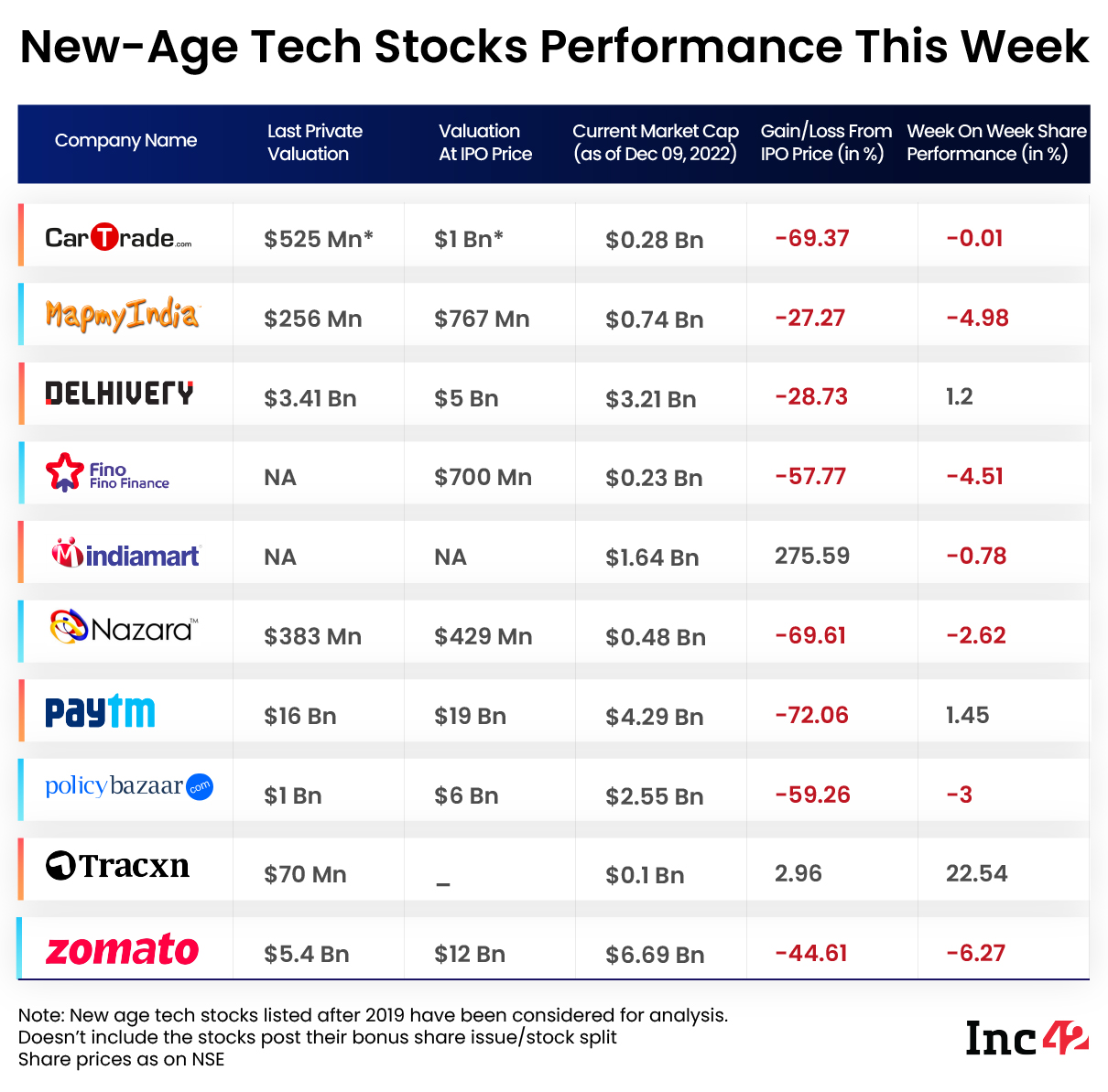

A majority of the new-age tech stocks fell this week, with traveltech major EaseMyTrip plummeting over 18% on a week-on-week basis

Tracxn Technologies emerged as the biggest winner among the new-age tech stocks this week, zooming over 23%, while Paytm rose 1.5% on a weekly basis

Benchmark indices Nifty50 and Sensex fell 1.1% and 1.09% to 18,496.60 and 62,181.67, respectively, this week

Indian new-age tech stocks, which have been under pressure over the last few months due to the current global macroeconomic situation, witnessed an uneventful week even as most of them saw the weakness persisting amidst the volatility in the overall Indian stock market.

A majority of the new-age tech stocks declined this week, with traveltech major EaseMyTrip emerging as the biggest loser. The shares of the online travel aggregator declined over 18% on a week-on-week basis.

After a significant northbound movement last week, foodtech unicorn Zomato’s shares fell over 6% this week, ending Friday’s session at INR 64.15.

