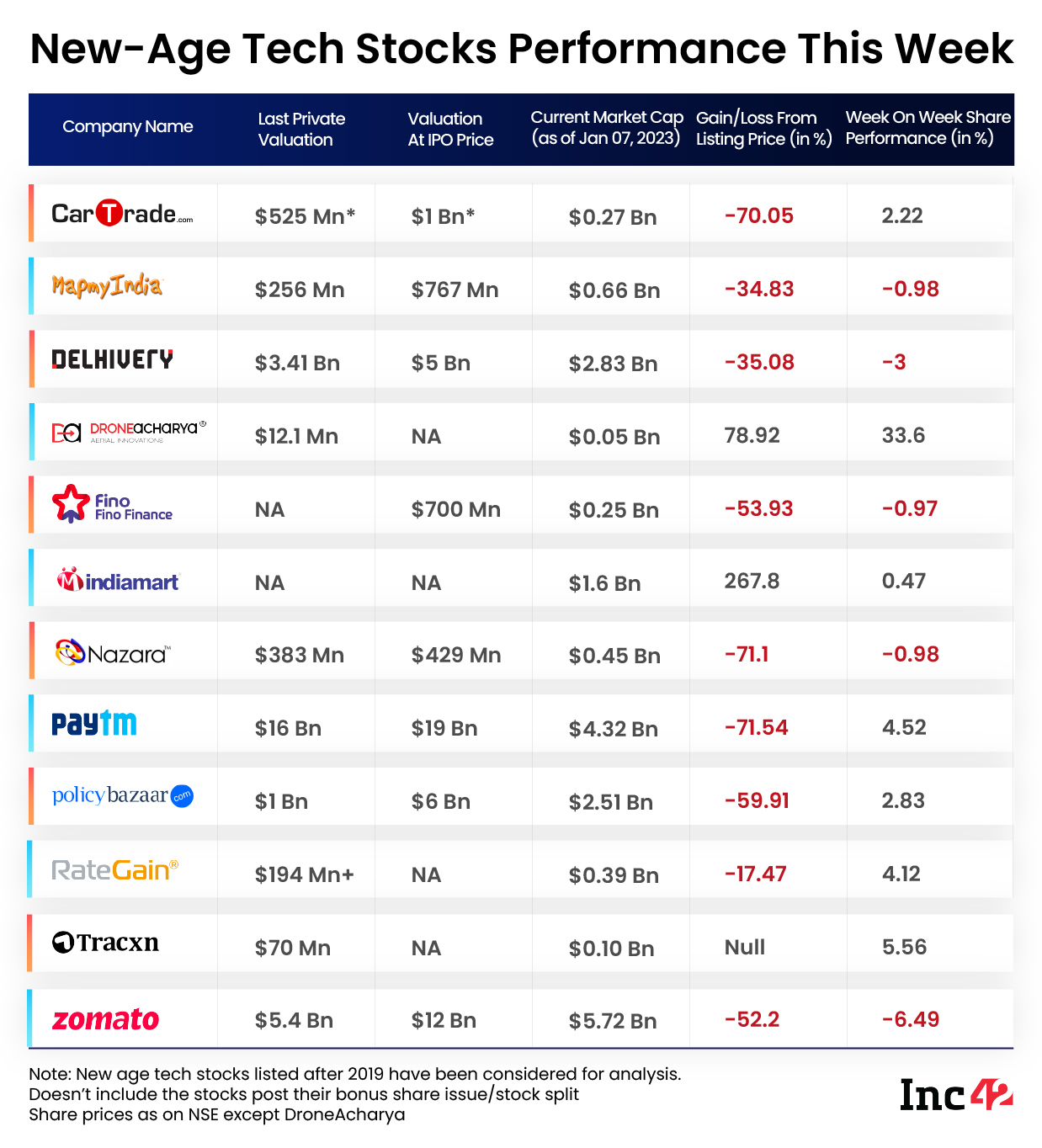

Seven out of 14 stocks under our coverage ended the week in the red zone, with Zomato emerging as the biggest loser with over 6% fall

DroneAcharya was the biggest gainer among the new-age tech stocks, with its shares jumping 33.6% this week

Benchmark indices Nifty50 and Sensex fell 1.36% and 1.55%, respectively, declining for three straight sessions during the week

Indian new-age tech stocks experienced a mixed first week of 2023, with most of them remaining under pressure, in line with the overall Indian stock market.

