The approval comes four months after Open received the RBI’s approval for cross-border payments

The payment aggregator framework mandates all payment gateways to obtain a licence to operate

Around 185 fintech startups have applied for the licence, according to reports

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

Neobanking unicorn Open has joined the list of fintech companies and startups that have received in-principle approval from the Reserve Bank of India (RBI) for a payment aggregator gateway (PA/PG) licence. With this, the unicorn has become the first neobank to receive RBI approval.

The approval comes four months after Open received the RBI’s approval for cross-border payments after completing the test phase of the second cohort under RBI’s regulatory sandbox.

Speaking about the in-principle approval, Open cofounder and CEO Anish Achuthan said, “We are delighted to receive the in-principle approval from RBI for our payment aggregator licence…it will help us in enhancing our existing product capabilities and innovate new solutions to automate finances for millions of SMEs and small businesses in the country”.

Achuthan added that the RBI has been ‘proactive’ by introducing regulations and frameworks to help the ecosystem. He said that the RBI’s moves also help build confidence among end users to adopt digital payments and banking.

The payment aggregator framework was launched by the RBI in March 2020. The new norms mandate all payment gateway operators to obtain a licence to acquire merchants and deploy digital payments solutions.

In September, RBI Governor Shaktikanta Das said that the online payment aggregator guidelines will be extended to offline players as well.

Around 185 fintech startups have applied for the licence. Interestingly, IRCTC is also on the list of applicants, along with many other big names in the segment. On Saturday (November 12), payments solutions startup SabPaisa also received an in-principle nod from the RBI for the PA/PG licence. Last month, CCAvenue operator Infibeam Avenues received in-principle approval.

However, media reports suggest major players like Swiggy, Zomato and Google Pay, along with Mobikwik’s Zaakpay, might see their applications for the PA/PG licence rejected by the central bank. The RBI has reportedly rejected more than 100 applications so far, given the stringent norms.

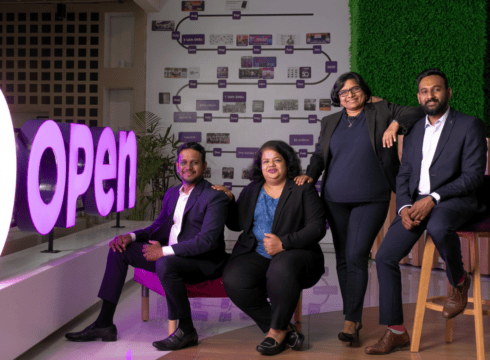

Founded in 2017 by Anish Achuthan, Ajeesh Achuthan, Mabel Chacko, and Deena Jacob, Open offers business banking, payments and expense management services to SMBs across the country. It has three major products, Open Flo, Open Settl and Open Capital, targeted at ecommerce firms and SMEs, respectively.

The startup became India’s 100th unicorn in May after raising $50 Mn from IIFL, Temasek, Tiger Global and 3one4 Capital. It competes with the likes of Nubank, IPO-bound Navi, CredAvenue and Oxyzo.

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.