CarTrade Technologies emerged as the biggest gainer this week, with its shares jumping a whopping 25% on the BSE; 10 other new-age tech stocks gained in a range of 0.04% to over 13%

EaseMyTrip shares continued their loss-making streak and emerged as the biggest loser by falling 5.5%

While benchmark indices Sensex and Nifty lost the upward momentum by falling in the last two sessions of the week, they still ended the week 0.13% and 0.2% higher, respectively

New-age tech stocks saw a sharp rally this week on the back of improved investor sentiment on them and the rise in the broader equity market.

CarTrade Technologies emerged as the biggest gainer this week, with its shares jumping a whopping 25% on the BSE. Ten other new-age tech stocks under Inc42’s coverage, including Paytm, Zomato, Pb Fintech, RateGain, and Tracxn, also gained in a range of 0.04% to over 13% this week.

Shares of Paytm and Zomato surged this week to cross important milestones. While Zomato crossed its IPO issue price level of INR 76 for the first time after a year of struggle, Paytm shares crossed the INR 800 mark for the first time since August last year.

The rise in Paytm’s share prices came on the back of BofA Securities upgrading it to ‘buy’ from ‘neutral’ rating this week with bullish commentary on the fintech major’s business fundamentals. The brokerage also raised Paytm’s price target (PT) to INR 885 from INR 780.

Some analysts expect the stock to further move upward to INR 900 level in the next few weeks.

While the sharp rally in new-age tech stocks this week may cap the rise in their share prices for a few sessions, they look bullish overall, as per analysts.

Meanwhile, EaseMyTrip bucked the trend to continue its falling streak this week. It emerged as the biggest loser this week with a decline of 5.5%.

IndiaMart InterMESH and Delhivery were the two other new-age tech stocks that ended the week in the red, falling 1.9% and 0.5%, respectively, on the BSE.

In the broader market, benchmark indices Sensex and Nifty50 rose in the first three sessions of the week but failed to sustain the momentum and fell in the last two sessions. Overall, Sensex and Nifty50 rose 0.13% to 62,625.63 and 0.2% to 18,563.4, respectively, this week.

Commenting on this, Siddhartha Khemka, head of retail research at Motilal Oswal, said that Indian equities are witnessing profit booking at higher levels. However, he said that the overall structure remains positive, with the Nifty gradually moving towards its previous lifetime high.

Meanwhile, Amol Athawale, deputy vice president of technical research at Kotak Securities, said, “Local shares had run up sharply in the run up to the RBI’s monetary policy, and with the outcome coming on expected lines, investors continued with their profit-booking spree.”

Earlier this week, the Reserve Bank of India (RBI) kept the repo rate unchanged at 6.5% amid a decline in retail inflation in the country.

Most analysts expect the market to remain volatile in the near-term. Investors will keep an eye on the US Fed meeting next week amid concerns that it will continue its hawkish stance, they said.

Now, let’s take a deeper look at the performance of some of the new-age tech stocks this week.