Investor sentiment continues to remain negative amid the ongoing Russia-Ukraine war and global geopolitical tensions, which continues to hurt listed as well non-listed Indian tech startups. Amidst this, Zomato’s unlisted competitor Swiggy announced a mass layoff of over 250 employees this week.

Meanwhile, Paytm, Delhivery, and Tracxn Technologies emerged as the winners among the new-age tech stocks this week. While shares of Paytm and Delhivery rose 1%, shares of Tracxn Technologies jumped over 23% on a week-on-week basis.

However, analysts expect the new-age tech stocks to continue to see volatility going ahead. Siddhartha Khemka, head of retail research at Motilal Oswal, said weakness in tech stocks is expected to continue on account of weak growth outlook.

“Markets seem to be consolidating for the last few sessions as participants are tightening their positions ahead of the crucial US Fed meeting next week. US PPI (Producer Price Index) data to be released later on Friday as well as US CPI data on December 13 would be keenly watched as they would influence the Fed’s interest rate decision,” Khemka added.

The US producer prices increased 7.4% year-on-year in the 12 months through November, data released on Friday showed. The increase of 0.3% in November was better-than-expected, showing signs of an improving inflationary environment.

Benchmark indices Nifty50 and Sensex fell 1.1% and 1.09% to 18,496.60 and 62,181.67, respectively, this week.

“The benchmark indices witnessed a huge profit-booking session on Friday amidst worries that the Fed will be unable to engineer a so-called ‘soft landing’ for the US economy. The street is now fearing an 80% chance of a 50 bps rate hike by the Fed in its December 14 FOMC meeting,” said Prashanth Tapse, research analyst, senior VP (research) at Mehta Equities.

Now, let’s take a deeper look into the weekly performance of the listed new-age tech stocks from the Indian startup ecosystem.