Seven out of 14 stocks under our coverage ended the week in the red zone, with Zomato emerging as the biggest loser with an over 6% fall this week. Nazara Technologies, Nykaa, Delhivery, Fino Payments Bank, EaseMyTrip, and MapmyIndia also fell during the week in the range of 0.6% to a little over 1%.

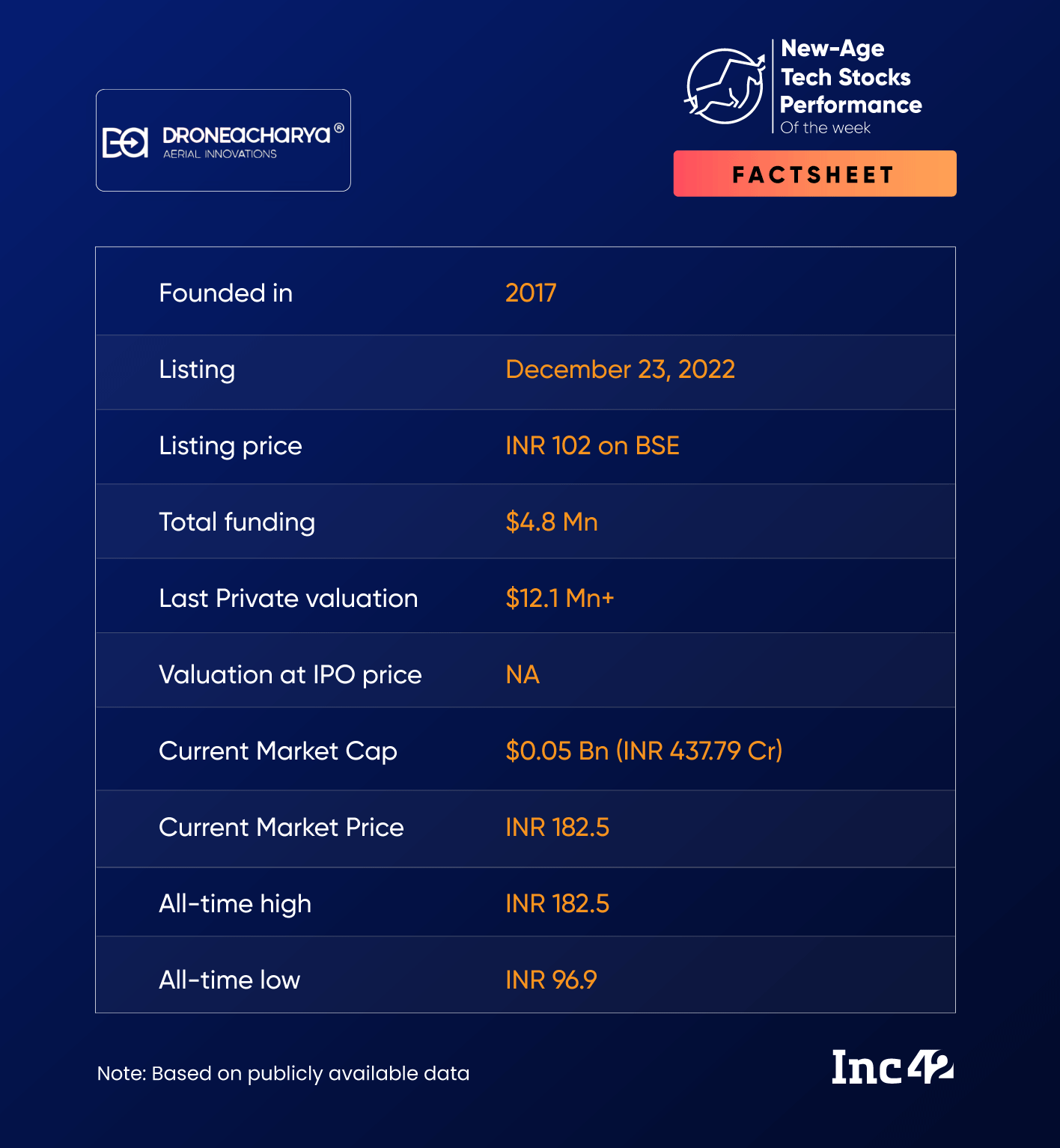

Amidst the bloodbath in new-age tech stocks, with many of them plunging 30-70% in 2022, shares of drone startup DroneAcharya have been on an upward trend since their listing last month. For the second straight week, DroneAcharya emerged as the biggest gainer among the new-age tech stocks, gaining 33.6% this week.

