Only four of the 22 new-age tech stocks under Inc42’s coverage gained this week in a range of 0.15% to about 9%. Zaggle emerged as the top gainer with shares rallying 8.8%

The shares of 18 tech stocks slipped, in a range of 0.7% to 18.5% during the week. TAC Infosec turned out to be the biggest loser with shares falling 18.54% on the NSE

Benchmark indices Sensex and Nifty50 increased 1.8% and 2.1%, respectively. While Sensex ended the week at 75,410.39, Nifty50 ended at 22,957.1

Indian new-age tech stocks witnessed a southbound movement this week amid less than impressive financial performances of some listed companies in Q4 FY24.

Only four of the 22 new-age tech stocks under Inc42’s coverage gained this week in a range of 0.15% to about 9%.

Zaggle emerged as the top gainer with shares rallying 8.8% this week on the back of an impressive financial performance in the last quarter of FY24. The fintech SaaS startup posted a more than 153% jump in its profit after tax (PAT) to INR 19.2 Cr in Q4.

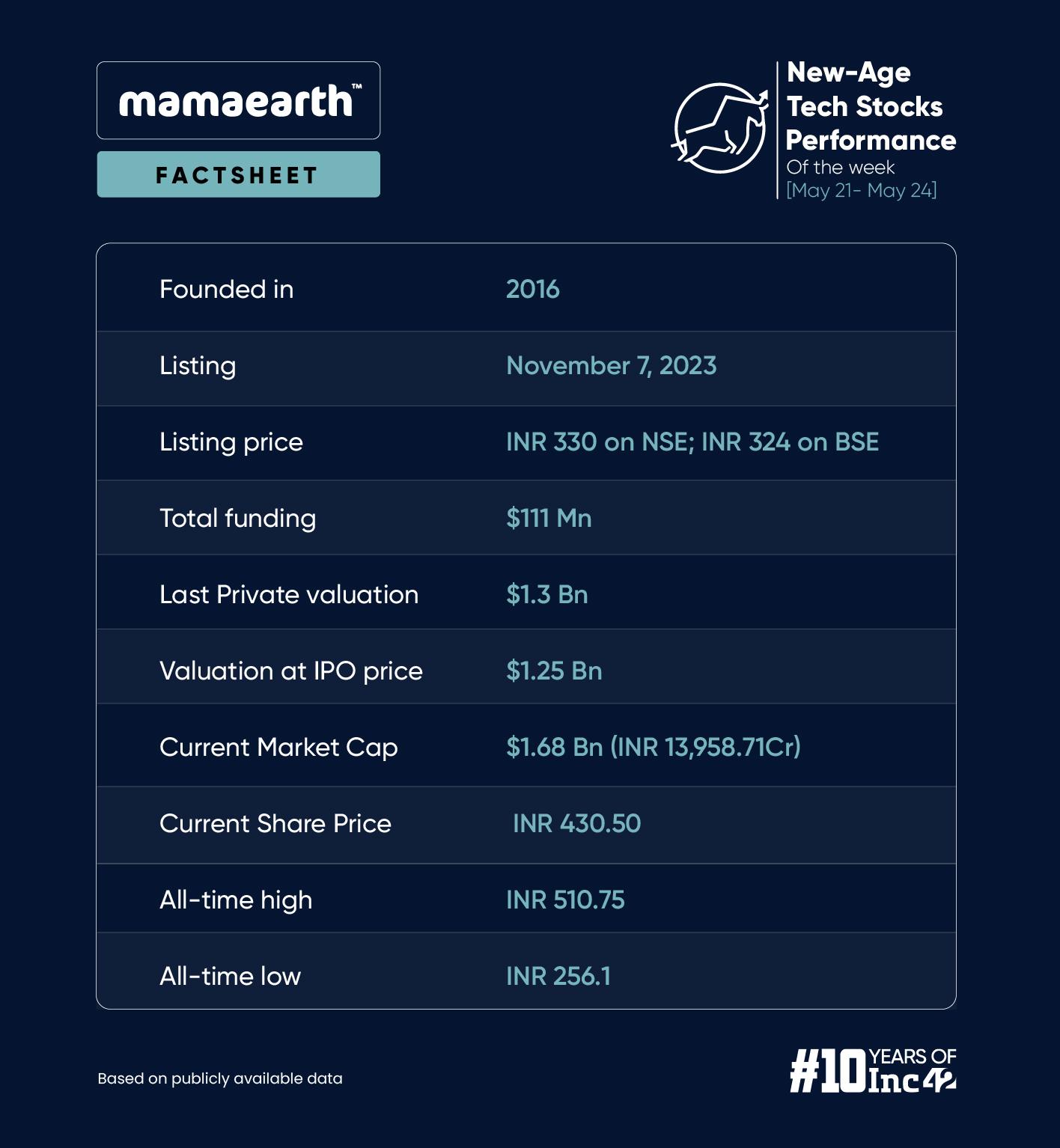

The other three gainers this week were Mamaearth, Fino Payments Bank, and ideaForge.

