The company boards and investors have been informed that PhonePe is not going ahead with the acquisition after months of due diligence

Sustainability of the business and shareholding structure of ZestMoney was one of the key reasons for this deal being cancelled

The BNPL platform had been on the lookout for a buyer as it struggled to raise fresh funds from investors

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

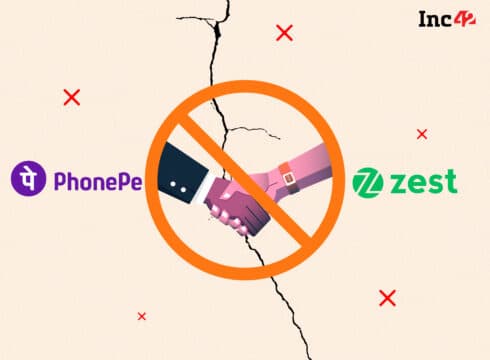

Fintech major PhonePe has reportedly cancelled its plan to acquire buy-now-pay-later (BNPL) platform, ZestMoney.

The company boards and investors have been informed that PhonePe is not going ahead with the acquisition after months of due diligence, ET reported.

Lack of due diligence, disagreements over valuation, sustainability of the business and shareholding structure of ZestMoney, were the key reasons for this deal being called off.

Further, the role of the parent company Primrose Hill Ventures has also raised questions, which is the Singapore-parent to India-registered Camden Town Technologies, the entity which owns and operates the ZestMoney platform.

BNPL startup ZestMoney was expecting a $200-300 Mn valuation out of the acquisition which was another reason for the deal not being finalised.

Founded by Lizzie Chapman, Priya Sharma and Ashish Anantharaman in 2015, Bengaluru-based ZestMoney offers BNPL services, allowing its users to pay their shopping bills in three instalments at 0% interest rate.

It competes against the likes of Simpl, LazyPay, and ePayLater in the BNPL space in the country.

In 2021, ZestMoney raised $50 Mn in its Series C round led by Zip Co Limited, a fintech firm listed in Australia. The startup is also backed by Quona Capital, Reinventure Ribbit Capital, Omidyar Network, PayU, and Xiaomi.

However, the BNPL platform had been on the lookout for a buyer as it struggled to raise fresh funds from investors.

Last year, PhonePe initiated discussions to acquire ZestMoney to strengthen its lending service. Initially, it was reported that the deal would be wrapped up quickly. If PhonePe’s acquisition of ZestMoney was fruitified, it would have become the biggest consolidation deal in the fintech’s lending segment.

ZestMoney saw its loss widen 3X year-on-year (YoY) to INR 398.8 Cr in the financial year ending March 31, 2022 due to a sharp rise in its expenses. The fintech startup’s loss surged 216% from INR 125.8 Cr reported in the financial year 2020-21 (FY21).

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.