As per data released by the NPCI, PhonePe, Google Pay and Paytm together processed 862.54 Cr UPI transactions worth INR 13.39 Lakh Cr in April 2023

PhonePe commanded a market share of 50.47% in terms of transaction value, while Google had a market share of 34.94% in April

Overall, UPI logged over 889.81 Cr transactions worth INR 14.07 Lakh Cr in April, even as transaction count saw a marginal month-on-month decline

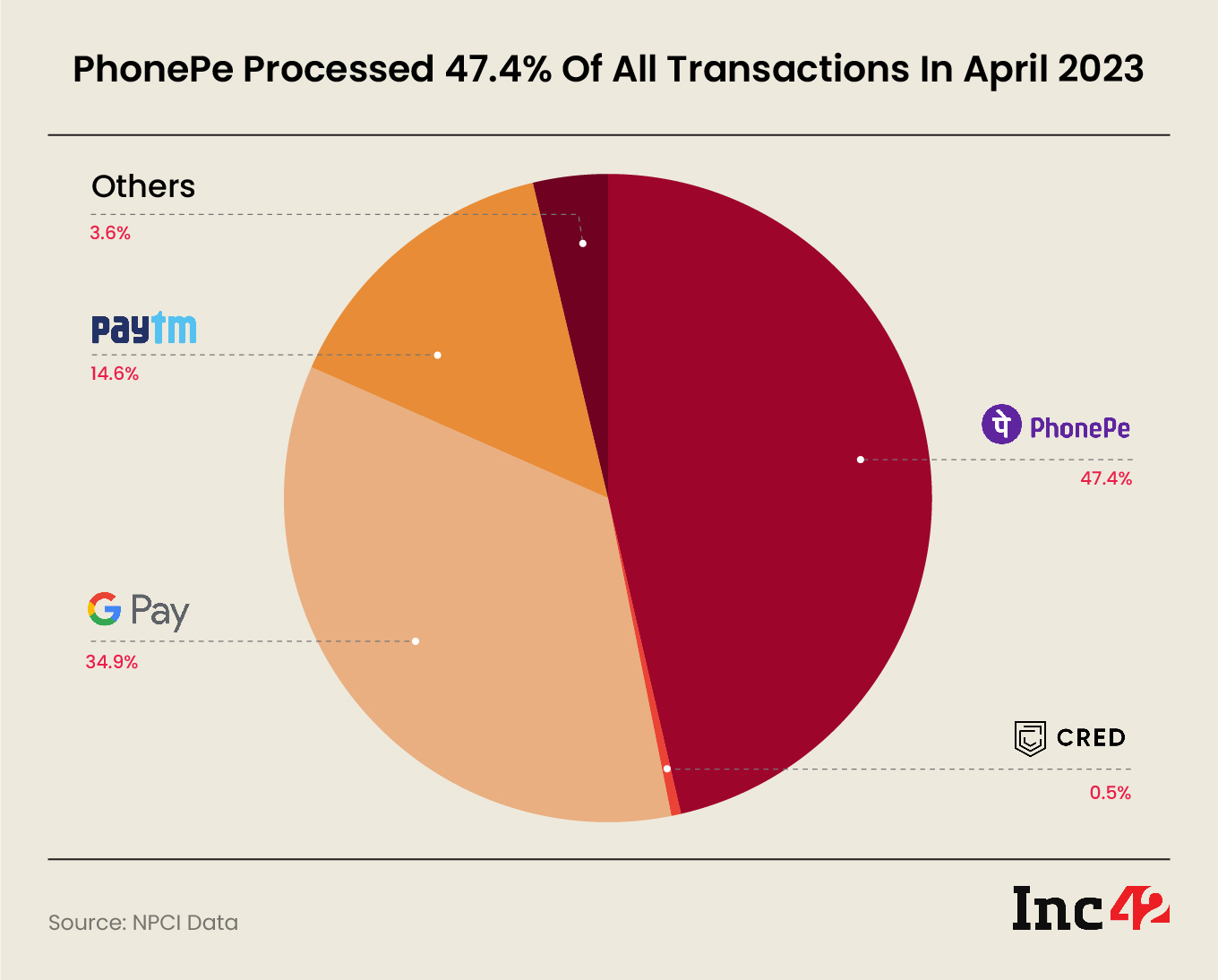

The Indian digital payments space continued to be dominated by just three players in April 2023, with PhonePe, Google Pay and Paytm accounting for nearly 97% of UPI transactions.

As per the data released by the National Payments Corporation of India (NPCI), the top three apps processed 862.54 Cr transactions last month.

