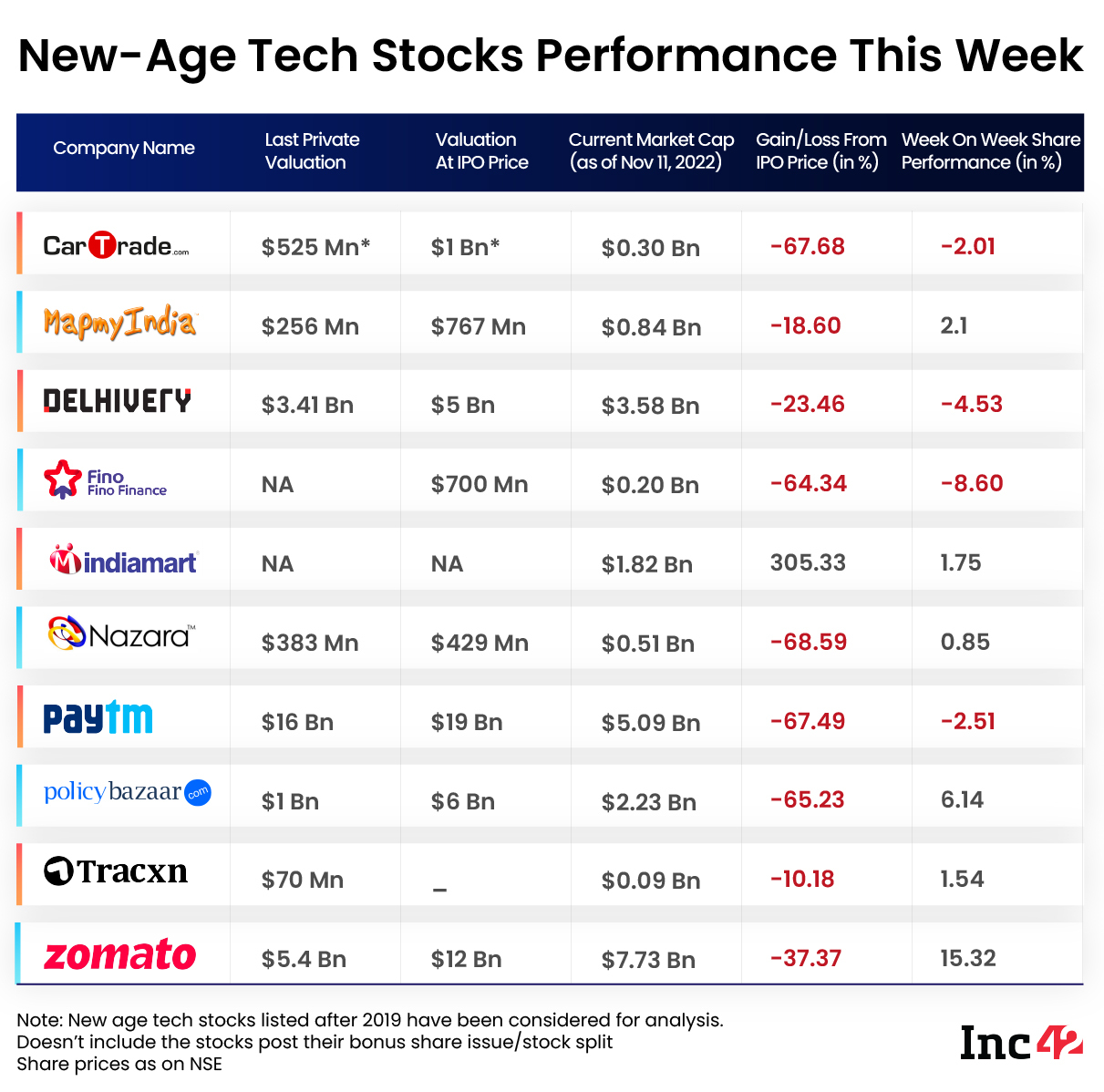

Fino Payments Bank was the biggest loser this week, falling over 4.5%, while Paytm also declined over 2%

Zomato and Nykaa were the top two winners this week, rising 15% and 12.7%, respectively

Benchmark indices NSE Nifty50 and BSE Sensex rose 1.3% and 1.4% this week, ending Friday’s session at 18,349.7 and 61,795.04, respectively

A majority of the Indian new-age tech stocks witnessed a good rally this week, helped by largely positive Q2 performances and positive sentiment in the overall Indian stock market.

