SUMMARY

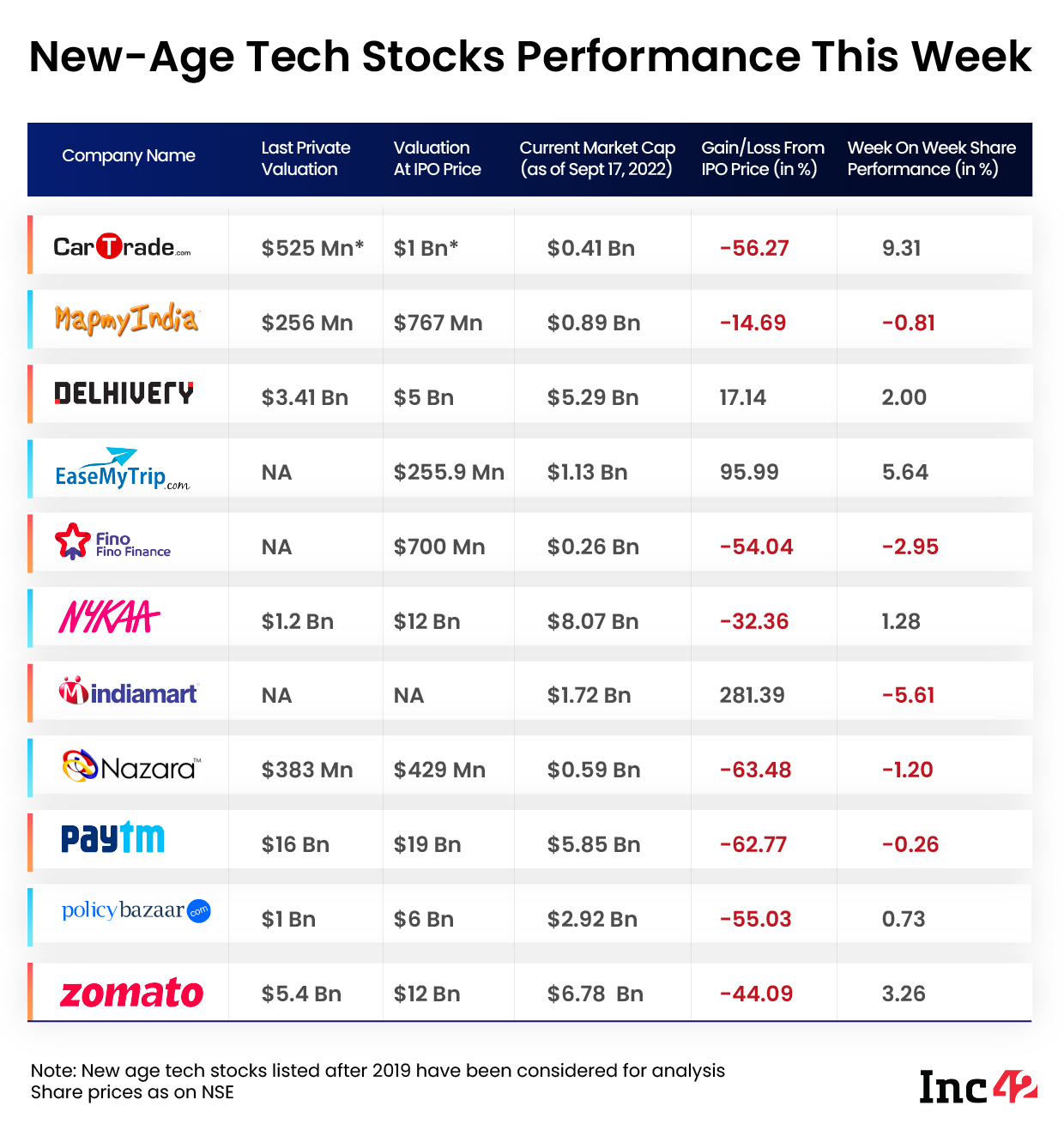

IndiaMart InterMESH shed some of the gains of the last two weeks to emerge the biggest loser this week, falling 5.6% to INR 4,496.6 on the BSE

CarTrade Technologies, EaseMyTrip, and Zomato were among the new-age tech stocks that gained this week

The benchmark indices NSE Nifty50 and BSE Sensex fell 1.70% and 1.59% this week, respectively, over concerns on high inflation and a possible rate hike by the Federal Reserve

The Indian stock markets crashed this week over concerns on high inflation and a possible rate hike by the Federal Reserve, with IT, media, realty, and PSU banks being the major laggards. A number of new-age Indian tech stocks also fell this week in line with the trend in the broader market.

IndiaMart InterMESH shed some of the gains of the last two weeks to emerge the biggest loser this week, falling 5.6% to INR 4,496.6 on the BSE.

