Razorpay bought the Malaysian startup Curlec in a $20 Mn deal in February last year

As a pure recurring payments player, Curlec currently works with over 700 Malaysian businesses

Razorpay said the launch in Malaysia will pave the way for the fintech unicorn to penetrate further into international markets, particularly emerging markets

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

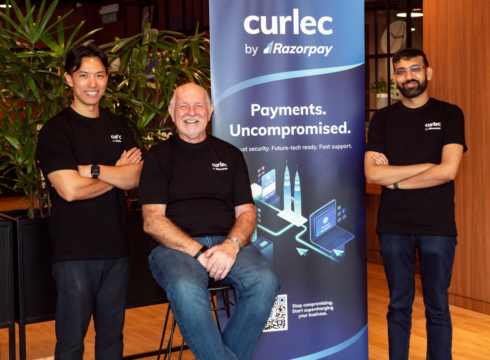

Fintech unicorn Razorpay has strengthened its presence in the Malaysian market with the launch of its first international payment gateway with Curlec, now known as ‘Curlec By Razorpay’.

Razorpay bought the Malaysian startup Curlec in a $20 Mn deal in February last year. By harnessing Razorpay’s technology that caters to 10 Mn businesses in India, the Curlec Payment Gateway aims to bridge the gap between local and international payment gateways.

As a pure recurring payments player, Curlec currently works with over 700 Malaysian businesses, which includes the likes of CTOS, Courts, Mary Kay, Tune Protect, and The National Kidney Foundation. The new Curlec Payment Gateway is set to serve over 5,000 businesses with a target of RM10 Bn ($2.1 Bn) in annualised Gross Transaction Value (GTV) by 2025, Razorpay said in a statement.

“When we joined forces with Curlec, our one single vision was to build products catering to the needs of the SEA region, and today the Curlec Payment Gateway is a first step in that direction,” said Shashank Kumar, MD and cofounder of Razorpay India.

“We see great potential in SEA, we recognise the power of payments in Malaysia and what it means for businesses of any kind and size. We firmly believe that our extensive experience in operating within the diverse and dynamic market of India has prepared us to tackle different challenges and solve payment problems on a global scale,” he added.

Razorpay is looking to reap the benefits of Malaysia’s growing digital economy. As per a 2021 report, digital trade in Malaysia contributed 22.6% to the country’s total GDP, which was expected to rise to 25.5% by 2025.

“Having witnessed India’s payment geography and finding similarities with Malaysia, I can boldly say that collaboration, innovation, and customer-centricity will be the three keys to unlocking the potential of digital payments and driving economic growth in Malaysia,” said Kumar.

Razorpay said that this launch in Malaysia will pave the way for the fintech startup to penetrate further into international markets, particularly emerging markets.

Meanwhile, Razorpay continues to bolster its domestic capabilities as well, at par with the evolving digital payments ecosystem in the country. Earlier this year, it launched ‘Turbo UPI’ – a one-step payment solution for the UPI network.

Recently, the fintech major also joined India’s Open Network for Digital Commerce (ONDC) platform to streamline payment processes.

In April, Razorpay roped in former RBI deputy governor N.S. Vishwanathan as its chairperson, as it looks to enhance its offerings and ensure better corporate governance and compliance in India.

However, regulatory challenges continue to remain a major issue for all fintech startups in India. Razorpay, along with other fintech entities, has recently been probed by the Enforcement Directorate (ED) over money laundering in a Chinese loan app case.

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.