Despite the slump in the overall stock market, PB Fintech emerged as the biggest winner by surging almost 19% this week on the BSE

Delhivery gained over 7% this week despite its major pre-IPO investor Tiger Global offloading stakes in a bulk deal

Benchmark indices Sensex and Nifty50 fell 2.5% and 2.7% to 59,463.93 and 17,465.80, respectively, this week over inflation concerns

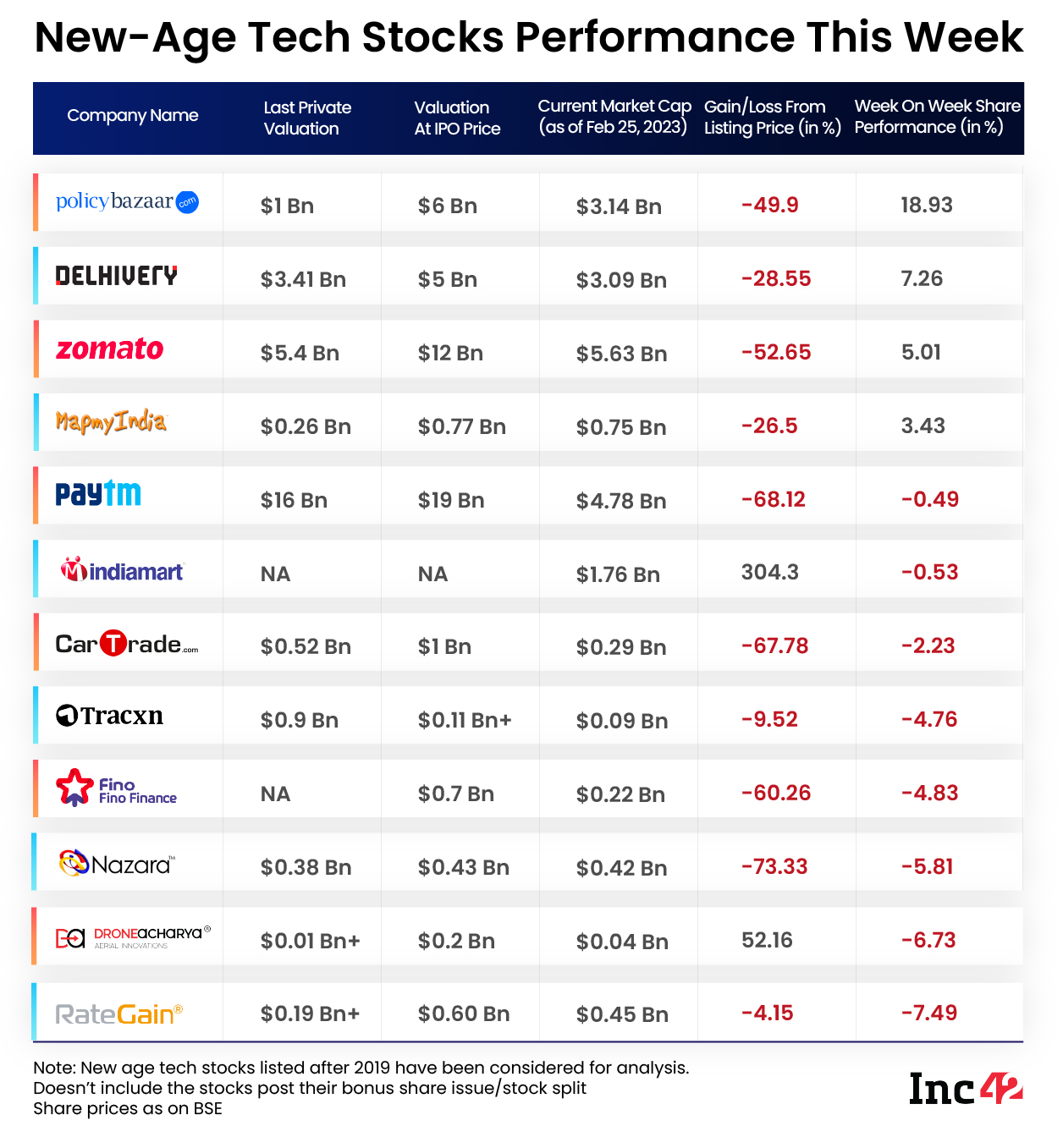

A majority of the new-age tech stocks fell this week amid a severe slump in the overall Indian stock market due to growing inflation concerns and fears of further rate hikes by the US Fed.