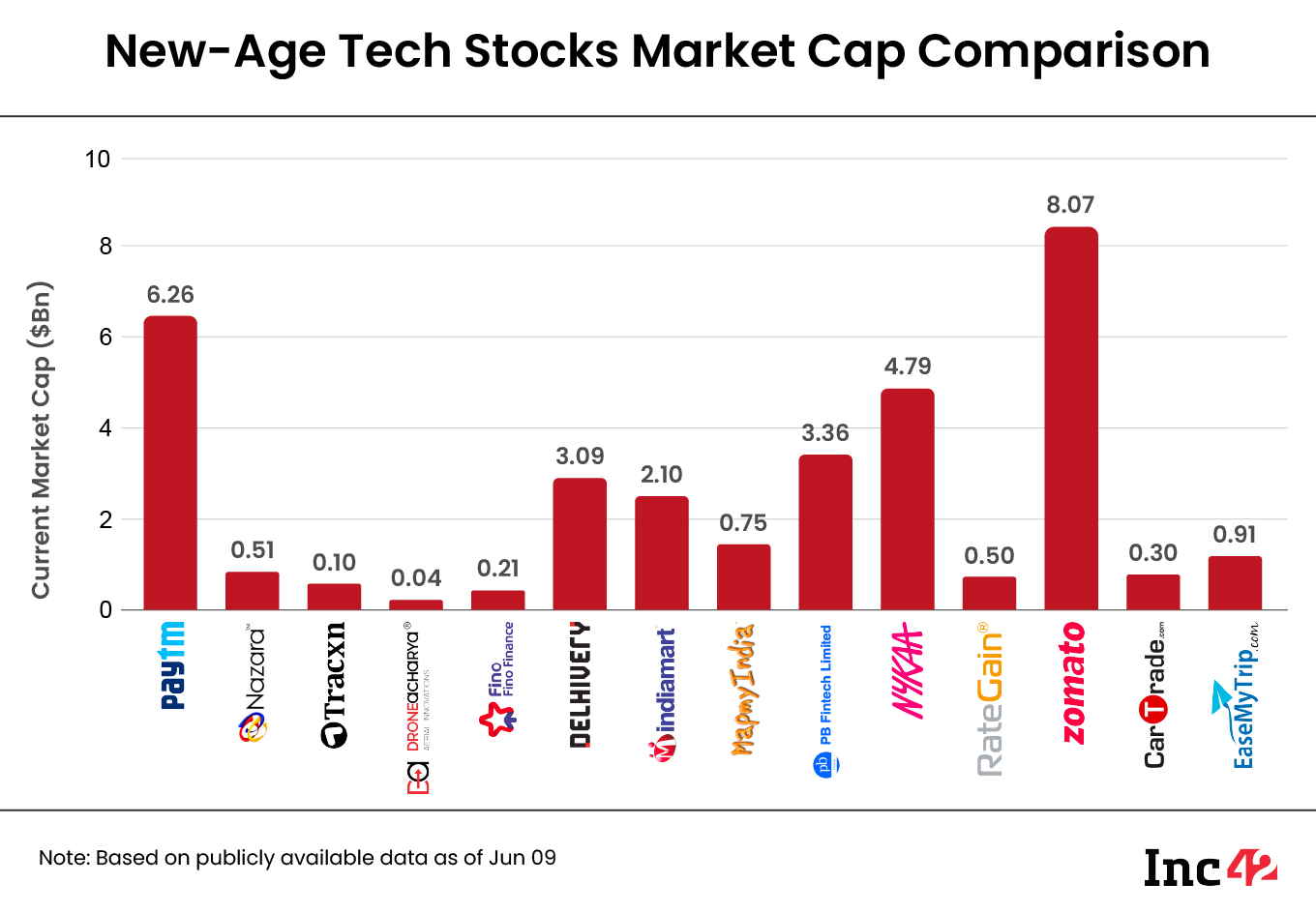

The 14 new-age tech stocks under Inc42’s coverage ended the week with a total market capitalisation of $31 Bn versus $28.96 Bn last week.

