SUMMARY

RateGain emerged as the biggest gainer on the BSE, rising 17.4%, followed by Tracxn Technologies (up 17%)

Despite a slump in its share price on Thursday following sale of 1.9 Cr shares by Alibaba, Paytm managed to end the week 1.6% higher

Benchmark indices Nifty50 and Sensex gained 0.5% and 0.6% this week, ending Friday’s session at 17,956.6 and 60,261.18, respectively

A majority of the new-age tech startups ended the week in the green zone amidst the ongoing volatility in the broader Indian stock market.

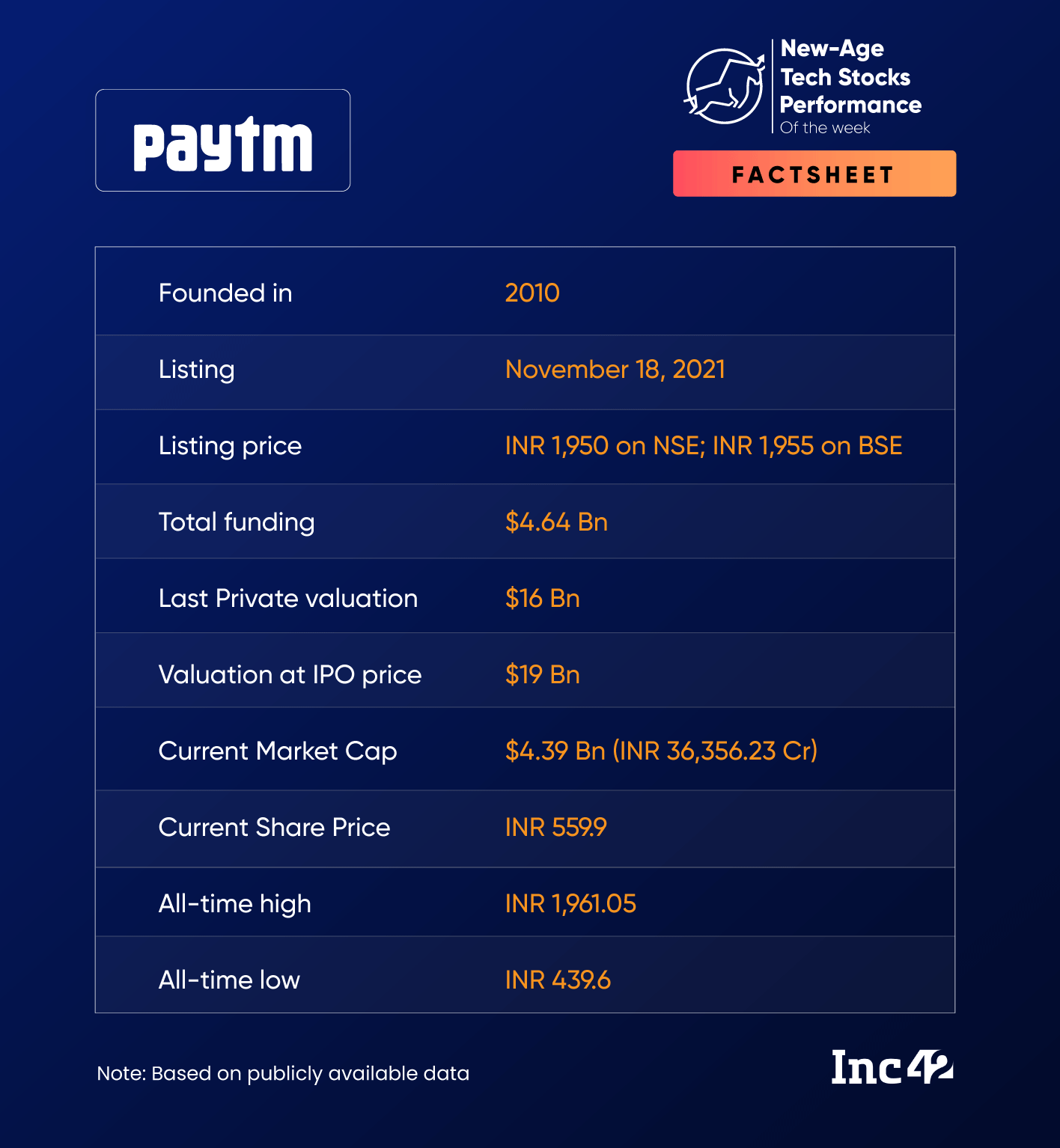

Chinese behemoth Alibaba sold nearly 2 Cr shares of Paytm through a bulk deal this week. Following this, shares of the fintech giant slumped on Thursday but managed to end the week 1.6% higher.