MapmyIndia, Nazara Technologies, Fino Payments Bank were also among the stocks that ended in the red. Shares of Fino Payments Bank fell as much as about 10% on the BSE on Friday, closing at their lowest price since August 29.

Despite the weakness in the broader market, CarTrade Technologies, EaseMyTrip, and Zomato were among the new-age tech stocks that gained this week. CarTrade Technologies was the biggest winner, rising about 8% on the BSE and ending the week at INR 690.55.

On the other hand, Zomato rose 1.2% this week, ending Friday’s session at INR 63.50 on the BSE. EaseMyTrip gained over 5% during the week.

Meanwhile, the benchmark indices NSE Nifty50 and BSE Sensex fell 1.70% and 1.59% this week, ending Friday’s session at 17,530.85 and 58,840.79, respectively. Both the indices declined for three straight sessions this week, falling 1.94% and 1.82%, respectively, on Friday compared to Thursday’s close.

“Indian markets were the worst performers in the Asian pack… We are likely to see strong bouts of volatility in the coming sessions as global slowdown looms large,” said Amol Athawale, deputy vice president of technical research at Kotak Securities.

“Technically, the double top formation on daily and intraday charts and bearish candle on weekly charts is indicating further weakness from the current levels,” he added.

Siddhartha Khemka, head of retail research at Motilal Oswal, also said that the weak trend is expected to continue until clarity emerges on the quantum of the US Fed rate hike in the meeting scheduled on September 21.

Let’s take a look at the weekly performance of some of the listed new-age tech stocks from the Indian startup ecosystem.