However, despite the pressure, PB Fintech emerged as the biggest winner by surging almost 19% this week on the BSE.

Besides the fintech major, Delhivery, Zomato, MapmyIndia, and Nykaa also rose in the range of 1% to 7% this week.

Delhivery’s gains came despite its major pre-IPO investor Tiger Global offloading stake in a bulk deal.

On the other hand, RateGain was the biggest loser among the listed tech startups, falling 7.5% on the BSE this week. Shares of DroneAcharya, last week’s biggest gainer, slumped 6.7% this week.

In the broader equity market, benchmark indices Sensex and Nifty50 fell 2.5% and 2.7% to 59,463.93 and 17,465.80, respectively.

“Most global equity markets witnessed corrections this week, as the markets seemed anxious over future Fed measures due to higher-than-expected recent inflation numbers. Indian markets too were affected as the growth-inflation mix remains a bit worrisome,” said Shrikant Chouhan, head of equity research (retail) at Kotak Securities.

Siddhartha Khemka, head of retail research at Motilal Oswal, believes that the market is likely to consolidate in the near-term in the absence of any fresh triggers.

Next week investors will take cues from macro data, including Gross Domestic Product (GDP) and Purchasing Managers’ Index (PMI) numbers.

Let’s take a deeper look at the performance of some of the new-age tech stocks this week.

