Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

In the past some time, mPOS market has seen significant growth and it is sure to overtake and replace the traditional POS industry. Experts predict that the mPOS is evolving and players in this segment could soon be adding 10,000-15,000 merchants a month.

Mosambee, dealing in the mPOS segment, has raised an undisclosed amount in its Series B round of funding from existing investors Rajasthan Venture Capital Fund (RVCF) and SIDBI Venture Capital Ltd, the former investing a little more than the latter. As part of the deal, both RVCF and SIDBI will get a significant minority stake in Mosambee.

According to Girish Gupta, CEO of RVCF, “RVCF and SIDBI will invest in two tranches and the deal is expected to close in six months.” The first half of the total investment has already been provided to the startup. The company plans to use the funds raised to complete its products and enhance their capabilities. Previously, in 2013, Mosambee had raised $1 Mn in funding from SIDBI and RVCF.

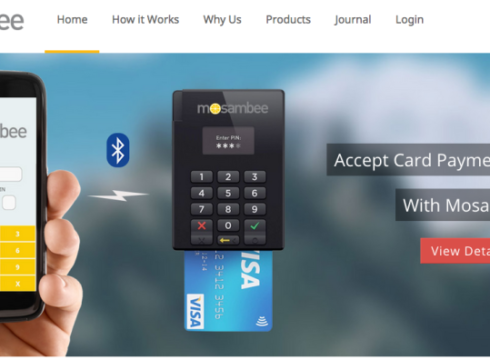

Mosambee is an EMV & AADHAAR compliant tablet based mobile (POS) Point of Sale system which provides end to end payment solutions for Bank, Cash, Cheque, Debit and Credit Card transactions. It enables mobile phones to function as card reading machines for real-time bill payments.

“Our services support all major global card schemes including Mastercard, VISA, American Express, Diners and JCB. The company also leverages the products created by NPCI to provide its users a complete payments experience,” says Alok Arora, CEO of Mosambee.

At the time of its launch, Mosambee claimed to be the only mPOS company in India to have obtained clearance from Reserve Bank of India to offer services. Though they had a modest beginning when the startup entered India with only a handful of merchants, but they are now adding around 80-100 merchants on a daily basis.

CLIENTS AND USERS

Mosambee caters to industries such as Restaurants, Ecommerce, Cab services and insurance besides others. Its payment partners include prominent companies such as Visa, American Express, MasterCard, HDFC etc. According to the company, it had over 10,000 users in India in 2013 and aims to increase this number to over 250,000 in the coming few years. Mosambee is active in Western and Northern India and is also planning of expanding, both nationally as well as globally.

Mosambee is facing competition from other similar service providers such as mswipe, MobiSwipe, and also, Mobile VAS firm, Mahindra Comviva’s mPOS solution called payPLUS. Mumbai based mSwipe last year raised undisclosed amount in funding led by existing investor Matrix Partners, along with participation from Axis Bank and DSG Consumer Partners.

Mosambee is run by Mumbai-based Synergistic Financial Networks Pvt Ltd, and was founded in 2013 by Alok Arora (CEO), Aditya Anand, Bhushan Thaker and Sameer Chugh. Arora previously has worked at organisations such as Wipro, Trilogy Software and Victrix LLC. Whereas, Anand was an assistant manager (R&D) at RAKBANK Direct. Thakkar was earlier the director at Mumbai-based Nucsoft Ltd. Chugh worked as an analyst at Ernst & Young.

RVCF, through its two SEBI registered domestic venture capital funds—RVCF Fund I and SME Tech Fund–RVCF Trust II, invests in startup and mid-stage companies.

SIDBI invested in Mosambee through its India Opportunity Fund. The fund provides growth capital to MSMEs operating in emerging sectors such as light engineering, logistics, educational services, and IT/ITES, along others.

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.