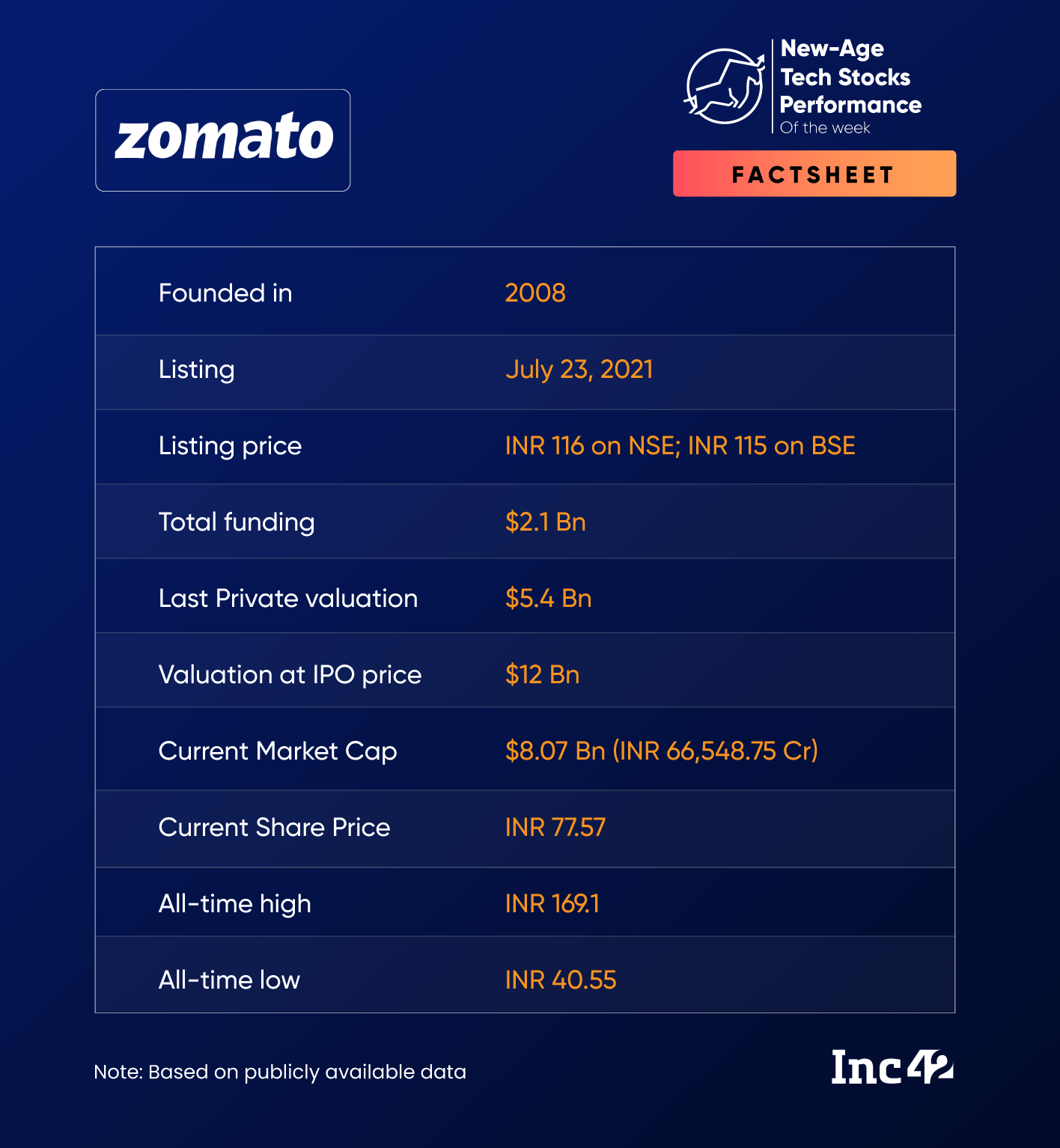

Zomato’s Bull Run Continues

Shares of foodtech major Zomato gained in all five sessions this week and crossed its IPO price band of INR 72-INR 76 after over a year.

On Friday alone, shares of Zomato rose 2.3% to INR 77.57 on the BSE. The stock closed at this level for the first time in over 13 months.

Analysts are of the opinion that the startup reporting adjusted EBITDA profitability, ex-Blinkit business, ahead of the estimates is benefitting the stock.

Besides, the aggressive march of other loss-making new-age listed companies towards profitability has also made the overall sentiment on these stocks positive. After all, fintech major Paytm achieved its adjusted EBITDA profitability ahead of expectations in Q3 FY23. PB Fintech also achieved break even on a consolidated basis in Q4 FY23.

Commenting on Zomato, Kotak Securities’ Athawale said that while the stock looks bullish on the technical charts, it is slightly in the overbought zone due to the recent rally.

“There is a possibility of non-directional activity or a sideways movement in the next few sessions. INR 70-INR 72 is a crucial support for Zomato while INR 80-INR 83 is the immediate resistance zone,” he said.

“Buy on dips and sell on rallies could be the ideal strategy for the traders,” Athawale added.

Meanwhile, talking to Inc42 this week, a few analysts said that Zomato could touch INR 90-INR 100 level in the next few weeks.

Zomato shares are currently trading higher by almost 31% year to date (YTD). However, the stock is still trading over 48% below its listing price of INR 115 on the BSE.