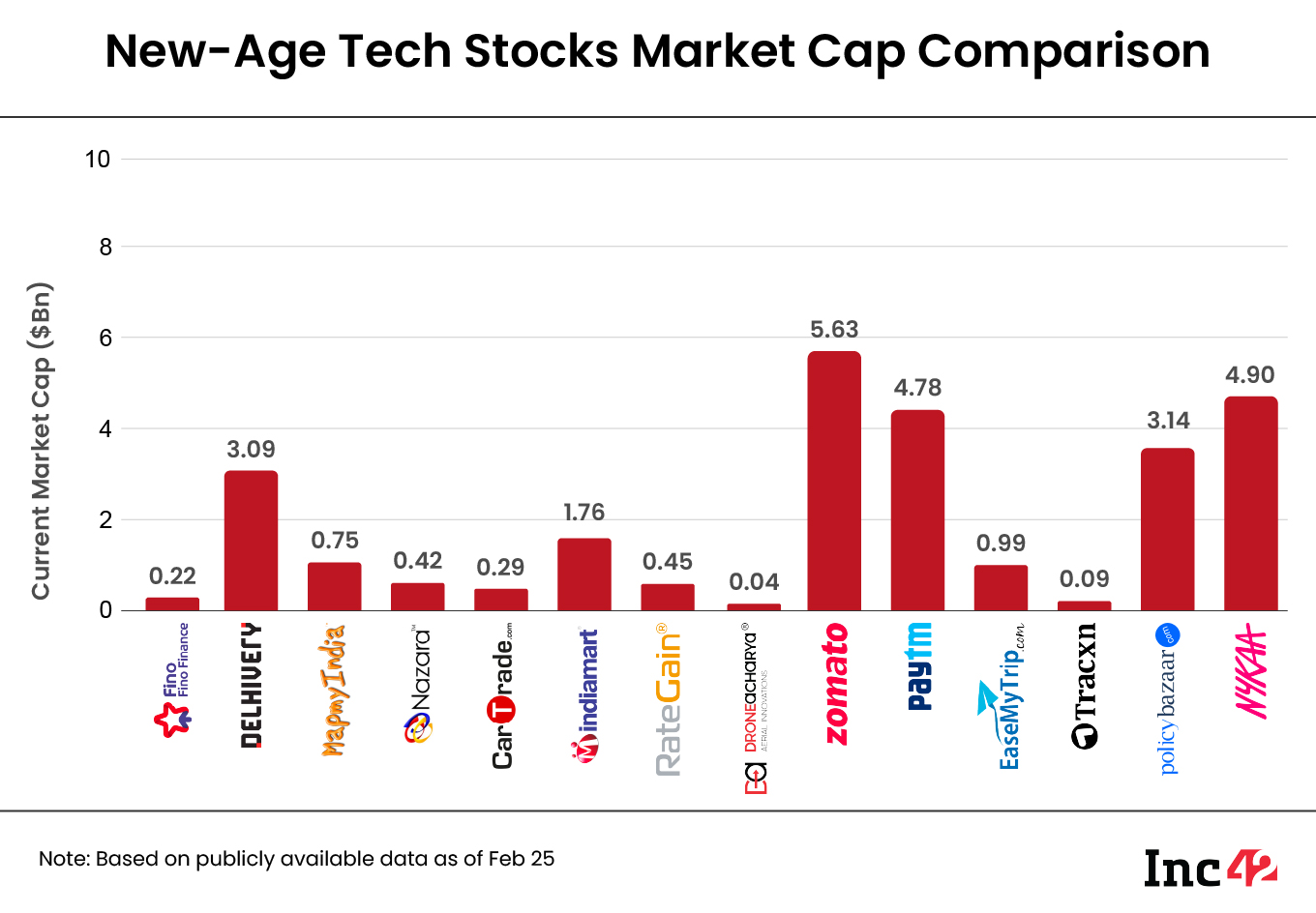

The 14 new-age tech stocks under our coverage ended the week with a total market capitalisation of $26.55 Bn as against $26.17 Bn last week.

