Shares of RateGain rose 16.9% on the BSE after its PAT almost tripled YoY to INR 24.9 Cr in Q1

Shares of ideaForge slumped almost 11% this week, while DroneAcharya, PB Fintech, Nazara Tech, Zomato, Nykaa, EaseMyTrip, and Delhivery also fell in a range of 0.1% to 9%

Paytm rallied 8.6% this week following the fintech major’s announcement that Vijay Shekhar Sharma would acquire Antfin’s 10.3% stake in the company

The change in investor sentiment continued to reflect in the performance of India new-age tech stocks for another week. However, due to a consolidation in the broader domestic equity market and some stock-specific reactions following Q1 FY24 results, new-age tech startups witnessed a mixed week on the bourses.

Seven out of the 15 new-age tech stocks under Inc42’s coverage gained in a range of 0.3% to 17% this week.

Travel SaaS startup RateGain emerged as the biggest winner, rising 16.9% on the BSE after its profit after tax (PAT) almost tripled year-on-year (YoY) to INR 24.9 Cr in Q1.

Paytm (up 8.6%), MapmyIndia (up 9.9%), and Fino Payments Bank (5.8%) were also among the gainers this week. Following its upbeat Q1 FY24 results, shares of CarTrade Tech also rose 3.6% this week.

However, after reporting muted Q1 earnings, ideaForge slumped almost 11% during the week, becoming the biggest loser.

DroneAcharya, PB Fintech, Nazara Technologies, Zomato, Nykaa, EaseMyTrip, and Delhivery also fell in a range of 0.1% to 9% on the BSE.

Among the benchmark indices, Sensex fell 0.61% to 65,322.65 and Nifty 50 declined 0.45% to 19,428.30 this week.

During the week, the Reserve Bank of India (RBI) kept the repo rate unchanged at 6.5% but hiked inflation projection for 2023-24 to 5.4%.

Commenting on the performance of the market during the week, Siddhartha Khemka, head of retail research at Motilal Oswal, said that domestic equities continued their weakness due to subdued global cues and hawkish commentary from the RBI.

“In the absence of any major trigger and uncertain global cues, we expect the market to consolidate in the range. Investors on Monday would react to India’s FII (Foreign Institutional Investors) data,” said Khemka.

Amol Athawale, vice president of technical research at Kotak Securities, said that weak European and Asian market cues, coupled with concerns about China slipping into stagflation amid slackening demand, are making investors jittery and prompting them to offload in domestic equities.

“With FII flows turning choppy this month so far, markets are struggling to maintain the upward bias amid rise in intra-day volatile trades,” Athawale added.