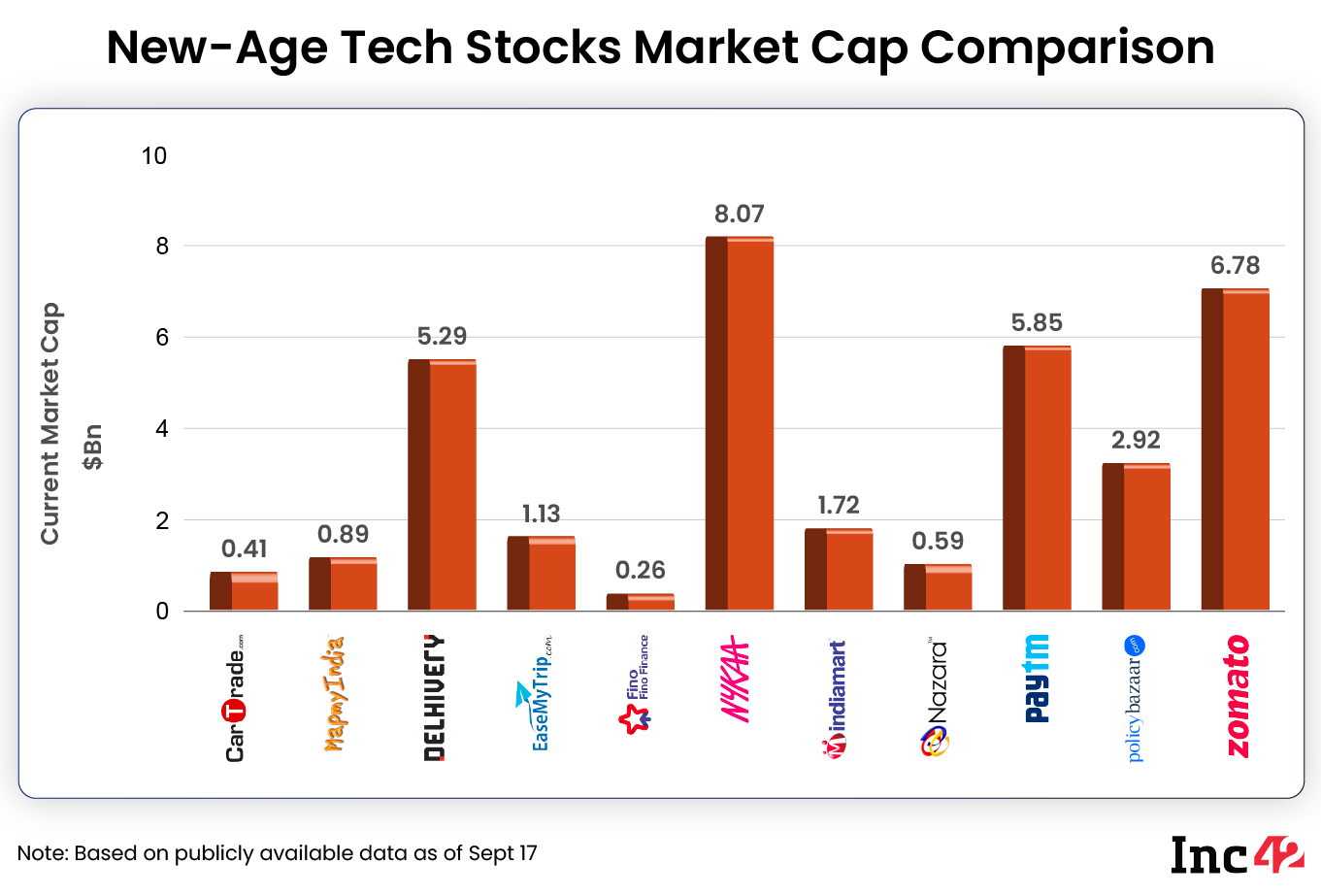

Despite the overall volatility, the 11 new-age tech stocks ended the week with a combined market cap of around $33.91 Bn as against $33.79 Bn last week.

Fino Payments Bank Slips 10% During Friday’s Session

Fino Payments Bank witnessed a sharp fall on Friday after its shares gained during the first four sessions. Its shares plunged about 10% to INR 252.1 on Friday on the BSE.

The shares gained 8.8% in the first four sessions of the week. However, following Friday’s fall, in line with the overall stock market, the stock settled about 2% lower on a weekly basis on the BSE.

The stock is constantly facing resistance at higher levels, with INR 288-290 being the immediate resistance area, said Kotak Securities’ Athawale.

“So, the short-term structure is non-directional and a fresh uptrend is possible only after INR 282-285 range breakout level. If the stock goes above INR 285, we can see a fresh uptrend rally,” he said. “On the flip side, INR 246 and INR 242 are the immediate support levels, and if stock trades below that level, then I think it will fall further till INR 235 to INR 228.”

In The News For

In its annual report published last week, Fino Payments Bank said that it is on a customer acquisition spree and its customer base will cross 10 Mn in the next 24 months.

“Going by the current pace of expansion for increased transactions and CASA (current and savings accounts) growth, your bank expects to double the network to over 2 Mn points in the next 36 months,” Fino Payments Bank said.

EaseMyTrip Stock Regains Momentum

After largely seeing sideways movement over the past few weeks, travel tech startup EaseMyTrip saw a big jump on Friday.

On a weekly basis, the shares rose over 5% as they gained 5.66% on Friday alone, settling at INR 415.6 on the BSE.

Its shares are currently trading at levels last seen in early August. Also, EaseMyTrip is one of the only three new-age tech stocks which is trading above its market debut price. Shares of EaseMyTrip are currently trading more than 101% above its debut price of INR 206 on the BSE.

“Post short-term correction, the stock bounced back sharply, and after a reversal, it is constantly taking support above 50-DMA (day moving average) and 20-DMA. It has also formed a bullish candle, which also supports the continuation of uptrend in the near future,” said Athawale.

“A couple of combinations are indicating that the uptrend will ideally continue — one is the volume activity and second is that it’s consistently taking support above the short-term and medium-term moving average, and the candlestick formation,” he added.

Athawale sees INR 390 to be the immediate support for the stock, and if the uptrend continues, INR 440 and INR 460 would be the immediate upside target.

Competition Watch

- Flipkart forayed into the online hotel bookings segment with Flipkart Hotels. It is backed by Cleartrip’s API

Paytm Remains Under Pressure

Shares of One 97 Communications, the parent entity of Paytm, saw some recovery in the last session of last week and in the beginning of this week. However, the shares fell again following the searches conducted by the Enforcement Directorate (ED) at the company’s premises as part of its probe into the illegal Chinese loan apps.

Paytm shares fell 1.43% this week, settling at INR 717.4 on the BSE on Friday.

In The News For

- The search operations of the ED at Paytm’s premises in connection with illegal loan apps case. The ED conducted searches this week as well.

- The ED has frozen funds worth over INR 46 Cr in payment gateways, including Paytm, Easebuzz, Razorpay, and others.

Brokerage Citi, in a report this week, reiterated its backing for the stock. It has a price target of INR 998 with a ‘buy’ rating.

“We value the financials services business on EV/S at 15x (we expect higher profitability in the financial services vertical and in-line with global fintech offering similar services; multiple at 50 per cent premium to global peers ) – INR 353 per share,” Citi said.

Meanwhile, Kotak Securities’ Athawale said that Paytm shares are consolidating after a short-term correction.

“On the higher range, it took the resistance near INR 760 and on the lower side the stock is taking support around INR 680. The short-term structure of Paytm is still weak. If the stock trades above the 50-day simple moving average, which is around INR 750, then only we can see a fresh uptrend,” he said.

For the time being, the consolidation is likely to continue. If it crosses the 50-DMA, then the immediate upside of the stock would be around INR 800-820, he added.