Meanwhile, after weeks of slump, Paytm shares have started showing steady upward momentum. Its shares rose almost 4% on the BSE this week, ending Friday’s session at INR 550.7. Paytm shares are currently trading at levels last seen in mid-November.

Meanwhile, benchmark indices Nifty50 and Sensex fell 1.36% and 1.55%, respectively this week, declining for three straight sessions. Nifty50 ended the week at 17,859.45, while Sensex closed at 59,900.37.

“Sentiments globally, including in India, were dampened as investors awaited release of the US monthly jobs report and key Eurozone inflation data,” said Siddhartha Khemka, head of retail research at Motilal Oswal.

“The onset of Q3 earnings from next week could provide fresh direction to the market. Overall the expectation is running high and any disappointment could cause profit booking in the market,” Khemka added.

Shrikant Chouhan, head of equity research (retail) at Kotak Securities, believes that the entire IT industry is expected to face a tough H1 2023. “While the correction in crude oil prices provided some respite; concerns with respect to global slowdown amid tightening of policy rates by central banks continue to weigh on investor sentiments,” he said.

Now, let’s analyse further the performance of the listed new-age tech stocks from the Indian startup ecosystem this week.

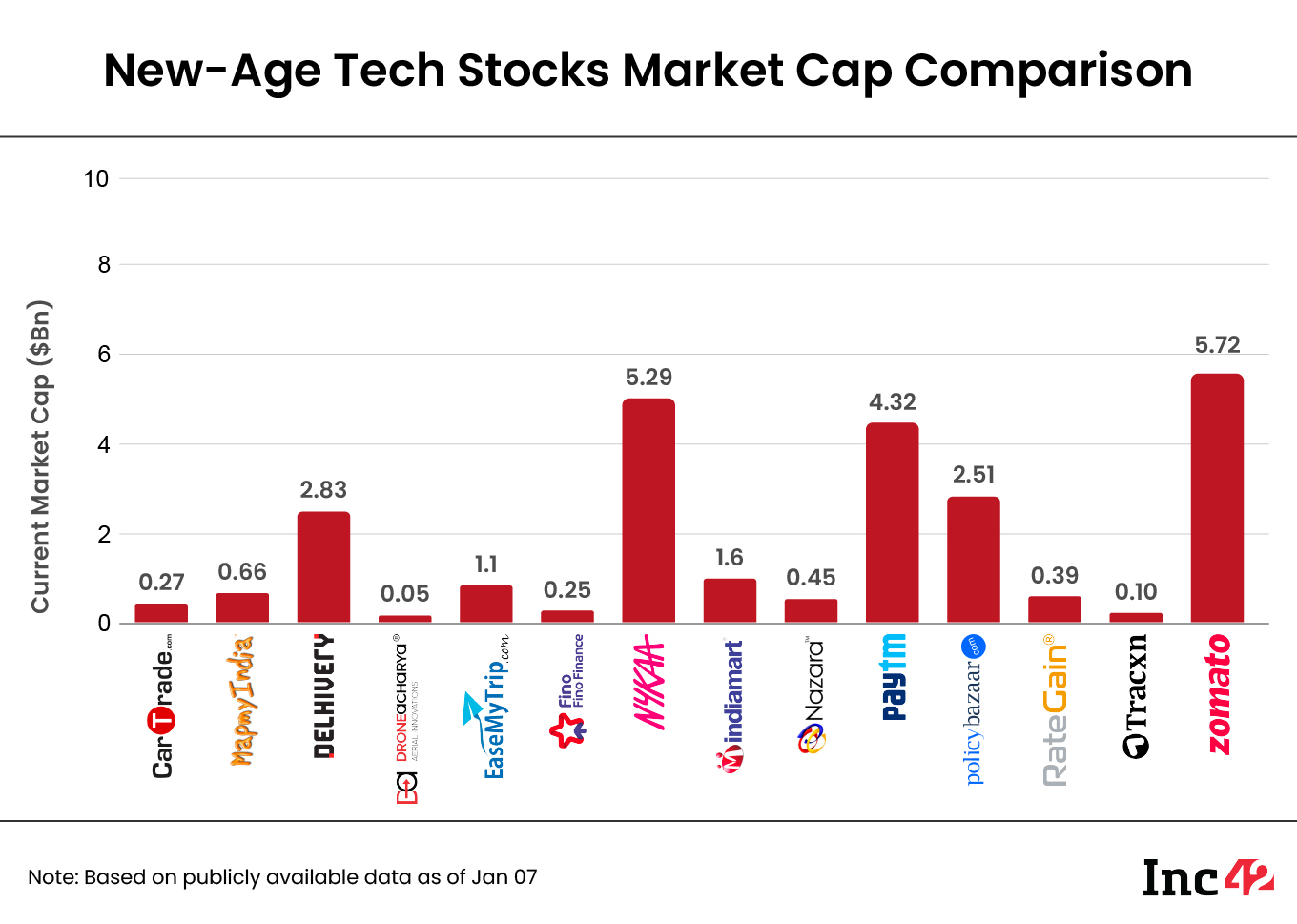

The 14 new-age tech stocks under our coverage ended the week with a total market capitalisation of $25.54 Bn as against $25.78 Bn last week.