Tiger Global Offloads Stake In Delhivery

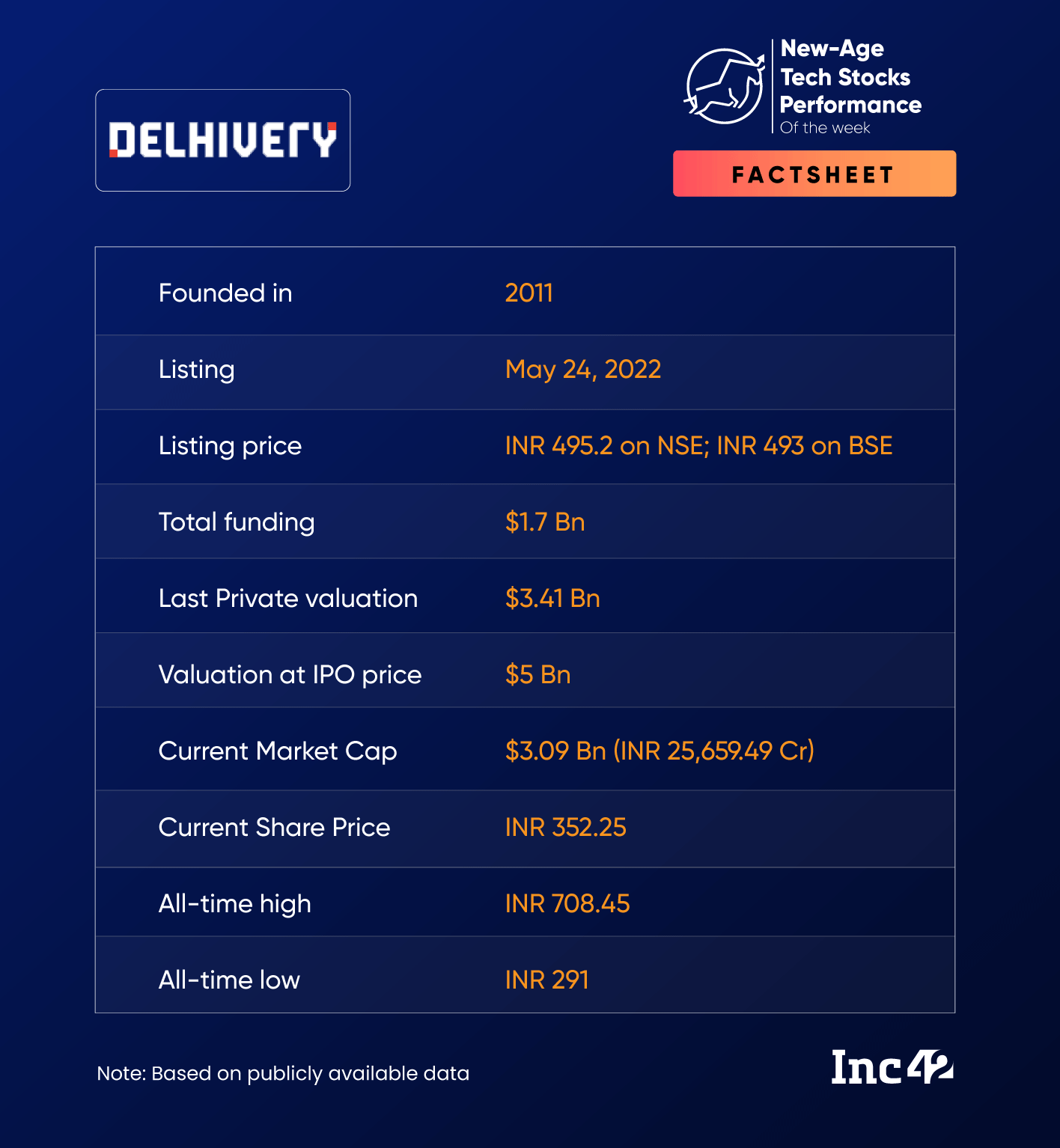

Shares of logistics startup Delhivery continued their northbound journey this week despite a mild slump mid-week following Tiger Global’s Internet Fund III offloading 1.2 Cr of its shares.

The VC fund sold 1.7% of its stake in Delhivery on Wednesday in a bulk deal worth INR 414.2 Cr. As of December 31, 2022, Internet Fund III held a total of 3.4 Cr shares of Delhivery, or a 4.68% stake.

The logistics startup’s shares jumped almost 7.3% this week, ending Friday’s session at INR 352.25 on the BSE. The stock also ended the week’s last session in the green zone, up 2% compared to Thursday’s close.

Shares of Delhivery have regained some momentum after the announcement of its Q3 FY23 results earlier this month. Delhivery reported a consolidated net loss of INR 195.6 Cr in the quarter, up 54.6% year-on-year (YoY). However, the loss was a 23% decline sequentially from INR 254 Cr in Q2 FY23.

Meanwhile, brokerage JM Financial initiated its coverage on Delhivery this week with a ‘hold’ rating and a price target (PT) of INR 350. The PT currently implies a downside of 0.6% to the stock’s last close.

The brokerage said that it expects Delhivery to continue holding its market share in express parcel, with growth driven by rising online penetration in retail and the rise of new ecommerce business models.

“We expect Delhivery to demonstrate high marginal profitability for only a few more quarters and then normalise to 25%-30%. However, a sustained growth path should see Adj. EBITDA margin inch upwards consistently to reach 12%-15% in a decade,” it said.

JM Financial said the stock’s further growth will largely be dependent on the macro environment.

Meanwhile, in a research note published this week, Kotak Institutional Equities retained a ‘buy’ rating on Delhivery and a fair value of INR 395, which implies over 12% upside to the stock’s last close.

On the other hand, HDFC Securities’ technical research analyst Vinay Rajani said in a note this week that Delhivery’s stock price has surpassed 50 days’ exponential moving average (EMA) resistance. Its price rise is also accompanied with rising volumes. He pegged the stock’s stop loss at INR 335.