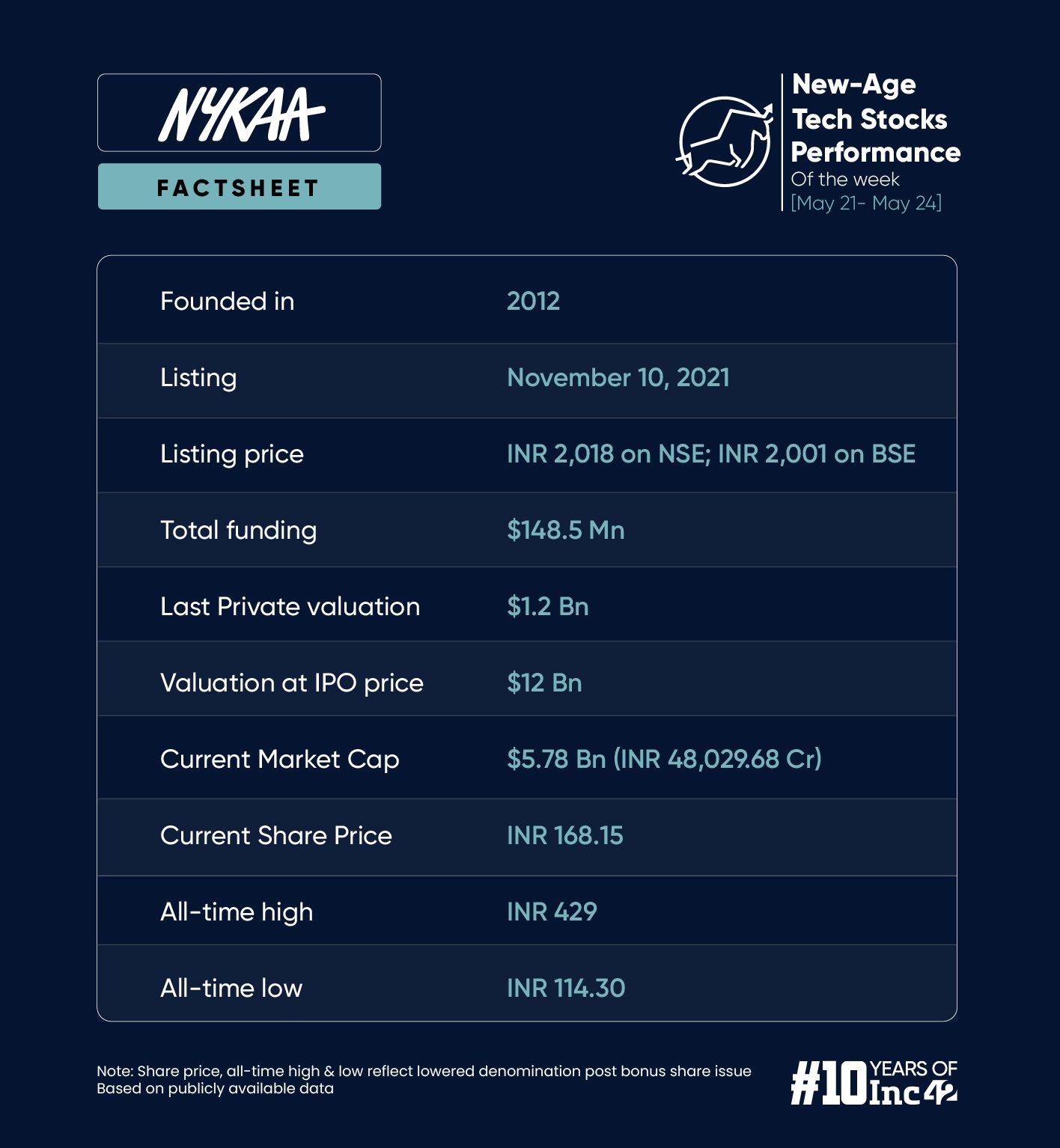

The shares of 18 tech stocks slipped, in a range of 0.7% to 18.5% during the week. The names included last week’s top gainer PB fintech, Paytm, Nykaa, and TAC Infosec. TAC Infosec turned out to be the biggest loser with shares falling 18.54% on the NSE.

Paytm and Nykaa also reported their respective Q4 performances this week.

Amid the bearish market sentiment, insurance tech unicorn Go Digit also made an underwhelming public market debut this week. Its shares were listed at INR 286 per share on NSE, a 5.1% premium to the issue price of INR 272. Its shares were listed at INR 281 on the BSEat a meagre 3.3% premium.

Brokerage firm Emkay initiated its coverage on the startup’s shares, giving it a ‘sell’ rating price target (PT) of INR 210. Besides Digit, coworking startup Awfis is also expected to list within this month. It closed its public issue on Friday (May 24) with an oversubscription of 11.4X. The startup received bids for 9.84 Cr shares as against the 86.29 Lakh shares on offer.

The sentiment towards new-age tech stocks this week was stark opposite to the broader equity market. Benchmark indices Sensex and Nifty50 increased 1.8% and 2.1%, respectively. While Sensex ended the week at 75,410.39, Nifty50 ended at 22,957.1.

Commenting on the market performance, Vinod Nair, head of research at Geojit Financial Services said that the domestic market gains are opposite to global market sentiments, which remained subdued due to the continued hawkish stance on policy rates.

“The domestic market is reaching new highs, with large caps playing second fiddle to the broader market rally, indicating sustained momentum in the short term. The BSE PSU index has experienced significant rerating due to strong performance and improved visibility, driven by PSU banks and defence stocks,” said Nair.