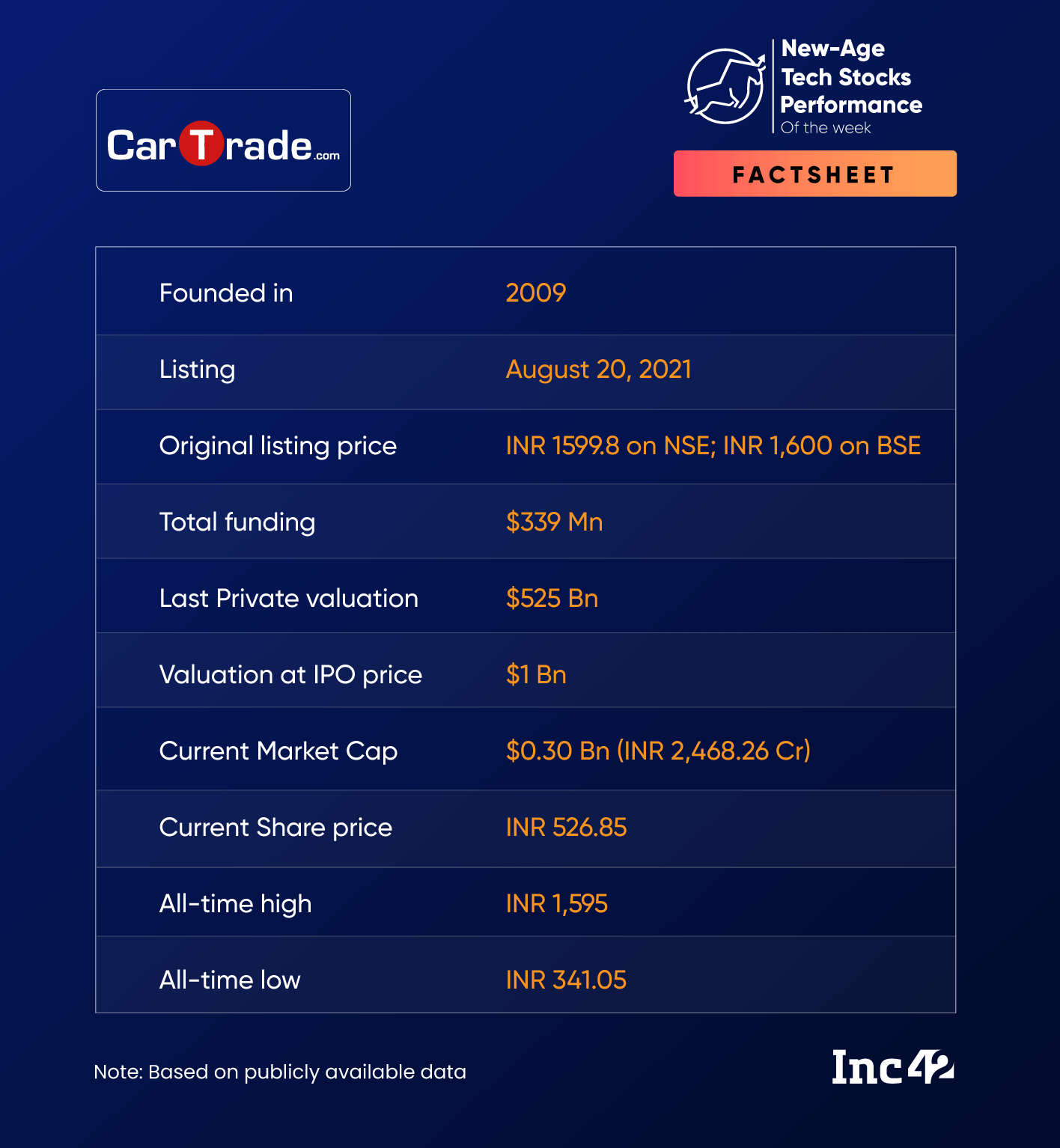

CarTrade The Biggest Winner

Shares of CarTarde Technologies saw a significant surge in the market this week, which was also accompanied by high trading volumes. Its trading volume of 1.7 Lakh on Monday (June 5) was the highest since September 20, 2021, on the BSE.

CarTrade jumped almost 25.2% this week, ending Friday’s session at INR 526.85.

It must be noted that the auto marketplace reported a consolidated net profit of INR 40.43 Cr in FY23 as against a net loss of INR 121.35 Cr in the prior fiscal. While announcing its financial results, the startup also said that it was a debt-free profitable company with surplus liquidity of over INR 1,110 Cr.

The jump in its volume this week also resulted in the BSE seeking clarification from the company. “…please be informed that there is no information/announcement to be made by the company which, in our opinion, may have a bearing on the volume behavior in scrip of the company and which is required to be disclosed under Regulation 30 of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015,” CarTrade said in its reply.

Meanwhile, the stock crossed its 200-day simple moving average of INR 500 for the first time since the end of February this year.

“While the structure is bullish, there is a possibility of a minor correction in the next few sessions. INR 480-INR 490 would be the immediate support zone for the stock,” said Athawale.

Meanwhile, Kunal Shah, senior technical and derivative analyst at LKP Securities, expects a slight correction in the stock and believes it’s a good time to exit.

