With this, the startup claims to have raised a total funding of $5.5 Mn (INR around 45 Cr) till date.

Founded by Gunasekaran in 2020, Pepul claims to be the world's first social media platform to bring KYC system for verification of users

In 2022, the company raised $1.5 in its seed funding round from a clutch of investors, including Hourglass Venture, Freshworks’ Girish Mathrubootham and Paytm’s Vijay Shekhar Sharma

Internet-based social media startup Pepul has raised $4 Mn (INR 33 Cr) as a part of its Pre-Series A funding round led by a Tamil Nadu-based family office.

With this, the startup claims to have raised a total funding of $5.5 Mn (INR around 45 Cr) till date.

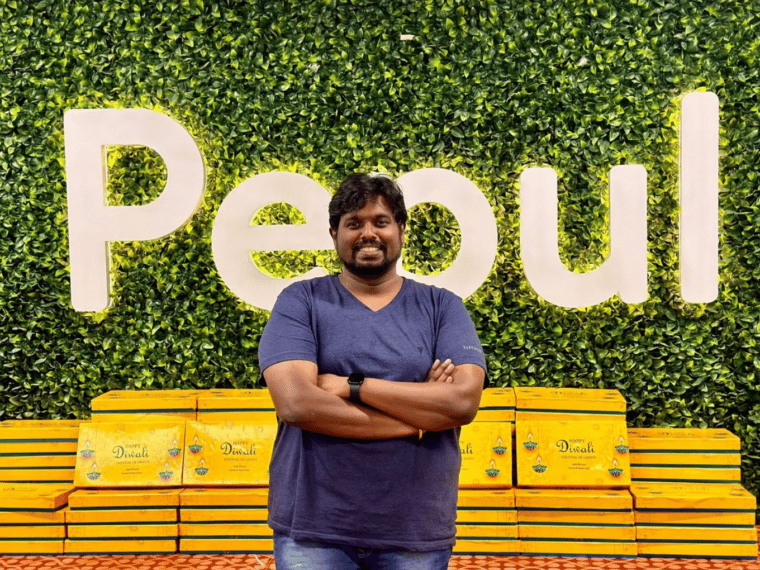

Announcing Pepul’s latest fundraise on LinkedIn, founder and chief executive officer Suresh Kumar Gunasekaran said that the fresh proceeds will be deployed to scale up its B2C social networking vertical as well as project management and communication platform Workfast.ai.

Founded by Gunasekaran in 2020, Pepul claims to be the world’s first social media platform to bring KYC system for verification of users.The job-focused social media platform further claims to offer skill development and job hunting in a data safe environment.

In 2022, the company raised $1.5 in its seed funding round from a clutch of investors, including Hourglass Venture, Freshworks’ Girish Mathrubootham and Paytm’s Vijay Shekhar Sharma.

This comes at a time when social media startups have started gaining a lot of investors’ traction for quite some time now.

For instance, a few days ago BellaVita cofounder Aakash Anand’s new AI-powered social media venture Unikon.ai raised INR 16 Cr (about $2 Mn) in its seed funding round from a host of entrepreneurs and influencers.

Similarly, social media platform Hunch also secured $23 Mn in its Series A funding round led by Alpha Wave. The fresh proceeds will help the company to expand its footprint in India and enhance its tech stack.

As per Inc42 report, the social networking market size is expected to grow from $69.54 Bn in 2023 to $153.06 Bn by 2028. With only 41% of its population over social media, India still manages to be one of the largest social media markets.

Ad-lite browsing experience

Ad-lite browsing experience