This infusion values Purplle at approximately $1.2-1.3 Bn, marking a 15% increase from its previous fundraising round last year

Creaegis, a sector-agnostic PE fund founded is expected to join Purplle’s funding round as a new investor

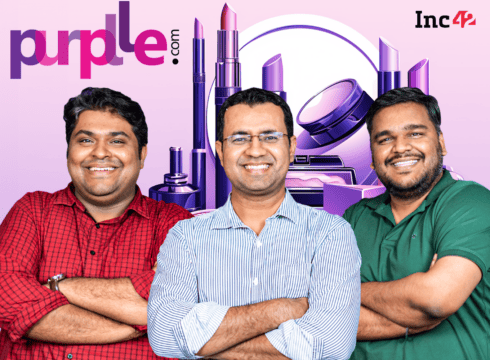

Founded in 2012 by Manish Taneja and Rahul Dash, Purplle sells beauty products and appliances

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

Beauty ecommerce marketplace Purplle has reportedly raised $100 Mn (INR 835 Cr) funding through a combination of primary and secondary investments led by Abu Dhabi’s sovereign fund ADIA.

As per an ET report, this infusion values Purplle at approximately $1.2-1.3 Bn, marking a 15% increase from its previous fundraising round last year.

Creaegis, a sector-agnostic PE fund founded by former Premji Invest partner Prakash Parthasarathy is expected to join Purplle’s funding round as a new investor and talks are in final stages of closing.

Additionally, Premji Invest, an existing investor in Purplle, has increased its investment in the firm, sources told ET.

Other investors in Purplle include Peak XV Partners and Blume Ventures.

This comes months after it was reported that Purplle was planning to launch more offline stores this year, and had entered initial discussions with ADIA for a $100 Mn investment.

Reportedly, Purplle plans to tap the public markets between the second half of next year and early 2026.

Founded in 2012 by Manish Taneja and Rahul Dash, Purplle sells beauty products and appliances. It sells products of several D2C brands, including Plum, WOW Skin Science, mCaffeine, Maybelline and SUGAR Cosmetics, on its platform.

The startup’s operating revenue or sales stood at INR 474.9 Cr in the financial year 2022-23 (FY23), an increase of 116% from INR 219.8 Cr in FY22.

The Indian BPC (beauty and personal care) market is set to grow rapidly, reaching a total GMV of $30 Bn by 2027, which will make up about 5% of the global BPC market. With an annual growth rate of approximately 10%, it’s the fastest-growing BPC market among large economies.

Several major players in India’s beauty industry, including Nykaa, Myntra, Mamaearth, Ajio, and Tira, are intensifying their efforts to capture a larger share of the market.

Tira has launched two private labels in the past month, signaling a focus on scaling up one year after its launch. Since entering the beauty and personal care market last year, Reliance Retail has expanded Tira’s offline presence to ten stores across major cities in India.

Meanwhile, Nykaa also announced a healthy uptick in its owned brands in beauty, which have grown 39% in FY24. For the quarter ending on March 31, 2024 (Q4 FY24), Nykaa’s consolidated net profit plunged by 48% quarter-on-quarter (QoQ) to INR 9.07 Cr from Q3 FY24’s INR 17.45 Cr. However, net profits grew 1.2X year-on-year (YoY) from Q4 FY23’s INR 4.27 Cr.

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.