It is pertinent to note that the bourses this week were closed on Monday (May 20) due to on account of the ongoing General Elections voting day in Mumbai.

Against this backdrop, here’s a deeper look at the performance of some of the new-age tech stocks this week.

The 22 new-age tech stocks ended this week with a total market capitalisation of $59.56 Bn as against 21 of them ending the previous week at $51.35 Bn.

Paytm Continues To Bleed

Shares of the fintech major shrunk 3% on the BSE this week, ending the last trading session at INR 340.95. The decline is owed to the company announcing a heavy dent in its financial performance earlier this week.

In The News For:

- Paytm’s net loss widened over 3X on a year-on-year (YoY) basis to INR 550.5 Cr in Q4 FY24 from INR 167.5 Cr reported in the year-ago period. Its revenue from operations also decreased 2.9% YoY to INR 2,267.10 Cr, compared to INR 2,334 Cr in the same period last year.

- The company informed the bourses that its merchant business saw higher attrition in February and March when Paytm was forced to transition its merchants from its payments bank to other bank partners. This led to its active point of sale device base plummeting by 10 Lakh despite a marginal increase in the merchant base.

- Observing industry-wide decline in asset quality, the Vijay Shekhar Sharma-led company paused its small personal loans business as well as completely shutting its Postpaid portfolio. The company also reported a 36% YoY decline and a steeper 50% sequential decline in its financial service arm revenue which stood at INR 304 Cr revenue.