Meanwhile, traveltech SaaS startup RateGain emerged as the biggest gainer on the BSE, followed by Tracxn Technologies.

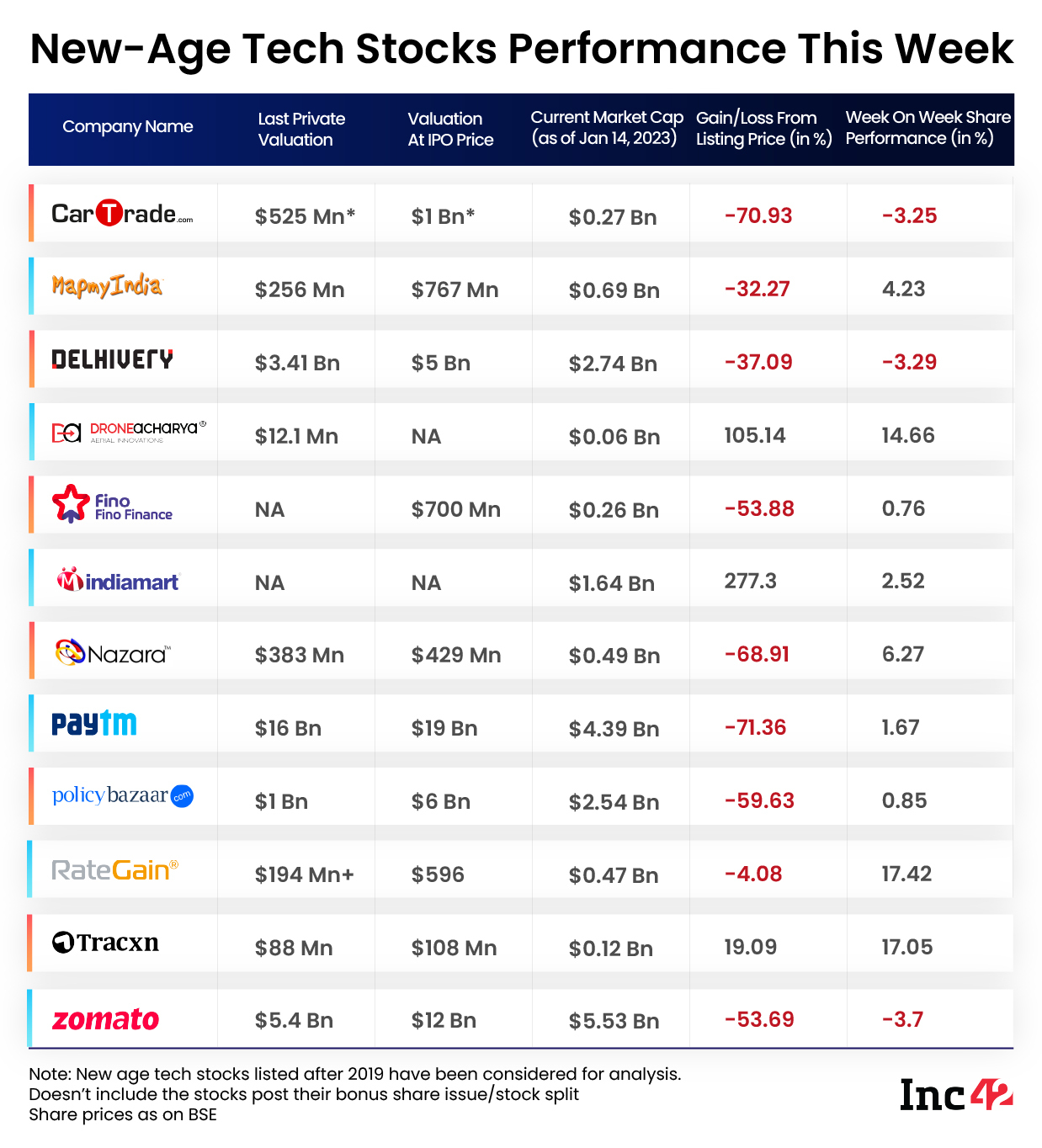

Nine out of 14 stocks under our coverage ended the week up 0.7%-17.5% higher.

