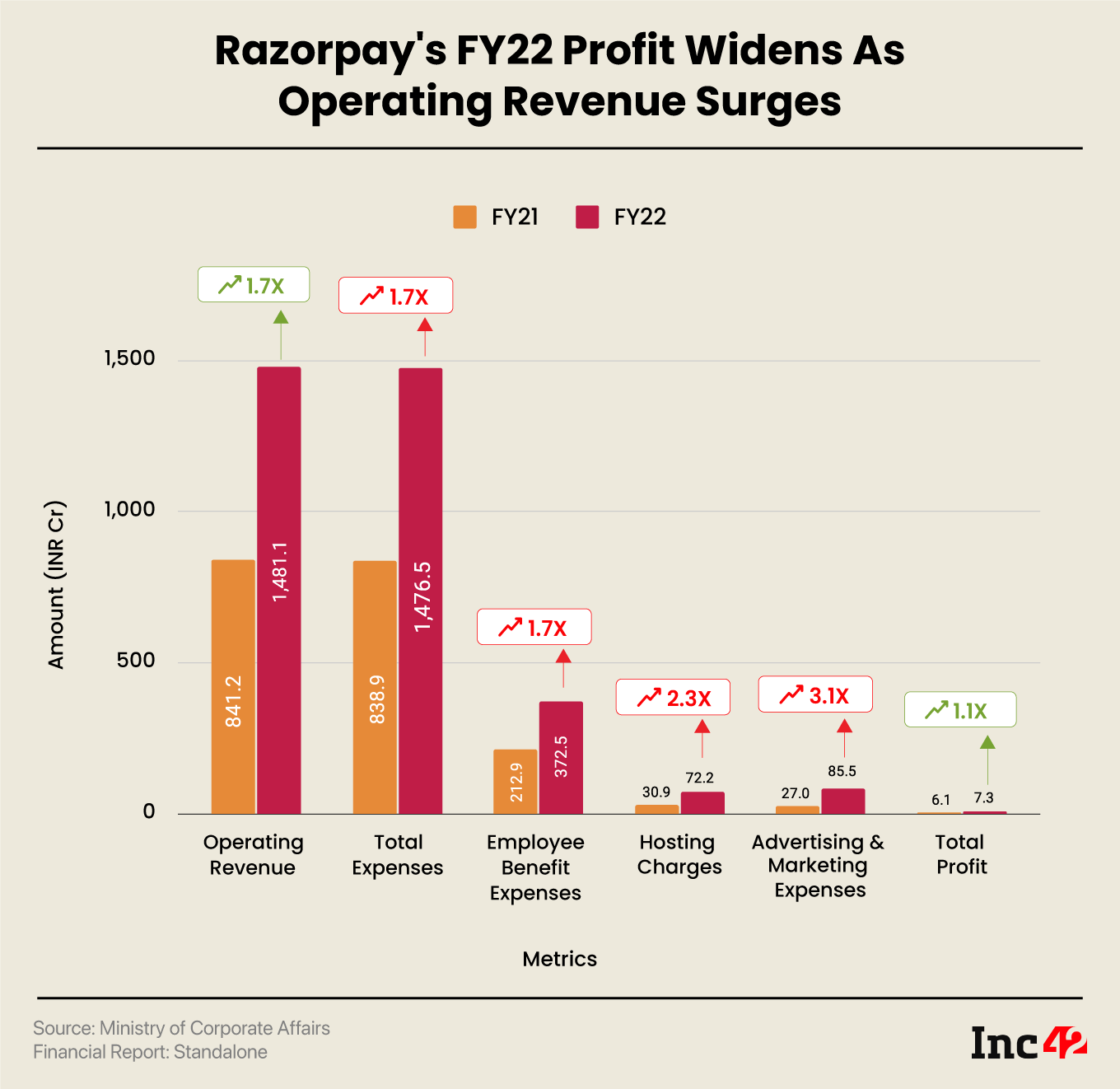

Bengaluru-based fintech unicorn Razorpay’s standalone net profit widened 20% to INR 7.3 Cr in the financial year 2021-22 (FY22) from INR 6.1 Cr in FY21 due to a strong growth in its business.

The startup’s revenue from operations surged 76% to INR 1,481 Cr from INR 841.2 Cr in FY21. Razorpay generates most of its revenue through payment commission fees that it earns by providing online payment services to merchants.

Apart from this, the startup also generates revenue through software development and maintenance services. Razorpay’s total revenue, including other income, rose to INR 1,485.6 Cr in FY22 from INR 844.6 Cr in FY21.

On the expenses front, total expenditure rose 76% to INR 1,476.5 Cr during the year under review from INR 838.9 Cr in FY21. A major chunk of expenses remained undisclosed, as Razorpay didn’t give any breakdown of INR 826.1 Cr of ‘other miscellaneous expenses’. This stood at INR 502.3 Cr in FY21.

Meanwhile, employee benefit expenses jumped 75% to INR 372.5 Cr from INR 212.9 Cr in FY21.

Razorpay spent INR 86 Cr on advertising and marketing expenses in FY22, a jump of 218.5% from INR 27 Cr in FY21. On a unit economics level, Razorpay earned INR 17.3 in operating revenue for every INR 1 spent by it on advertising and marketing.

However, Razorpay’s EBITDA margin contracted to 2.62% in FY22 from 3% in FY21.

The startup was last valued at $7.5 Bn, which is 38X of its revenue from operations in FY22.

Razorpay also offers two relatively new products — Razorpay Opfin, a payroll management platform, and Razorpay X, a neobanking platform. Earlier this year, the startup, through RazorpayX, launched a forex service for startups to help them seamlessly transfer funds raised globally to India.

In 2021, Razorpay bagged $375 Mn in its Series F round from Lone Pine Capital, Alkeon Capital, and TCV, among others, at a valuation of $7.5 Bn, making it the highest valued fintech startup then. Currently, another Bengaluru-based fintech startup PhonePe, which is valued at $12 Bn, is the most-valued fintech startup.

Razorpay entered the unicorn club in 2020 after bagging $100 Mn from Singapore’s GIC and Sequoia Capital, among others.

Founded by Shashank Kumar and Harshil Mathur in 2014 as a payment gateway platform, the startup has branched out into SME payroll management, banking, lending, payments, insurance among others, over the years.

Razorpay is among the few startups which are profitable in the fintech sector in which startups spend big on marketing and advertising. The Kamath brothers led Zerodha is another fintech startup which is profitable. Zerodha saw its net profit grow to INR 2,094 Cr in FY22, while its revenue from operations stood at INR 4,964 Cr.

Razorpay competes with multiple startups for its different offerings. It competes with Juspay, Billdesk, CCAvenue, and PayU, among others, in the payment gateway market, while it locks horns with Open, Niyo, Fi, among others, through its neobanking offering.

Ad-lite browsing experience

Ad-lite browsing experience