Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

Gurgaon-based mobile wallet company, MobiKwik has signed a subscription agreement with South Africa-based Net1 UEPS Technologies, Inc.

As part of the strategic partnership, Net1 will invest $40 Mn in MobiKwik. In addition, Net1’s Virtual Card technology will also be integrated across all MobiKwik wallets in order to provide ubiquity across all merchants in India.

Serge Belamant, Chairman and CEO of Net1 said, “We believe that this investment will accelerate our ability to build scale in India. Over the next three years, MobiKwik has targetted having 150 million users and 500,000 merchants, and the introduction of our various technologies is expected to enhance their value proposition and differentiation to users, online and offline merchants, increase acceptance, and accelerate growth. With Net1’s expertise and track record in facilitating financial inclusion across Africa, our strategic relationship with MobiKwik marks an important milestone from which we can leverage India’s substantial efforts to drive financial inclusion, down to the grassroots in rural and deep rural areas. Many of our solutions, most notably UEPS/EMV, are tailor-made to provide multiple financial and other services, increase accessibility, eliminate fraud and reduce cash.”

According to a July 2016 Google-BCG study, the size of India’s digital payments industry will reach $500 Bn by 2020, representing a ten-fold increase from current levels. The report predicts that more than 50% of India’s Internet users are expected to use digital payments by 2020, and the top 100 Mn users are expected to drive 70% of digital payments by value. The report also predicts that the value of remittances and money transfers that will pass through alternative digital payment instruments will double to 30% by 2020.

Net1 is a provider of alternative payment systems that leverage its Universal Electronic Payment System (“UEPS”) or utilise its proprietary mobile technologies. The Company operates market-leading payment processors in South Africa and the Republic of Korea. Through Transact24, Net1 offers debit, credit and prepaid processing and issuing services for Visa, MasterCard and ChinaUnionPay in China and other territories across Asia-Pacific, Europe and Africa, and the United States. Through Masterpayment, Net1 provides payment processing and enables working capital financing in Europe.

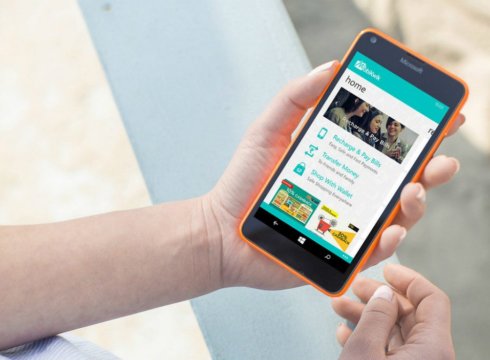

On the other hand, MobiKiwk was founded in 2009 by Bipin Preet Singh and Upasana Taku. It is a wallet that enables users to pay in a flash for their mobile recharge and bill payments. It has partnered with over 50,000 businesses like Café Coffee Day, PVR, Domino’s Pizza, Pizza Hut, TastyKhana, JustEat,eBay,Jabong, Snapdeal, ShopClues, HomeShop18 among others.

MobiKwik has over 32 million users and 100,000 retailers on its platform. MobiKwik’s current shareholders include Sequoia Capital, Tree Line Asia, American Express, Cisco Investments, GMO Payment Gateway and MediaTek, as well as Bipin Preet Singh and Upasana Taku, the founders and executive officers.

Prior to this in May 2016, Mobikwik raised an undisclosed amount of funding led by Japan’s GMO Payment Gateway and Taiwanese fabless semiconductor company MediaTek. In December 2015 it closed about $6.5 Mn (INR 44 Cr.), in a mix of debt and equity funding from existing investors Sequoia Capital and Asia-focussed hedge fund Tree Line Asia. The round also saw participation from Cisco Investments and American Express.

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.