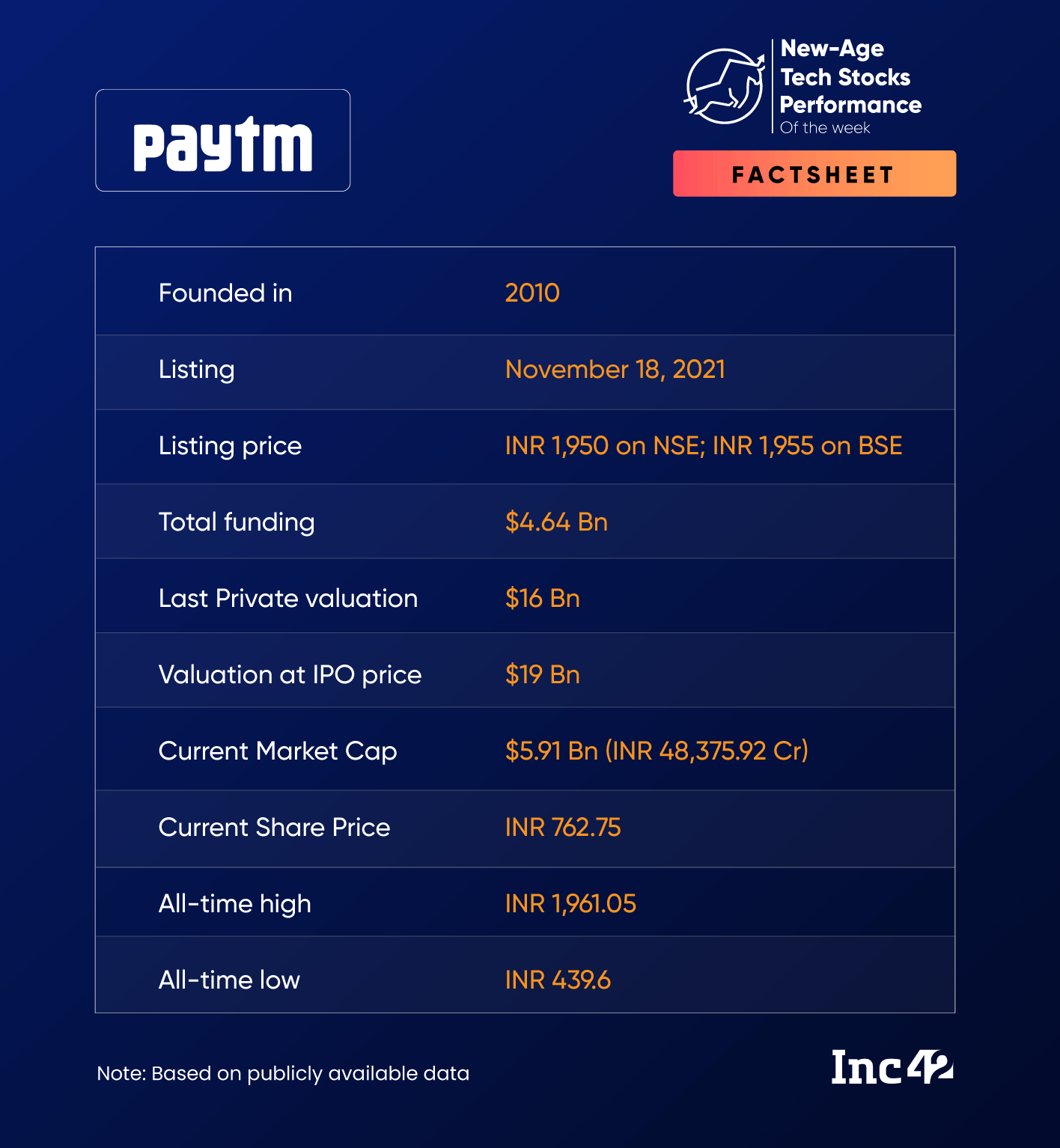

Ten out of the 15 new-age tech stocks under Inc42’s coverage declined this week. Paytm emerged as the biggest loser, falling 9.6% on the BSE

Fino Payments Bank rallied this week, with its shares touching their 52-week high and hitting the upper circuit on Friday. The stock emerged as the biggest gainer this week

After touching record highs last week, benchmark indices Sensex and Nifty 50 fell 0.8% to 66,160.20 and 0.5% to 19,646.05, respectively, this week

Last week’s slump in Indian new-age tech stocks continued this week as well, as the broader domestic market saw another volatile week with Q1 FY24 financial results being the major drag.