Shares Of PB Fintech At A 6-Month High

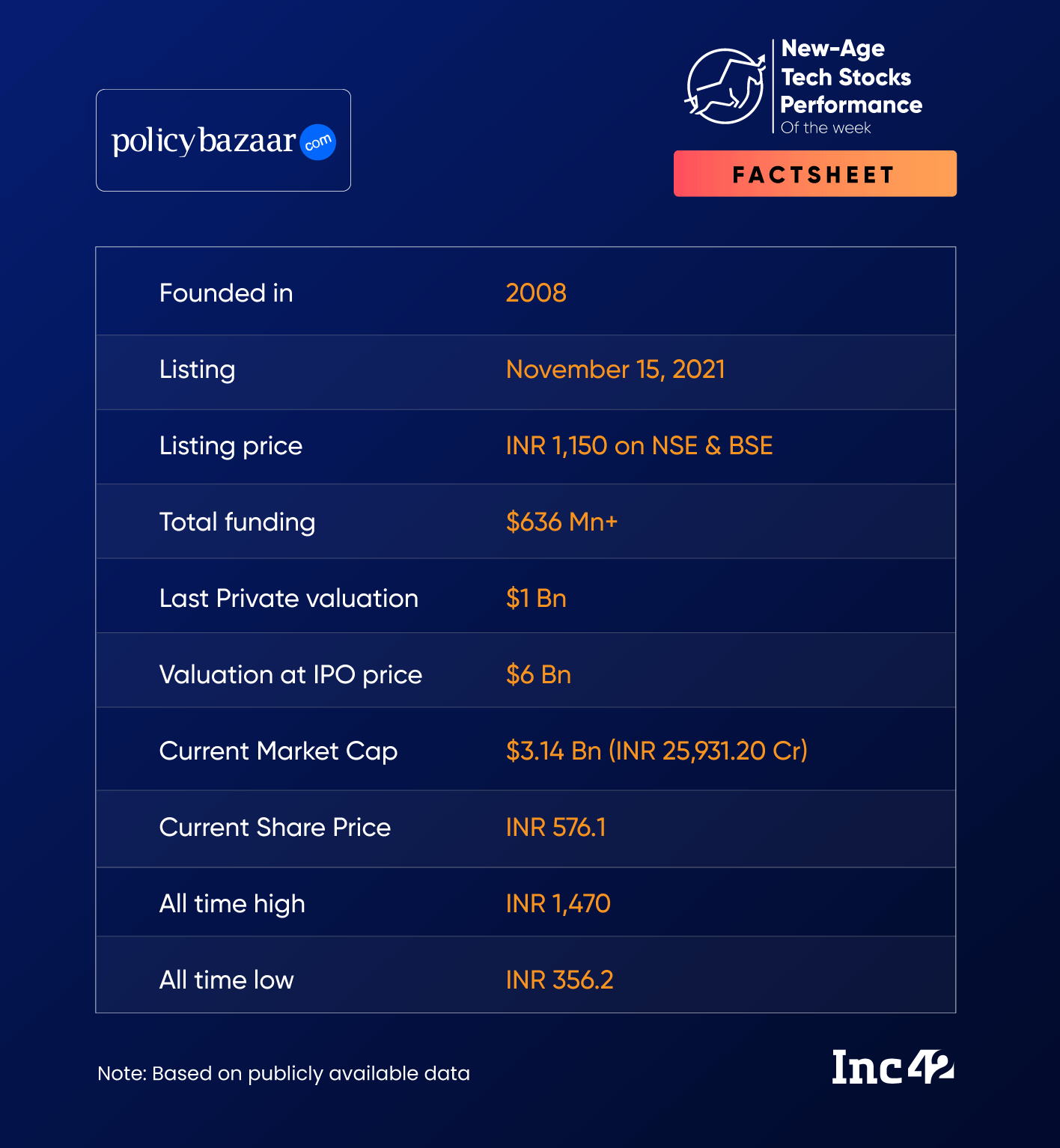

Shares of PB Fintech, the parent company of Policybazaar, gained in all five sessions this week, rising 18.9% on the BSE, to end Friday’s session at INR 576.1.

Despite a slump in the broader market on Friday, the fintech major’s shares jumped 10.5% on the day compared to Thursday’s close. It was the biggest gainer among the new-age tech stocks this week.

Also, PB Fintech is also the biggest gainer in the Nifty500 index this month, with its shares up over 37%.

It must be noted that PB Fintech’s shares witnessed a severe downfall last year from June. The shares fell over 52% in 2022.

However, the stock has been witnessing an upward momentum after it reported upbeat Q3 FY23 results. PB Fintech’s consolidated net loss declined 70.6% to INR 87.6 Cr during the quarter. Besides, the company also said that its lending vertical Paisabazaar achieved break even on an adjusted EBITDA level in the quarter.

With a market cap of INR 25,931.2 Cr, its shares are currently trading at a level last seen in August 2022.