Despite the flailing condition of the stock, analysts are of a mixed view towards the startup’s shares. Brokerage firm YES Securities gave the fintech major’s shares a ‘buy’ rating along with a PT of INR 450, observing some upturn in its payments business.

“After being under pressure, the merchant payments business started to grow in April and May. On the other hand, monthly transacting users, which drive consumer payments business, are down 25% compared with January. April was the worst month for MTUs but this has stabilised in May. MTU growth will happen once the TPAP commencement happens,” it said.

However, Ganesh Dongre, senior manager of technical research, Anand Rathi, anticipates the startup’s stock to reach INR 328-INR 330 level in the upcoming days.

“Currently, we don’t recommend a buy in this counter because there are possibilities of the shares going down from the current level,” he said.

Mamaearth’s First Profitable Fiscal Attracts Investors

With a positive outlook from its financials, Mamaearth’s parent Honasa Consumers shares zoomed about 6% this week to close Friday’s trading at INR 430.50 on the BSE.

For the fiscal year, it reported a net profit of INR 110.5 Cr as against the INR 150.96 Cr loss it incurred in FY23. Similarly, operating revenue for the entire fiscal also jumped 30% to INR 1,919.6 Cr in the year ended March 2024 from FY23’s INR 1,492 Cr.

It also posted a net profit of INR 30.47 Cr Cr in Q4, a 17% sequential increase from the previous quarter’s INR 28.91 Cr.

Brokerage firms turned bullish over the startup’s shares post the financial disclosure. While JM Financials, Kotak Institutional Equities, and Emkay maintained a ‘buy’ rating on the stock and gave it a PT of INR 505, INR 450, and INR 500 respectively.

Brokerages expect the company to bank on its “house of brands” strategy moving forward. Kotak highlighted that although its flagship brand Mamaearth’s growth decelerated to 6-7% in FY24, there was a “nice heavy lifting by the younger brands.”

“Honasa would be able to replicate Mamaearth’s success with some of its other brands which should aid overall revenue performance, enable it to extract savings across lines and drive profitability,” JM Financials said.

Anand Rathi’s Dongre said that he wouldn’t recommend a buy on Mamaearth as there are possibilities of some correction towards the INR 390 level.

Nykaa’s Q4 Results Fail To Excite The Market

With a lukewarm performance in the final quarter of FY24, Nykaa’s share price declined 4.87%, standing at INR 168.15 by the end of the week.

Nykaa’s consolidated net profit plunged by 48% on a quarter-on-quarter (QoQ) basis to INR 9.07 Cr from Q3 FY24’s INR 17.45 Cr. Its operating revenue also declined 6% on a sequential basis to INR 1,667.9 Cr from the previous quarter’s INR 1,788.8 Cr.

Brokerage firms hold mixed feelings for the shares of the Falguni Nayar-led brand.

JM Financial reiterated its ‘buy’ rating on the stock and increased the target price for Nykaa to INR 220 apiece from INR 210 earlier.

“Overpowering the recent discretionary spending slowdown, Nykaa reported robust 30%/27%/68% YoY growth in BPC/Fashion/Others segments… [The] company reported strong operating metrics across transacting users, conversion and AOVs, indicating rising business momentum. We reiterate a ‘buy’ rating with a TP of INR 220,” it said in a note.

However, ICICI Securities downgraded the Nykaa stock to a ‘hold’, while maintaining a price target of INR 175. The homegrown brokerage cited margin concerns and growing competition from other players in the space as the reason for this.

“While the revenue growth trajectory is improving, ad revenue growth (as a proportion of GMV) remains muted. Also, increasing competitive intensity from other channels/players and its potential impact on margin remains unclear at this point,” ICICI Securities said in a note.

Anand Rathi’s Dongre said that some more correction is expected in this counter till the INR 150 level.

Ad-lite browsing experience

Ad-lite browsing experience