SUMMARY

Mswipe will now offer uTap, its omnichannel payment solutions for merchants, in the UAE

The companies will also offer services, such as cloud pay, table management, and customer management, to businesses to efficiently manage their operations

Last year, Mswipe got an in-principle approval from the RBI for a payment aggregator licence

Fintech startup Mswipe Technologies on Monday (August 7) said it has expanded its services to the UAE in partnership with Etisalat by e&.

The startup has launched uTap, its omnichannel payment solutions for merchants, in the UAE.

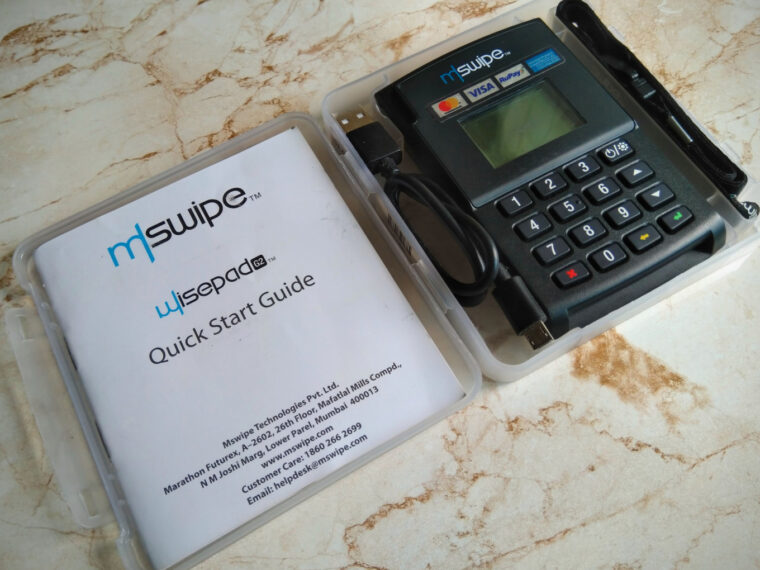

Mswipe, founded in 2011 by Manish Patel, provides latest generation POS terminals with integrated offline and online card payments, business management applications and automation tools through its uTao service to empower small and medium-sized businesses (SMBs).

Commenting on the partnership, Mswipe CEO Ketan Patel said, “Through this strategic partnership, we are committed to leveraging our robust technology platform to serve diverse markets and offer a seamless payment ecosystem to our merchant partners.”

“This partnership enables us to expand our reach and introduce our innovative product portfolio to new territories, further driving our growth,” he added.

The companies will also offer a bunch of services, including cloud pay, table management, and customer management, to businesses to efficiently manage their operations. The clients will be able to access round-the-clock digital support and on-field assistance offered by Etisalat by e&.

uTap offers payment acceptance solutions starting $13.61 per month.

The latest development comes almost a year after Mswipe got approval from the Reserve Bank of India (RBI) for a payment aggregator license. Back then, the startup said it would develop an in-house online payment gateway and offer full-stack payment solutions to offline and online merchants.

Mswipe competes with the likes of Ezetap, Innoviti, among others.

It looks like Mswipe is on a global expansion spree to leverage the market with $65 Bn cross-border payment market potential by 2030, as estimated by Inc42’s State Of The Indian Fintech Report Q2 2023. The report estimates that the overall market size will grow to $2.1 Tn by 2030 growing at 18% CAGR from 2022.

Ad-lite browsing experience

Ad-lite browsing experience