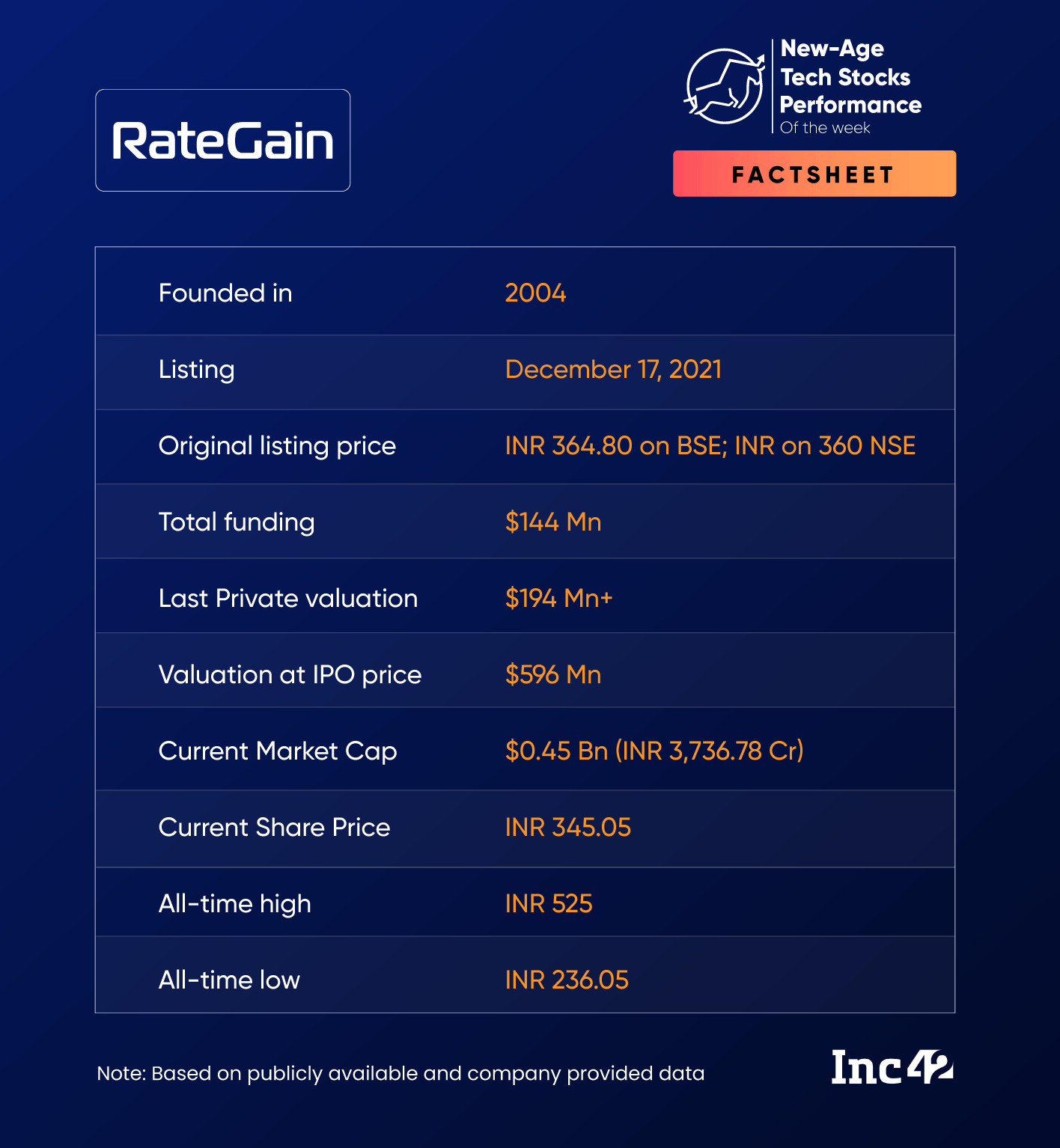

RateGain Becomes The Biggest Loser

Shares of the traveltech SaaS startup fell in four straight sessions this week to become the biggest loser among the newly-listed tech stocks.

Shares of RateGain declined almost 7.5%, ending Friday’s session at INR 345.05.

Cloud-based property management platform for hotels HotelKey announced a partnership with RateGain this week to integrate the latter’s global distribution, central reservations, and pricing capabilities into HotelKey’s PMS platform. However, the announcement failed to have any major impact on the stock’s performance.

RateGain’s shares declined following more than a month’s rally post the startup’s announcement of acquisition of data exchange platform Adara for $16.1 Mn in January.

Earlier this month, the startup reported a 147X YoY jump in its profit after tax (PAT) to INR 13.3 Cr in Q3 FY23, with a 39.7% increase in its operating revenue to INR 138.3 Cr.

Ad-lite browsing experience

Ad-lite browsing experience