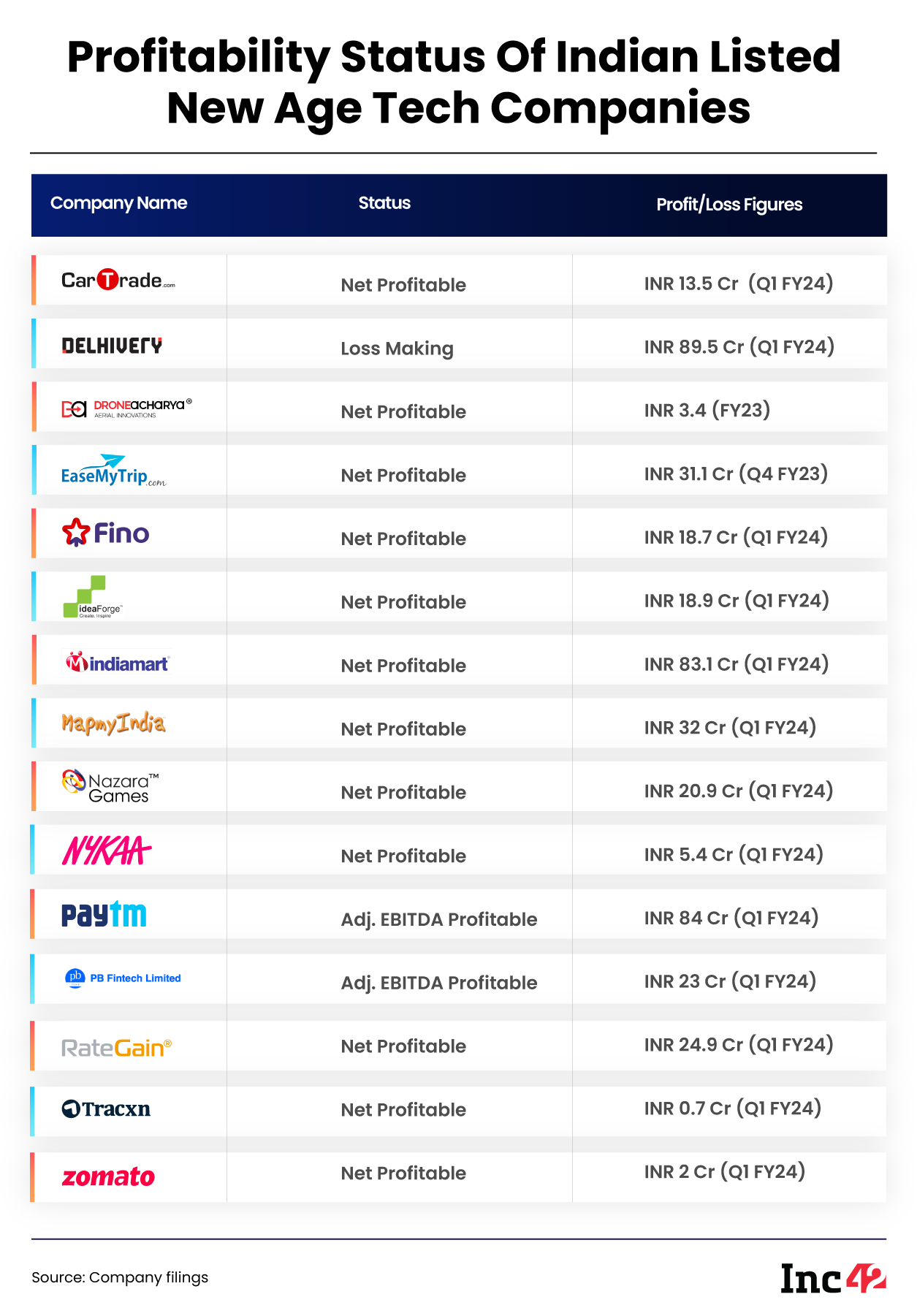

Before analysing the performance of the new-age tech stocks this week, let’s take a quick look at the financial health of these companies.

Now, let’s dig deeper into the performance of some of the new-age tech stocks this week.