Ten out of the 15 new-age tech stocks under Inc42’s coverage declined this week. Paytm emerged as the biggest loser, falling 9.6% on the BSE.

PB Fintech, EaseMyTrip, Nykaa, Delhivery, and ideaForge were among the other losers this week, falling in a range of 0.4% to over 5%.

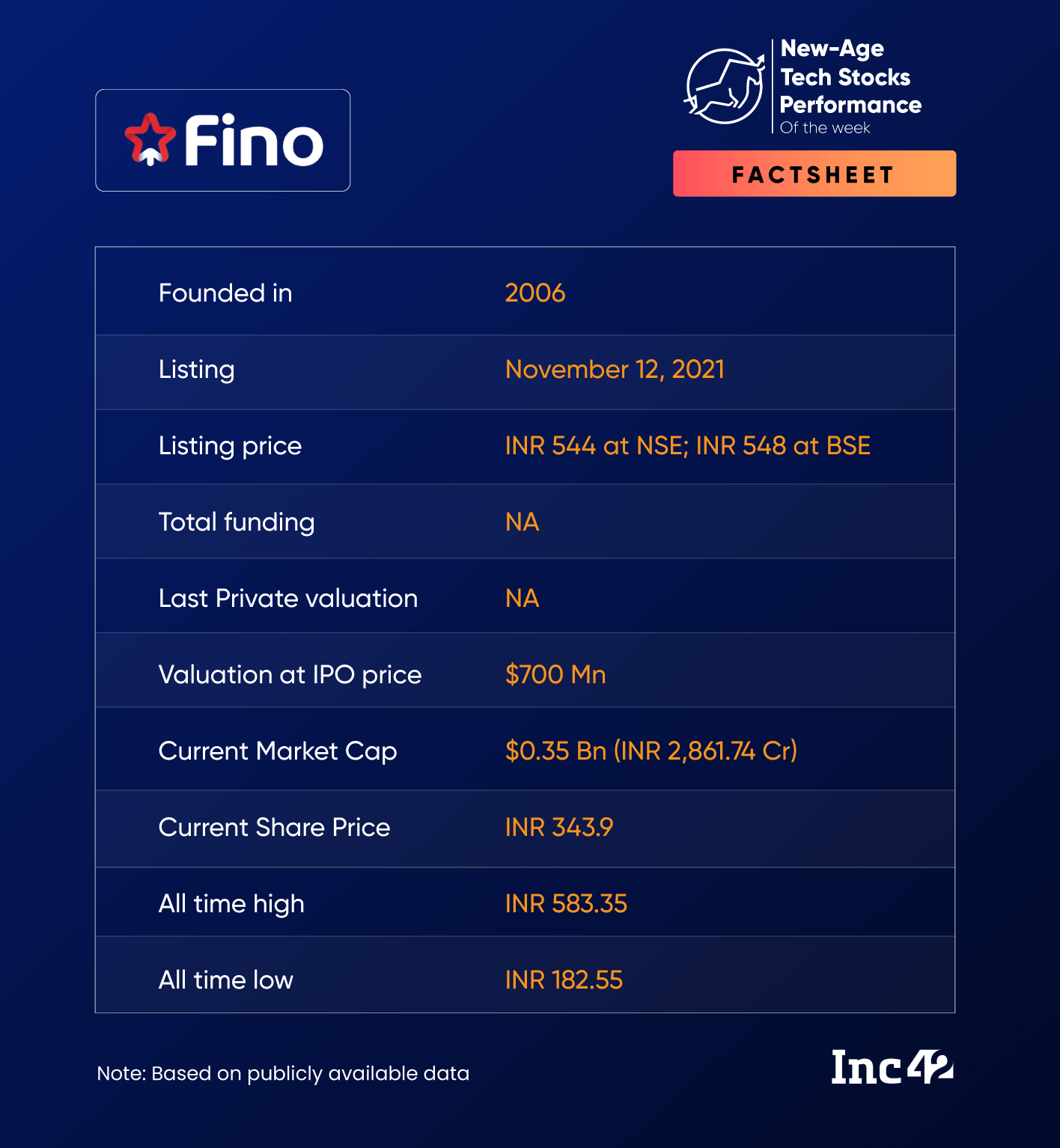

However, Fino Payments Bank rallied this week, with its shares touching their 52-week high and hitting the upper circuit on Friday (July 28). The stock emerged as the biggest gainer this week, soaring almost 19% on the BSE.