Zomato was the biggest gainer this week as its shares jumped over 15% on a weekly basis after the startup reported a year-on-year (YoY) decline in loss in Q2.

Nykaa was the second biggest gainer as its shares jumped 12.7% on a weekly basis despite apprehensions about a sell-off after the expiry of the lock-in period for its pre-IPO investors.

Six other new-age tech stocks from EasyMyTrip to Policybazaar also rose between 0.8% and 6% this week.

However, Fino Payments Bank emerged as the biggest loser this week, falling over 4.5%. It ended Friday’s session at INR 194.6 per share. Fino Payments Bank fell for three consecutive sessions this week, but ended Friday’s session marginally higher from the previous close. Meanwhile, as per reports, Fino Payments Banks is internally mulling an upgrade to become a small finance bank. The expiry of its lock-in period is also impending this month.

The Indian stock market was closed on November 8 on the occasion of Gurunanak Jayanti.

Meanwhile, Paytm also fell over 2% this week, ending Friday’s session 0.8% higher at INR 632.3 on the BSE following its Q2 results. The fintech giant reported a 21% YoY increase in net loss to INR 571 Cr during the quarter. While its GMV and operating revenue grew in Q2, Paytm’s ESOP costs shot up YoY by a whopping 1,823% to INR 371 Cr.

It is pertinent to note that the lock-in expiry of Paytm’s pre-IPO investors is also coming up next week, which is likely to continue to weigh on its stock price. However, post its Q2 results and amid near-term uncertainties, several brokerages maintained a bullish stance on Paytm and raised their price target (PT).

On the other hand, Delhivery also fell over 4% this week, ending Friday’s session up 1% at INR 379.25 on the BSE. Over the last few weeks, the stock has remained under pressure ahead of its lock-in period expiry and following a muted Q2 performance forecast. However, post Friday’s market close, Delhivery reported a 60% decline in its YoY loss to INR 254.1 Cr during Q2.

Meanwhile, EaseMyTrip reported a 4% YoY increase in its consolidated net profit to INR 28.2 Cr on Friday.

The Indian stock market rallied well Friday, breaking the falling streak of two days. Benchmark indices NSE Nifty50 and BSE Sensex rose 1.3% and 1.4% this week, ending Friday’s session at 18,349.7 and 61,795.04, respectively.

“With the benchmark indices touching 52-week highs and the Nifty Bank Index touching new all time highs, we remain cautiously optimistic, advising investors to be agile and aware of the recent and upcoming macroeconomic events in order to take dynamic decisions both ways,” said Anmol Das, head of research at Teji Mandi.

“However, at these levels, we are equally aware of the downside of new stock entries as the earnings season is coming to an end, and there may be some profit booking in many sectors that have rallied significantly over the past couple of months,” Das added.

Now, let’s dig deeper into the weekly performance of some of the listed new-age tech stocks from the Indian startup ecosystem.