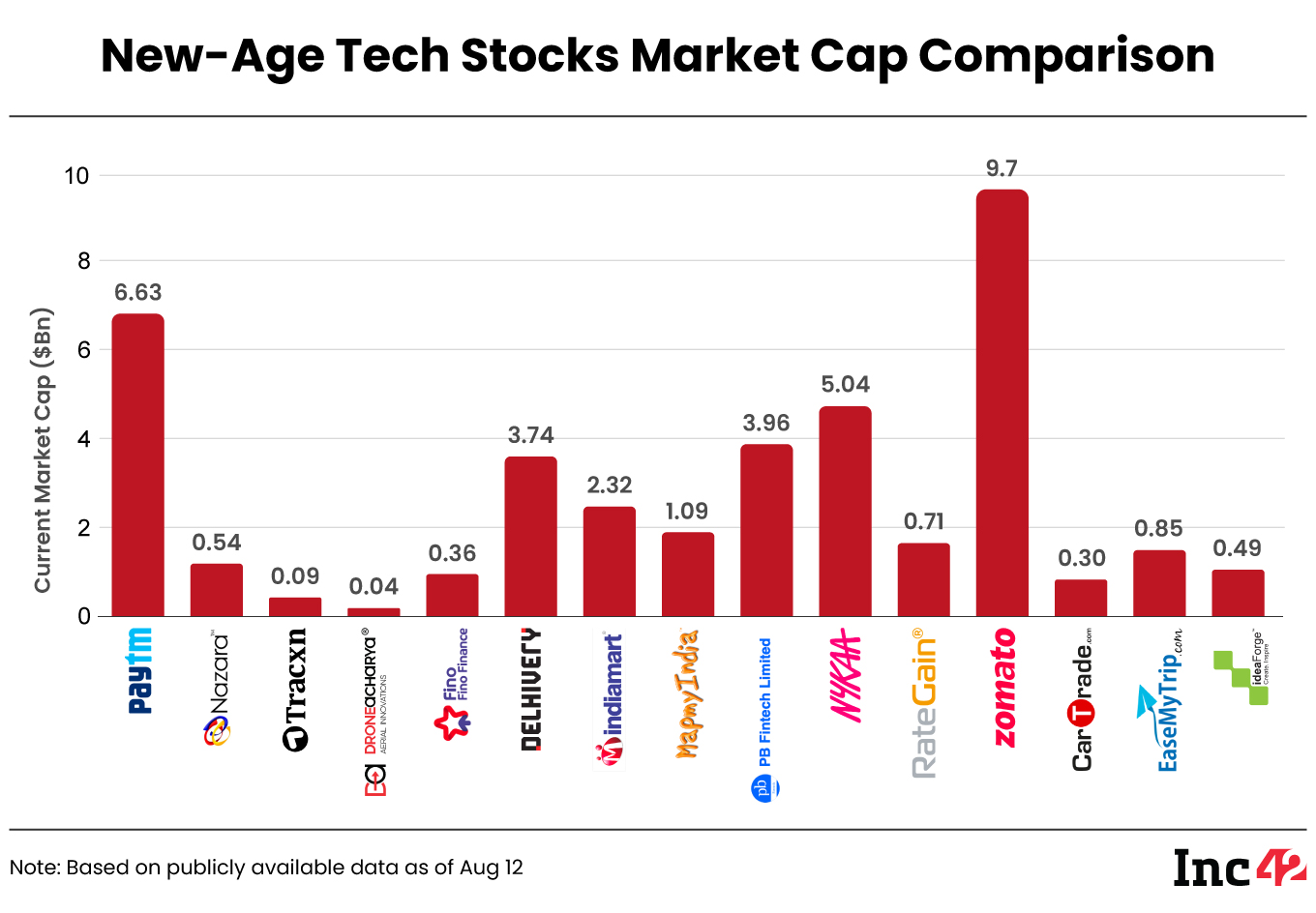

The 15 new-age tech stocks under Inc42’s coverage ended the week with a total market capitalisation of $34.96 Bn as against $36.33 Bn last week.

Paytm Rallies After Share Transfer From Antfin

Shares of Paytm had witnessed a slight decline after reporting its Q1 FY24 results towards the end of last month. However, its shares rallied sharply after the fintech major’s announcement earlier this week that Vijay Shekhar Sharma would acquire Antfin’s 10.3% stake in the company.

Paytm gained 8.6% this week on the back of the announcement and ended Friday’s session at INR 864.05 on the BSE.

Proxy firm Institutional Investor Advisory Services (IiAS) came out with a report following the transfer of shares, saying that Sharma, along with the equity holding of the family trust, is now in control of 24.3% of voting rights in the company.

“It’s time Vijay Shekhar Sharma formally signals that he remains in control. He needs to give investors the comfort that he is the promoter and not someone who is sitting in the shadows,” the IiAs said.

On the back of improving investors’ sentiment towards new-age startups, particularly, Paytm, Zomato, and PB Fintech, shares of Paytm have gained over 23% since June this year.

The stock is consolidating right now but it is showing positive consolidation, said Kotak Securities’ Athawale.

“Investors should still wait for a fresh breakout, which is around INR 890-INR 900 levels. If the market continues to correct then the stock may retrace towards INR 820-INR 810 levels,” Athawale said.