DroneAcharya, which has been witnessing a sharp rise in its share price since its listing last month, declined slightly this week to end Friday’s session 5% lower at INR 209.25 on the BSE SME platform. However, shares of DroneAcharya ended 14.6% higher on a week-on-week basis.

Zomato, Delhivery, Nykaa, and EaseMyTrip were among the stocks that ended the week in the red zone. Zomato was the biggest loser on the BSE this week, falling 3.7%, followed by Nykaa.

Meanwhile, benchmark indices Nifty50 and Sensex gained 0.5% and 0.6% during the week, ending Friday’s session at 17,956.6 and 60,261.18, respectively.

“Market session was once again marked with volatility as indices gyrated sharply intra-day before managing to end in positive territory. Reports of cooling inflation and rise in November growth failed to enthuse investors, as higher valuations remain a major concern,” Amol Athawale, deputy vice president, technical research at Kotak Securities, said about Friday’s trading session.

“Despite improved domestic economic readings, FPI outflows have continued, which has been a major dampener for local traders,” he added.

Now, let’s dig deeper to analyse the performance of the listed new-age tech stocks from the Indian startup ecosystem.

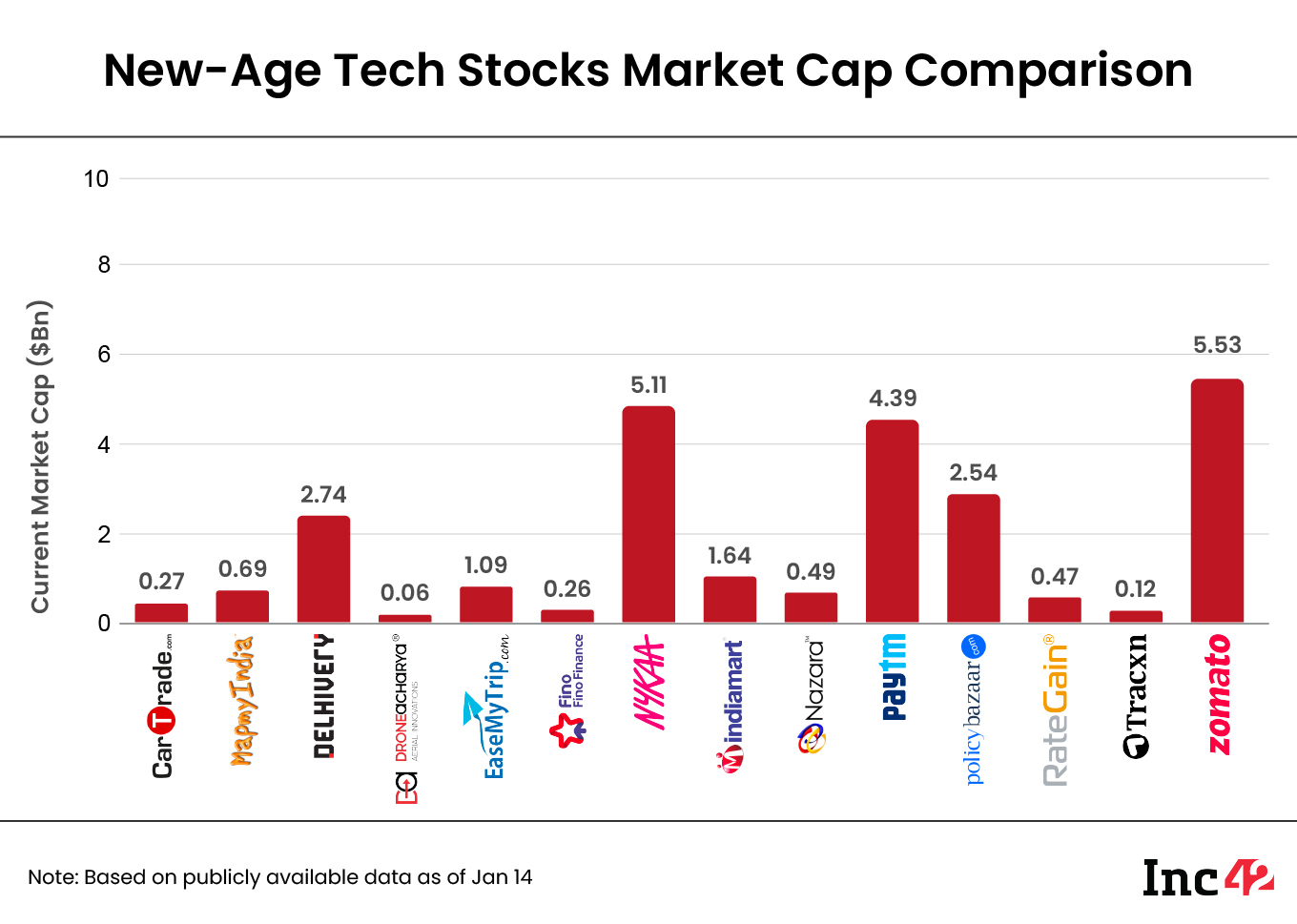

The 14 new-age tech stocks under our coverage ended the week with a total market capitalisation of $25.40 Bn as against $25.54 Bn last week.

Alibaba Sells 1.9 Cr Paytm Shares

The winning streak of Paytm shares ended on Thursday after its pre-IPO shareholder Alibaba offloaded 1.9 Cr shares in a bulk deal worth INR 1,030.9 Cr.

