Eight new-age tech stocks gained this week, with Tracxn Technologies emerging as the biggest gainer (up 12%)

Nykaa emerged as the biggest loser this week by falling around 5%, while Zomato, Paytm, DroneAcharya, Nazara, and IndiaMart InterMESH declined between 0.2% and over 2%

Benchmark indices Sensex and Nifty 50 gained 0.87% and Nifty gained 0.74% this week but there was a drag as the market witnessed profit booking at higher levels

New-age tech stocks saw another mixed week amid the fluctuations in the broader domestic equity market. However, the underlying sentiment remained strong.

Drone startup ideaForge made a stellar debut on the bourse on Friday (July 7), listing at a premium of 94% to its IPO price and becoming the first new-age tech startup to go public in 2023.

Of the other 14 new-age tech stocks under Inc42’s coverage, eight gained this week. Tracxn Technologies emerged as the biggest gainer (up 12%).

Besides, Fino Payments Bank, PB fintech, RateGain, Delhivery, Cartrade Technologies, EaseMyTrip, and MapmyIndia gained in a range of 0.7 and 7% on the BSE this week.

On the other hand, Nykaa turned out to be the biggest loser this week by falling around 5% on the BSE. Zomato, Paytm, DroneAcharya, Nazara, and IndiaMart InterMESH also declined between 0.2% and over 2%.

Benchmark indices Sensex and Nifty 50 touched new record highs this week at 65,785.64 and 19,497.3, respectively, on Thursday. However, both the indices fell on Friday due to profit booking on weak global cues. While BSE ended the week at 65,280.45, NSE closed at 19,331.8.

Overall, Sensex gained 0.87% and Nifty gained 0.74% this week.

“Globally, sentiments turned sour after strong US private jobs data raised the probability of interest rate hikes by the Fed in its upcoming meeting. On the domestic front, markets are witnessing profit booking at a higher level after seeing a run-up of more than 4% in the last eight trading sessions,” said Siddhartha Khemka, head of retail research at Motilal Oswal.

Khemka expects markets to sustain the current momentum in the coming days as stock-specific action picks up with the onset of the Q1 FY24 earnings season. India’s upcoming retail Inflation data would also provide some cues.

Meanwhile, Santosh Meena, head of research at Swastika Investmart, believes that volatility may increase amid Q1 earnings and rising US bond yields. HCL Tech, TCS, and Wipro are set to report their earnings next week but the predictions for IT companies in Q1 appear bleak, he said.

Now, let’s take a deeper look into the performance of some of the new-age tech stocks this week:

The 15 new-age tech stocks under Inc42’s coverage ended the week with a total market capitalisation of $33 Bn. Last week, 14 of them had ended the week with an aggregate market cap of $32.5 Bn.