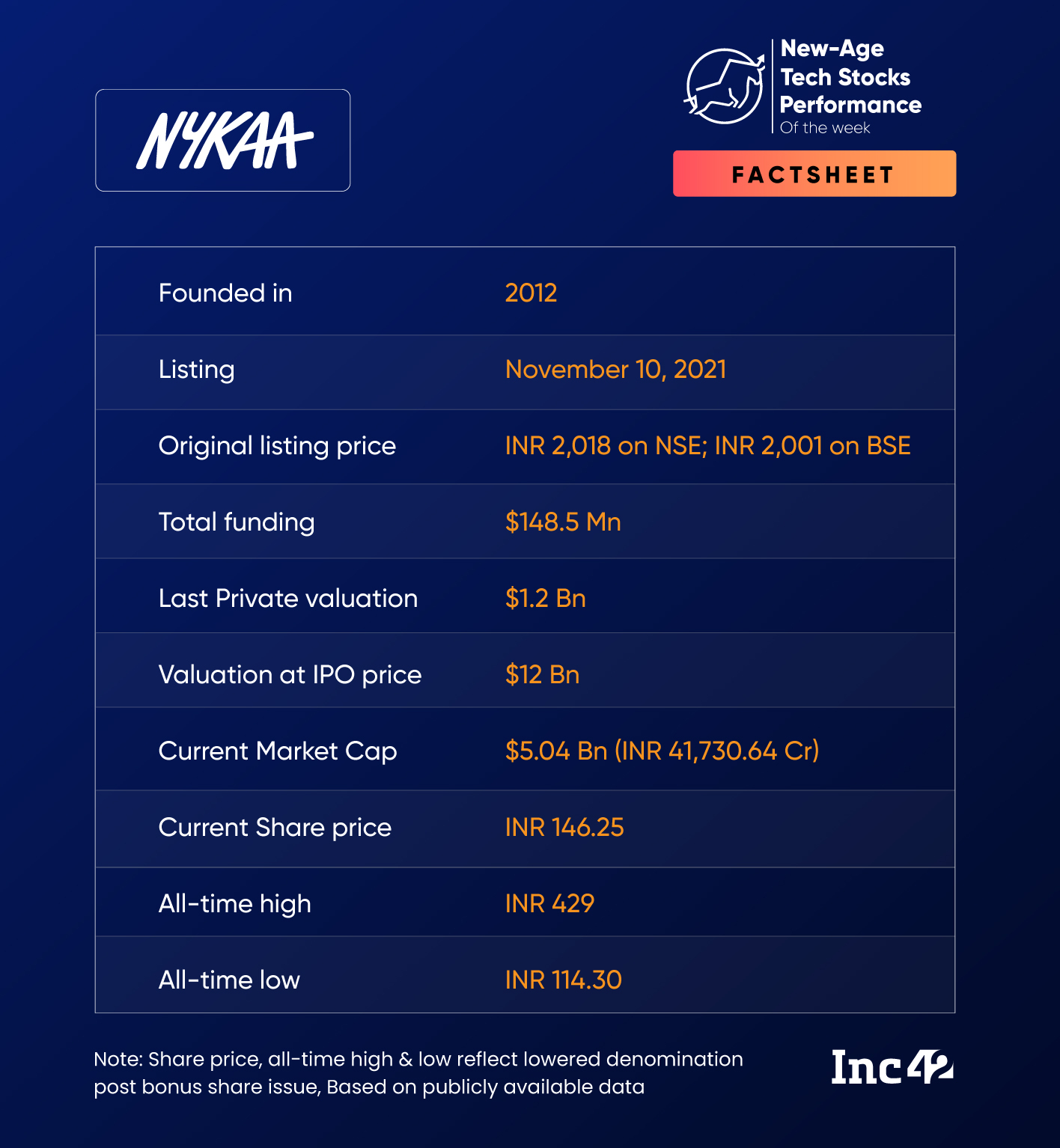

Nykaa’s Profit Rises

Nykaa on Friday reported an 8.2% YoY rise in profit after tax (PAT) to INR 5.4 Cr in Q1 FY24, which was also up 138% sequentially.

While the growth of the fashion business continued to lag during the quarter under review, Nykaa saw steady growth across other business segments.

The beauty and fashion ecommerce major’s gross merchandise value (GMV) rose 24% YoY to INR 2,667.8 Cr in Q1.

It must be noted that shares of Nykaa have been under pressure over the past few quarters on the back of its declining profit, despite its major peers seeing steady upward trends. It remains to be seen how the market reacts to the company’s Q1 performance in the coming week. Its shares fell 0.9% this week, ending Friday’s session at INR 146.25 on the BSE.

Athawale said that Nykaa is also seeing a positive consolidation but investors should wait for the INR 153-INR 155 range breakout. If the stock trades above this level, there could be a possibility of further upside till INR 160-INR 165 in the short term.

On the flip side, if the stock falls to its biggest previous support, which is at around INR 143, then there is a possibility of short-term correction till INR 138-INR 137, he added.