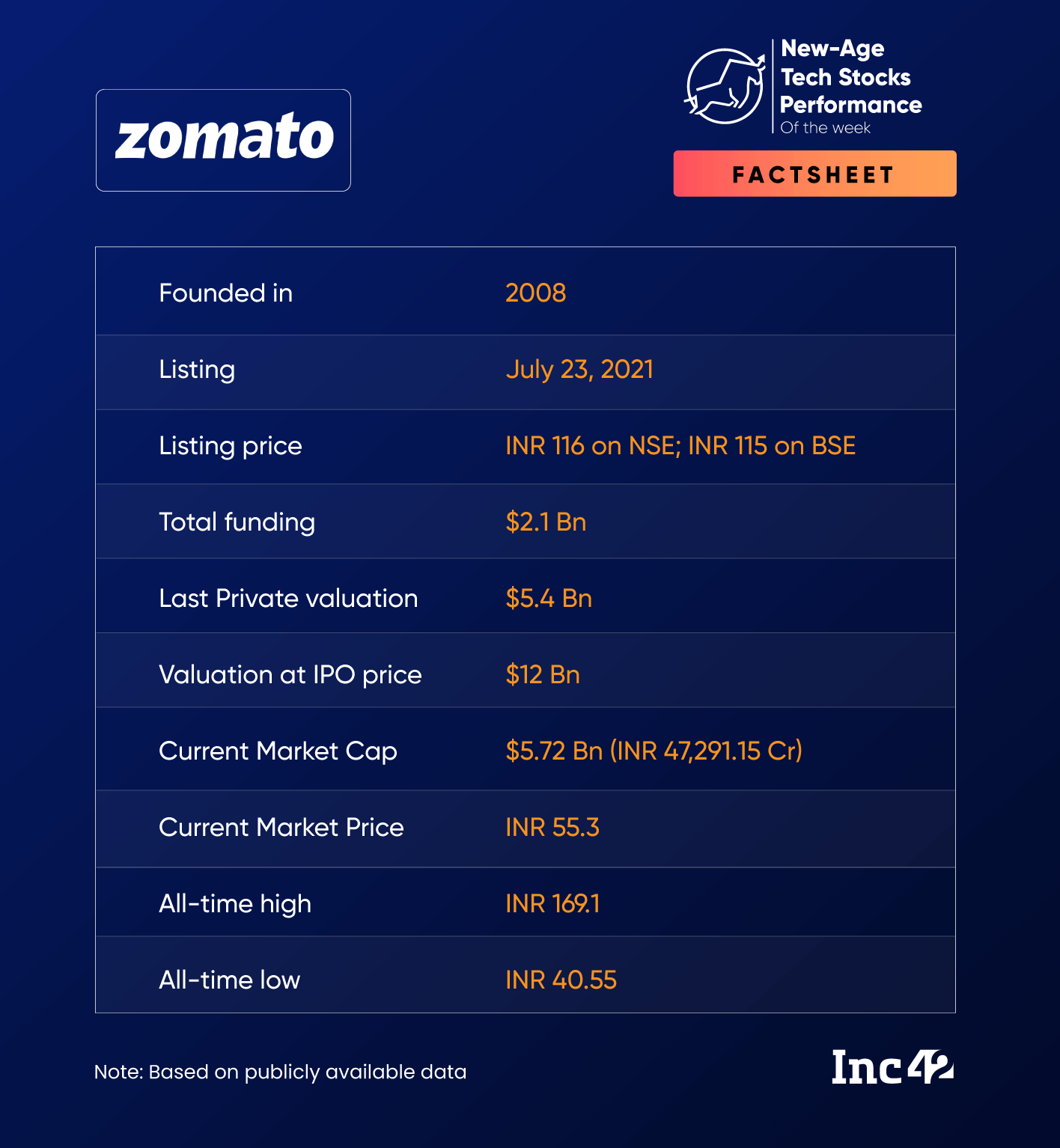

Zomato Sees Another Top-Level Exit

There seems to be no respite for shares of Zomato despite the change in year. After rising for a few sessions last week and ending 2022’s last week almost 11% higher, its shares fell again in the first week of 2023.

Shares of Zomato fell in four consecutive sessions this week to become the biggest loser among its tech stock peers. The stock fell 6.8% on the BSE to end Friday’s session at INR 55.3.

Its shares took a hit after the foodtech giant announced the resignation of Gunjan Patidar.

In The News For:

- After several top-level exists at the end of last year, Zomato’s 2023 began with the resignation of its cofounder and chief technology officer Patidar, who, the company said, was not a key managerial personnel.

- Zomato saw a 45% surge in order volumes on new year’s eve, compared to the previous year’s order volume of over 2.5 Mn.

- Zomato is likely to bring back its customer loyalty programme Zomato Gold.

Despite the volatility in its stock price and constant changes in its business strategies, brokerage Bernstein reiterated its confidence on Zomato this week.

In a research note, the brokerage said that Zomato is still the top pick in its internet coverage. It also maintained an ‘outperform’ rating and INR 90 price target (PT) on the foodtech giant, implying an upside of over 62% to the stock’s last close.

“Zomato shares should cross INR 65, and only then we can think about going long in this counter,” said Ganesh Dongre, senior manager, technical research, at Anand Rathi, adding that further downside is expected from here on and the stock can touch INR 52 again.

Zomato shares may also go down to their previous low zone of INR 41-INR 42, Dongre said.

DroneAcharya’s Winning Streak Continues

DroneAcharya has defied the fall in new-age tech stocks since its listing, with its shares currently trading 79% higher from their listing price.

This week, DroneAcharya’s shares touched their upper circuits in all five sessions. On Friday, its shares jumped 10% to end the week at INR 182.5. Overall, the shares gained 33.6% this week.

DroneAcharya got listed on the BSE SME platform on December 23 at INR 102 apiece, a premium of almost 90% to its issue price of INR 54 apiece.

DroneAcharya’s IPO was oversubscribed 262X as it saw a strong demand from high net-worth individuals (HNIs) and retail investors.

The startup is backed by Bollywood celebrities like Aamir Khan and Ranbir Kapoor, and veteran investor Shankar Sharma.