As of September 2022, Alibaba’s Antfin Netherlands Holding held 16.1 Cr shares, or 24.88% stake, of Paytm, while Alibaba.Com Singapore E-Commerce Private Limited held over 4 Cr shares, or 6.26% stake.

While preliminary reports suggested that Antfin sold the shares, the stake sale was done by Alibaba.Com, which sold 2.96% of its stake in the startup.

Meanwhile, Morgan Stanley Asia and Ghisallo Master Fund were amongst the buyers of the shares. Together, they bought a little over 1 Cr shares of Paytm worth INR 560.2 Cr.

Paytm gained in three straight sessions this week but fell 6.4% on Thursday. However, the shares rallied again on Friday to end the session 3.2% higher at INR 559.9 on the BSE.

The stock is consistently forming a higher-bottom formation despite the overall market weakness, which is broadly positive, Kotak Securities’ Athawale said.

“I am expecting a continuation of the uptrend if the stock sustains above INR 530. So, for the short-term, INR 530-INR 525 would be the immediate support area,” Athawale said, adding that above that, the stock could reach INR 600-INR 620 in the near future.

While the market still remains divided on the fate of the new-age tech stocks like Paytm in the near to medium-term, valuation expert Aswath Damodaran recently told Inc42 that the market has lost faith in Paytm management’s ability to monetise their users. The fintech giant needs to pivot from user growth to increasing the take rate in order to make a comeback, he added.