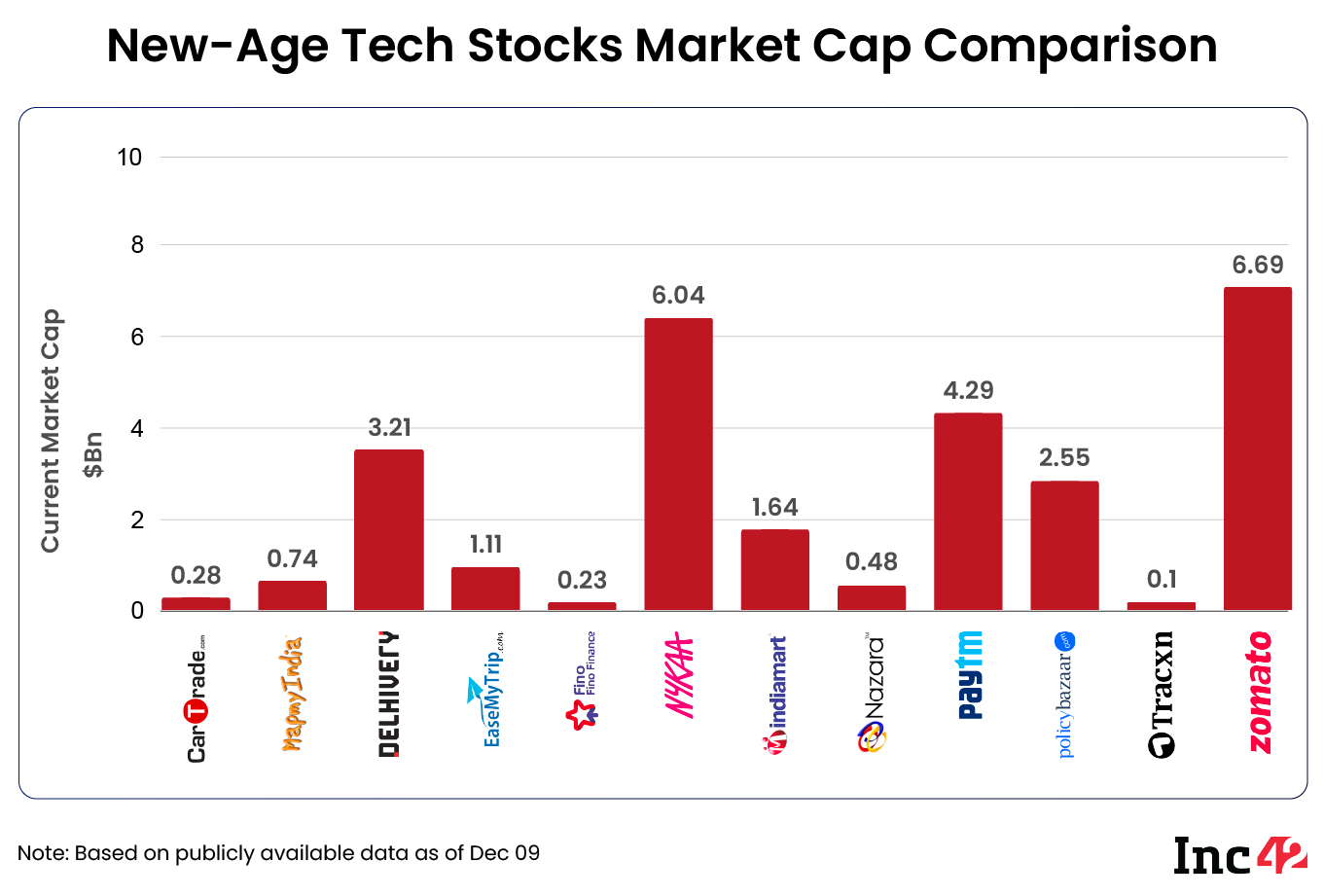

The 12 new-age tech stocks under our coverage ended this week with a total market capitalisation of $27.36 Bn versus $28.44 Bn last week.

Paytm Mulling Share Buyback

Shares of Paytm fell for four consecutive sessions from the start of the week. However, after Paytm’s announcement of a possible share buyback on Thursday, investors reversed the course and its shares ended 7.2% higher than Thursday’s close on the BSE.

On a weekly basis, shares of the fintech giant rose 1.5%, ending the week at INR 545 on the BSE.

In The News For:

- Paytm’s board is set to meet on December 13 to consider a proposal for share buyback. The startup believes that this move will be beneficial for its shareholders given its prevailing “liquidity/ financial position”.

- Paytm held a meeting with a group of analysts last week to provide more clarity on its business growth, fundamental metrics, and regulatory headwinds, among others, which made a majority of the analysts take a positive stance on the startup.

- Paytm’s approval for payment aggregator licence from the RBI is still pending.

It must be noted that Paytm is considering the share buyback proposal at a time when the sharp fall in its share prices has resulted in huge losses for its post-IPO retail investors. Since its IPO, Paytm shares have lost 60% of their value, while the shares have plummeted nearly 60% in 2022 so far.

Paytm has support at around INR 460-INR 480 zone, said Ganesh Dongre, senior manager and technical research analyst at Anand Rathi.

Dongre expects shares of Paytm to gain in the coming week. “Upward stand is still there and, I think, in the coming one or two weeks, Paytm can move up to INR 575-INR 600 zone,” he said.

EaseMyTrip Shares Slump

Shares of EaseMyTrip witnessed a major correction this week as they fell over 18%, ending Friday’s session at INR 52.5. Last month, the stock shot up significantly as its shares started trading ex-bonus and ex-split.

EaseMyTrip shares shed a majority of their gains in the first two sessions this week. Though they gained a bit during the third session this week, the shares fell again during the last two sessions.

In The News For:

- The traveltech major announced becoming the official travel partner for the inaugural season of World Tennis League taking place in Dubai.

- Airline Go First has signed a general sales agreement with EaseMyTrip to sell, promote, and market passenger tickets and other services to passengers in Saudi Arabia.

The increase in its expenditure for advertisements and promotions saw EaseMyTrip reporting a sequential decline of over 14% in its profit in Q2 FY23. The online travel aggregator was a co-sponsor for the Asia Cup and the Road Safety Series, which limited its profit during the last quarter.

Besides, the startup is also on an acquisition spree. Last week it announced acquisition of a 75% stake in Gujarat-based charter aircraft leasing company Nutana Aviation Capital IFSC Private Limited. It was eyeing at least three acquisitions by the end of FY23, its cofounder Prashant Pitti told Inc42 recently.

EaseMyTrip is one of the few profit-making new-age tech companies in the country. Ex-bonus and ex-split, its shares are currently up over 300% since their listing on the Indian bourses in March last year.

“EaseMyTrip is in a very oversold zone on an hourly basis. So, one can buy on this counter. Upward zone is around INR 60 level for a safe bet,” said Anand Rathi’s Dongre.

Tracxn Zooms Over 23%

Market intelligence firm Tracxn Technologies made its market debut in October this year amid significant volatility and value loss in global as well as domestic tech stocks. In line with the overall market sentiment, its shares also fell significantly after its IPO.

While the stock had been trading largely sideways since its listing, it jumped 23.8% on the BSE this week, ending Friday’s session at INR 88.05.

On Friday alone, the shares rose over 6% compared to Thursday’s close.

However, Anand Rathi’s Dongre believes that the stock can see some correction in the coming weeks. “In the short-term, one should avoid this counter and wait for a little correction towards INR 79-INR 80 zone or below that. I don’t think entering here is a very good opportunity,” he said.

On the daily chart, the counter has given a breakout, but it needs to sustain above the INR 85-INR 90 zone, then it can move till INR 110, he added.

Last month, Tracxn Technologies reported a profit after tax of INR 1.54 Cr in Q2 FY23 as against a loss of INR 4.83 Cr in the same quarter last year.

Ad-lite browsing experience

Ad-lite browsing experience