MobiKwik’s IPO will entirely comprise a fresh issue of equity shares, with no offer for sale component

The fintech unicorn plans to use the IPO proceeds to fuel the growth of its financial services segment, expand its payments business, among others

Mobikwik, which refiled its IPO documents in January, may also pursue a pre-IPO placement of INR 140 Cr

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

Fintech unicorn MobiKwik has secured approval from the Securities and Exchange Board of India (SEBI) for its INR 700 Cr initial public offering (IPO) aimed at expanding its financial services and payments business.

The markets regulator issued the observation letter to the Delhi NCR-based unicorn on September 19. In SEBI’s parlance, issuance of observation is a green light to go ahead with the public issue.

MobiKwik’s IPO will entirely comprise a fresh issue of equity shares, with no offer for sale component.

Of this, the startup plans to use INR 250 Cr to fuel the growth of its financial services segment. While INR 135 Cr will be used to support the expansion of its payments business, another INR 135 Cr will be invested in data, machine learning (ML), artificial intelligence (AI), and product development.

An additional INR 70.28 Cr will go towards capital expenditure for payment devices, with the remainder earmarked for general corporate purposes.

MobiKwik, which refiled its IPO documents in January, may also pursue a pre-IPO placement of INR 140 Cr. Should this placement occur, the size of the fresh issue will be adjusted accordingly.

The fintech unicorn became profitable in the financial year 2023-24 (FY24), reporting a net profit of INR 14.1 Cr, a significant turnaround from a net loss of INR 83.19 Cr in the previous year, driven by strong business growth. Revenue from operations surged 62% to INR 875 Cr from INR 539.5 Cr in FY23.

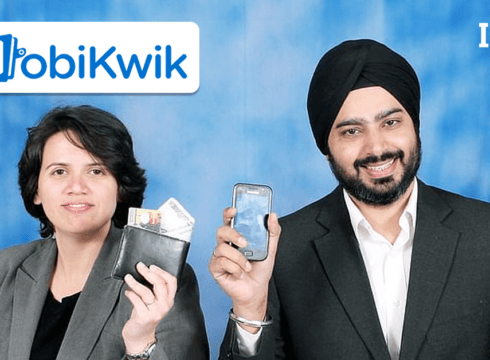

Founded in 2009 by Bipin Preet Singh and Upasana Taku, MobiKwik is a digital banking platform offering a comprehensive suite of financial products for both consumers and merchants.

Its revenue streams include services such as online checkout, Kwik QR scan and pay, MobiKwik Vibe (Soundbox), MobiKwik EDC Machine, and merchant cash advances, among others.

As of September 2023, MobiKwik had 146.94 Mn registered users and facilitated payments for 3.81 Mn merchants across online and offline platforms.

Notably, the fintech unicorn has slashed its IPO size by 63% when compared with the first filing of its DRHP in 2021. At the time, it was looking to raise INR 1,900 Cr, out of which INR 1,500 Cr was to be raised from a fresh issue of shares and INR 400 Cr via offer for sale (OFS).

The 2021 DRHP was filed amid the startup IPO boom. However, with the crash in Paytm share price, MobiKwik’s share price also slumped in the unlisted market. With the smaller IPO size, the startup seems to be trying to reduce the risk of overvaluation – a challenge faced by Paytm post-IPO.

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.