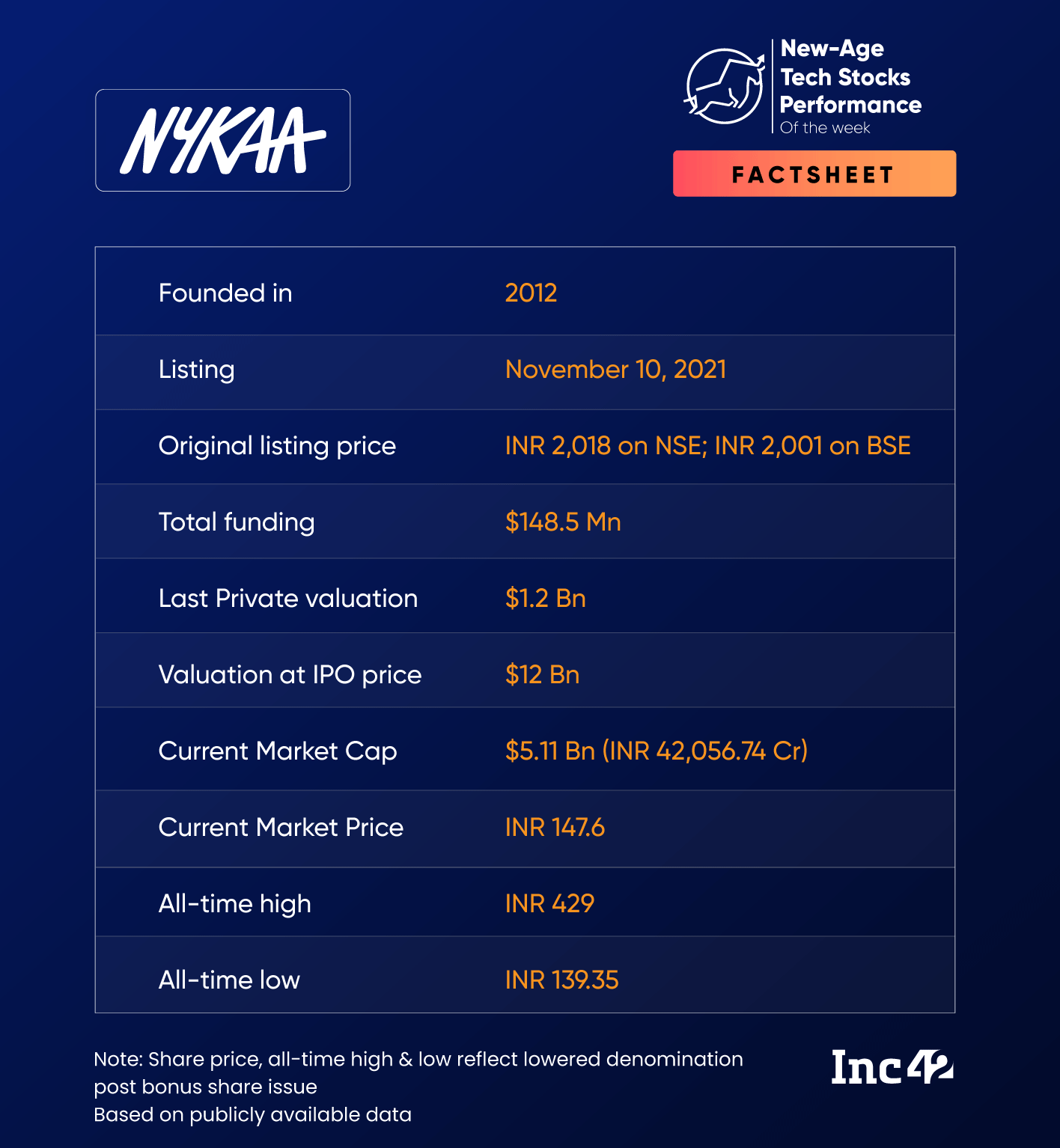

No Relief For Nykaa

Nykaa was one of the worst-hit tech stocks in 2022 with its shares falling over 60% during the year. While its peers like Zomato and Paytm have shown some signs of recovery in 2023, Nykaa continues to remain under pressure and has largely seen sideways movement in the new year.

After Nykaa’s lock-in expiry in November last year, several of its major pre-IPO shareholders including Kravis Investment Partners, Lighthouse India Fund III, TPG Capital, Mala Gopal Gaonkar, and Narotam S Sekhsaria offloaded their stakes in the beauty ecommerce giant.

Meanwhile, Nykaa shares fell 3.6% this week, ending Friday’s session at INR 147.6 on the BSE.

“The stock is in the oversold zone but still there is no sign of reversal. After a sharp fall, the stock is moving in a sideways direction. So, a range-bound action is likely to continue,” said Athawale.

He expects INR 156 or 20-day simple moving average to be the immediate resistance for the stock. On the downside, INR 140-INR 144 is the immediate support area.

“A fresh pullback is possible only after INR 156. Above that, INR 163 and INR 168 would be the immediate resistance,” he added.