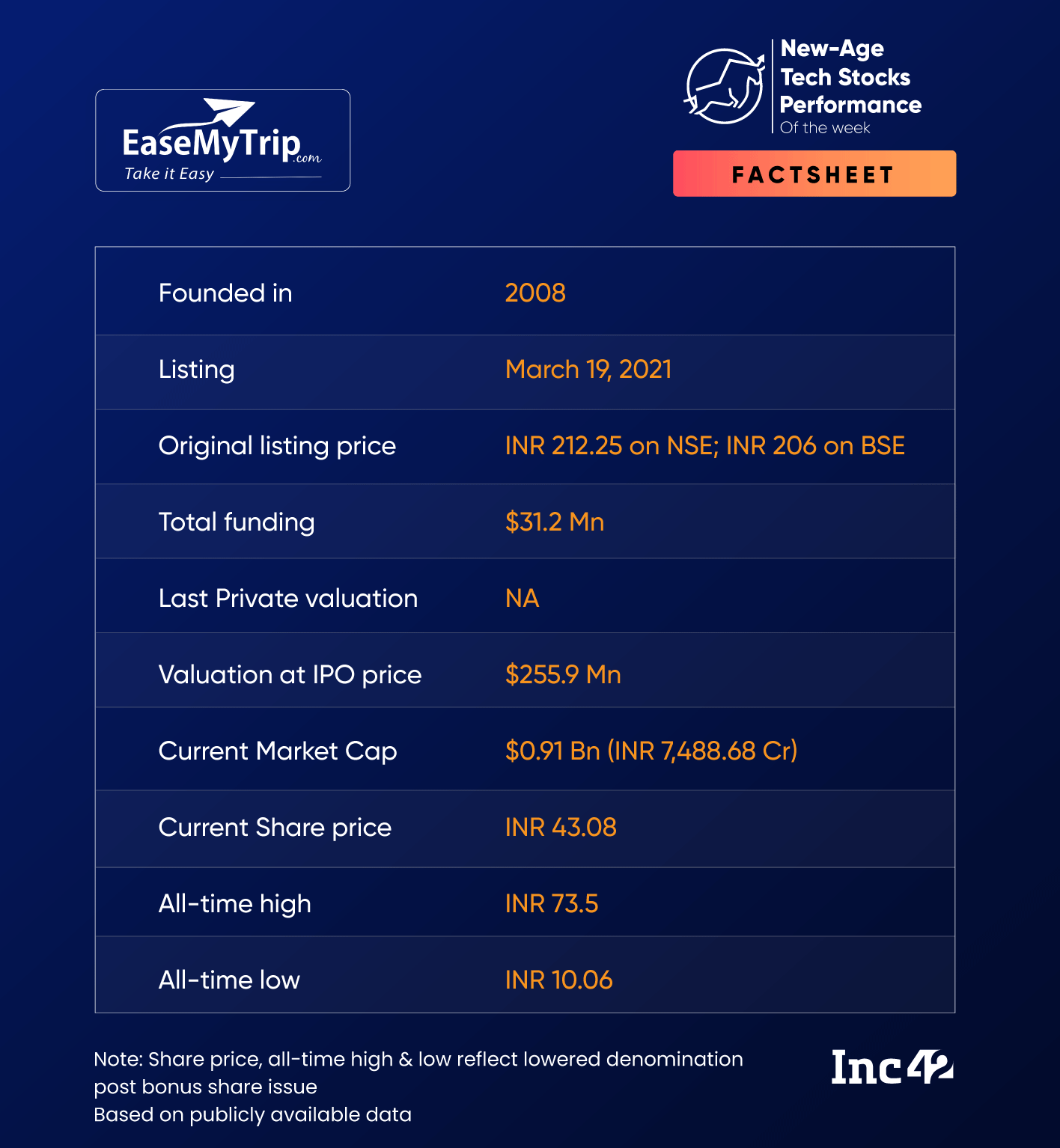

EaseMyTrip The Biggest Loser

Shares of EaseMyTrip, which have been under pressure since the traveltech startup announced its financial results for Q4 and FY23, continued their downward trajectory this week as well and emerged as the biggest loser.

Its shares have fallen over 8% in the two weeks after it reported a 25.4% decline in net profit to INR 31.1 Cr in Q4 FY23 from Q3 FY23. However, net profit rose 33.1% on a year-on-year basis.

The startup’s shares fell in four consecutive sessions this week to end 5.5% lower. It ended Friday’s session at INR 43.08, down 3.5% compared to Thursday’s close.

It is pertinent to note that the fall in the shares is sectoral. Most of the listed travel services companies, including Thomas Cook and BLS International Services, are also seeing selling pressure.

LKP Securities’ Shah said that the support for EaseMyTrip stock is currently at INR 41.

On the other hand, Kotak’s Athawale said that it’s difficult to predict EaseMyTrip’s movement currently. “I am not expecting any break movement right now. On the downside, the immediate support would be INR 42 and on the upper side, the immediate resistance is INR 47,” Athawale said.

Ad-lite browsing experience

Ad-lite browsing experience