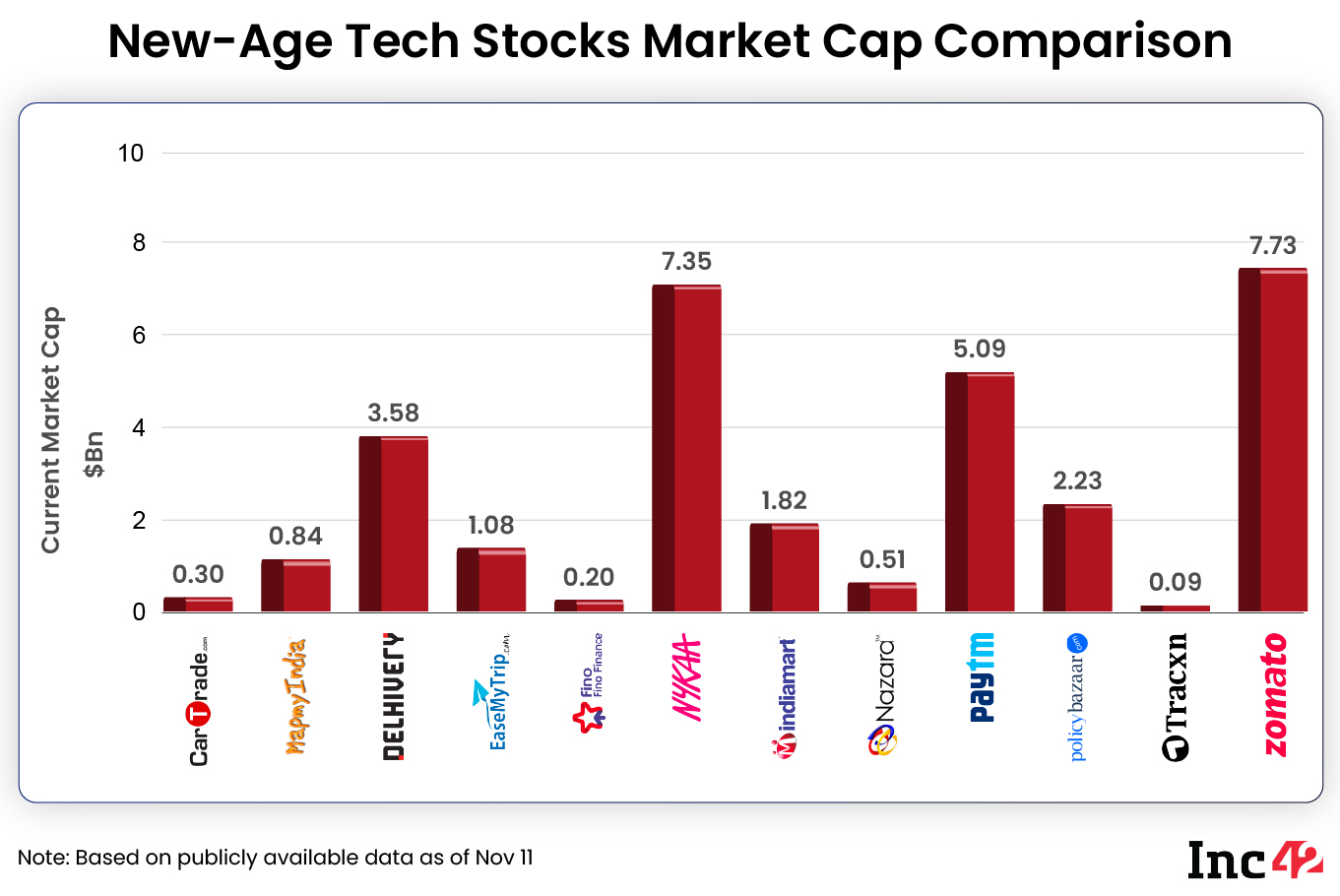

The 12 new-age tech stocks under our coverage ended this week with a total market capitalisation of $30.82 Bn versus $28.33 Bn last week.

Zomato The Biggest Winner

While the overall market sentiment around the new-age tech stocks remains mixed, exposing them to risks of high volatility, Zomato seems to have recovered significantly from the recent negative sentiment that battered the stock earlier this year.

After posting its Q2 results, Zomato shares jumped about 14% on Friday, ending Friday’s session at INR 72.8.

In The News For:

- Zomato posted a consolidated net loss of INR 250.8 Cr in Q2, which widened nearly 35% sequentially but narrowed YoY. Newly acquired quick-commerce platform Blinkit posted a sequentially narrower adjusted EBITDA loss of INR 259 Cr during the quarter, but it dragged down Zomato’s growth towards profitability.

- Zomato has rolled out its new dining-out programme Zomato Pay in a few Indian cities.

- The food delivery giant is creating a new and “more differentiated” loyalty program for its customers after discontinuing Zomato Pro and Pro Plus memberships earlier this year.