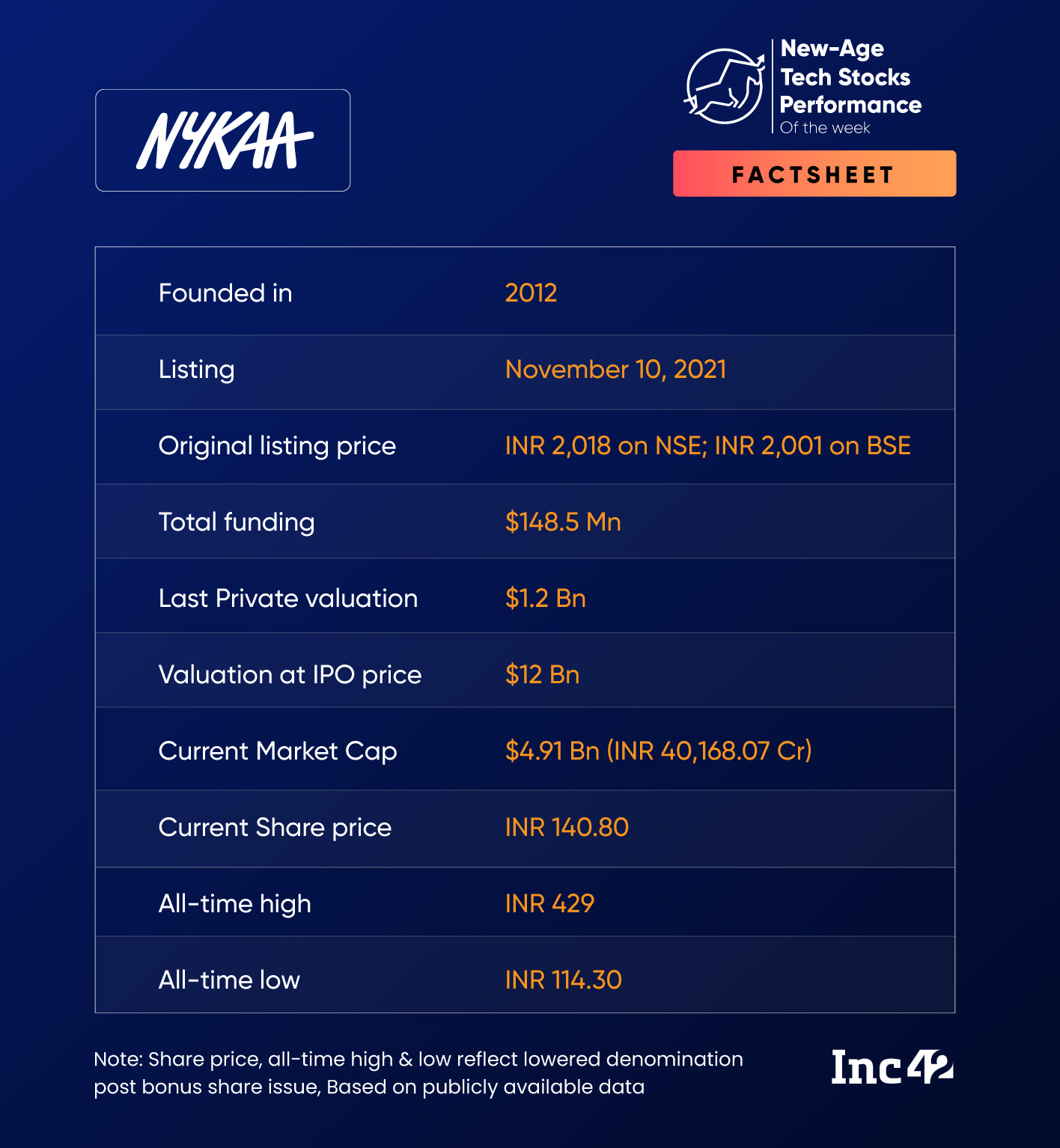

Nykaa Continues To Fall

Shares of beauty and fashion ecommerce major Nykaa fell 4.9% to end the week at INR 140.8 on the BSE.

While the shares rose slightly during the first session of the week, they fell sharply in the next two sessions. After a slight recovery again on Thursday, Nykaa shares fell 2.2% on Friday to end the week in red.

The slump on Friday came despite its bullish operating performance update for Q1 FY24. Nykaa on Friday said it expected to report year-on-year (YoY) consolidated revenue growth in the mid-twenties during the quarter.

Despite a slowdown in discretionary spending, its beauty and personal care (BPC) category and fashion business witnessed growth, the company said.

Though Nykaa’s fashion business has been under pressure and the company’s overall profit also witnessed a downfall in the past few quarters, brokerages have largely been bullish on its long-term trajectory.

While Paytm, Zomato, PB Fintech, and Delhivery, among others, have witnessed a significant improvement in their stock performance this year, shares of Nykaa continue to remain volatile. Its shares are down over 9% year to date.

The stock has support at INR 138 and might plunge further next week, said Rupak De, senior technical analyst at LKP Securities.

“If the shares fall below INR 138, then they might drop further down towards INR 133,” he said, adding that it could move toward INR 146-INR 147 level if it sustains above INR 140 next week.

Paytm’s Loan Disbursals Surge In Q1

Paytm reported its monthly loan disbursement update this week. Its loan disbursals surged 167% YoY to INR 14,845 Cr during the April-June quarter and the number of loans disbursed also rose 51% to 12.8 Mn.

However, Paytm’s loan disbursals in the month of June declined 5.02% to INR 5,227 Cr and the number of loans fell 2.27% to 4.3 Mn.

Shares of the fintech giant fell about 2% this week. On Friday alone, the shares declined 2.2% to end the week at INR 850.7 on the BSE.

Meanwhile, competition for Paytm is rising across its existing business verticals. Recently, PhonePe launched point-of-sale (PoS) devices to enable merchants to accept payments via debit cards, credit cards, and UPI, taking on Paytm and others.

LKP Securities’ De said that if Paytm shares sustain above INR 844, then they can move up towards INR 870.

Meanwhile, Motilal Oswal further increased its price target on Paytm to INR 1,050 from INR 865 earlier and said that the startup is on track to report EBITDA breakeven in H2 FY25.

ideaForge’s Bumper Debut

Shares of drone startup ideaForge listed on the stock exchanges this week at a whopping premium of 94%.

The IPO had an issue price band of INR 638-INR 672. The shares listed on the NSE at INR 1,300, a premium of 93.45% to the issue price. On the BSE, the shares listed at a premium of 94.21% at INR 1,305.10 apiece.

A total of 10.4 Mn shares of ideaForge were traded on the first day of its public listing.

Speaking about the stellar market debut, Ankit Mehta, CEO of ideaForge, said in a statement that the milestone represented a significant achievement for the company.

However, some analysts are of the opinion that the high valuation the startup has received with its listing might not sustain.

Anubhuti Mishra, equity research analyst at Swastika Investmart, said that while the IPO was a great opportunity for investors, it is recommended that investors book profits and exit their positions.

Mishra cited the high valuation and business-related risks as the reason for this recommendation.

It must be noted that the drone sector is an emerging one. Consequently, regulations around the sector are also evolving, which continues to be a major risk factor for the startup as well as its peers. Besides, ideaForge’s profit after tax (PAT) declined to INR 32 Cr in FY23 from INR 44 Cr in the previous fiscal.

Though it is a profit-making venture, like most other new-age startups, ESOPs contribute a major chunk to its expenses.

Ad-lite browsing experience

Ad-lite browsing experience