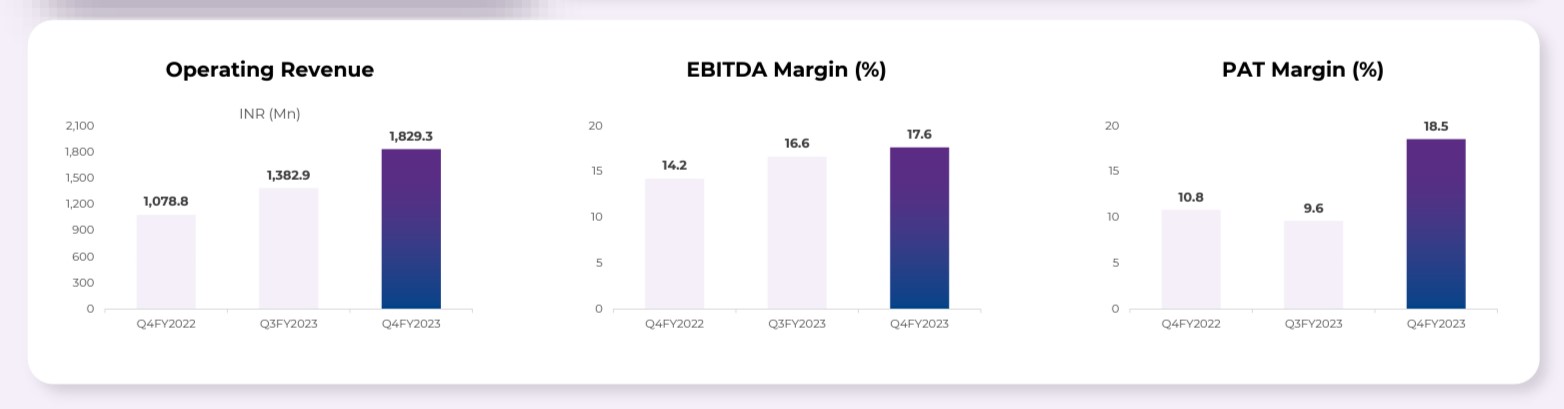

RateGain’s operating revenue grew over 69% to INR 182.9 Cr in Q4 FY23 from 107.9 Cr in the corresponding quarter of the previous year

Profit after tax jumped to INR 68.4 Cr in FY23 from INR 8.4 Cr in FY22

The traveltech SaaS startup said its operating margin expanded to 15% in FY23 from 8.3% in the previous year due to better operating leverage and cost efficiencies

Traveltech SaaS startup Rategain

The startup had reported a PAT of INR 11.6 Cr in Q4 FY22. Profit rose 154% from INR 13.3 Cr in the preceding Q3 FY23.

Shares of RateGain jumped almost 5.7% to INR 424 on the BSE during the intraday trading, after the company reported its results. They ended the session 2.82% higher at INR 412.50.

RateGain’s operating revenue grew over 69% to INR 182.9 Cr in Q4 FY23 from 107.9 Cr in the corresponding quarter of the previous year. It also grew sequentially from INR 138.3 Cr reported in Q3 FY23.

RateGain completed its first full year of listing in FY23. Despite tech companies across the world experiencing growth and cost pressures, RateGain’s operating revenue jumped 54.2% YoY to INR 565.1 Cr in FY23.

Its operating margin also expanded to 15% during the fiscal year from 8.3% in the prior year. In a statement, the startup attributed better operating leverage and cost efficiencies across different businesses for the improvement in operating margin.

Overall, RateGain’s PAT rose 712% to INR 68.4 Cr in FY23 from INR 8.4 Cr in FY22.

“It has been a standout year for the company in terms of performance across all key areas contributing to record revenue with commendable margin improvement. This is a validation of the underlying business fundamentals and the value we continue to drive for our customers,” said Tanmaya Das, chief financial officer of RateGain.

“We witnessed balanced growth across our three verticals with an improvement across all key metrics contributing to a stellar year. Adara integration continues on track… With a strong pipeline across verticals, we are well positioned to deliver value to our customers and stakeholders,” he added.

On the expenses front, RateGain’s total expenses were up to INR 161.9 Cr in Q4 FY23 from INR 101.6 Cr in the corresponding quarter of the last fiscal. The rise in expenses was largely driven by the increase in spending towards employee benefits.

The startup spent INR 76.7 Cr towards employee benefits in the quarter under review as against INR 47.7 Cr spent in Q4 FY22.

RateGain said it continues to add to its headcount, which saw a 17.7% increase YoY with a total headcount of 713 at the end of March 2023.

With the increase in its overall headcount, the company claimed that it was able to reduce its attrition rate to 21.1% currently.

The company’s other expenses also rose 65% YoY to about INR 75 Cr in the quarter under review.

RateGain said it continues to have strong customer relationships that are enabling it to build predictive, stable, and sustainable revenue streams. Its annual recurring revenue stood at an all-time high of INR 774.5 Cr in FY23 and the loan-to-value (LTV) to customer acquisition cost (CAC) for the fiscal year came in at 21.3X.

“We continue to use AI capabilities to advance our mission of building an integrated tech stack that allows our customers to acquire guests, engage, and retain them and have a wallet share expansion. With continued momentum across all business lines along with our continued investments into RG Labs, especially in areas of AI and now Generative AI, we continue to lead digitisation of the industry,” said Bhanu Chopra, founder and chairman of RateGain.

Ad-lite browsing experience

Ad-lite browsing experience