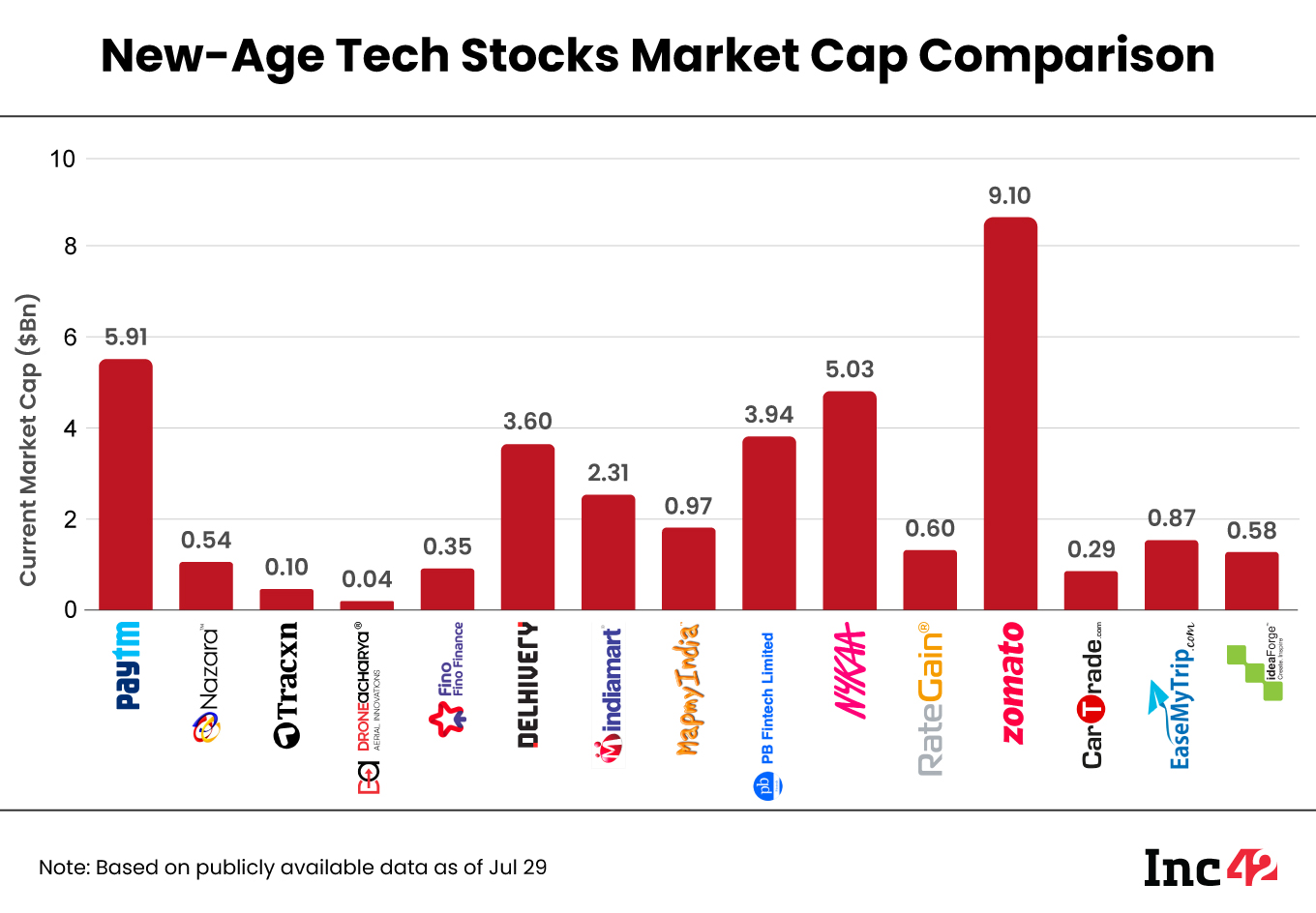

Zomato also rose over 8% this week, becoming the second-biggest winner. At $9.1 Bn (INR 74,518.82 Cr), the foodtech major currently has the highest market cap among the listed new-age tech stocks.