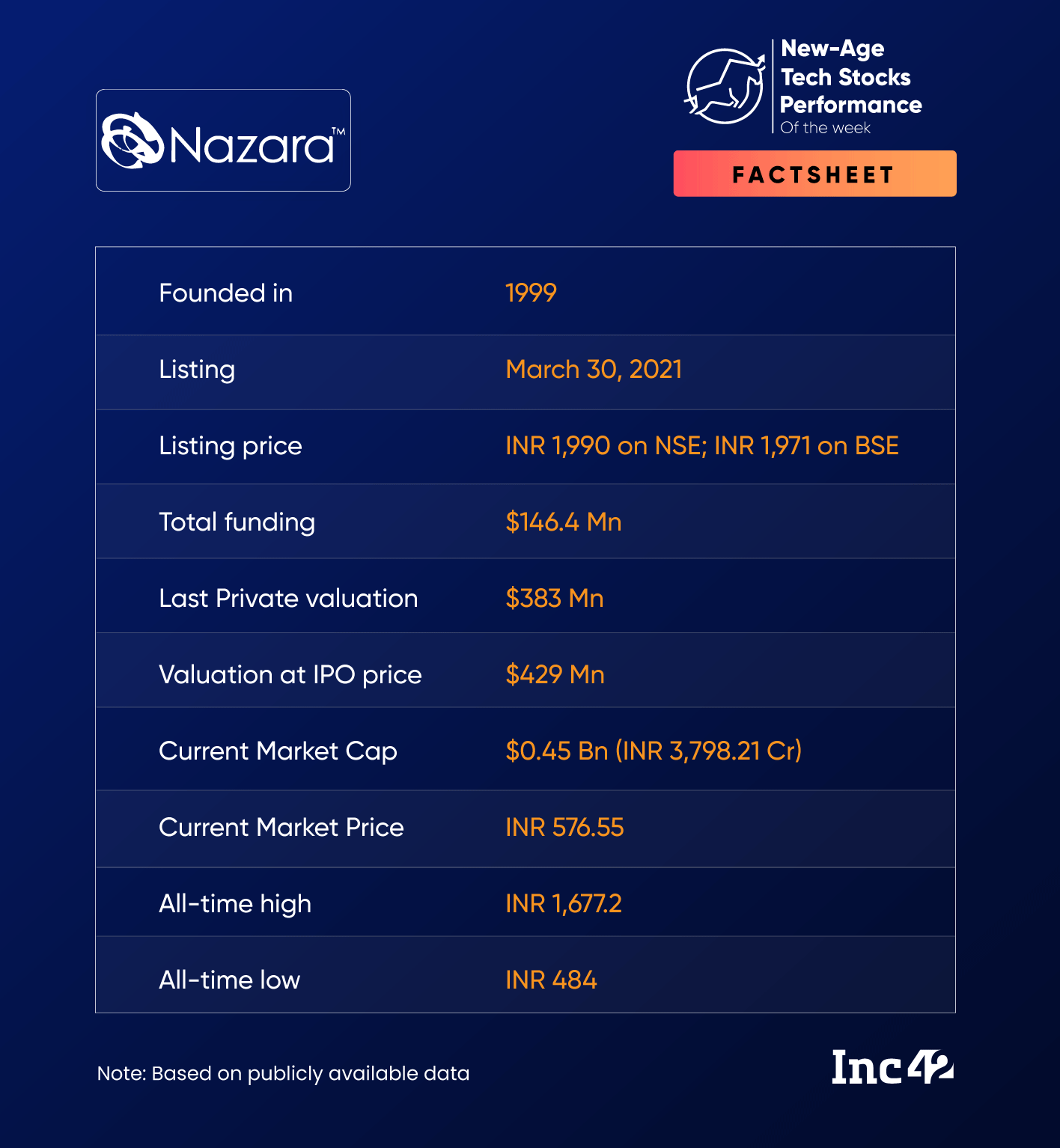

Change In Gaming Regulations & Nazara Tech

Shares of Nazara Technologies were on an upward trend since December 26, with the stock jumping almost 6% on the BSE in the first trading session of this week. However, its shares fell in the remaining four sessions of the week following the release of the draft rules for online gaming.

Shares of Nazara closed at INR 576.55 on the BSE on Friday, down 1.5% from Thursday’s close. Overall, the stock declined 0.6% on the BSE on a weekly basis. However, it must also be noted that the decline was in line with the broader market trend.

Earlier this week, the Ministry of Electronics and Information Technology (MeitY) proposed a self-regulatory mechanism for online gaming companies in its draft online gaming rules.

According to the draft amendments, online gaming intermediaries will need to observe the due diligence required under the rules, including reasonable efforts to cause its users not to host, display, upload, publish, transmit or share an online game not in conformity with Indian laws, including any law on gambling or betting.

Speaking on the regulatory changes, Nitish Mittersain, joint MD and CEO of Nazara Technologies, said, “There are a lot of details which we will need to study in more depth. There’s a one-month consultation period during which we will provide our inputs to the government. We believe that the draft recommendation will help to catalyse a lot of growth for the industry.”

Shares of Nazara declined over 70% in 2022.

“One can try to buy the counter below the INR 530-INR 540 zone. If the stock touches that level, it could be a good opportunity to buy the stock,” Anand Rathi’s Dongre said about Nazara, adding that investors should avoid buying the stock at least for a week.

Ad-lite browsing experience

Ad-lite browsing experience