- National Restaurant Association of India’s (NRAI) tussle with both Zomato and Swiggy is on as the association wants the foodtech startups to stay away from dine-out programmes due to competition concerns.

Analysts largely remain positive about Zomato’s growth trajectory post its Q2 results. However, some of them are a bit concerned about Zomato trying to reach profitability by compromising on growth. In fact, its food delivery business’ contribution margin as a percentage of its gross order value (GOV) showed rapid growth over the last one year, but its GOV growth has slowed down compared to the previous few quarters.

BofA Global Research, with a ‘neutral’ rating and INR 67 PT on Zomato, opined that Zomato is balancing growth with profitability. ICICI Securities also raised the same concern.

However, overall, brokerages are bullish and on the technical aspects, an upward movement is expected.

“Bullish diversion has been seen on the weekly chart,” noted Jigar S Patel, senior manager, technical research analyst at Anand Rathi, adding that in the next week, this tech stock could move till INR 80.

“Its support would be INR 65-INR 66 level and we can see 8-9 points rally in next week,” Patel said.

Nykaa Surprises With A Significant Rally

The shares of Nykaa jumped 12.7% on a weekly basis, ending Friday’s session at INR 208. In fact, the rally started from the day of its lock-in expiry and continued even the next day. However, it is pertinent to note that its shares have started trading at a lower denomination from Thursday, reflecting the 5:1 bonus issue.

In The News For:

- Nykaa’s bonus share issue seems to have cushioned Nykaa’s stocks from potential sell-off after its lock-in expiry.

- After the lock-in expiry, Norges Bank, Aberdeen Standard Asia Focus, Segantii India Mauritius, Societe Generale, and Morgan Stanley purchased over 23 Mn shares of Nykaa in bulk and block deals.

- Pre-IPO investors Narotam S Sekhsaria, Mala Gopal Gaonkar, Lighthouse India, and TPG Growth, sold large volumes of shares after the lock-in expiry, with Sekhsaria completely exiting the company.

- Nykaa reported a net profit of INR 5.2 Cr in Q2, which was over a 300% YoY jump. However, profit remained almost flat sequentially.

Nykaa in the next week can go up to INR 225-INR 230 level, and its support would be INR 195, said Anand Rathi’s Patel. “Rate of change is also almost near positive to positive, so we can see a nice rally of around 25-30 points in the next week,” he added.

Policybazaar Shares Regain Momentum

After witnessing a significant downfall since mid-September, shares of PB fintech, the parent entity of Policybazaar, have started regaining some momentum. The shares rose after the insurtech major reported its Q2 results earlier this week.

Policybazaar shares jumped over 7% on Friday alone, ending the week’s session at INR 399.3 despite the impending lock-in expiry next week. Moreover, it also saw a significant uptick in volume on Friday, with over 6.6 Cr shares being traded.

In The News For:

- PB Fintech reported an 8.6% YoY decline in its consolidated net loss to INR 186.5 Cr in Q2 while its operating revenue more than doubled to INR 573.5 Cr. Its lending business witnessed steady growth in the quarter.

- Tiger Global Management divested a 3.57% stake in PB Fintech through the open market where it sold 1.6 Cr shares.

Post its Q2 result, ICICI Securities cut its PT on Policybazaar to INR 550 from INR 700, factoring in the threat of possible competition from the proposed insurance marketplace Bima Sugam. However, with a ‘buy’ rating on the stock, the brokerage remains bullish on the company’s overall performance and outlook.

On the other hand, brokerage JM Financial reiterated its ‘buy’ rating with a PT of INR 910 on the stock as it continues to see Policybazaar as the dominant insurance distribution platform in India despite the regulatory headwinds due to the introduction of Bima Sugam.

For the last one and half months, Policybazaar stocks have been trying to stabilise between INR 375 and INR 400. It is also interesting to note that for the last two weeks the price fell but with very less volumes, said Anand Rathi’s Patel. This could be early signs of reversal for the stock, he said.

INR 370-INR 375 would be a credible support for the stock and next week INR 425-INR 440, could be the resistance, Patel added.

Ad-lite browsing experience

Ad-lite browsing experience