Zomato has also regained its place among the 100 top companies by market cap on the BSE, joining the likes of Tata Power, Tata Consumer Products, Apollo Hospitals, Bharat Petroleum Corp, and several other conglomerates.

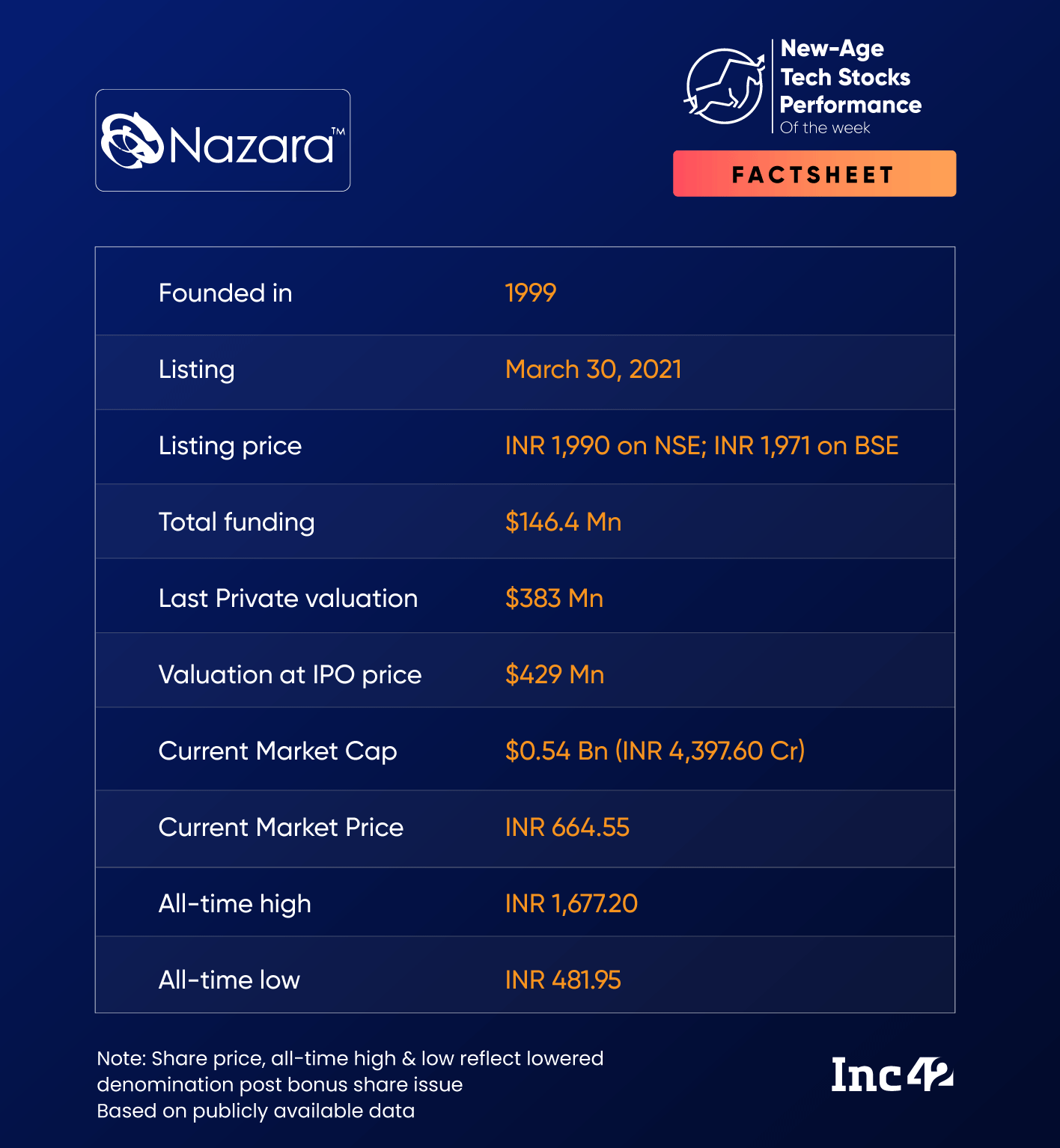

Meanwhile, RateGain, Nazara, and MapmyIndia were the other gainers of the week – rising about 1.7% to 2.7% on the BSE.