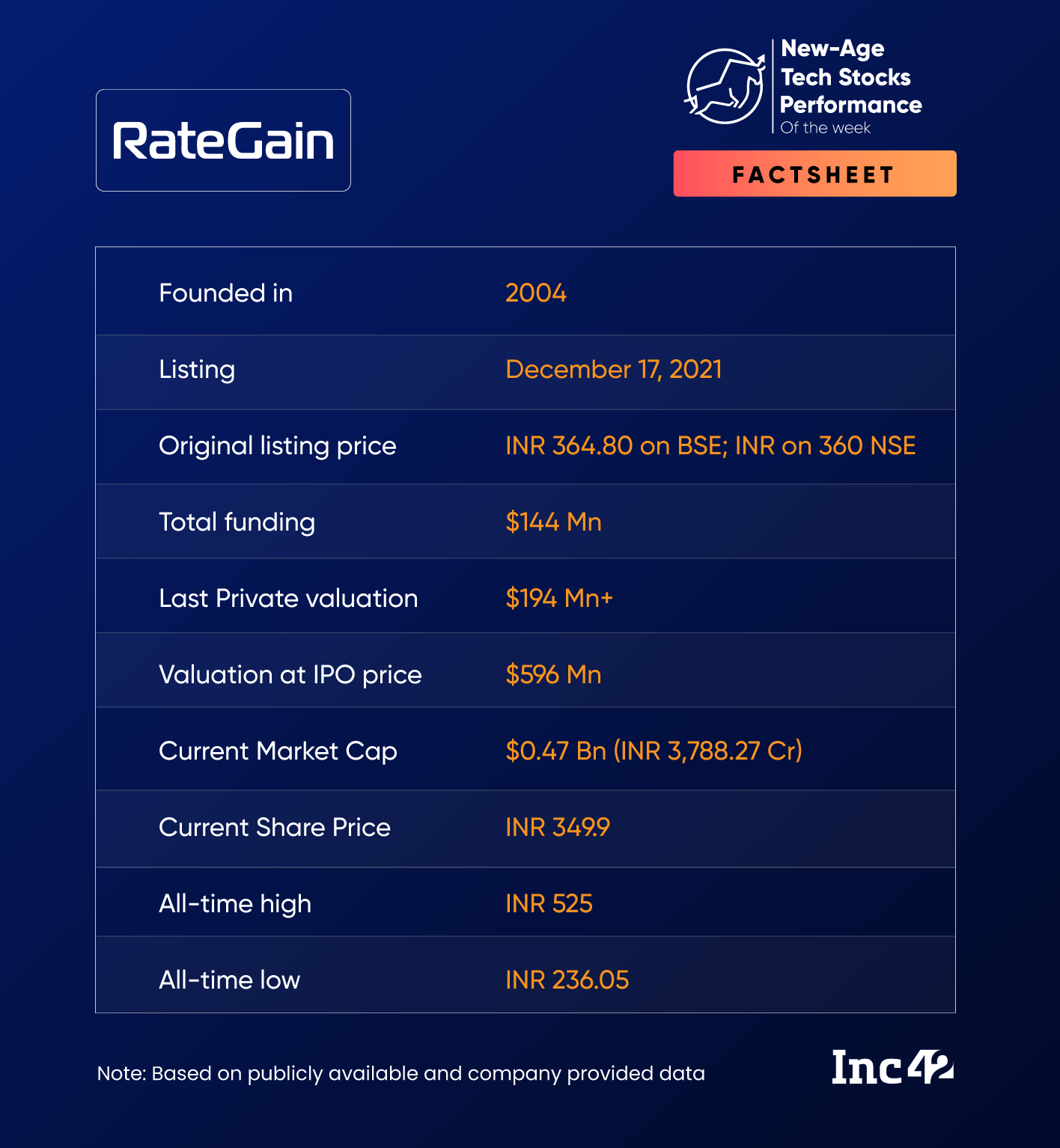

RateGain Biggest Gainer

Shares of RateGain have been witnessing a rally since the beginning of January after the startup announced the acquisition of data exchange platform Adara for $16.1 Mn (INR 134 Cr).

“Together Adara and RateGain will become the most comprehensive travel intent platform that processes over 200 Bn ARI update, manages close to 30 Bn data points and works with 700-plus partners across 100-plus countries, giving the industry a single source to understand intent, target them and convert them,” Bhanu Chopra, chairman and founder of RateGain, said.

This week, RateGain gained almost 21.2% by rising in four straight sessions. On Tuesday, RateGain, in an exchange filing, said that it completed the acquisition of assets of Adara on January 9.

However, RateGain shed some of its gains to end Friday’s session 3.1% lower at INR 349.9 on the BSE. Overall, the shares rose 17.4% this week.

“The stock has formed a bullish candle on the monthly chart and it looks like there is a range breakout. The volume activity is also decent,” said Kotak Securities’ Athawale.

He opined that the upward movement in RateGain is likely to continue. While there is a possibility of minor correction, INR 330 and INR 323 would be the immediate support area for the stock. On the higher side, INR 383-INR 387 would be the immediate resistance, Athawale said.

Listed in December 2021, RateGain fell over 23% last year in line with the slump that most tech stocks faced in India and globally. Its shares are currently trading at levels last seen in April 2022.