SUMMARY

Nilekani expects the state-backed ONDC to begin full-fledged operations soon

Nilekani also said that GST, FAStag and e-way bills will also aid in significant economic activity in the next 10 years

Earlier this month, Nandan Nilkenai said that the rollout of the account aggregator network and ONDC would open up new avenues for Indian startups

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

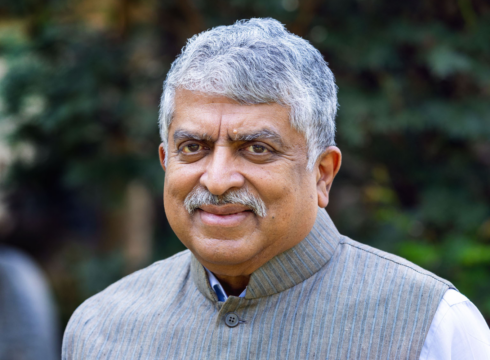

Former UIDAI chairman and Infosys cofounder Nandan Nilekani has said that the open network for digital commerce (ONDC) and the account aggregator framework will power ‘significant economic activity’ in the country over the next decade.

He added that other government measures including the GST, FAStag and e-way bills will also aid in significant economic activity which will be inclusive and democratic.

Nilekani made the comments while speaking at the Global Technology Summit organised by Carnegie India.

He also said that he expects the state-backed ONDC to begin full-fledged operations soon.

It is pertinent to note that Nilekani is the architect of the Unique Identification Authority of India (UIDAI) and has been one of the leading brains behind the government’s digital commerce venture.

Reacting to the ongoing transformation in the logistics sector, Nilekani said that a variety of startup innovators and other players would leverage the new changes to streamline delivery of goods and services.

Indian Govt’s Mega Push

This comes weeks after Nandan Nilekani echoed a similar sentiment when he said that the rollout of the account aggregator network and ONDC would open up new avenues for startups and entrepreneurs in the country.

ONDC and the account aggregator framework, along with unified payments interface (UPI), form the bedrock of the India Stack. WIth these offerings, the centre aims to spur the next level of digitalisation, address working capital requirements and bring the ecommerce revolution to smaller merchants.

Account aggregator framework has been envisaged with ensuring the quick sharing of user data with financial entities. It is a data-sharing protocol between financial institutions such as banks, insurance companies, NBFCs, and others to seamlessly share user information such as credit score. This will allow financial institutions to easily sanction loans, without a long drawn process involving multiple agencies.

So far, the account aggregator ecosystem has 76 certified entities, including eight account aggregators, 29 NBFCs, 24 banks, 6 registered investment advisors (RIAs), 3 insurance companies, 3 stock brokers, and others.

On similar lines, ONDC will deploy open protocols to enable any user on any platform to buy from any seller. It aims to take on the hegemony of ecommerce giants such as Flipkart, Amazon and Meesho and aims to onboard small merchants and brick-and-mortar stores to scale hyperlocal commerce.

ONDC plans to sign up 900 Mn buyers, 1.2 Mn sellers and achieve a gross merchandise value (GMV) of $48 Bn in the coming two years.

While authorities have left no stone unturned to tout its ambitious projects, it remains to be seen whether they translate well on ground. Modelled on the lines of UPI, it remains to be seen whether these new offerings replicate the success and scale of India’s digital payments revolution.

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.