After touching record highs last week, benchmark indices Sensex and Nifty 50 fell 0.8% to 66,160.20 and 0.5% to 19,646.05, respectively, this week.

“The recent correction of the domestic market can be attributed to several headwinds, including mixed Q1 results, a reversal in FII activity, a rising dollar index and US bond yields, and an increase in crude oil prices,” said Vinod Nair, head of research at Geojit Financial Services.

Meanwhile, the better-than-expected US Q2 GDP data also impacted the mood in the domestic market as it suggested the likelihood of another rate hike, he added.

In the coming weeks, Q1 earnings reports will continue to play a major role in driving market sentiment.

Besides, various data reports in the US, monthly sales figures of Indian auto companies, and developments during the Monsoon Session of the Parliament will also be significant points of interest for investors and traders alike, said Pravesh Gour, senior technical analyst at Swastika Investmart.

The 15 new-age tech stocks under Inc42’s coverage ended the week with a total market capitalisation of $33.24 Bn as against $34.35 last week.

Fino Surges Ahead Of Q1 Results

Shares of Fino Payments Bank jumped almost 18% to INR 343.9 on the BSE on Friday, ahead of its Q1 FY24 results, which were published after market hours.

Its shares also hit a 52-week high at INR 350.15 on Friday. Overall, the shares were up almost 19% this week.

Fino reported an 85% year-on-year (YoY) jump in profit after tax (PAT) to INR 18.7 Cr in Q1, while revenue increased 21% YoY to INR 348.3 Cr.

However, the company’s PAT declined 15% from INR 22.1 Cr reported in Q4 FY23.

Besides, Fino said that it would also apply for a Small Finance Bank (SFB) licence.

The stock looks very bullish and can now move upwards to INR 430 in the coming weeks, said Rupak De, senior technical analyst at LKP Securities. The support for the stock is at INR 330, he added.

Paytm Slumps 9% Following Q1 Earnings

Shares of fintech giant Paytm slumped in all five sessions to end the week at INR 762.75 on the BSE. Overall, the shares fell 9.6% during the week, after the company released its Q1 FY24 results last Friday (July 21).

Paytm reported a net loss of INR 358.4 Cr in the June quarter of FY24, registering a 44.5% decline YoY but a 113% increase sequentially.

On the other hand, Paytm’s operating revenue stood at INR 2,342 Cr in Q1, which was a 39% increase YoY but a mere 0.3% rise quarter-on-quarter.

Shares of Paytm were on a rise since March this year as investors became bullish due to signs of the company reaching its overall profitability target. However, the stock is likely to see further correction following the sharp decline this week.

“As per the daily chart, the stock might fall further from the current level. On the lower end it might fall down towards INR 700,” LKP Securities’ De said.

The resistance for the stock is at INR 790. The stock is likely to continue to decline till it doesn’t regain this level, he added.

However, most brokerages continue to remain bullish on Paytm. ICICI Securities said in its research report after the results that it expects the company to achieve profitability in FY25.

“The positive cycle of customer growth, retention and cross-sell as shown by the company is going to build confidence and valuation multiples,” it said.

CLSA increased its target price on Paytm to INR 1,050 from INR 850 earlier.

However, the brokerage also highlighted the increase in the number of employees at the company. “Fixed costs, ex-ESOP, were up 14% QoQ as the company continues to increase manpower. We understand the need to capture growth opportunities, but we struggle to understand what the company will do with so many employees in five years,” it said.

Nazara Reports Net Profit of INR 20.9 Cr In Q1

Gaming unicorn Nazara Technologies reported a 31% YoY jump in net profit to INR 20.9 Cr in the Q1 FY24. Operating revenue also increased 14% to INR 254.4 Cr.

Ahead of its quarterly results, which were published on Friday after market hours, Nazara shares showed sideways movement. Overall, the stock gained 1.7% this week to end Friday’s session at INR 664.55 on the BSE.

Nazara shares, like Paytm, were on an uptrend since March and were trading above INR 700 level earlier this month. However, the stock has seen some correction after the GST Council decided to levy a 28% GST on real-money gaming earlier this week.

LKP Securities’ De said that shares of Nazara are currently in a consolidation phase. The support for the stock is at INR 640.

If it falls below that level, then the stock can correct further. Otherwise, the stock is likely to show a sideways pattern and might go up till INR 720 on the higher end, before coming down to INR 640, he added.

Ad-lite browsing experience

Ad-lite browsing experience