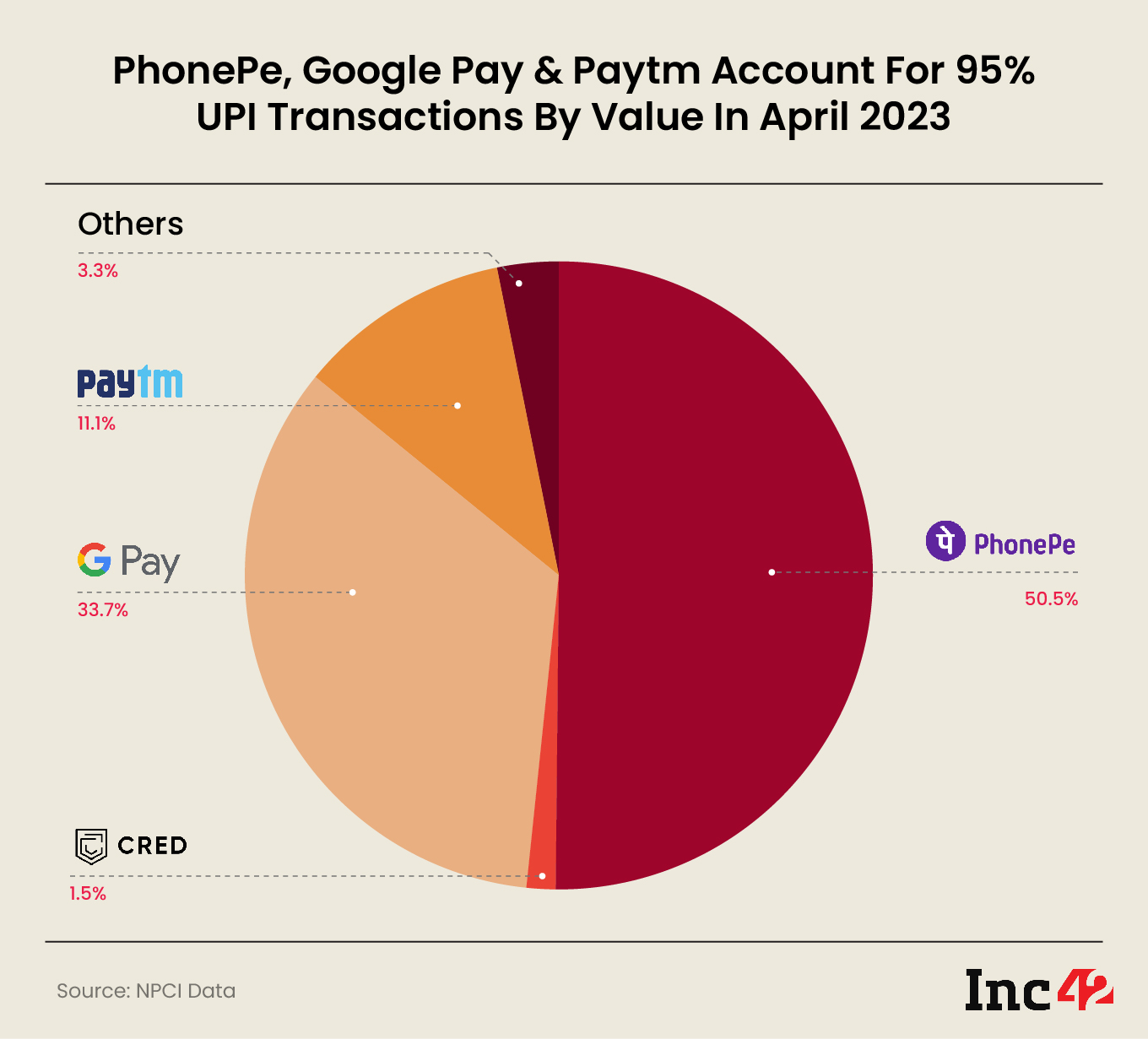

A similar trend was seen in terms of transaction value, as the three players cumulatively processed transactions worth INR 13.39 Lakh Cr last month and cornered 95% of the share.

In contrast, PhonePe, Google Pay and Paytm together processed 841.91 Cr transactions worth INR 13.44 Lakh Cr in March 2023.

Overall, UPI witnessed 889.81 Cr transactions worth INR 14.07 Lakh Cr in the month of April. While the transaction count inched up 2.45% month-on-month (MoM), transaction value saw a decline of 0.24% compared to March 2023.

Walmart-backed PhonePe continued to dominate as the biggest digital payments player, accounting for 421.6 Cr transactions worth INR 7.10 Lakh Cr last month. It commanded 50.47% market share in terms of transaction value and 47.39% in terms of transaction count.

Google Pay was at the second spot, processing 310.9 Cr transactions worth INR 4.74 Lakh Cr. Its market share stood at 34.94% and 33.69% in terms of transaction count and value, respectively.

Homegrown fintech giant Paytm emerged as the second runner-up as it processed 129.92 Cr transactions totalling INR 1.55 Lakh Cr in April.

Despite recording just 4.57 Cr transactions during the month, Kunal Shah-led CRED processed INR 20,729 Cr worth of payments. While state-backed BHIM raked up 2.37 Cr transactions worth INR 7,368 Cr last month, WhatsApp processed 1.48 Cr transactions worth INR 1,319 Cr during the same period.

Peer-to-peer (P2P) transactions contributed 77% to the total UPI transaction value and 43% to the transaction count. A majority of the P2P transactions were above INR 2,000, while sub-INR 500 payments continued just 3.21% to the value count.

On the other hand, P2M transactions accounted for 22% of value and 56% of payment count.

UPI payments for groceries, at supermarkets and restaurants, and for telecommunication services and games emerged as the high transacting categories, while utilities and online marketplaces were clubbed under medium transacting categories.

Earlier this month, a report by consulting firm Bain & Company said that merchant payments on UPI could reach as high as $1 Tn annually by 2026.

The growth in online payments has also propelled digital payment giants to deploy a slew of new offerings for their customers. Earlier this month, PhonePe launched the UPI Lite feature on its app, allowing users to make payments under INR 200 without any pin. Its rival Paytm announced the same feature in February, and launched the support for the same earlier this month.

Paytm also plans to unveil the ‘UPI International’ service on its app in the near future to cater to the burgeoning Indian population travelling abroad. PhonePe already launched the support for cross-border UPI payments in February this year as well.

Ad-lite browsing experience

Ad-lite browsing experience