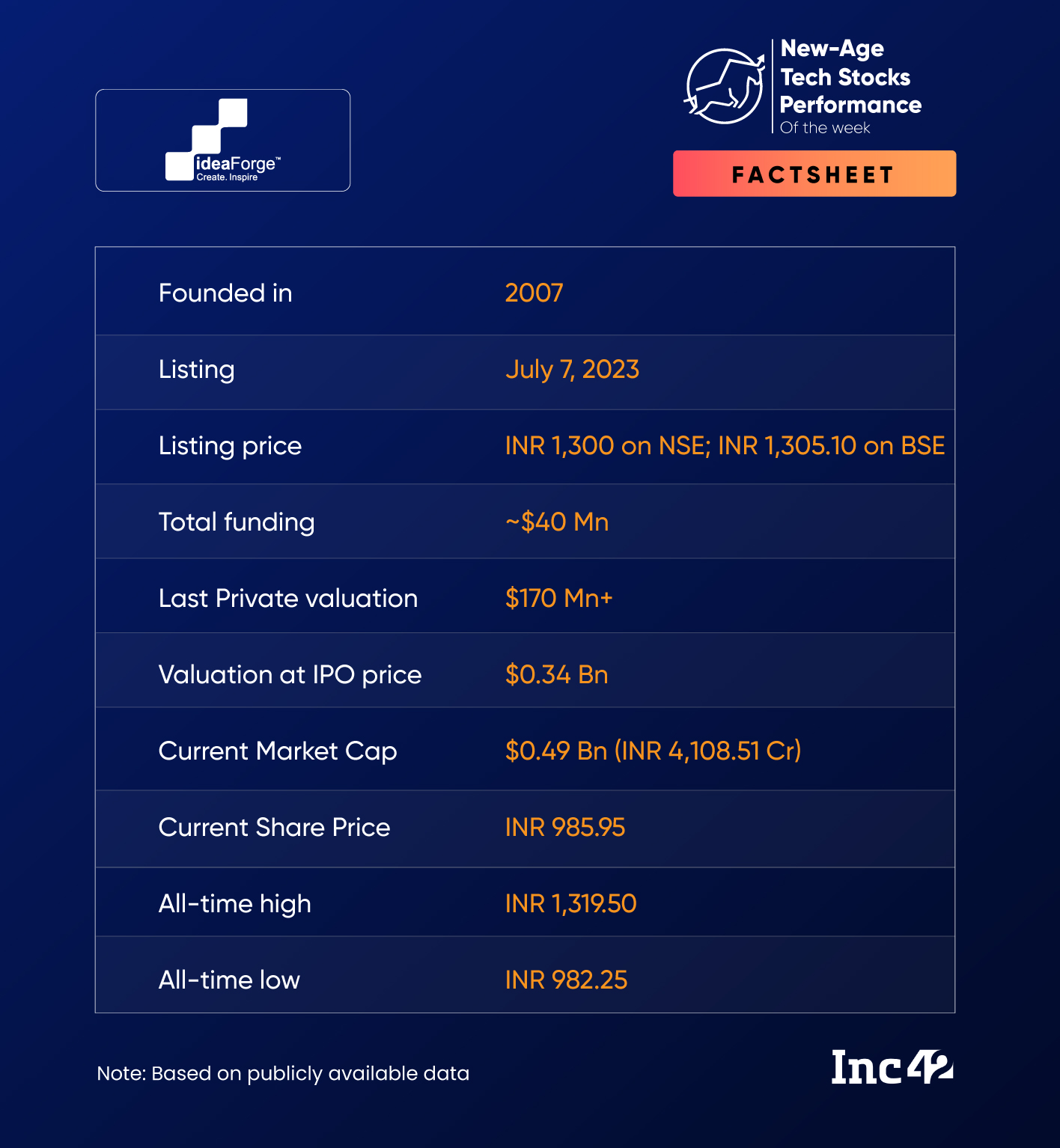

ideaForge Biggest Loser

Shares of drone startup ideaForge plunged 10.8% to INR 985.95 on the BSE this week, touching the lowest level since its listing in July.

The fall in shares came after ideaForge reported over 54% YoY decline in profit after tax (PAT) to INR 18.9 Cr in Q1 FY24. The startup’s operating revenue also declined to INR 97.1 Cr in the quarter from INR 99.3 Cr in the year-ago period.

Though ideaForge saw its profit and revenue rise on a quarterly basis, the startup said its business performance was not immediately comparable on a quarterly basis.

The drone startup got listed on the stock exchange at a 94% premium to its issue price. The shares listed at INR 1,300 on the NSE and at INR 1,305.10 on the BSE.

After witnessing a sharp rally in the first few weeks of its listing, ideaForge shares have started witnessing a decline. Its shares are currently trading over 24% lower than the listing price.

Ad-lite browsing experience

Ad-lite browsing experience